Weathering Future Economic Storms

Economic rebound, inflation likely to peak, and interests rates going higher. Founder & CIO, Scott Morrison, shares his thoughts on how this will impact the market.

After a year of extreme risk taking around the world, January saw many markets have the worst performance since the Great Financial Crisis of 2009. Last year we spoke much about inflation risk and it is finally resulting in oscillating markets.

Our underweight positions in the highly-valued technology and growth-heavy U.S. market haves helped us get through this significant market sell-off. It gave us great opportunities to buy back some positions we previously sold in best-of-breed type companies that we believe have the pricing power to weather the storm of inflation. There are still industries that have not returned to pre-covid levels and others that have over-earned because of covid. However, we still lean towards having exposure to industries that have not returned to pre-covid levels as having better upside/downside ratios.

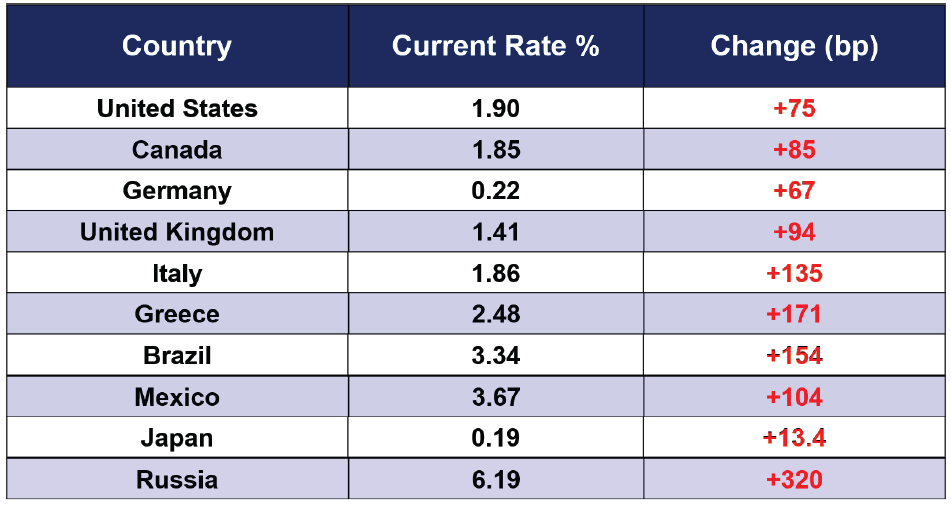

Again, we highlight that the world is coming off a period which marked the lowest interest rate levels ever in the history of finance, while at the same time experiencing the highest levels of debt. The continued elevation of inflationary pressures is bound to cause increased market volatility. As you can see in the chart below, we are seeing major increases in interest rates. The absolute numbers are not frightening, but the degree of change is expected to cause valuation contractions across asset classes, since most assets previously benefitted and saw valuation expansion as yields fell as a result of covid.

PLAIN VANILLA BOND HOLDERS GETTING HURT VERY BAD “YOU DON’T KNOW WHO IS SWIMMING NAKED UNTIL THE TIDE GOES OUT” – BUFFET

I was asked recently to give a market update presentation to a group of technology-orientated investors from an investment group based in Montreal. I last spoke to them at their off-site event in the beautiful Laurentian mountains in October of 2018. The bad news for airlines and car rental companies is that this time I was forced to speak virtually. Perhaps next time I will meet them face-to-face, like in the good old days.

