Fixed Income Flourishes

Coming off one of the worst years for bonds in recent history, 2023 has been an exceptional time for fixed income. With rising rates, fixed-income securities have been yielding almost as much as the earnings yields of major equity indices, and even surpassing those indices’ dividend yields. Bonds are in vogue again, which encourages us to look at why credit income funds are attractive – now more than ever.

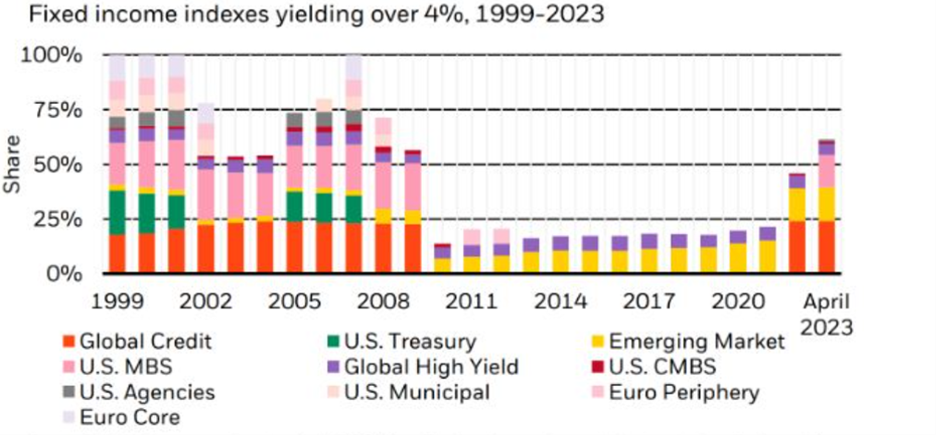

YIELD IS BACK

After years of being starved of income, the most aggressive hiking cycle in decades has made short-dated fixed-income securities a haven for cash generation and for investors not looking to take on large interest rate risk. This environment is ideal for fixed-income carry strategies, designed to own short-dated credit and produce a high margin of safety with these spreads.

These times are also a reminder of how important it is to remain agile and liquid. With a looming recession, most market participants have chosen not to expose themselves and are instead staying in attractive money markets or sitting on cash. While this shows that investors are taking economic headwinds seriously, it also indicates that some of the best opportunities are yet to come. The deployment of this cash when economic sentiment turns bullish could lead to large gains in risk assets quickly. As Wealhouse has said time and time again – we prioritize liquidity and nimbleness to mitigate these situations. When there are major moves to the upside, we can identify and take advantage of those opportunities promptly.

The resounding sentiment in our market’s current situation is fear. The regional bank crisis, tight lending conditions, resilient inflation, and a strong job market have created a great deal of uncertainty for most. However, this volatile perception of economic conditions has benefited holders of quality credit, which is precisely how carry strategies like Amplus position themselves. In treacherous conditions, investors get back to basics, and holders of quality short-term fixed-income securities are anticipating gains as this trend continues and more investors arrive late to the party.

Overall, the attractiveness of fixed income right now rests in relative terms. With a plethora of risk in equity markets and fears in commercial real estate producing a variety of negative externalities across real assets, there is not a better offering on the market than credit funds like Amplus that preserve your capital through stable and liquid fixed income securities. We believe that the coming months will be painful for many investors, and Amplus’ strategy composed of active management of quality credits positions us to protect investors during this decline and as well for growth when the good times return.