Who's Buying?

As Lions Bay Fund approaches its three-year anniversary this August, PM Justin Anis discusses the importance of determining the marginal buyer and the influence of retail investors on the market after a stellar first half performance.

The Lions Bay Fund was up +7.08% for the second quarter. For the first half of the year, Lions Bay was up +25.15% net of all fees and expenses versus the S&P 500 up 15.24%.

The Lions Bay Fund will mark an important milestone this summer, as we reach our three-year anniversary in August. Since inception in August 2018, Lions Bay has delivered an annualized net return of 15.39% and importantly, has done so with 43% lower volatility than the S&P 500. We are extremely grateful for all our clients who have supported us over these years.

Gains this quarter were driven by strong results in our core investment portfolio, particularly among our largest holdings. Our largest and longest held investment, Houlihan Lokey, was up 23.68% for the second quarter after reporting $1.51 in earnings per share for the quarter, relative to consensus estimates of $1.14. Houlihan also reiterated their commitment to returning cash flow to shareholders by hiking their dividend and boosting their stock buyback plan. Following the results, we had the opportunity to speak with CFO Lindsey Alley and then with Chairman Irwin Gold to better understand the drivers of their success. We came away from these conversations reassured that the strong quarter was not driven by isolated events, and that such success is sustainable. This is truly an outstanding franchise with a long runway of growth ahead. We have recently been trimming the position out of respect for the position size relative to the rest of our portfolio, but it remains our largest investment.

We are much more cautious on equity markets entering the second half of the year than we were to start the year, which makes us excited about the near-term prospects for Lions Bay. Our Fund was designed to profit from periods of market volatility.

History has shown that volatility tends to accompany episodes of monetary and fiscal policy tightening. While the Fed will remain accommodative for a long time, there is no question that we are past the peak of easy money, as the Fed will look to taper their bond purchases this year and some members suggest rate hikes in 2022. As absurd as it sounds, the Fed’s job a year ago was much easier than what that they face today. The FOMC was completely united in their actions during the depth of the pandemic when it was expedient to use the bazooka of cutting rates to zero and embarking on massive quantitative easing. While they succeeded in their objective of preventing a health crisis from turning into a financial crisis, they now face the daunting task of removing that stimulus from the market and controlling the inflation that they were so eager to create. The unity the Fed enjoyed last year no longer exists, and a much higher degree of dissension among members exists about the best past forward for monetary policy. This is compounded by increasing political pressure as inflation begins to damage consumer confidence. Maybe they will be able to thread the needle and remove accommodation and manage inflation without any hiccups, but we are certainly glad we have the tools to protect from a policy misstep.

At the same time, we are past the point of peak fiscal stimulus. Like the Fed, Washington was united in combatting the crisis and was able to quickly pass extraordinary bipartisan measures to support businesses and individuals. We are clearly past the point of stimulus cheques and direct relief for consumers. Divisions have once again returned to Washington as evidenced by the inability to pass Biden’s infrastructure bill. With the U.S. debt ceiling deadline approaching at the end of this quarter, partisan politics and deadlock represents a further source of risk.

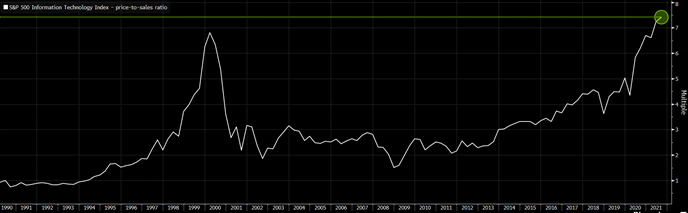

Against this backdrop, we find a stock market that is trading at incredibly rich valuations. Breadth of the market has deteriorated significantly in recent weeks, as most of the recent gains have been driven by the largest tech companies – the “FANG” stocks, namely Facebook, Amazon, Netflix and Alphabet. Most of these are fantastic businesses and many were large holdings of the Fund in the past year, but we are no longer inclined to own them as we find the valuations indefensible. As shown by the chart below, the information technology sector has now eclipsed the nosebleed valuations of the 1999 tech bubble based on a price-to-sales ratio.

Source: Bloomberg

When examining an investment, we try to always ask ourselves “who is the marginal buyer for this stock?” We aim to own investments where we see improving fundamentals and where Wall Street underestimates their prospects. Thus, if our thesis is correct, improving fundamentals will drive increasing earnings, while shares can get a boost through expanding multiples as Wall Street analysts revise their view.

Conversely, we seek to avoid the opposite. When we encounter a stock trading at rich valuations, where we have a hard time seeing fundamentals improving, there is considerable downside if a business fails to deliver on the lofty expectations set by investors. A business that is priced to perfection has a terrible risk/reward proposition.

