Lions Bay Q4 2023 Commentary: Navigating Sideways Markets

Explore our latest Lions Bay commentary for a deep dive into our market analysis and strategic insights. This commentary sheds light on our response to market volatility, the strategic measures we’ve implemented, and our plans for sustained growth and resilience. It’s a comprehensive look at our journey through complex market conditions and our forward-thinking approach for future challenges and opportunities.

For the fourth quarter of 2023, Lions Bay was up +3.21%, resulting in a full year return of +10.81% compared to the S&P 500 which was up +26.25% for the year. Lions Bay has generated annualized returns for the past three years of +32.16%, the past five years of +21.47%, and since inception +20.54%. Over the corresponding periods, the S&P 500 has annualized +10.17%, +15.84% and +11.66%.

It has been an interesting two years for equity markets. The S&P 500 closed 2023 almost exactly where it closed 2021, declining close to 25% from the all-time high of 4796 marked in the first week of 2022, before mustering a 36% rebound from the October 2022 lows to close out 2023 back at 4783 – a long road to nowhere. We highlight this to reiterate the importance of producing ‘downside alpha’ – our strategy aimed at preserving capital during market downturns and generating outsized returns relative to the market. It’s a vital approach, especially considering that a 25% market drawdown requires a 40% recovery just to break even. This underscores the compounding effects of drawdowns and the significance of avoiding them.

While Lions Bay underperformed the market rally meaningfully in 2023, due to the downside alpha we generated during the bear market in 2022, the Fund was up 54% over two years that were ultimately sideways for the market.

Looking back at each of the past two years, it was clear that the dominant narrative going into year-end in each case was completely wrong.

At the end of 2021, the narrative was that inflation was transitory, that Powell wasn’t serious about tightening policy, and a richly valued market was reflecting a high degree of complacency. The result was of course that inflation was not transitory, the Fed proved more aggressive than expected, volatility ripped, and equities were punished – in particular those which were highly speculative and overvalued. This created an ideal environment for the strategy we employ at Lions Bay.

At the end of 2022, the narrative was that inflation was sticky, a recession was mere months away, and at 3840 the market was pricing in a great deal of this pessimism. Inflation ended up reversing in an orderly fashion while the economy proved more resilient to higher rates. The market had a stellar year, led by the largest and most liquid companies. Volatility was crushed all year, and the market was driven by a very narrow group of stocks, a challenging environment for Lions Bay to differentiate ourselves.

At Lions Bay, we did not appreciate the extent to which our fears on the economy had been priced into the market and spent much of the year overly defensive. Our underperformance relative to the broader market was also because we own a portfolio of largely idiosyncratic, economically sensitive businesses, and are underweight the mega cap technology stocks that dominated the index returns this year. As the chart below shows, seven stocks contributed over 1500 basis points to the S&P 500’s return for the year.

| Company | Sector | Starting Mkt. Cap. Weight | Total Return | Contribution to Index Return (bps) |

| Microsoft | Information Technology | 5.60% | 58.00% | 324 |

| Apple | Information Technology | 6.10% | 49.00% | 297 |

| NVIDIA | Information Technology | 1.10% | 239.00% | 272 |

| Amazon | Consumer Discretionary | 2.30% | 81.00% | 188 |

| Alphabet | Consumer Discretionary | 3.10% | 58.00% | 162 |

| Meta | Consumer Discretionary | 0.80% | 194% | 164 |

| Tesla | Consumer Discretionary | 1.00% | 102.00% | 105 |

Looking ahead to 2024, we believe the current market set up rhymes with the one we faced at the end of 2021. The market is once again operating under the framework of a firmly established consensus: a belief in a “goldilocks” outcome to this evolving business cycle. On the one hand, by pricing 6 rate cuts between now and January 2025, the market clearly feels things are not going to get ‘too hot’, and that the Federal Reserve will be able to aggressively cut rates without risking a resurgence in inflation. On the other hand, the market is not concerned about things getting ‘too cold’, which would be characterized by a rapid rise in the unemployment rate or a deterioration in corporate earnings, as reflected by the 17% expansion in the S&P 500 forward earnings multiple over the course of 2023. Asset manager positioning towards equities bordering on euphoric also reflects this optimism on the economy.

