Our Interests Are Piqued: How Peaking Interest Rates Shape Our Investment Strategy at Voyager

I recently watched an excellent interview with Howard Marks, a famous money manager who in 1995 founded Oaktree Capital Management. In 2011, Mr. Marks authored one of my favourite books. It is entitled, The Most Important Thing. He said in the interview that, “he writes when he has an idea.” Some of you might have heard that my family and friends often call me “the idea guy.” Hence, I am writing to tell you that based on our research process, we believe that U.S. and Canadian interest rates are in the process of peaking for this interest rate cycle. As a result, our portfolio of investment ‘ideas’ in Voyager should do well as rates are cut.

We at Wealhouse spend most of our time meeting and speaking with those who represent existing investment ideas in our portfolios, and/or trying to find better opportunities for your capital. We believe that rates are peaking partly because the companies we meet have customers who must borrow money in order to buy the products that they need, and these companies are seeing significant slow downs. The following is an interesting quote from CEO Elon Musk, made during Tesla’s recent conference call:

I’m worried about the high interest rate environment that we’re in. It’s — I just can’t emphasize this enough that the vast majority of people buying a car is about the monthly payment, and as interest rates rise, the proportion of that monthly payment as interest increases naturally. So, if interest rates remain high, or if they go even higher, it’s that much harder for people to buy the car. They simply can’t afford it.

Eventually, the interest rate situation will lead to increases in inventories, order cancellations, margin pressures, layoffs, and this in turn will help dampen certain sticky inflation pressures in other parts of the economy with too much labour and input cost tightness. As well, we believe that excess and unsustainable government spending over the last few years has crowded out many private enterprises from access to labour. As a result, the unemployment rate in the U.S. has been below 4 per cent for over 2 years which has not been seen since the 1960’s. There will be more said on this government spending later in the comments.

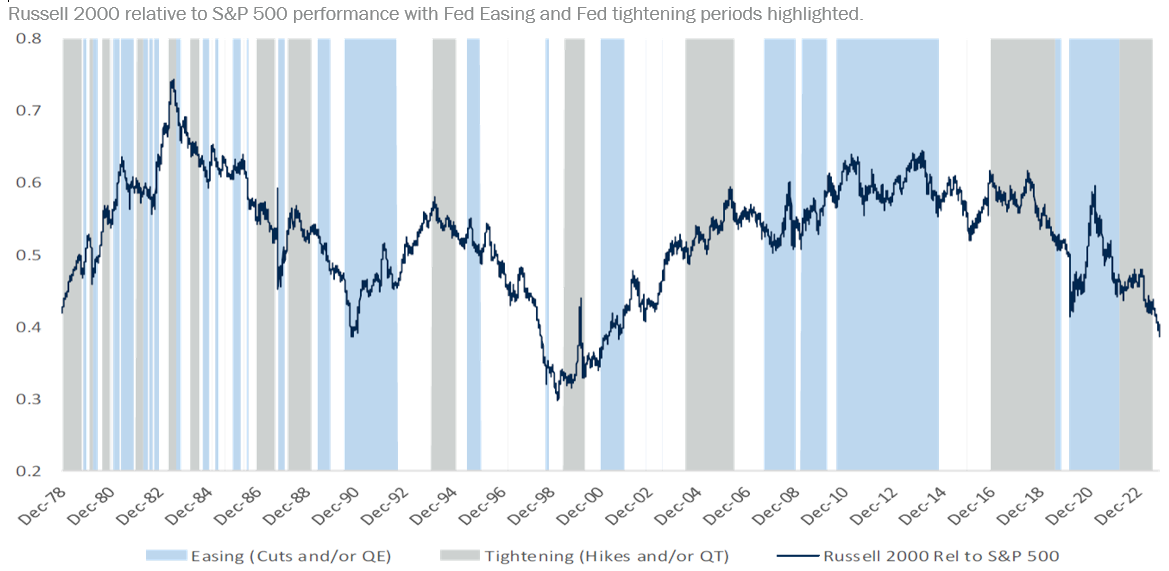

An eventual fall in interest rates will be very positive for the small- and medium-sized businesses that we own in Voyager. It is all just a function of when and not if they will be cut. Smaller companies have a tendency to benefit more from lower rates because they can access capital to grow their businesses more aggressively than larger enterprises that often have to fight the law of large numbers. As you can see in the below chart, small-cap companies per the blue-shaded area outperform versus larger-cap companies when the U.S. Fed enters an easing cycle.

