Amplus Credit Income Fund Q3 2023: Bond Market Trends, Risks, & Opportunities

Senior Portfolio Manager, Andrew James Labbad provides an in-depth exploration and delves into bond market trends, potential risks, and investment opportunities. Amplus Q3 commentary provides a valuable resource for investors and those seeking to understand the evolving dynamics of the credit market.

“The U.S. can draw comparisons to the Greek-Debt Crisis, they spend like Greeks but fund like Germans, until they can’t any longer” – U.S. Credit Strategist

The Fund

In Q3 2023, Amplus saw gains of +2.58%, with year-to-date gains at +8.54%. Meanwhile, interest rates continued to put pressure on bonds, with fixed income benchmarks down in July, August and September. Canadian corporate bonds spreads were about 3bps tighter for the quarter and 14bps on the year, marginally outperforming U.S. credit spreads by 1bp on the quarter and 5bps on the year.

Recall, Amplus Credit Income Fund started investing in an environment of ultra-low interest rates. Looking back now, we can say with confidence that without the ability of hedging interest rates, the odds of generating positive returns in a historically-safe asset class would have been very challenging. Out of over 400 Canadian debt deals outstanding and issued between 2020-2021, only about 1% trade above their issued price. If we exclude naturally hedged floating rate notes, only 2 offerings currently trade above water.

Fund performance in Q3 can be attributed to the following:

- The portfolio accrued an annualized return of ~9% throughout Q3. Tighter credit spreads allowed the strategy to produce gains on its long exposure.

- Our derivatives overlay produced an additional 0.45% of performance, with market volatility picking up in August and September.

- As interest rates moved higher, we continued to unwind more rate hedges. Naturally increasing our long rates exposure throughout the quarter. This weighed on performance, but we are excited about the risk-reward of being outright long bonds, as a natural premium-free hedge against a large risk-off event.

- In June, Brookfield issued debt with proceeds to be used in refinancing their 2024 USD maturity. Shortly after, the company had filed an early partial redemption of these bonds for July 14th. The market continued to misprice the bonds, which allowed us to accumulate bonds with 1-1.5% of upside potential.

- September saw elevated levels of issuance in the Canadian market. One deal we took note of was Canadian Tire: they came to market with a 7-year deal at levels that made other retailers look cheap on an RV-basis. We quickly pounced on those opportunities, and patiently waited for the deal to reprice the overall sector.

- Throughout the quarter, we saw Bell Canada, Telus and Rogers Communications issue debt. We took that as an opportunity to add exposure in the sector. Rogers was the last to come to market; issuing a three-tranche deal in mid-September that saw spreads rally post deal about 10bps into month-end.

Go Forward Outlook

With three quarters of the year behind us, one shocking fact reminds us that even the safest investments left unchecked can cause losses in a portfolio: U.S. Treasuries currently producing negative returns YTD, have not seen three consecutive years of losses in the history of the U.S republic. Until possibly now? With emphasis… this is sovereign debt from the world’s strongest and largest economy.

As such, some concerns that we are focused on continue to be:

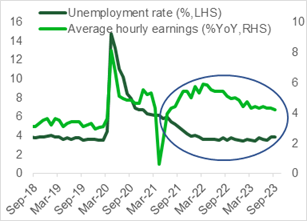

- The stickiness in wage inflation caused by the elevated job openings, low unemployment and union pressures: Central banks will be forced to keep growth in check. Unlike the U.S. with 10% of labour force unionized, Canada has about 30% of their labour force unionized. In a tight labour market, there is real risk of elevated labour costs for years to come. The labour market continues to show strength despite central bank tightening conditions, and we are convinced that a big shock to the economy may be the only option available to balance both supply and demand of labour.

IMBALANCE BETWEEN UNEMPLOYMENT & WAGE GROWTH

IMBALANCE BETWEEN SUPLLY & DEMAND OF JOBS

ELEVATED WAGE INFLATION

- The lagging impacts of tightening conditions from policy makers are seeing themselves filter through the economy. A few headlines that have caught our attention:

- Apartment rent growth has turned negative YoY while vacancy rates have risen.

