Amplus Credit Income Fund Q1 2024 Commentary: Patience & Prudence

In our latest update we are pleased to report Amplus Credit Income Fund closed up +2.94% for the first quarter of 2024.

One of my favourite movies growing up was Kung Fu. Having practiced karate for over 20 years, martial art movies have always piqued my interest. In the movie, the Grandmaster would often provide wisdom by saying, “patience, young grasshopper’ to remind his student to relax and focus on the mission’s fundamental purpose. He used a grasshopper analogy as this insect is known to be constantly jumping from one point to the next, irrationally and on impulse. When thinking of financial markets, we can often see irrational behaviour and complacency. Patience can become very critical during these periods. Q1 has been a humbling lesson to follow in an environment of new market highs. We count every day as one step closer to our goal of compounding returns while remaining disciplined irrespective of market behaviour.

At the risk of sounding entirely like a broken record, equity and risk assets continued their ascent in Q1 2024 following the last quarter; however, rates didn’t cooperate with hotter data. Powell’s rhetoric of a soft-landing in sight, did not stop interest rates from going higher, with fixed income investors challenging the status quo. With April’s arrival, we are finally starting to see reality set in. Unlike Q1 in which good economic data was good news for the market, Q2’s good economic data is bad news for the market. Several Fed officials are now pushing back on the notion of cuts, and estimates are now calling for possibly only 1 rate cut for all of 2024 – a far cry from the 7 priced-in cuts to start the year. Equities have finally started to react accordingly.

Credit Update and Forward Outlook

Much like equity markets, credit spreads closed out Q1 2024 at the tighter end of the range. With credit firm, we saw a record number of debt deals in the U.S. market for any given quarter, with $550bn of supply (+40% YoY). The Canadian market saw the second highest first quarter on record with $36bn of supply. Despite this, credit spreads still finished ~13bps tighter in Canada and ~10bps tighter in U.S. markets. Demand for credit was very firm.

One theme worth highlighting in Q1 for Canada: Many of the new debt deals came at zero or negative concessions. In other words, it was cheaper buying existing debt ahead of the deal, as the outsized demand for new issues outstripped supply. This required much more diligence on our part; in which we passed or dropped our order on several deals. REIT issuers were active, as they tend to refinance in waves. We benefited from the negative concession trend in this sector as we were overweight REITs, with new supply repricing our existing positions as much as 40bps tighter.

Last quarter we highlighted that Canadian spreads were cheap to global comparables. As such, Canadian spreads outperformed their U.S. counterparts. We continued to take this as an opportunity to sell down risk, while increasing our interest rate exposure in light of higher yields. By doing so, we see it more as a premium-free hedge for our credit exposure in the face of increasing geopolitical uncertainty. Our proprietary research also sees more merit in being long interest-rates as the risk-reward and historical valuations justify some exposure. With such worries, we continue to also like commodity-linked credits such as energy producers with pristine balance sheets, which now trade cheap to telecom and senior bank debt.

Below are a few data points that we are watching closely going forward:

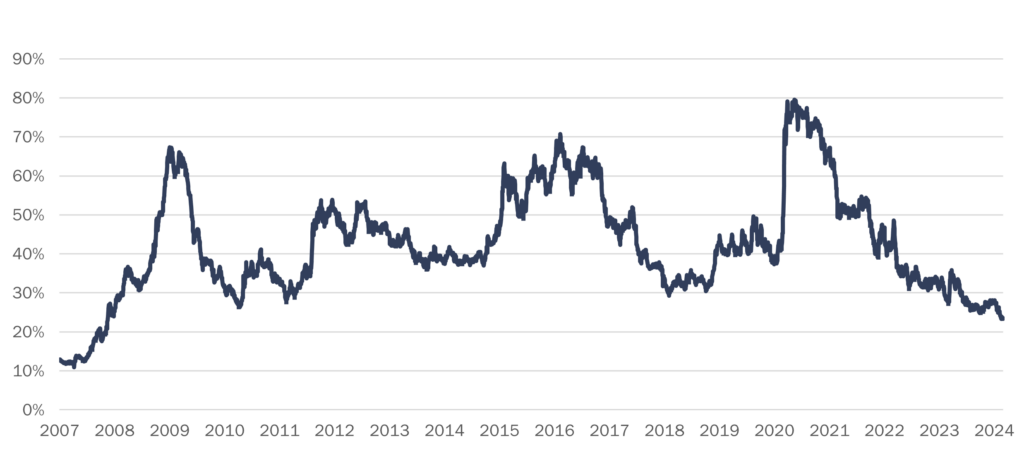

- When Amplus started investing in the Summer of 2020, credit spreads made up about 80% of the overall yield on a corporate bond. Now, credit spreads make up 20% of the overall yield. This doesn’t mean that credit is expensive; we see this dynamic more so impacted by the huge spike in treasury yields making up much more of the overall yield on a corporate bond. Given this, we see it as prudent to have long interest rates.

Ratio Between Bloomberg Canada Aggregate Corporate Spread & All-in Yields

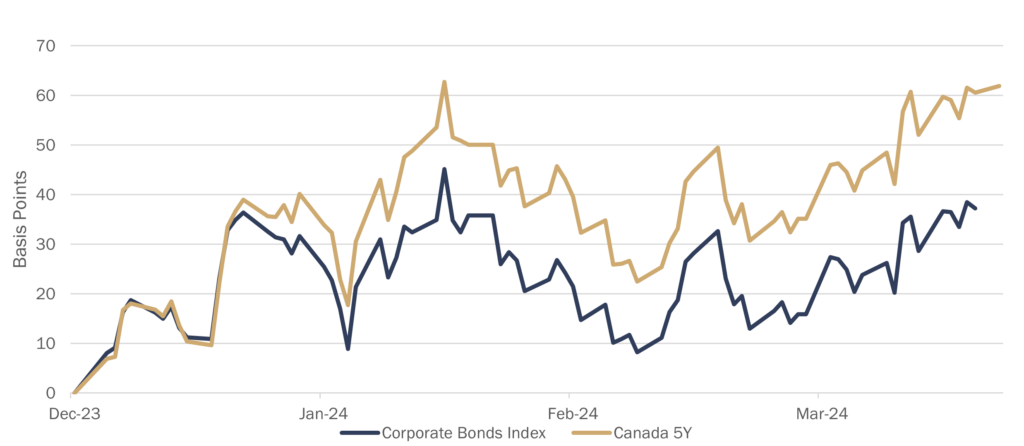

- Corporate bonds are yielding 0.37% more now than at the start of the year. Whereas, Canadian Government 5yr bonds are yielding 0.60% more. This highlights the outperformance of spreads relative to higher yields and also reinforces our view of shifting our exposures from credit into rates. Nevertheless, we believe that spreads will remain stable and perform well compared to other risk assets as yields remain higher for longer, supported by inflows into the asset class. So far, April is showing signs of this trend, spreads have done well relative to the magnitude seen in equities selling off.