HIKING CYCLES NORMALLY HURT SMALL CAPS, EASING CYCLES NORMALLY HELP THEM

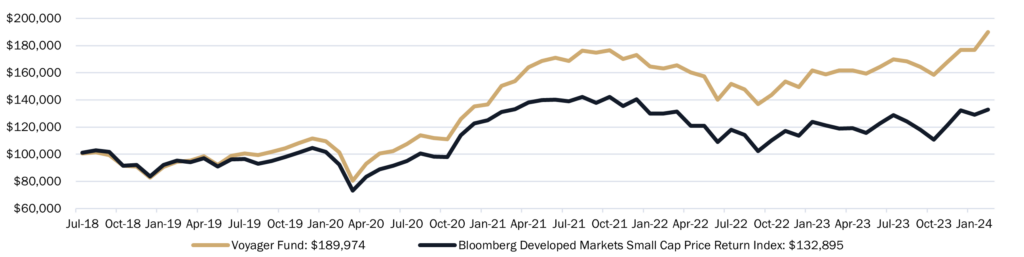

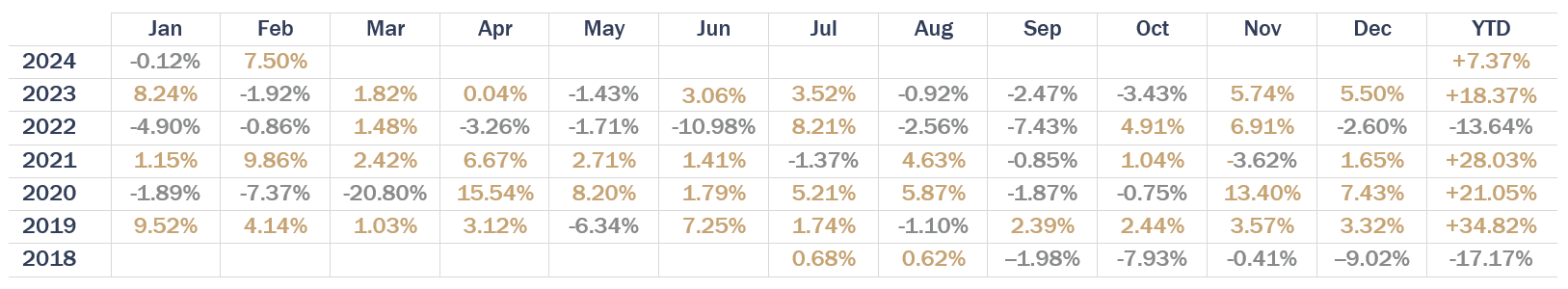

Despite rising rates during 2022 and 2023, Voyager has a 3-year compounded annual return at a respectable 8% level after costs and is up over 7% year-to-date in 2024. As you can see in the below chart, during the years of easing monetary policy in 2019, 2020 and 2021, returns were much more robust for Voyager. When we compare Voyager to small and mid-cap benchmarks, we are happy to see we have outperformed materially. When one drills downs on the index outperformers, it is often made up of money losing and/or more levered business models which do not pass our investment check list. It is central to our investment philosophy to avoid companies that don’t generate free cash flow and/or have a lot of debt. Instead, we want to anchor our portfolio with businesses that can weather tighter monetary conditions like we have seen for the last two years. After three decades of investing in smaller companies, I have learned it is important to populate your portfolio with companies that will come out stronger on the other side of an economic cycle that has slowed due to higher rates. This is a reflection of the discipline we employ to be invested in companies with both balance sheet strength and the ability to take advantage of cyclical weaknesses.

