Amplus Fund July Update

With Fed Chairman Powell focused on the labour market, Andrew James Labbad gives his outlook on how the expiring unemployment subsidies may in fact lead to better economic jobs data and potentially sooner-than-expected tapering.

Home ownership is a hot commodity. The housing market is on fire, literally, and I am not referring to the deadly heatwaves spreading across the globe right now. Burned down homes are fielding multiple offers pouring in above ask. In San Francisco, shambles of a fire-torn house are drawing plenty of bids above the listed $850,000. Could this be a result of the endless stimulus?

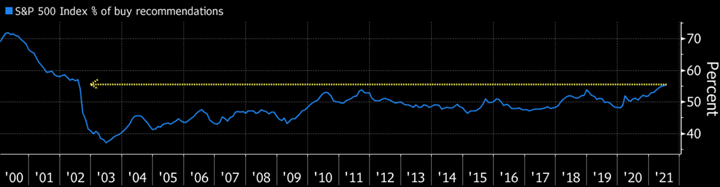

With the help of Fed Chairman Powell’s printing press, savings have reached record levels. Money market accounts, viewed by some as “dry powder” reserved for equity deployment, sit at just under $4.5 trillion. The Federal Reserve’s count of money on deposit with commercial banks, has risen 33% from 2019 to $17 trillion. And despite equity markets hitting all-time highs again last month, market optimism continues to rise – the most since 2002.

Why is there so much stimulus in the market, with record savings and so many jobs left unfilled? Fed Chairman Powell seems to be razor-focused on the labour market and unemployment with inflation being a backburning thought, yet inflation is the highest since 2008. There are over 10 million job openings in the U.S. versus 8.7 million people unemployed. Small businesses, restaurants and entertainment are reporting a shortage of workers with about half unable to fill the reported job openings in July. The reality is that millions of Americans are making good money remaining unemployed and so they choose not to work. With enhanced jobless benefits, expanded healthcare subsidies, childcare payments, child tax credits, food stamps and more, the question becomes: why work? With many benefits expiring in September, can this be the inflection point that Powell has been waiting for to see Americans return to the workforce? With unemployment possibly going lower, will this lead to the carefully-watched Fed tapering?

FUND UPDATE

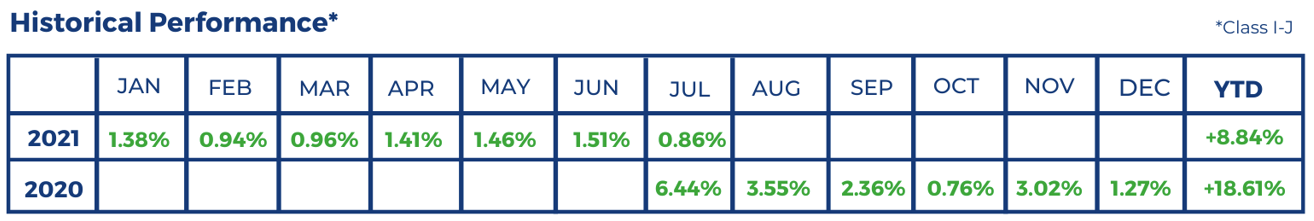

Our strategy continues to be rewarding despite the head scratchers above. We are pleased to announce that Amplus Credit Income Fund has finished up +0.86% in July after costs. Our year-to-date returns in 2021 are +8.84%. For the last couple of months, we have taken a defensive approach to investing, with the possibility of sooner-than-expected tapering on the horizon. Security selection has been a key driver to our consistent positive performance. While Canadian credit spreads finished a handful of basis points wider on the month, resulting in lower prices; our holdings still produced positive returns. We were underweight the two sectors that traded lower – telcos and banks. Higher-than-expected 5G airway spectrum auction prices forced existing telecom-related debt to trade lower. Investors had to fine tune their models in anticipation for higher-than-expected debt supply. Separately, senior bank debt also underperformed due to flattening yield curves and record corporate supply of 12.3bn for the month of July.

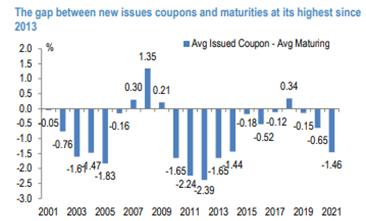

With all-in yields significantly lower in the last month, the attractiveness for companies to refinance debt earlier at a much lower rate is mounting. We have taken this as an opportunity to seek out those bonds with the highest probability of being taken out at a premium to be refinanced at lower yields early.

GO FORWARD OUTLOOK

Overall, we continue to hedge out interest rate risk when investing in corporate debt securities, while paring down our tactical short on rates. We continue to see strong tailwinds in specific credits driving positive returns for our investors. Central banks continue to pour trillions of dollars into the economy, robust inflows in U.S. fixed income ($114bn year-to-date) and a rising rate environment are all positive for credit spreads. We continue to invest in companies that should see an increase in asset growth and earnings power from either rising interest rates or inflation including banks, commodities, and real estate.