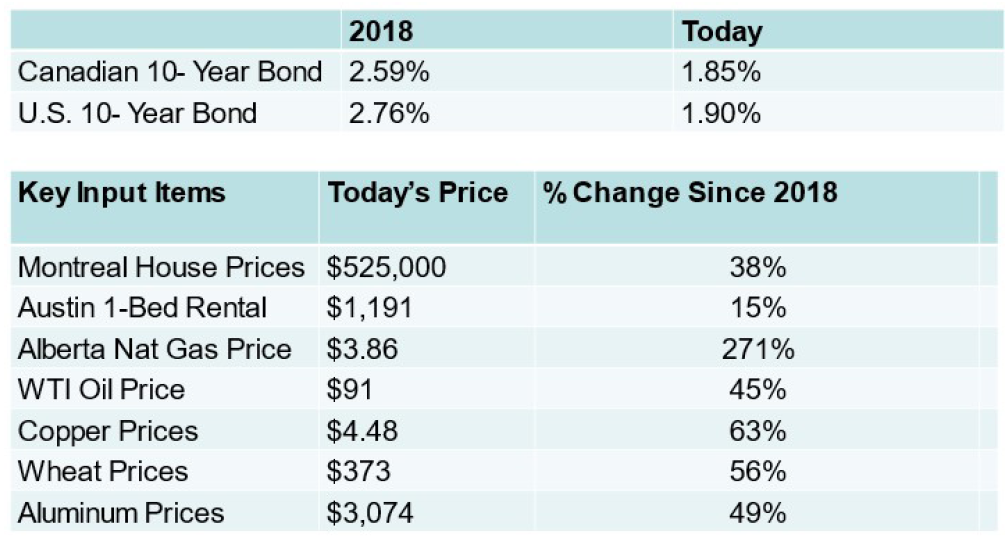

In 2018 I was asked to discuss recession risks relative to past cycles since the U.S. Fed was raising interest rates in that year. You may recall that the Fed raised rates until December of 2018 and then changed its mind in early 2019 after a severe market sell-off into Christmas Eve. Only time will tell how the markets will react once the U.S. Fed starts to raise rates in March. There is one very important difference that I tried to highlight to this savvy investment group that has benefitted from private market valuations which have skyrocket since 2018: Inflation is a major problem and we do not believe that it will go away soon. The U.S. Consumer Price Index (CPI) just printed at 7.5% for the month of January. As you can see in the below chart, I highlighted the position of some major commodity prices today versus where they were 3.5 years ago. I assume that many of the individuals to whom I spoke with were not even alive when inflation was last this high in 1982.

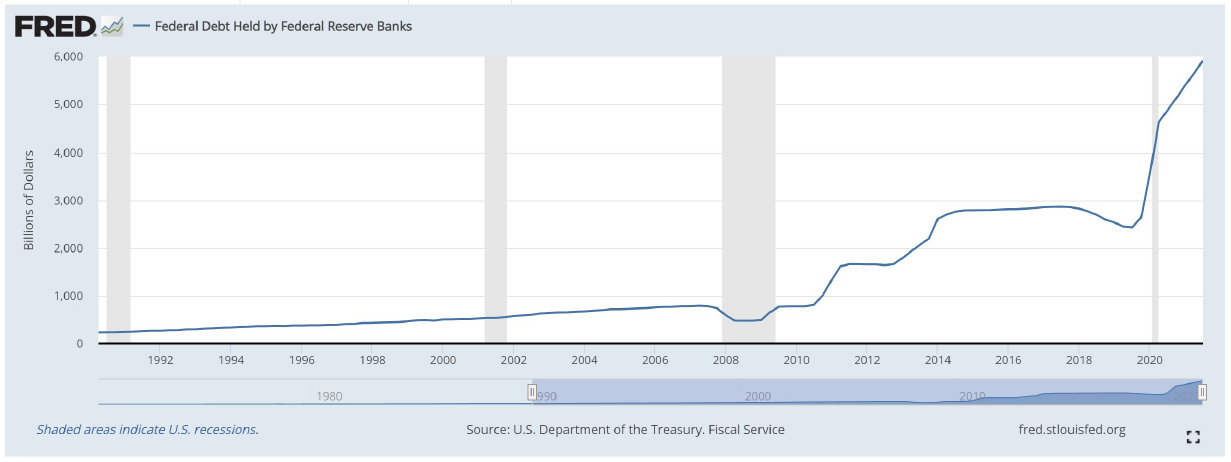

BOND MARKET MANIPULATION ILLUSTRATED SINCE WE LAST SAW ONE ANOTHER – RISK FREE RATE PURPOSELY SEPARATED FROM REALITY

What causes me concern from the above illustration is that the 10-year bond yields are lower. Yes -lower, despite all the underlying economic inflation and higher levels of debt. We might reasonably conclude that this is somewhat nonsensical — if supply is massively without commensurate demand, price should be lower. However, since 2018 the amount of government debt owned by the central bank has more than doubled, as you can see in the second chart below. Yes, doubled in basically in a few years, to a figure over $6 trillion in the U.S.! In my opinion, this is representative of false demand and not at all natural. Perhaps I just underestimate the degree to which desperate times call for desperate measures. Maybe we live now in a state of perennial desperation.