Voyager Fund Performance as of February 29, 2024

GROWTH OF $100,000 INVESTMENT SINCE INCEPTION*

STRATEGY PERFORMANCE*

Annualized Performance*

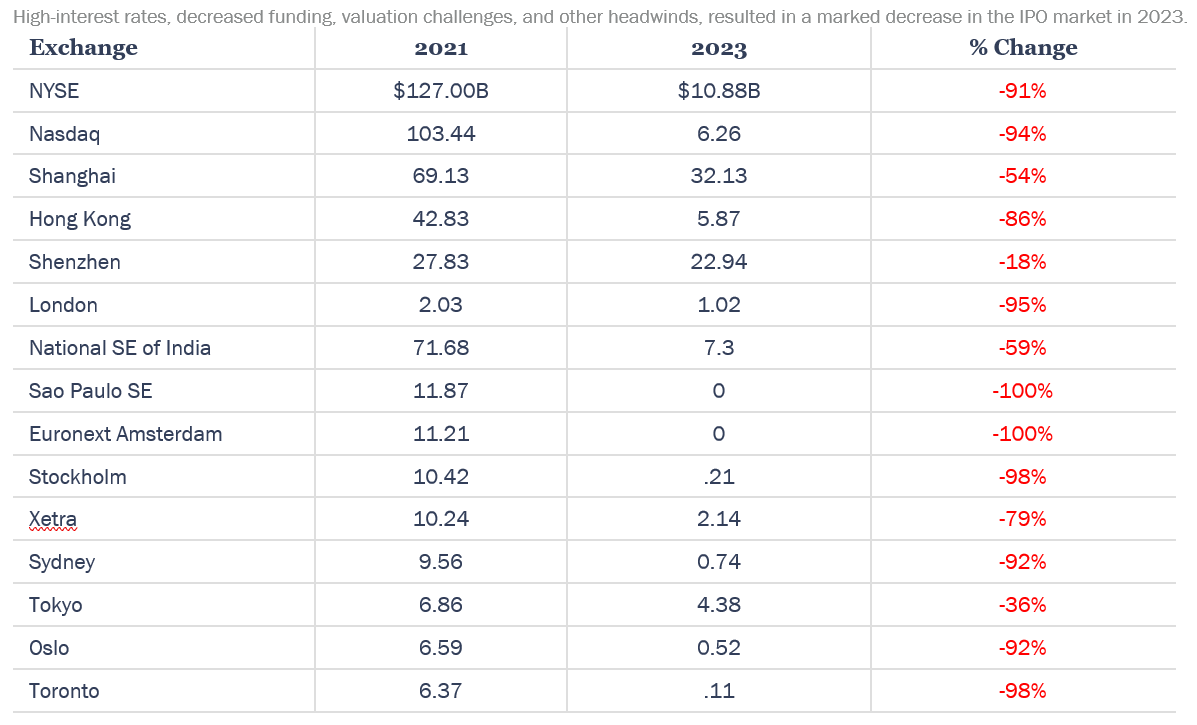

It may seem counterintuitive, but we are particularly excited that it has become very difficult for companies to go public. As you can see in the below data from Bloomberg, in 2023, the supply of new companies for us to evaluate came to a standstill. As many of you know, I believe that economics is rather simple: a decrease in supply typically means that prices rise if demand stays flat or increases. Therefore, one should buy assets whose supply is decreased but demand is flat to up. This is happening in the small-cap universe. Thus far in 2024, three of our investments have received takeover offers. One was an offer from a large private equity firm named Blackstone with much dry powder raised from their Limited Partners during the easy-money period of 2021. Two others were from rival corporates. We believe that this is a very, very important trend that could provide significantly bullish equity prospects versus private equity investing opportunities.