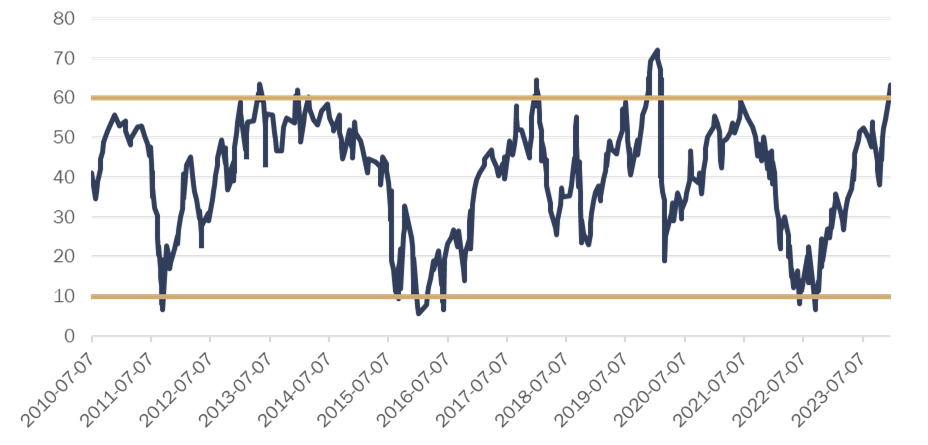

LONG/SHORT LEVERAGE: OVERALL PRIME BOOK

ASSET MANAGER POSITIONING AS A % OF SPX MKT CAP (IN BPS)

Our view is that something will have to give: either growth will stay too strong to justify the current outlook for monetary easing, or if the current outlook for easing is correct it will be due to a sharp deterioration in corporate earnings and employment. Fortunately for Lions Bay, we are currently in an extremely low volatility environment, which allows us to prudently protect our portfolio against the type of market dislocation either reality check would represent.

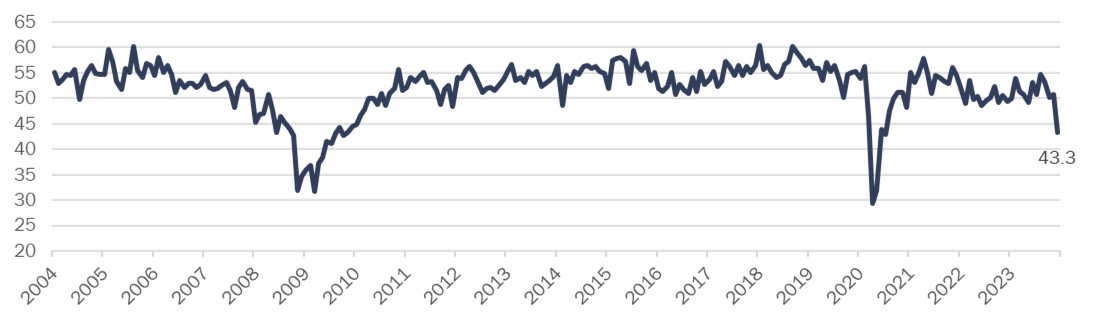

When it comes to the path of how quickly the Fed may adjust rates, we are cognizant that this will be very dependent on the U.S. labor market which up until now has been quite strong. As the Fed manages its dual mandate the path of moderate or more pronounced easing depends on the employment picture in our opinion. Currently, U.S. unemployment sits at a very low rate of 3.7%. For the Fed to lower rates by the market expectations of nearly 150 basis points, we would need to see employment deterioration. Below is a chart showing the first signs of declining employment expectations from the US services industry which has been the backbone of US economic strength.

The path of rates and the inevitable resolution of whether this will be a ‘hard’ or ‘soft’ landing rests on the pace at which the labour market deteriorates. We are not as sanguine about this outcome as the aforementioned market appetite for risk.

NAPMNEMP INDEX

Despite our cautious view on the broader market, we do believe that 2024 will be a better environment for stock pickers than last year and continue to find compelling single stock investment ideas despite our generally defensive posture. One recent addition to our core portfolio was IBM.

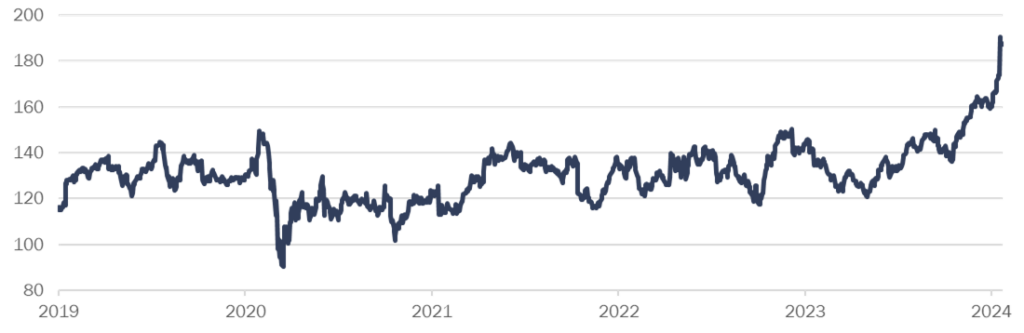

IBM STOCK PRICE

Since acquiring shares in early January, the stock has broken out of a multi-year consolidation as the investment community has begun recognizing the company as an under-appreciated AI beneficiary trading at much more reasonable valuations than their peers.

