Silver Linings - Glenveagh Properties PLC

At Wealhouse, we are committed to finding exceptional investment prospects that leads us to explore far and wide, with a focus on opportunities that align with our core philosophy: targeting areas where supply is scarce, and demand is surging. Today, we are excited to introduce our investment thesis on a well-managed company with a strong balance sheet, track record of profitability and improving fundamentals in the years ahead. Our portfolio manager Scott Morrison toured their operations outside of Dublin, Ireland in 2018 before Covid. After recent follow-up due diligence conversations with senior management, we firmly believe that Glenveagh Properties PLC (GLV) offers an extraordinary investment opportunity within the ever-evolving domain of homebuilding. Below we delve deeper into this compelling opportunity.

Dublin’s Thriving Economy and the Affordable Housing Sector

Dublin, Ireland, stands at the forefront of Europe’s rapidly expanding economies, bolstered by a thriving tech industry and an influx of multinational corporations choosing it as their European hub. Amidst this economic dynamism, one sector poised for substantial growth due to robust supply and demand dynamics is affordable housing. The Irish government’s commitment to supporting first-time homebuyers through an allocation of 8 billion Euros is a transformative force for companies like GLV, one of only two publicly-listed homebuilders in the country.

Furthermore, the government’s strategic allocation of land to homebuilders, particularly for urban apartment construction, creates an opportunity for returns that could exceed 30% on capital invested. This targeted approach to land allocation aligns with Wealhouse’s philosophy of identifying investments where demand exceeds supply, paving the way for potential long-term value.

Persistent Supply-Demand Gap

One of the most compelling aspects of Dublin’s housing market is the persistent supply-demand gap. While the demand for new homes in Ireland consistently surpasses supply, with an annual demand for 40,000 new homes, actual construction lags at just 30,000 units. This housing deficit can be traced back to the aftermath of the housing crisis over a decade ago, which had a profound impact on the country’s banking industry. GLV, with its strategic positioning, is well-prepared to capitalize on this enduring supply-demand gap and contribute to bridging the housing shortfall.

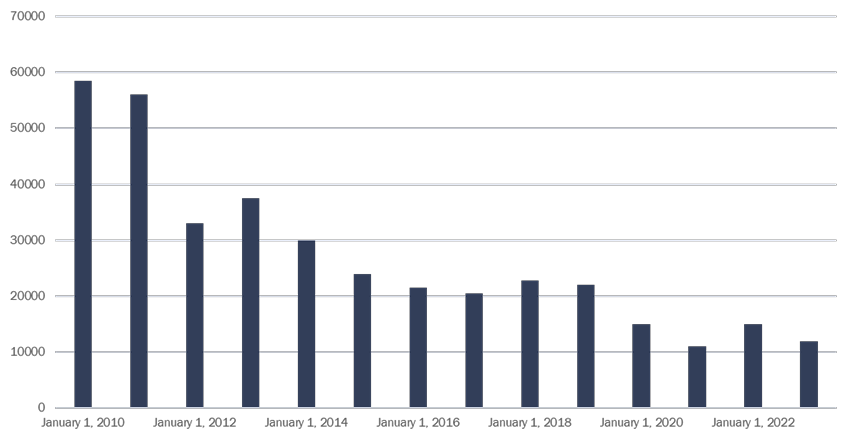

STOCK OF PROPERTIES ON SALE

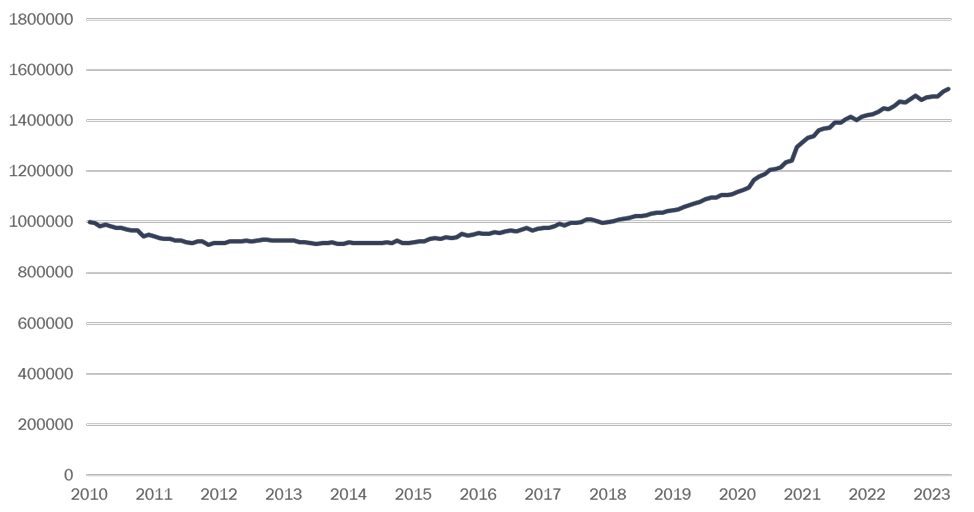

HOUSEHOLD DEPOSITS €M

Commitment to Efficiency and Margins Expansion

GLV’s unwavering commitment to efficiency improvement is another key driver of our investment thesis. The company has invested more than 40 million Euros in the construction of three advanced manufacturing sites. These state-of-the-art facilities standardize various elements of home construction, resulting in cost reductions of more than 2 euros per square foot. As a result, GLV anticipates an expansion of margins by 150 basis points, aligning with its target of achieving a 15% return on equity. Intriguingly, despite significant improvements in business fundamentals, GLV’s shares continue to trade below their IPO price from 2017, presenting an appealing opportunity for investors looking for potential value.