THE BIG COLLAPSE – IPO MARKET

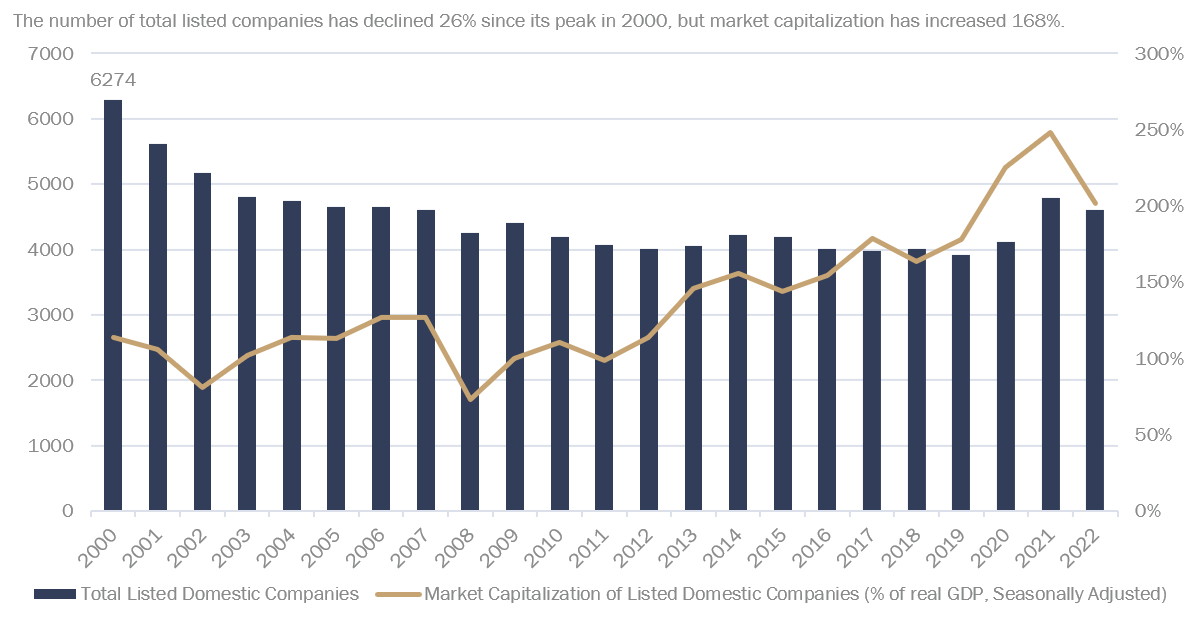

TOTAL LISTED PUBLICLY TRADED COMPANIES

Everyone should know that Private Equity (PE) firms tend to use much more leverage when they buy companies. This is in comparison to public companies that are challenged by their shareholders to be more disciplined around the use of leverage. Since the implementation of Quantitative Easing (QE) after the financial crisis of 2008 — which saw a collapse to zero or near-zero interest rates around the world – PE firms had jumped all over the opportunity to raise money and buy businesses at the expense of public companies who have a more conservative approach to capital structure management. Time and time again I talk to CEOs and CFOs of public companies who say that they do not see as much competition, if any, when making corporate acquisitions. In certain cases, public companies are being shown opportunities to buy businesses from PE firms that outbid them for those assets previously. This, we believe, will lead to an acceleration of earnings and free cash flow growth for many public companies who have not benefitted from a low level of PE competition since before and during 2008/2009. So often over the QE environment it was so frustrating for public companies to lose out expansion opportunities where the companies knew they could extract synergies PE could not. That was then, and this is now; public companies now often have the upper hand in this higher interest rate regime with Quantitative Tightening (QT).