YTD YIELD CHANGE

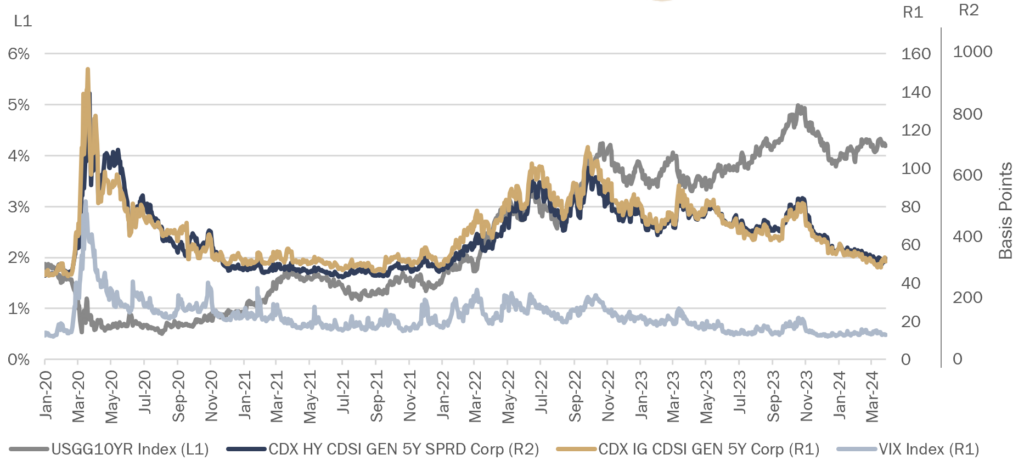

- Volatility (VIX) is a good indicator to look at when thinking of Credit Default Swaps (CDS). It also provides an overall read on complacency in the market. At low levels, the cost of insuring a portfolio becomes cheaper. In Q1 2024, CDS on IG and HY indices reached multi-year tights, while the VIX reached multi-year lows. This gave us the opportunity to hedge our book with cheap insurance-like protection, without selling away strong conviction credits in our portfolio. When looking specifically at CDS for high-yield indices, protection costs are close to 200bps or 40% less than they did in October. We see a lot of value in owning insurance like contracts in this higher-beta derivative.

DECOUPLING OF MARKET SENTIMENT

- Many high-yield issuers chose Q1 to refinance debt early and extend their maturity schedule. Cineplex, Secure Energy, Mattr, Baytex, and Atkins Realis were a few Canadian names that chose to refinance early. A natural question would be why? Is this signaling a top? Much like equity IPOs, the optionality doesn’t lie with the investors. In this case, the optionality lies with the high-yield issuer when refinancing debt early. The treasurers of these companies must have seen more favorable and opportunistic pricing now, while markets were open and competitive, rather than risk a weaker environment closer to the date of their maturing debt.