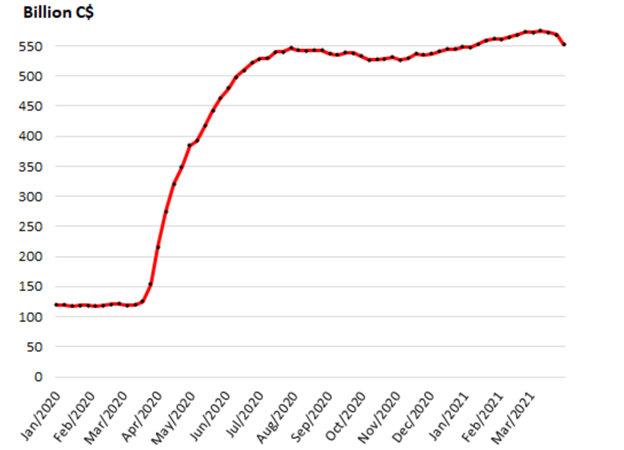

As investors we must recognize that we have benefitted from this bond market manipulation. And it is a stark reality that the resulting price shocks will cause true pain for many less fortunate members of society who do not own off-setting assets or benefit from income streams with pricing power. During a market sell-off like the one in January, our long-only fund, Voyager, will get hurt more than our other funds that use hedging toolsets. If the central banks continue to monetize the debt to infinity and beyond, then Voyager will likely do very well. If banks change their pace of purchases, then a wise investor should have some hedges in their investment portfolios. And this is where I get to congratulate my colleagues Andrew and Justin for their respective Amplus and Lions Bay Funds, who through the use of those hedging tools were able to significantly outperform in January, when central banks discussed stopping their purchases and raising rates. Below you can see that the U.S. and Canada own approximately 20 and 40% of their government bonds, respectively. Suddenly Canada owns about as much of its government debt as does the Bank of Japan. Perhaps one day I will see the North American central banks own equities too. In Japan they account for up to 10% of the stock market.

FEDERAL DEBT HELD BY FEDERAL RESERVE BANKS

BANK OF CANADA TOTAL ASSETS

When I sit to write January comments a year from now I will no doubt be discussing how the economy slowed materially in 2022. It is very, very important not to fight the U.S. Fed and to make note of the fact that on January 26th, U.S. Fed chair Powell said that:

“The Fed’s monetary policy actions have been guided by our mandate to promote maximum employment and stable prices for the American people. As I noted, the Committee left the target range for the federal funds rate unchanged and reaffirmed our plan, announced in December, to end asset purchases in early March. In light of the remarkable progress, we’ve seen in the labor market and inflation that is well above our 2 percent longer-run goal, the economy no longer needs sustained high levels of monetary policy support. That is why we are phasing out our asset purchases and why we expect it will soon be appropriate to raise the target range for the federal funds rate.”