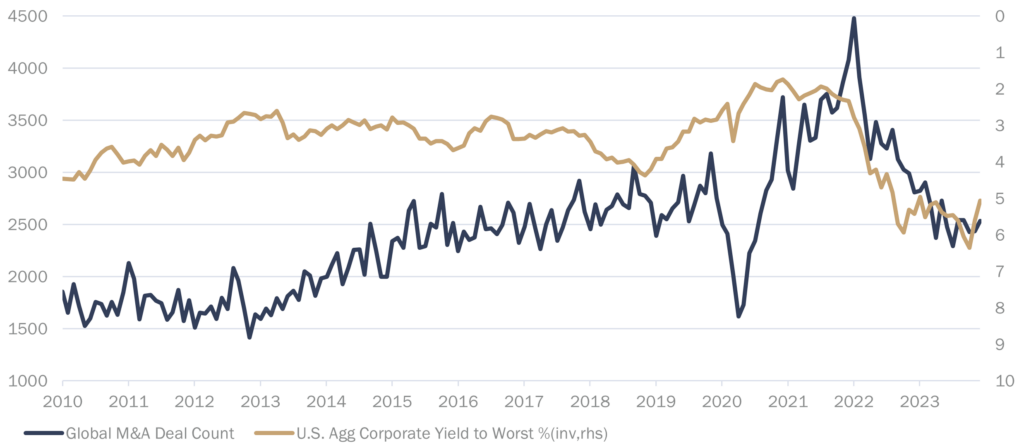

As always, we like to own companies that are cheaper and better capitalized than the market, and with better profitability. If rates do stay higher for longer, we passionately believe that public companies with balance sheet strength and proven management teams will have a competitive advantage over many PE firms who were simply financial engineers when money was easy to access. As I mentioned above, this will shrink the universe of investable public companies. Stay tuned for an increase in M&A as more and more boards gain confidence that rates have peaked.

RISING INTEREST COSTS HAVE BROUGHT GLOBAL M&A ACTIVITY TO A STANDSTILL OVER THE PAST TWO YEARS…

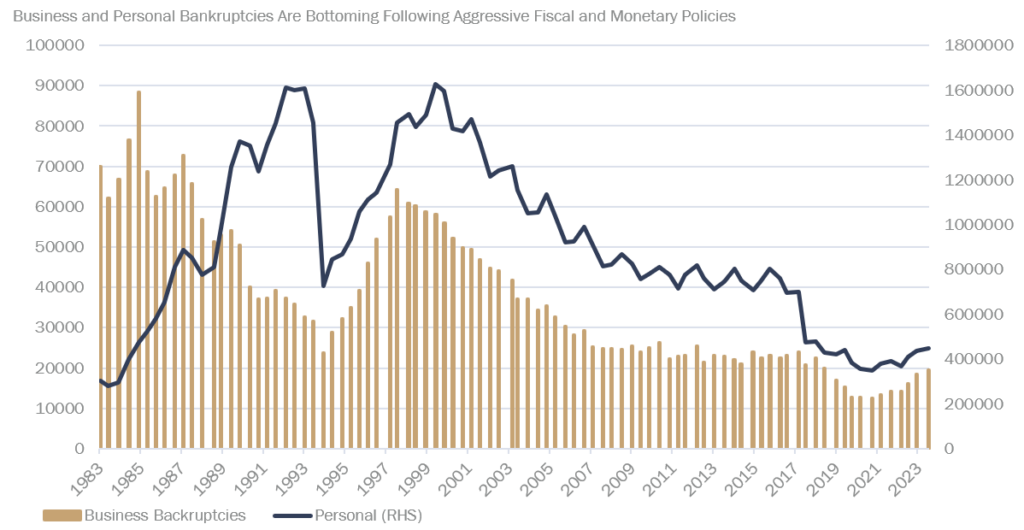

Public companies have been unable to gain market share, buy new technologies, expand into new territories or build economies of scale as a result of being crowded out from buying assets. As well, a false sense of security was created by governments who frivolously gave away our tax money to prevent bankruptcies. Nowhere was this better illustrated than with the bankruptcy of Silicon Valley Bank (SVB) last March. As SVB’s deposits grew during Covid (along with those of so many other banks) a complacency settled in amongst their investors. Those investors did not realize that many of SVB’s deposits came from money-losing, early-stage companies who had easily raised money in 2020 and 2021 when QE was manipulating bond market yields lower and lower. Now that we are in a world of QT, we anticipate the bankruptcy stats illustrated below to steadily tick up in the months and quarters ahead. Congratulations again to our long-short equity strategy, Lions Bay Fund, that was short Silicon Valley Bank last year.

BANKRUPTCY STATISTICS – ANNUAL BUSINESS AND PERSONAL BANKRUPTCIES (1983-3Q23)