- Housing affordability is now at the lowest level on record.

- Default activity increased in the quarter, raising the YTD total volume affected to the eighth largest total on record.

- Small bank delinquency rates are at an all-time high of 7.51%.

- Ballooning debt and interest rates may become too hard for the U.S. Government to handle: Technicals in long-end interest rates have recently broken support levels. Last week, U.S. 30-year treasuries touched 5%, a level not seen in over 10 years. After breaching 33trn in debt, it took the U.S. government just 18 days to add another $500bn. To put that into context, in 1975 the U.S. had under $500bn total debt. In the next 27 months, the U.S. Government has 47% of its debt come due, with interesting payments over that time at $1trn.

A market slowdown is required to tame inflation, but with the U.S. government continuing to run a fiscal deficit, the markets are rightfully wondering who is going to be the marginal buyer of incremental government debt, especially when government are going to be conducting fiscally expansionary policy for the next 3-4 years?

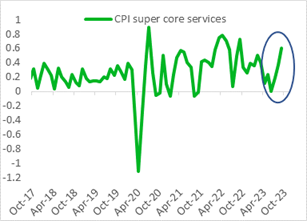

Interestingly, the recent strong labour market data and hot CPI numbers, coincided with a uniform message from Fed speakers possibly drawing a line in the sand for long-end yields. They communicated that the recent move in long-end yields may substitute for front-end rate hikes. This is a new and important link, and represents the first time this cycle that the Fed seem to be actively managing to dampen financial conditions rather than tighten them.

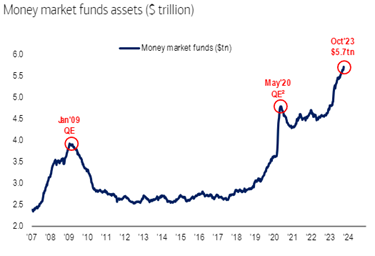

- A lot of cash remains on the sidelines and can support possible shocks in the system. Money market funds hold a record 5.7trn in assets. Furthermore, as employment levels remain strong, yields become more attractive inflows continue in across fixed income, emphasizing the marginal buyer could very well be retail.

$1TN INFLOW TO MMFS IN 10 MONTHS… THE NEXT BULL MARKET

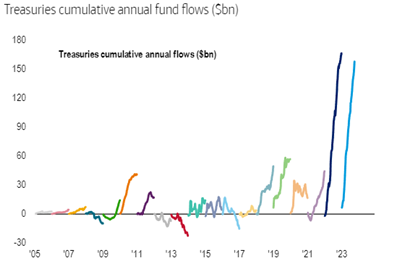

…NOR BONDS IN 2023… EVERYONE “BEARISH” BUT NOBODY “SOLD”

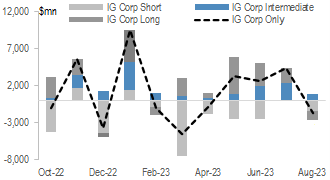

IG CORP-ONLY FUND FLOWS BY MATURITY

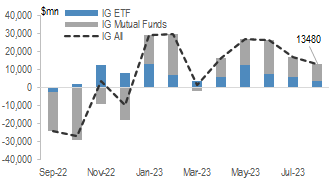

OVERALL IG FUND FLOWS

Opportunity Set

With interest rates having risen sharply over the last year, fixed income securities are yielding more than the earnings yield of the S&P 500. The opportunity set of owning fixed income continues to be the most attractive it’s been in over a decade. The inversion of the yield curve continues to benefit owners of short-dated debt. Carry strategies such as Amplus are designed to thrive in this type of environment. Being long short-dated high-quality credits, yielding over 9% should provide a high margin of safety for investors. As we remain optimistic about credit, our preference is to own higher quality and more liquid names. We view energy, infrastructure, telecom, senior bank and GIC insurance debt as favourable investments.