Source: https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220126.pdf

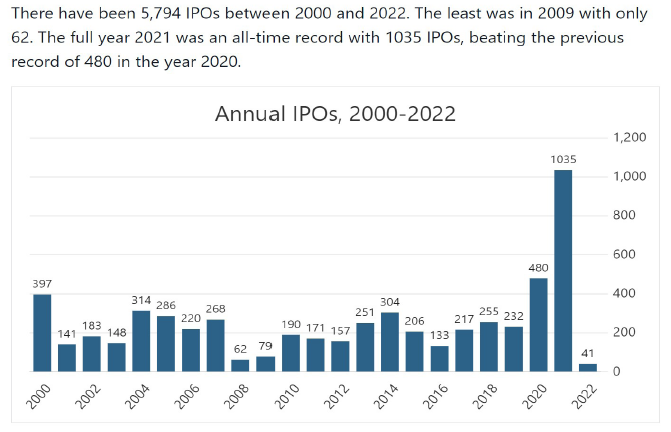

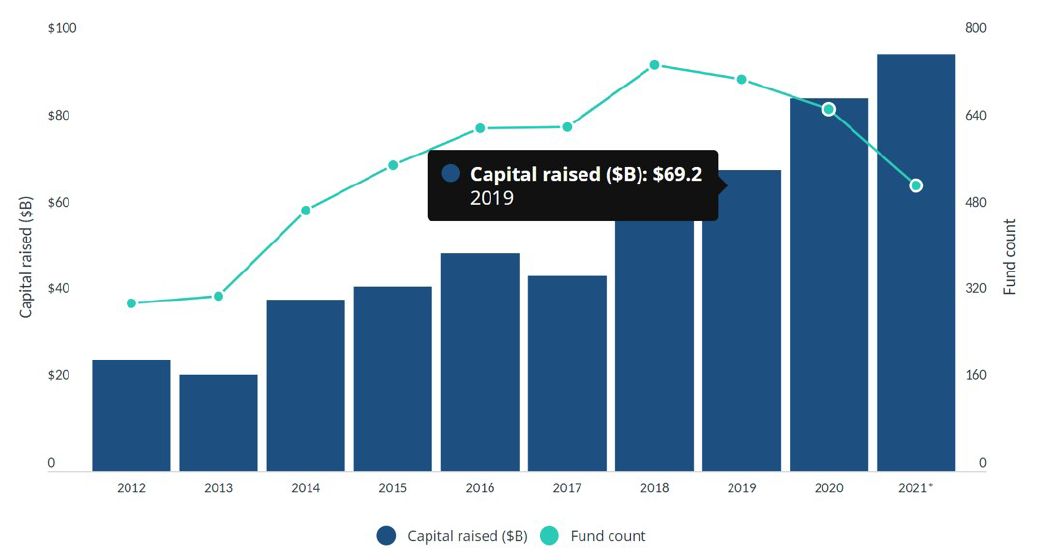

2021 saw record levels of capital raising, as you can see in the charts below. Indeed, it hit an all-time record. We always look to extremes as reasons to justify a contrarian approach. We would never be contrarian simply for contrarian’s sake, but if supply does go up and demand is flat-to-down, then watch out. Consider the chart below, which illustrates the reality of massive supply-of-capital raising events, in the context of the above U.S. Fed quote. Access to, or supply of money will decrease, which will surely dampen demand for companies going public. I give a shout out to our domestic investment in Magnet Forensics for successfully going public and still being far above its first-day-closing IPO price. As below, some of the world’s largest IPOs were completed being underwater for most investors who bought on the first day of them going public. Magnet is the type of company we looked to own during January’s sell-off, as it hits so many attributes on our check list: insider ownership, clean balance sheet, free cash flow generation, sub-sector leader, long-growth runway, recurring revenue business model, ability to raise prices, etc.

VCS CLOSE IN ON $100 BILLION IN FUNDRAISING

Private markets are “overvalued” and must “rebalance”, said SoftBank Group Corp. Visions Fund Chief Executive Officer Rajeev Misra

He said that companies that had asked the Vision Fund for unrealistically high valuations last year, and wound up not doing a deal, had in recent weeks asked the firm to reengage. Misra also said that private companies have over-high valuations compared to publicly traded companies, citing the software-as-a-service market as an example. There, private companies are often still valued at 20 times forward revenue, he said, but in public markets, SAAS company valuations have come down to about 12 times revenue. “That gap is going to tighten over the next six months,” he said of the discrepancy between public and private markets. Misra, who leads the famous multibillion-dollar investment fund for the Japanese conglomerate, spoke on Wednesday at an Axios Pro Rata event.

Source: Bloomberg, January 2022

ANNUAL IPOS, 2000-2002

SAMPLE TECH IPO PAIN AND ONE SUCCESS FROM THE WIDE OPEN WINDOW IN 2021

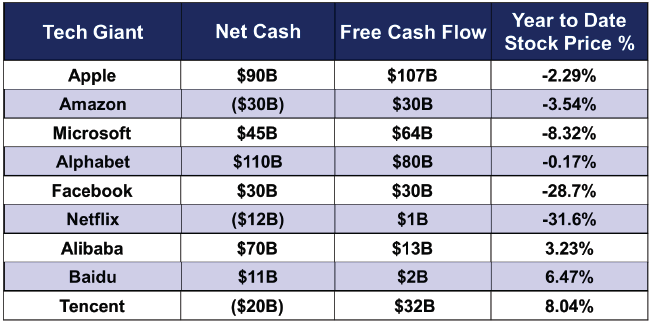

We are not calling for a Nasdaq market-type crash from the year 2000 since the quality of the capital structures of leading tech companies is so much stronger than 20+ years ago, as is illustrated in the below chart. This strength will enable such companies to take advantage of the current downdraft and buy out smaller rivals. For example, Panorama was fortunate to be a shareholder in Activision, which in January received a takeover offer from Microsoft. We anticipate more deals to come from the big and strong as they will do everything they can to plant seeds for future growth and fight the law of large numbers.

We were impressed to see that Amazon disclosed that it bought back $1.3 billion of its own stock during January’s market sell-off. Also impressive in that month — and supportive of our view that structural inflation will be a bigger issue for consumers for a long time to come — was that both subscription-based model companies Amazon and Netflix announced price increases. This was in part catalyzed by the significant salary increases tech companies are complaining about. For example, Amazon announced that it will be increasing its base-salary pay levels to $350K from a previous $160K. That is quite a jump and perhaps indicative that the stock buyback is in part needed to help support the stock price, which has been such an important part of employee compensation packages.