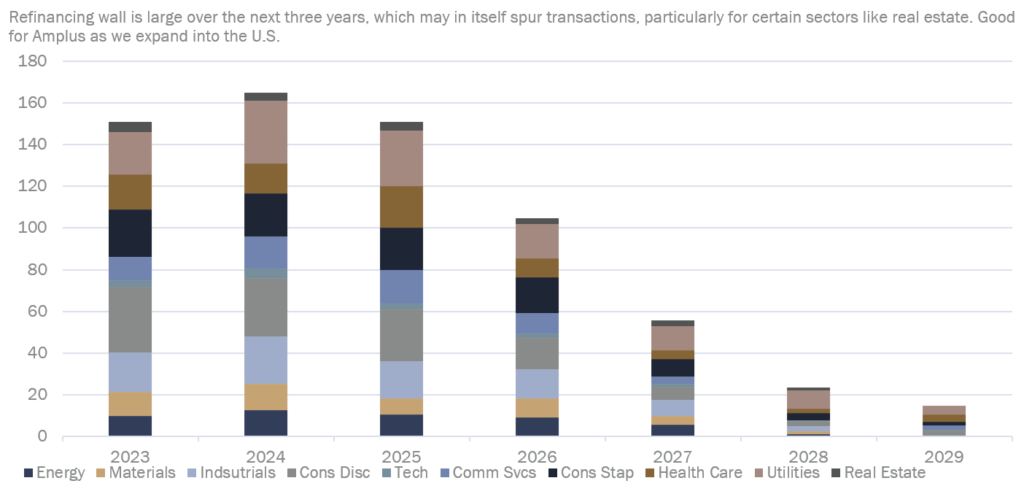

Our long-short credit strategy, Amplus Credit Income Fund, is very well-positioned to benefit from the record number of deals to get refinanced at much higher rates in the next few years. Again, as Voyager Fund’s well-capitalized holdings need not worry about higher interest expense, they will be better positioned to take share and talent away from businesses that have more debt on their balance sheets. As you can see in the second chart below, banks after the SVB collapse have become less willing to lend and their loan officers are being pressured to raise reserves. Once again, the advantage is to public companies who have access to capital in the public markets, over private enterprises.