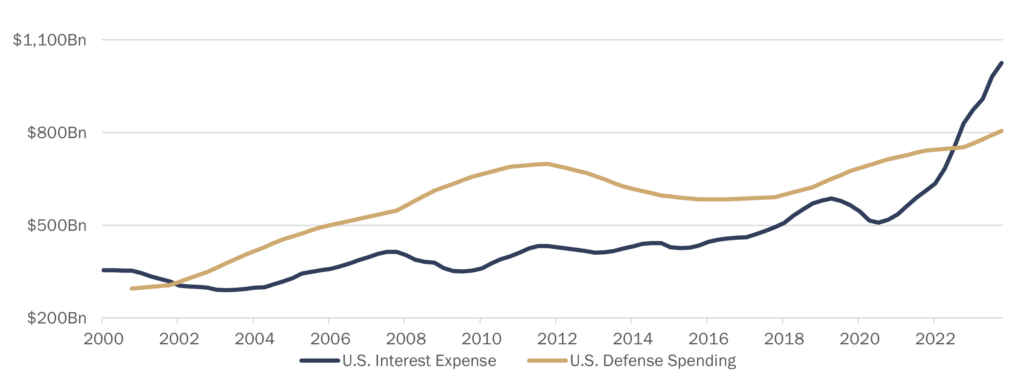

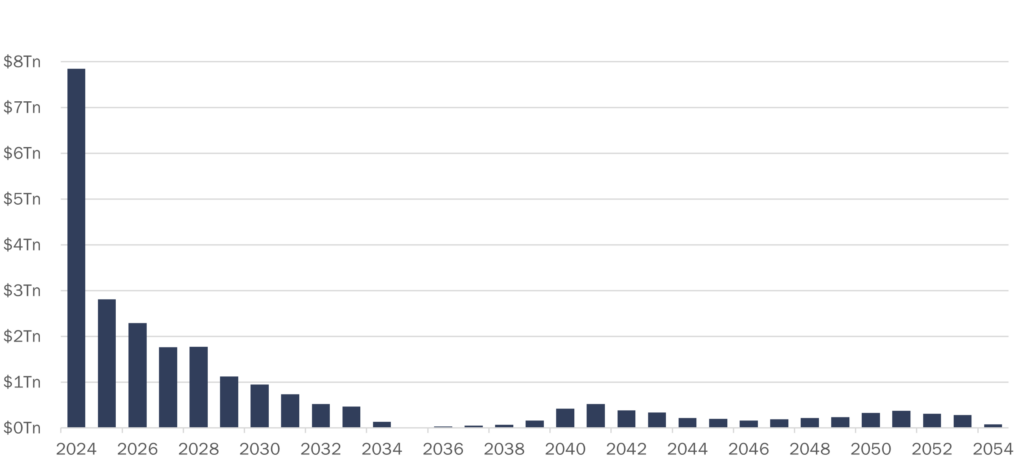

- We highlighted in our most recent The Weekender the diverging paths between the Canadian and U.S. economies. With a hotter economy and higher inflation in the U.S., the Fed may be forced to keep interest rates elevated for longer than they’d like. The single largest expense for the U.S. government is interest payments on their debt, outpacing defence spending. Interest payments have nearly doubled since the onset of the pandemic. Furthermore, when looking at the debt maturity schedule of U.S. government, short-term T-bills make up an outsized portion of the overall debt. Therefore, higher interest rates have a much bigger impact on the government’s future interest profile. Something has got to give, as deficit spending, ultra low unemployment and record high interest payments may be taking the government to a path of no-return. We see merit in owning interest rates given this unpleasant reality setting in.

