Amplus Credit Income Fund Q4 2023 Commentary: Emerging Trends and Strategic Insights

As we enter 2024, the Amplus Credit Income Fund Q4 commentary offers a reflective and forward-looking perspective on our fund’s journey. The past year has been a testament to our strategic resilience in the face of fluctuating market conditions. In this commentary, we delve into the key factors that shaped the market in the fourth quarter of 2023, our fund’s performance amidst these dynamics, and the strategies we employed to navigate the evolving financial landscape.

If we were to use ‘one word’ to describe fixed income markets in 2023 – chaotic. At first one would think otherwise. 10yr U.S. treasuries both started and ended the year at the same yield of 3.87%… Looking underneath the hood, 10yr government yields swung between 3%-5%, caused by regional banks collapsing, two ongoing wars, and changing economic data. We started the year with sticky inflation; met with cooling data to end the year, causing investors to believe that a soft-landing was very possible.

We are pleased to report in our latest update that the Amplus Credit Income Fund closed up +3.96% for the fourth quarter of 2023 and +12.84% for 2023. We finished 2023 with positive monthly returns throughout.

Since inception of July 2020, the fund is now up +58.9% after all costs. As always, the fund’s goal is to participate in the upside of the market while protecting investors from market risk. A testament to this goal was reflected in winning multiple honors at this year’s Canadian Hedge Fund awards, most notably 1st place for best 3-yr Sharpe ratio. As we look back, we wanted to re-highlight the secret sauce behind our philosophy. A Chinese Proverb sums it up best:

“It is better to take many small steps in the right direction, than to make a great leap forward only to stumble backward.”

This has been a humbling lesson to follow in an environment of new market highs. We count every day as one step closer to our goal of compounding returns.

Credit Update and Forward Outlook

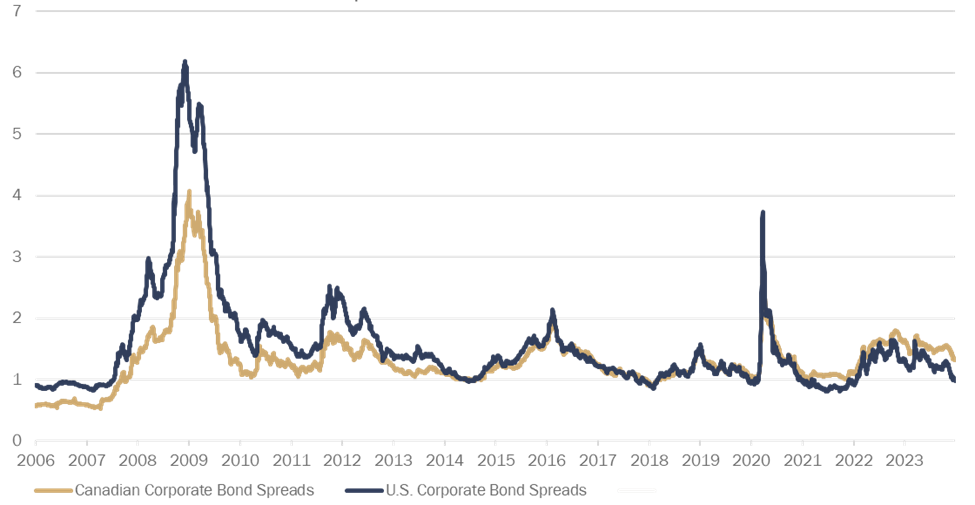

Much like the equity market rally, credit spreads closed out 2023 at the tighter end of the range. The fourth quarter saw spreads compress 15bps in Canada. The US$ markets outperformed seeing spreads close about 22bps tighter during that same period. Overall, Canadian credit fixed income indices finished up ~8% for 2023.