One simple way of measuring market valuations is to look at the implied dividends on the S&P 500 relative to the index level. Market returns are a combination of cash flow (dividends) and growth. Looking at market-based pricing, the next four quarterly dividends for the S&P 500 total around $60. The S&P 500 is currently trading around 4,400, a steep price to pay for $60 in cash flow. If investors in the S&P 500 are earning a paltry 1.36% from cash flow, they are relying on a great deal of growth to earn a reasonable return. We believe based on this valuation the market either has a very complacent price for risk or is pricing in a quite a robust growth picture for quite some time. If that growth fails to materialize, there is significant downside in store for the market.

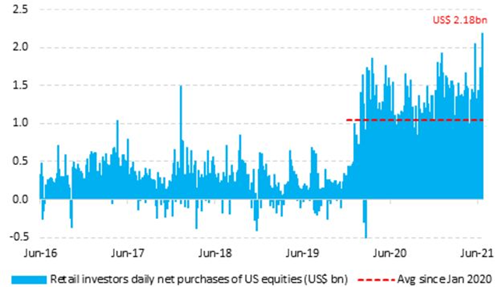

This brings us back to our earlier question – who is the marginal buyer for securities given the simple observations above? The answer seems to be retail investors, as shown in the chart below.

Source: Bloomberg

Retail investors, as a cohort, have been the largest buyer of securities this year, eclipsing institutional investors and pension funds.

Last week provided a perfect example of this behaviour. On Monday July 19th 2021, the market was experiencing a rare down day, with the S&P 500 down about 2% an hour into trading. By 1pm, Google searches for “Dow Jones” had spiked. Monday wound up being the largest day of retail buying on record, according to Vanda Research. This conditioned “buy-the-dip” response has led to the longest stretch for the S&P 500 without a 5% correction in three years. We don’t write this to disparage retail investors, we make this observation because history has shown that this cohort tends to be the last marginal buyer during bull market cycles. As we said earlier, perhaps this time is different, but we are grateful to have the tools to protect our investors if it’s not.

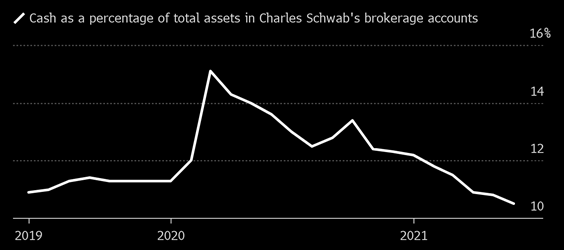

The chart below shows that retail investors may finally be running low on dry powder, with cash levels as a percentage of total assets in Charles Schwab’s accounts now at its lowest level since 2018.

Cash Made up 10.5% of Total Assets in Charles Schwab’s Accounts in June

Source: Bloomberg, Charles Schwab

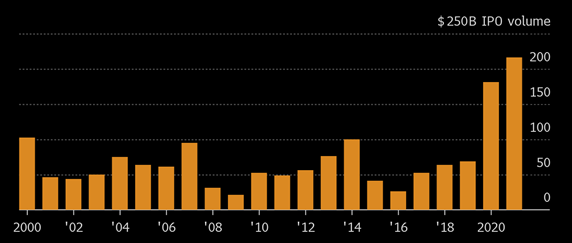

The activity we’ve seen in the market for new issues this year reminds us of a story about a veteran Canadian portfolio manager. As a manager of a large mutual fund, he would receive every prospectus for upcoming IPOs. Even though he never participated in IPOs, he kept the prospectuses in a stack on his desk, and when the pile began to grow rapidly it was a sign that markets might be getting frothy. Year-to-date through last Monday, U.S. IPOs raised $216 billion, eclipsing every past full year record as the chart below highlights. It is interesting to observe that past peaks in this chart (2000, 2007, 2014) were all followed by challenging years in the equity markets.

Companies Including SPACs Took Advantage of 2021’s Red Hot Equity Market

Source: Bloomberg

We have great respect for financial history, and the history of past cycles tells us that this is a time to be cautious. We respect that these periods of overvaluation can last longer than one would expect and reach even more lofty levels, but we do not want to expose our investors to excess risk. Thus, we have been steadily reducing our exposure to equity markets over the past weeks. We will continue to hunt for attractively valued and underappreciated securities, but we intend to continue to reduce our exposure to the broad market.

While our core investment portfolio has delivered solid gains in the first half of this year, as we head into what is seasonally the most challenging period for equity markets, we expect that our risk management tools and active trading will be significant profit centers through the end of the year.