U.S. DEBT INTEREST VS. DEFENSE SPENDING

U.S. DEBT OUTSTANDING

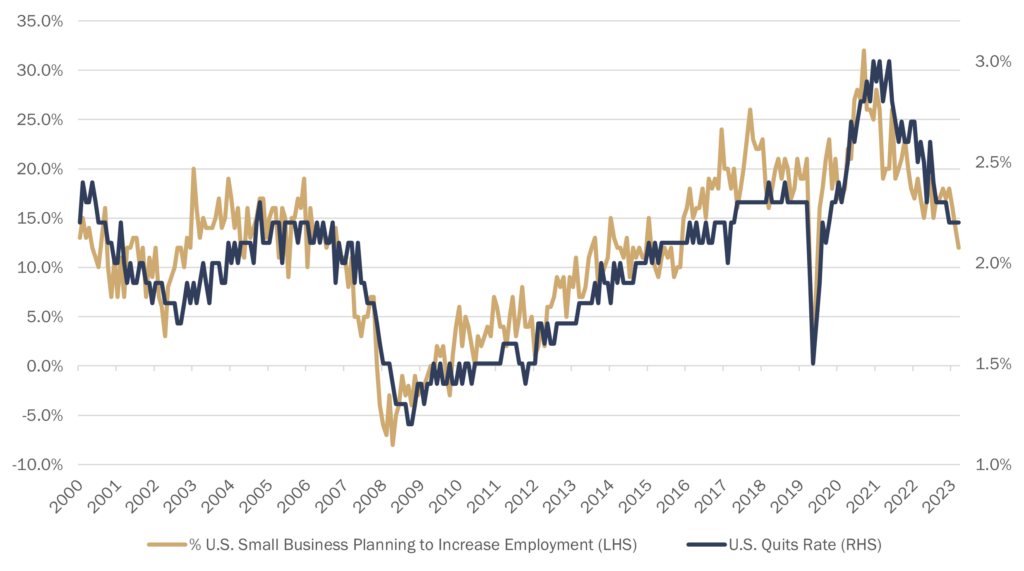

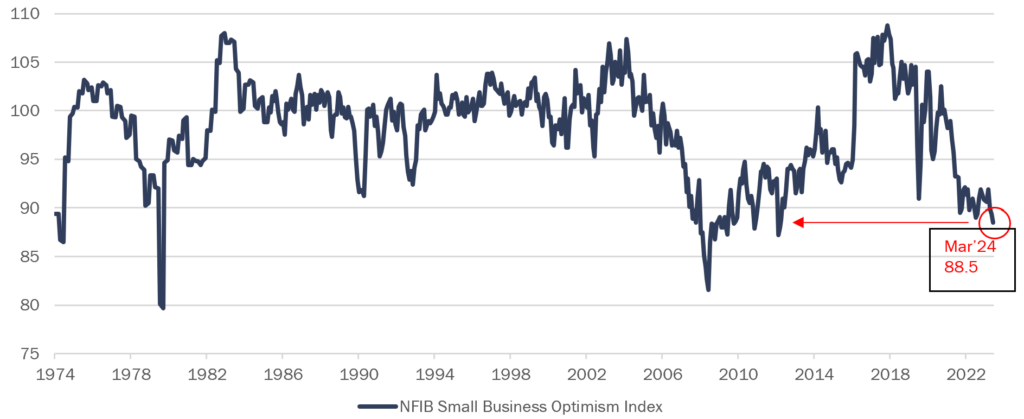

- We are carefully monitoring overall macro trends, to better position ourselves within interest rates. Ignoring the large blue-chip companies that have longer maturity schedules and access to cheaper financing, small businesses are really feeling the impacts of higher rates. Last checked, according to the U.S. Small Business Association, small businesses of 500 employees or fewer made up 99.9% of all U.S. businesses, accounting for 44% of GDP and 64% of new jobs annually. There is truth in the saying that small businesses are the heart of the economy. As shown below, with increased challenges, small businesses will have a big impact on the overall economic slowdown.

SMALL BUSINESS HIRING PLANS DROP TO LOWEST SINCE JUN’16

SMALL BUSINESS OPTIMISM AT 11-YEAR LOW

Final Words

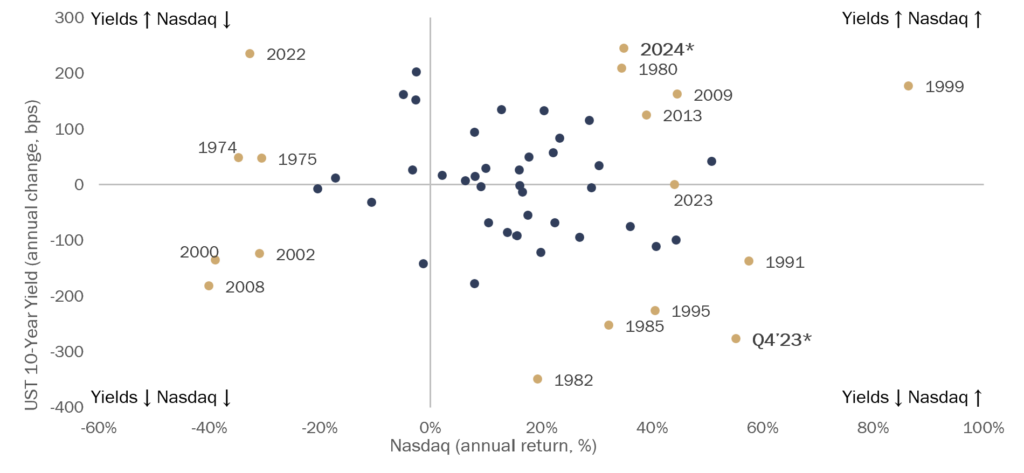

To conclude, we leave you with this chart, which summarizes very well the dislocation highlighted in our opening remarks between equities and interest rates. The contrast between Q4 2023 (lower-rates, higher equities) and YTD 2024 is eye-opening (higher-rates, higher equities).