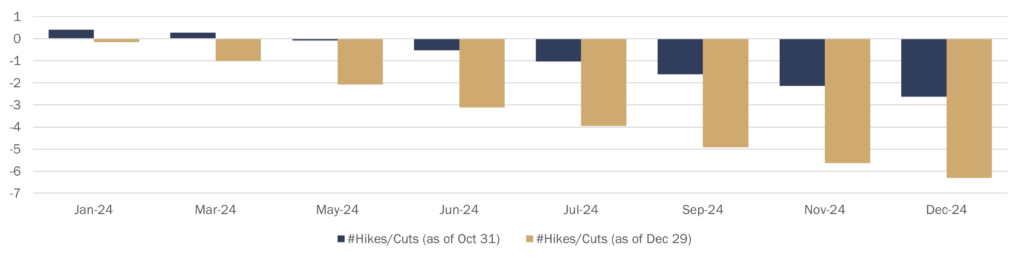

As spreads continued to compress and interest rates rallied, we sold down risk while believing it was overdone in the short-term. To better position ourselves for 2024, we looked at the risk-reward and historical valuations given the ongoing geopolitical situation, the upcoming elections, the supply landscape, Fed expectations, disappointing earnings and/or inflation as possible headwinds. The velocity of the interest rally (100bp swings in 10/30yr UST) also caused us to expect some profit-taking. With most of our positions in Canada, when looking at the Canadian futures market specifically October month-end vs December month-end, the market went from pricing 2 rate cuts to 6.5 cuts in 2024.

Despite the headwinds mentioned above, we were very much aware that Canadian markets remained cheap for credit investors versus other global markets and would limit domestic supply accordingly. In addition to this, inflows into fixed income continue to be very strong, as all-in yields remain attractive versus the last decade and the recent run-up in other asset classes.

Below are a few data points and charts that better illustrate our perspective:

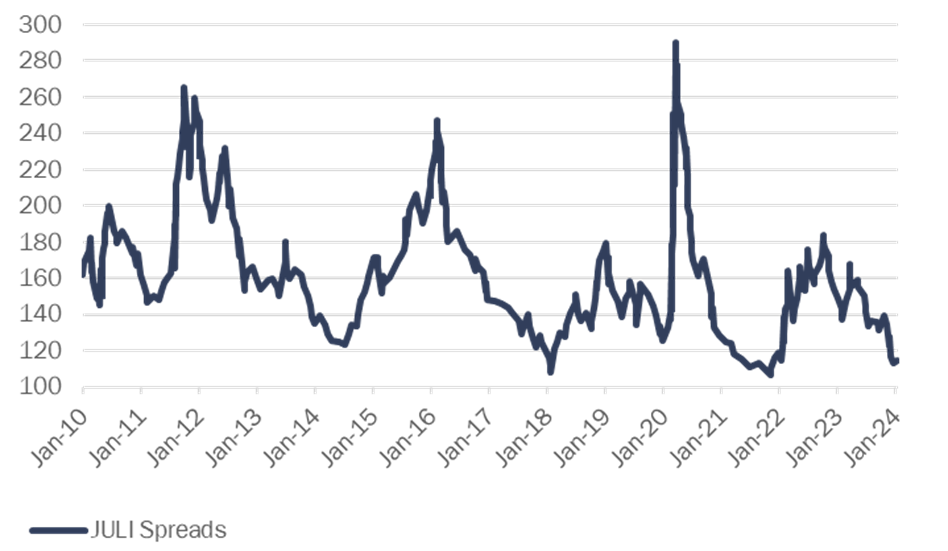

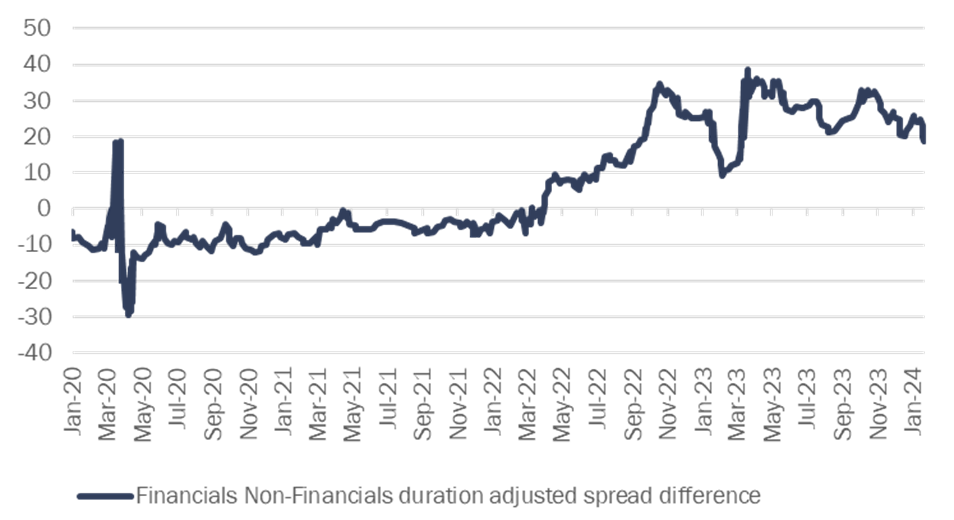

- On the one hand, investment-grade U.S. markets closed 5bps off their tightest levels since the global financial crisis, in which yields were generally much lower. On the other hand, they closed ~20th percentile since 2002. Banks and REITs stand out as the underperformers, both are sectors that we remain overweight, given the recent rate rally and new consensus of ‘soft-landing’.

