Note from the Credit Desk

Amplus Credit Income Fund’s portfolio has gone from yielding 8.4% to 9% with the latest move higher in yields, all while producing a positive gain MTD of about 0.3%. Meanwhile…

June continues to see losses in fixed income with indices down 1-1.5%, following May’s negative returns of about 2%. Central banks around the world have recently become the most hawkish in over 2-3 months with a surprise hike by the Bank of Canada of 25bps, a larger than expected 50bp hike by the Bank of England and Fed Chair Powell not expecting any rate cuts for a few years. To our surprise, risk markets are shrugging off the warnings. Equities up, credit tighter, vol lower…. Has the recession been delayed? Will it be a soft landing? We aren’t so sure about that.

Fortunately, interest rates and forward-looking rates are higher, supporting the central banks’ hawkish tone. Futures are pricing in more hikes and no cuts expected for the next 6-9 months. Below are a few charts that highlight why we’re excited about fixed income as a whole. As such, similar to our March playbook, we view rate risk as a premium free hedge in case of a large risk-off event. This was one of the main reasons why we posted positive returns in March despite the large SVIB risk-off event. Over the last month, we have been unwinding with discipline our interest rate hedges, increasing our rate risk from <1yr to 2yrs. Yes, interest rates may be going higher, but the forward-looking curve (OIS) is already pricing in these hikes. The high margin of safety in owning 1-2yr high-quality corporate bonds yielding close to 6% makes a lot of sense, as reinforced by the charts below. History also reminds us that when central banks turn, they generally overshoot.

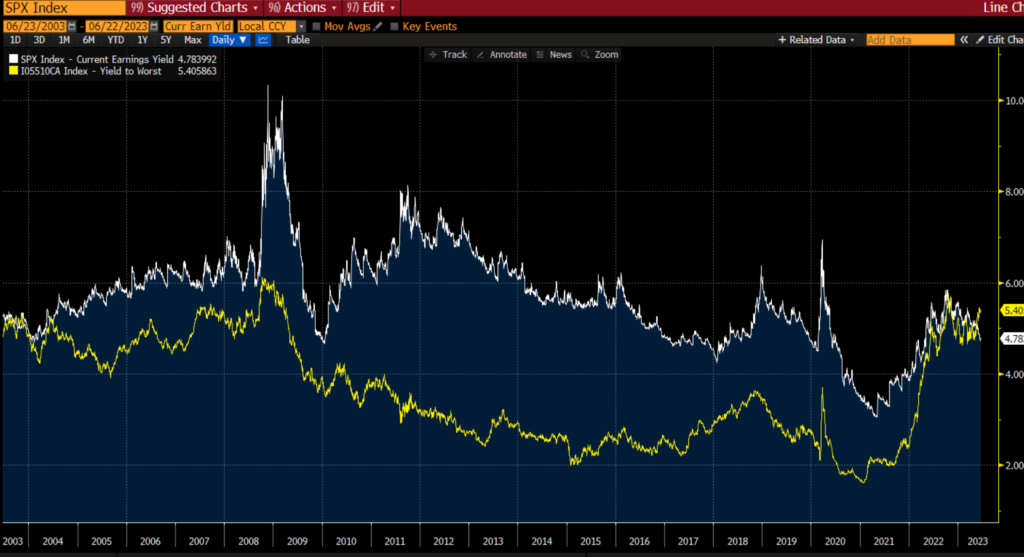

The yield of the Canadian corporate bond index pays more than the earnings yield of the S&P 500. This has only happened once in 20 years.

Credit spreads are historically wide, but from an all-in yield perspective credit premiums make up 27% of it given how high treasuries yields are. This is at the lower end of the range. From a relative risk premium, we see a lot of value owning bonds outright without any rate hedges on. The chart below displays the average credit spread of the corporate bond index relative to the overall yield of the corporate bond index.