Note from the Credit Desk: Summer's Bond Market Shake-Up

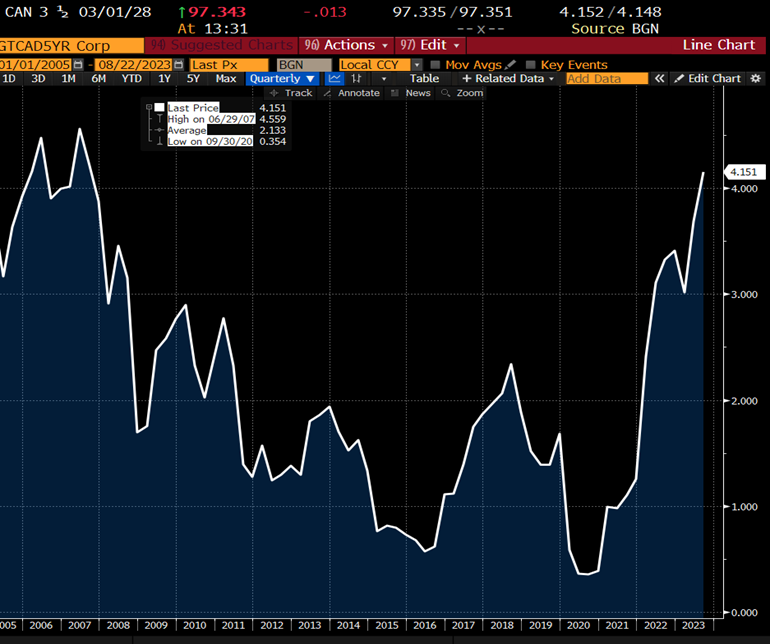

This year’s “Dog Days of Summer” has been anything but for fixed income investors as we experienced a violent repricing of government bonds. For example, the yield of the five-year Canadian Government Bond (CGB) rose by 45 bps since the end of June.

Economic data of late in both the U.S. and Canada has shown the resilience of the respective economies in the face of higher interest rates, thus reinforcing the “higher for longer” undertone from the Federal Reserve and Bank of Canada. As a result, we have seen both Central Banks restart their hiking programs over the summer following a short pause, throwing traditional fixed income markets for a loop.

As we surpass risk free yields not seen since 2007, we view these levels as a great opportunity to not only generate strong risk-adjusted returns but also to create a natural hedge to adverse economic events. With that said, we have taken a patient approach to adding interest rate duration, helping generate strong returns during this volatile repricing.

The aggressive re-pricing of “higher for longer” has taken a toll on regular index funds. For example, The Canadian Credit Index (XCB) has lost over 1.70% since the end of June while Amplus Credit Fund has generated over 1.10% during the same time for its investors.

As summer comes to an end, all eyes are on Jerome Powell and the economic powerhouses alike as they meet in Jackson Hole to discuss economic conditions and provide hints to the future path of interest rates. While it is largely expected that Powell will be sounding a hawkish tone, we at Wealhouse are excited for the prospects ahead while opportunistically staying nimble.

GOVERNMENT OF CANADA 5YR YIELD