U.S. HG SPREADS ARE JUST 5BPS OFF ITS POST GFC TIGHTS

FINANCIAL STILL TRADE WIDE TO NON-FINANCIALS, KEEPING SPREAD DISPERSION HIGHER THAN IT WOULD BE OTHERWISE

| Index | Yield Percentile |

| IG | 68% |

| HY | 54% |

| Index | Spread Percentile |

| IG | 19% |

| Banks | 47% |

| Basic Industry | 71% |

| Brokers/Asset Managers/Exchanges | 30% |

| Capital Goods | 9% |

| Communications | 6% |

| Consumer Cyclical | 5% |

| Consumer Non-Cyclical | 4% |

| Energy | 18% |

| Financials | 39% |

| Industrials | 0% |

| Insurance | 13% |

| REITs | 30% |

| Technology | 2% |

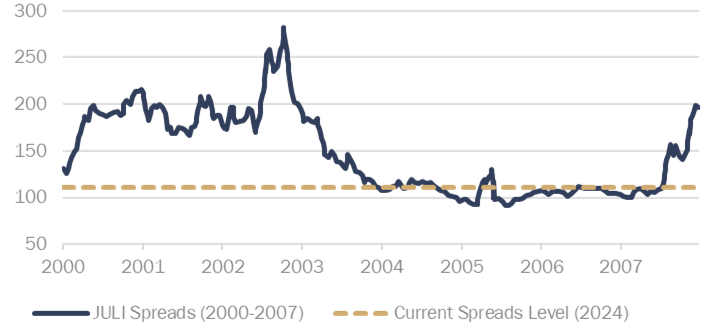

- Historically the excess return earned 12 months forward when investing at these spread levels has been negative. Spreads can also remain in a tight-range for long periods of time as seen pre-global financial crisis.

- More importantly, given the inversion of the yield curve and our continued preference for short-dated securities, the margin of safety remains very high. Our portfolio continues to offer over 8.5% running yield. The positioning of our portfolio supports this view with shorter than normal securities, giving us the ability to redeploy capital into a sell-off.

Excess Returns Over Next 12m Have Been Negative When Investing At Current Tight Spreads

