Sell in May & Go Away

“Sell in May and go away” … A popular adage for many years encouraging a strategy of avoiding equity market participation from May to October. Historically the markets have underperformed during these months, with the S&P returning a cumulative average gain of 6.7% from the months of November to April and just a 2% average gain between May and October since 1945.

This gives investors a rule of thumb for entry and exit timing and paints a simplified picture of historical market returns and their seasonality. While the statement is thought-provoking, there are many exceptions and caveats to the theory of middle-year underperformance in the stock market. Regardless, the alluring thesis gives us an opportunity to discuss the state of our stock market heading into May and why we think this may be the summer to undertake a similar strategy.

With recession fears looming since the beginning of the year and only further exacerbated by the banking mess, stocks have soldiered on. The S&P is up ~8% YTD characterized by a massive rush to a limited cohort of tech stocks. However, it seems difficult to imagine equity markets staying this healthy as tighter lending conditions, resilient inflation, commercial real estate scares, and a strong service-driven labour market persist. Approaching the end of one of the most aggressive hiking cycles in memory, our economy is only beginning to feel the effects of expensive funds.

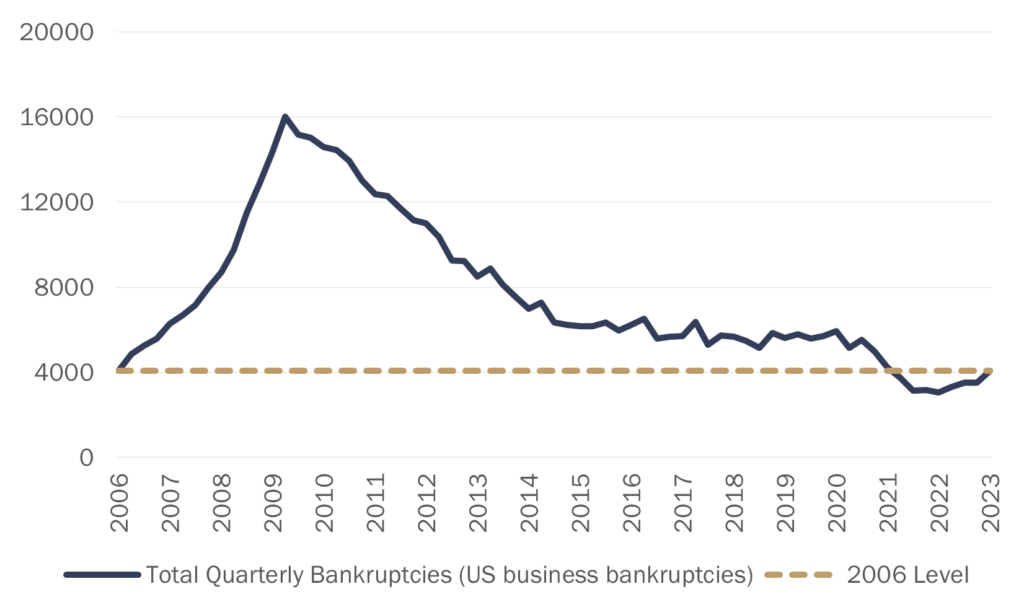

Just past the 1-year anniversary of the first hike in this cycle, quarterly bankruptcy filings in the U.S. remain at their lowest levels since 2006. This disconnection between policy and material economic pain indicates that the worst is yet to come. Once corporations and individuals look to re-up on their loans, the true ramifications of the past 12 months will reveal themselves. An extreme tightening of monetary policy and lending standards is unlikely to end in peace for both creditors and debtors, which will increase cost-cutting pressures, lead to larger layoffs, create difficulties in attaining new funding, and overall slow growth.

It appears this pessimism has yet to be priced in across equity markets, as major indices trade at forward earnings estimates well above their long-term averages. This thin margin of safety in equities before the real effects of tightening have been felt, coupled with a high risk-free rate makes the assumption of market risk unattractive for the coming months. The economy must remain robust for earnings yields to stay competitive with attractive money market fund yields and risk-free asset returns, and since the worst of the credit cycle has yet to begin this is unlikely.

One of the most aggressive hiking cycles in history is sure to come at a cost, and it appears that our economy has yet to feel the extent of it. As the summer months progress and the pain sets in, investors will have to adjust to a much tougher environment. The times when one can win by rushing to tech in response to every scare won’t last forever, and capital preservation will rely on vigilant management of treacherous conditions. With all the aforementioned factors at play, it is time to stay balanced between long and short capabilities in Amplus and Lions Bay.

U.S. BANKRUPTCIES STILL AT PRE-FINANCIAL CRISIS LEVELS