TECH TITANS HAVE FORTRESS LIKE BALANCE SHEETS THEY ARE WELL POSITIONED TO SOFT THROUGH THE RUBBLE – PLATFORM CAPITALISM WINS

As I sit here typing my comments, Akzo Nobel, one of our holdings which is a leading paint company from the Netherlands, just announced on its annual conference call: “At the same time, we continue to deliver significant price increases to catch up with the raw material inflation with Q4 pricing at 12.5% and December at 14%. As a reminder, Q3 pricing was 9% with September at a 10% run rate. We expect the first quarter pricing to land between 14% to 16% when compared to the first quarter of 2021.” Companies that can raise prices like this are the ones we want to own. As well, Akzo also has the financial capacity to be able to buy back its stock. The risk highlighted in the above quote, however, is that these price increases will likely eventually lead to some decrease in demand. Moreover, I assume that everyone realizes that the biggest input cost to make paint is the price of oil, which has been steadily rising. We are monitoring oil prices closely since rising oil prices can foreshadow recessionary conditions.

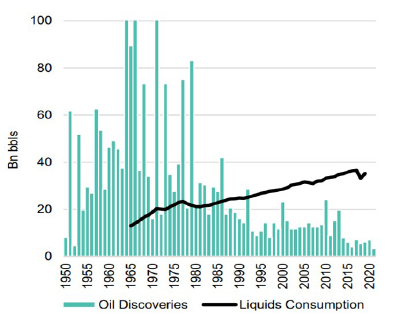

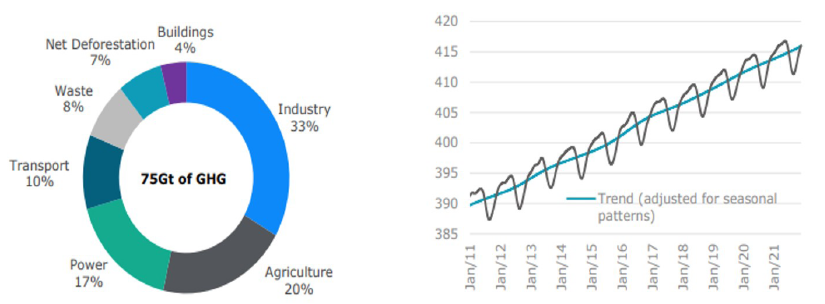

In the end, none of us should be surprised that oil prices are skyrocketing, since OPEC has not increased production enough to meet the post-covid rebound in demand. More and more oil and gas companies we speak to are only modestly investing in growing production. As you can see in the below chart, last year was a historically low year with respect to new oil discovery. The second chart shows as well that despite all the headlines around voters wanting to be more environmentally friendly, SUV sales growth rates are up — which means increased fuel consumption. Supply down and demand up equals INFLATION!

CONVENTIONAL OIL DISCOVERIES VS DEMAND

GLOBAL SUV SALES

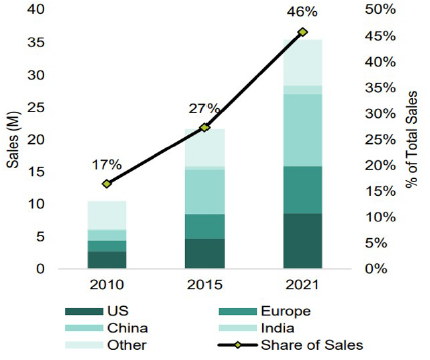

SHARE OF YEARLY CHG EMISSIONS BY SECTOR CO2 IN THE ATMOSPHERE IS AT RECORD LEVELS

Another storm that we are monitoring closely is Russia’s military ambitions in Ukraine, obviously because of its potential impact on energy supplies and social/geopolitical tensions. I noted that Putin and Xi were shown shaking hands in Beijing at the opening of the Olympics, while France’s Prime Minister Macron went to Moscow to try and “talk” Putin out of invading the Ukraine, and German leadership said it will not send military support to the beleaguered country. I hope that someone will remind Macron and the German Chancellor of the very famous quote by Winston Churchill: “I cannot forecast to you the action of Russia. It is a riddle wrapped in a mystery inside an enigma. But perhaps there is a key. That key is Russian national interest.”

The bottom line is that the overall economic rebound has peaked, inflation is likely peaking too and interest rates will go higher, because inflation is not as transitory as central bankers have assumed. If and when something economically breaks, either because of rising rates or geopolitical tensions, then central banks will be forced to monetize more and more debt. Just in case central banks do not navigate smoothly the next economic crisis, we want to own a portfolio of very well-capitalized companies that can weather future economic storms because of their leading business franchises. It may have been a long time since many of you have taken an airplane, but I anticipate that we should all fasten our seat belts and expect more turbulence.