PRE GFC SPREADS WERE TIGHT FOR LONG PERIODS BUT THE EVENTUAL SELL-OFFS QUICKLY ERASED PRIOR EXCESS RETURNS

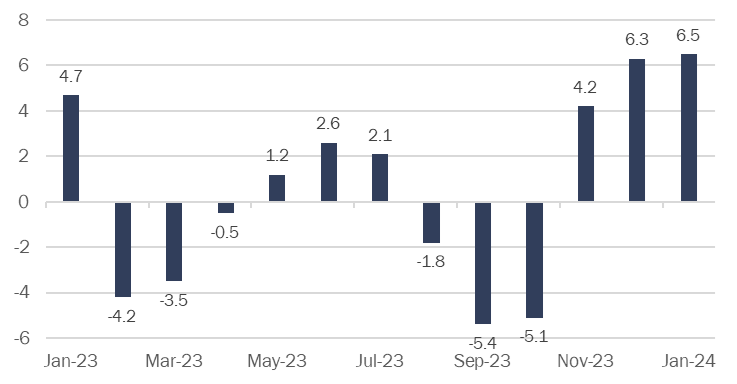

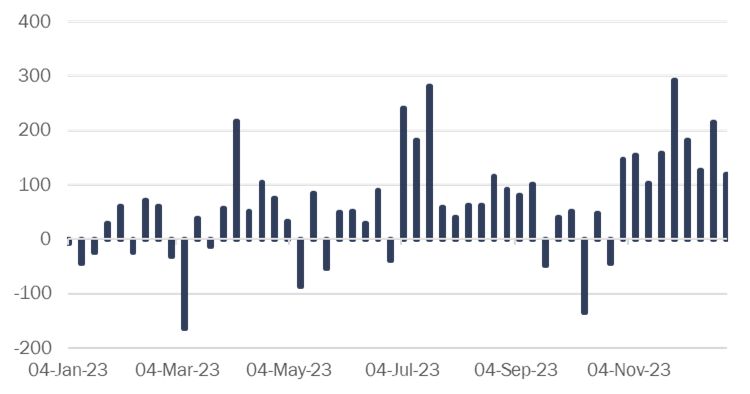

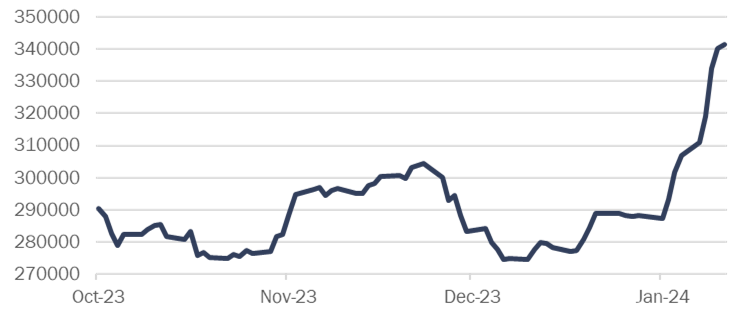

- Fund flows into fixed income remain very strong; and we expect technicals to keep spreads in a tight range for the time being. In the US$ markets, the first week of January saw the largest inflows since September 2020, with ETFs seeing the second largest weekly inflow ever.

- In Canada, demands remains robust with inflows throughout the last two months of the year. On the supply side, the final quarter of an eventful 2023 delivered $21bn of gross issuance, bringing the total for the year at close to $101bn, the lowest annual volume since 2018’s $98.8bn. And with cross-currency valuations forcing issuers into more attractive funding markets, we think there may be more room for spreads to tighten in CAD$, where a large part of our investments remain.

STRONG INFLOWS IN US$ CORP ETFS

STRONG INFLOWS IN CAD CORP FUNDS (US$)

LQD SHARES OUTSTANDING GOING VERTICAL

- Cross currency valuations and historical levels remain attractive for investors in Canada; and naturally for corporate issuers elsewhere. This push-pull dynamic should allow CAD$ spreads to outperform. With some exceptions, many issuers that have access to USD markets can get up to 50bps of savings by issuing in USD vs CAD.

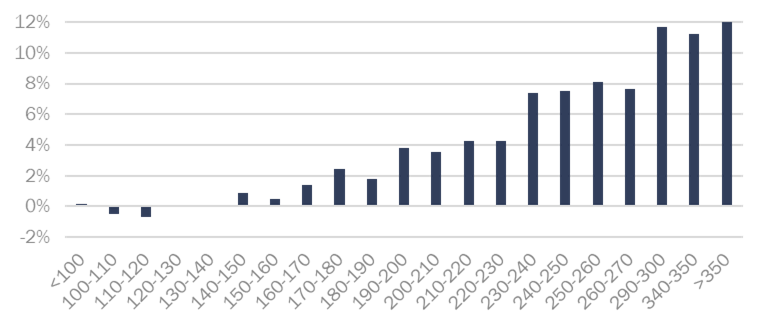

CREDIT SPREADS HISTORICAL AND BREAK-EVENS

Final Words

With all the recent hype around the Super Bowl and Taylor Swift taking an overnight flight to go watch Kansas City play, we thought it would be best to leave you with a ‘Swiftie’ analogy to better explain our process of consistent returns. Taylor Swift has broken multiple records in the music industry including: most tickets sold for an artist in a single day, most streamed album in a single day, and longest streak spent at No 1 on the billboard album chart as a solo artist. She is clearly not a one hit wonder. At the forefront of her success is a large inventory of hit singles that can be played on repeat throughout the day, slowly converting more people into Swifties. What does this prove? Those steady, consistent positive returns being compounded over the long-term will bring major league success. Being long very short-dated high-quality credits, yielding over 8.5% should provide a high margin of safety for investors, while we remain patient to redeploy cash into future opportunities. Our preference continues to be higher quality names such as banks, and REITs that benefit from a lower rate environment and demand-supply imbalances.