Acknowledging Potential Risks

While the investment prospects appear promising, it is essential to acknowledge potential risks. These include changes in government policies, labour and material shortages, rising interest rates, and the challenges associated with navigating bureaucratic planning departments. Additionally, an increasingly competitive landscape poses an ongoing challenge. At Wealhouse, we believe in a proactive approach to risk management, and these factors are closely monitored in our investment strategy.

Attractive Valuation and Growth Potential

One of the standout features of GLV is its attractive valuation. The company’s shares are currently trading at a modest 13 times next year’s earnings, accompanied by a robust free cash flow yield exceeding 10%. As GLV completes urban construction projects, such as apartment buildings and hotels, its balance sheet strength is anticipated to fortify further. Moreover, sourcing land from the government’s land bank will contribute to the expansion of return on capital, reinforcing the growth potential of this investment.

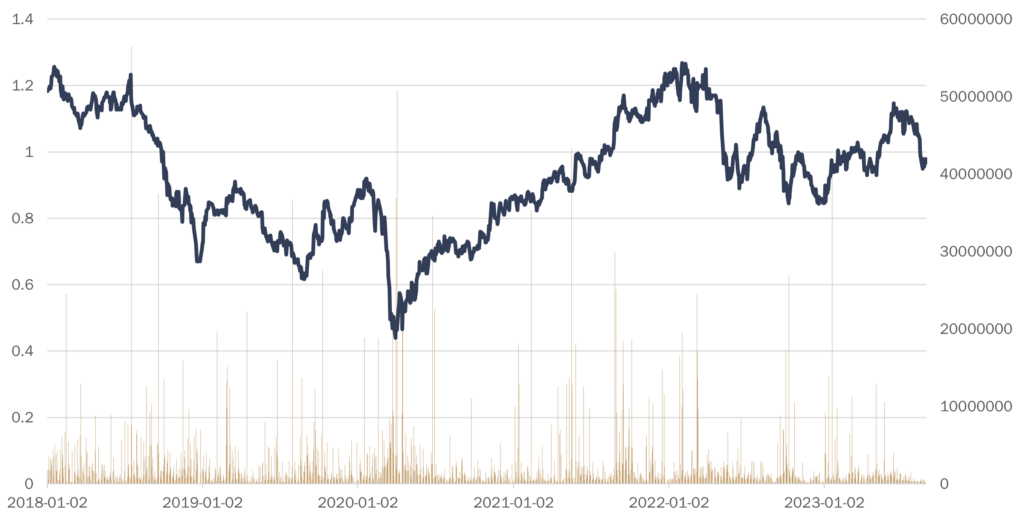

PRICE HISTORY

KEY FINANCIAL DATA (USD)

| FY2021 | FY2022 | FY2023 | FY2024 | |

| Revenue | 477 | 645 | 595 | 945 |

| EBIT | 52 | 72 | 63 | 125 |

| EBIT Margin | 11.5 | 11.4 | 10.5 | 13 |

| EPS | 0.05 | 0.08 | 0.08 | 0.17 |

| Free Cash | 89 | 122 | -13 | 100 |

MARKET DATA (USD)

| Market Cap (Millions) | 578 |

| Exchange | Dublin |

| Net Debt | 183 |

In Conclusion

In summary, the housing market in Dublin, fueled by Ireland’s booming economy and the government’s commitment to affordable housing, presents an enticing investment opportunity characterized by favorable supply and demand dynamics. This is further reinforced by GLV’s strategic initiatives and commitment to efficiency. While we remain mindful of the inherent risks in any investment, the potential rewards in this case make it a noteworthy addition to the Wealhouse portfolio.

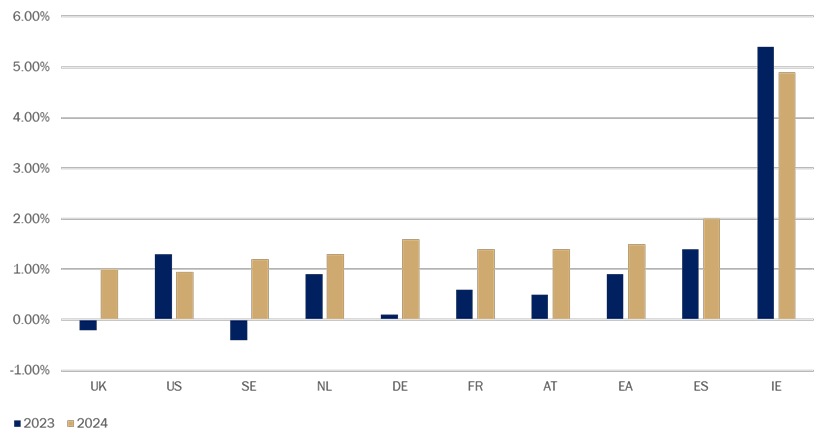

GDP GROWTH FORECAST