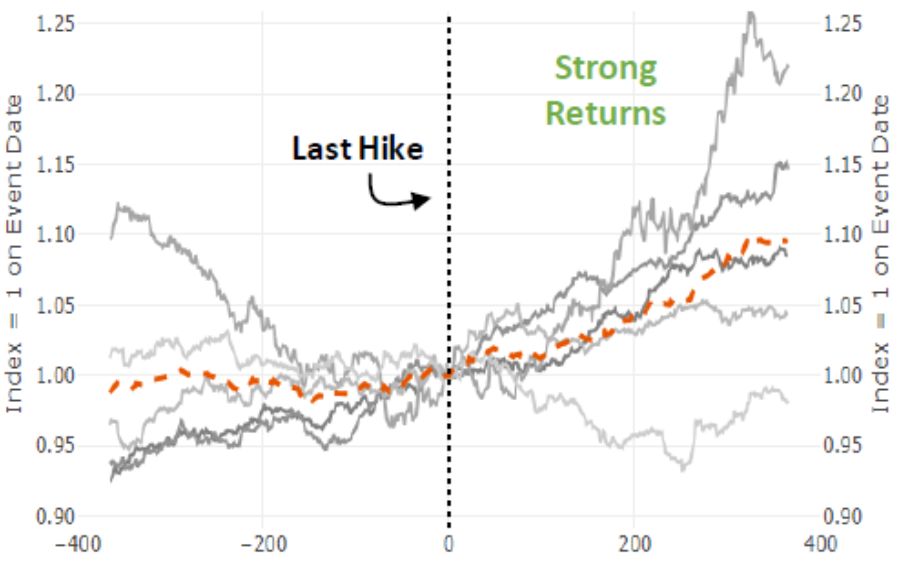

IBM shares are trading at a 6.8% forward Free Cash Flow yield and are expected to generate a Return on Equity of over 30% for 2024. Importantly, as the work from strategists at Pipe Sandler shows below, Free Cash Flow Yield is historically the top performing factor in the 6, 9 and 12 months following a Fed pivot.

RELATIVE PERF OF HIGH FCF YIELD AFTER FED PIVOTS (S&P 500, HIGH TO LOW FCF YIELD, Q1 VS Q5)

| Factor | +6M | +9M | +12M |

| Free Cash Flow Yield | 3.58 | 6.98 | 9.49 |

| Free Cash Flow to EV | 2.63 | 5.38 | 8.55 |

| Earnings Yield | 1.75 | 4.93 | 7.68 |

| ROE | 3.46 | 5.7 | 7.62 |

| Buyback Yield | 1.86 | 4.54 | 7.04 |

| Operating Margin | 3.64 | 5.96 | 6.84 |

| ROIC | 1.44 | 3.88 | 6.66 |

| ROA | 1.91 | 4.47 | 6.49 |

| Net Income Margin | 2.2 | 4.87 | 6.44 |

| Shareholder Yield | 0.29 | 3.82 | 6.09 |

IBM will enjoy meaningful margin expansion in the coming years, with EBIT margins of 12.1% last year expected to grow to 17.5% by the end of 2024. Microsoft’s shift to cloud computing in the mid-2010s was an example of a mature business that shifted into faster growth, higher margin end markets and saw their shares benefit both from a ramp in earnings and a tremendous expansion in their trading multiple. We believe IBM is undergoing a similar transition and expect it to be a long-term core holding for the Fund.

Against the backdrop of a richly valued market, the year ahead holds a high risk of a slowdown in the economy, considerable uncertainty around the direction of inflation and monetary policy, continued geopolitical tensions and a Presidential election in the United States. Given such an environment, we are confident that the year ahead promises to be much more volatile than the last. We anticipate this to translate to a greater number of alpha opportunities for Lions Bay in 2024 and look forward to a more dynamic market environment ahead.