LARGE REFINANCING WALL IN THE NEXT 3 YEARS, INCREASING POSSIBILITIES TO SPUR TRANSACTIONS

YoY GROWTH IN LOANS OF U.S. COMMERCIAL BANKS SLOWING

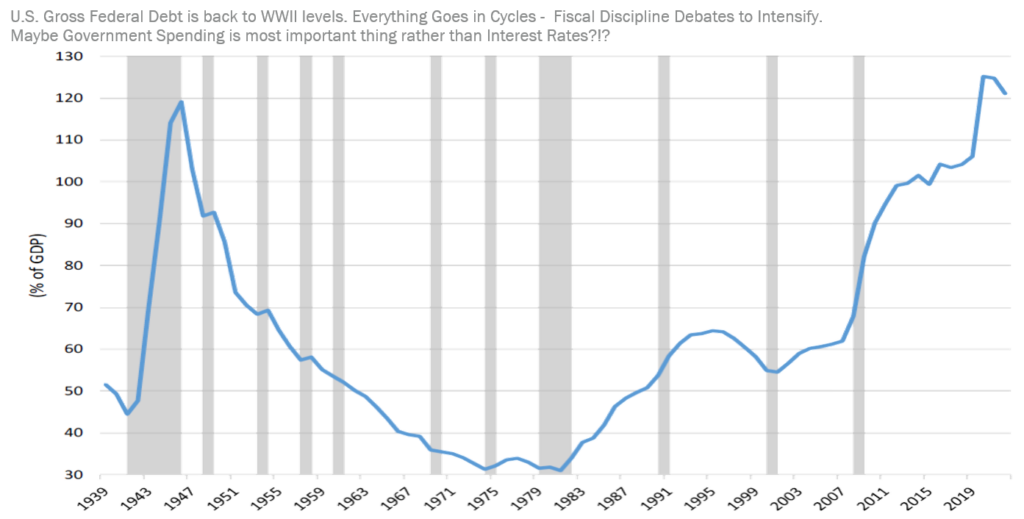

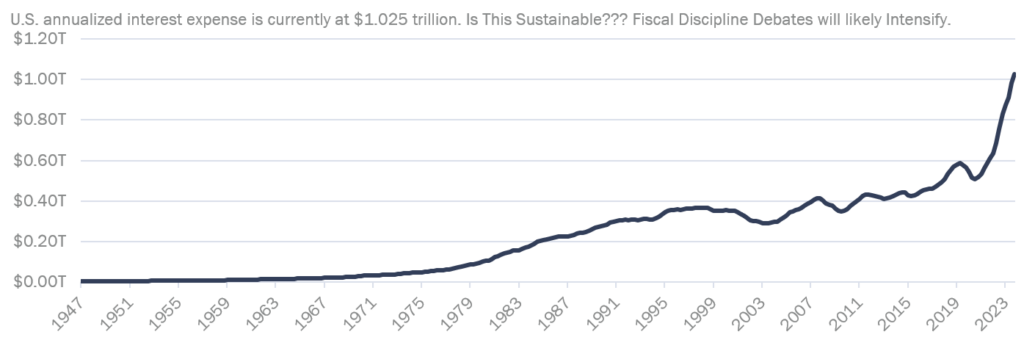

Throughout my whole business life, I have believed that interest rates are the most important factor in properly determining the value of any given business. However, I postulate that the unprecedented amount of government spending, supposedly to prevent personal and business bankruptcies during Covid, is now the most important factor in driving interest rates. As you can see in the below chart, we have not seen this level of debt in the number one global economy, as a percentage of GDP, since World War II. I believe that we are now fast approaching a tipping point. Government spending will have to be curtailed and very tough choices will have to be made. No doubt taxes/revenues will have to increase, but spending will also have to be tightened. Indeed, the second chart below illustrates the interest expense on past debt accumulation.

U.S. GROSS FEDERAL DEBT AS A PERCENTAGE OF NOMINAL (1939 – 2022)

U.S. INTEREST EXPENSE ANNUALIZED

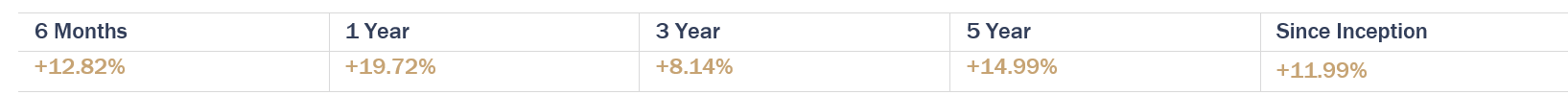

In the end, Voyager is full of ideas from around the world that meet the bottom-up investment checklist as outlined below. This lies at the heart of our investment process. My family and I have invested in this portfolio of ideas every month since it was created in July of 2018, and have seen our savings compound quite well over that time. It was the goal of the fund to produce high single-digit returns, and we are happy to have compounded at 11.99% since inception. Obviously, we would not extrapolate the returns experienced during this past February since there have only been nine months since the fund was created where returns were better over one month.

Unlike PE funds, Voyager can embrace the volatility of the market to generate incremental profits and yield enhancement strategies. It should also be appreciated that, unlike a PE fund, Voyager is a strategy that also promises monthly liquidity for its investors as do Wealhouse’s other long/short credit and equity funds where I also dollar-cost-average into every month for my family. I call this approach to asset allocation “The Modern-Day Balanced Fund”. And I consistently balance my family across Amplus, Lions Bay and Voyager because I believe there will be a lot of volatility in the world in equities, bonds, commodities, currencies and geopolitics because there is too much debt in the world.

In order to help manage smaller company investing risks, Voyager is diversified by sector, geography, currency, and size of company. We like companies with secular tailwinds that will support above-average growth in free cash flow and earnings for many years to come. The fund is positioned to benefit from the circumstance of others who cannot get financed in today’s harder-to-access lending markets. This investment thesis is still strong, and we will work very hard to build on our successful long-term, money-making track record.

Thank you again for investing alongside my Wealhouse partners and family in this investment strategy. Be on the lookout for some more silver linings in the coming months and quarters for examples of ideas we are invested in that meet our below checklist.

INVESTMENT CHECKLIST

| 1. Liquidity | 8. Improving Fundamentals |

| 2. Liquidity – Balance Sheet | 9. Proven Management Teams |

| 3. Liquidity – Free Cash Flow | 10. Higher Margins and ROE |

| 4. Solid Corporate Governance | 11. Sustainable Competitive Advantage |

| 5. Under Appreciated Long Term Growth Potential | 12. Attractive Valuations |

| 6. Conservative Accounting | 13. Quality Product and Services |

| 7. Low Employee and Customer Turnover | 14. Aligned Management Comp and Inside Ownership |