Panorama 2020 Wrap-Up

In his final commentary of the year, CIO Scott Morrison discusses the biggest market movers of 2020 and his outlook for the new year.

What a year this has been. A sudden market collapse in March has steadily recovered into year-end and despite increasing case counts of COVID-19 during the second half of 2020, we have seen global investors taking a “glass half-full” view of the economic world for 2021 and 2022 as the vaccines roll out. As expected, the stock market mended itself faster than the “main street” economy. Panorama Fund benefitted the most from those of our investments exposed to the technology, consumer, auto, healthcare, industrial, natural gas and the basic materials sectors.

We continue to carefully add to certain travel sectors most negatively impacted by the virus, such as hotels. We took profits in the ski hill operator, Vail (who also owns Canada’s Whistler Blackcomb) and entertainment events company, Live Nation (who owns Ticketmaster) as they reached pre-pandemic highs. We believe that the ski hills and concert venues will return in full force in the next couple years, but we are not willing to pay higher prices than we did a year ago for these businesses.

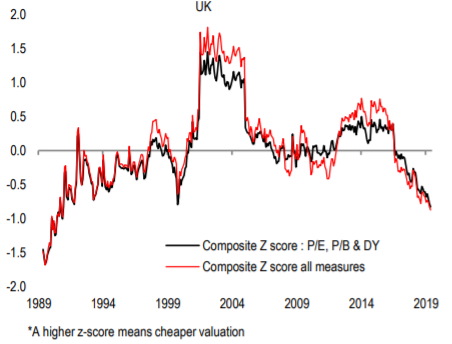

One contrarian investment idea that we have put in place for the Fund as we head into 2021 is an overweight position in domestic United Kingdom stocks, now that BREXIT has been completed. As you can see in the two charts below, there has been a steady depreciation of the U.K. currency and stock universe since the surprise vote for BREXIT in 2016. Longer-term, we believe that many U.K. assets should appreciate from here and revert to the mean and/or normalize, now that there is a removal of uncertainty and a better transparency around the new rules of Europe and the U.K. doing business together. To express this view, we have invested in U.K. domestic consumer discretionary, media, specialty finance and real estate companies that we have met on our many research trips in the past.

Source: Bloomberg

Source: Credit Suisse research, Refinitiv

Even though we have a muted outlook for a rise in interest rates, we do feel that they are too low for a world that is likely positioned to recover economically from 2022 to 2023 as vaccines continue to roll out. Therefore, we must be careful extrapolating low interest cost savings that companies and consumers are realizing at present into outer years when we model expectations for earnings and free cash flow. If we learned anything in 2020, it is that central banks are willing to be super aggressive at manipulating interest rates to support economic pullbacks. As the world issues more and more debt, we will be on the lookout for unintended accidents to occur if interest rates unexpectedly rise faster and higher than expected.

Inflation remains a big question mark for many, as some see inflation on the horizon due to all the central bank money printing. We stick to our long held view that, yes, there will be pockets of inflation when supply/demand equations fall out of balance as we saw last year with lumber, iron ore and copper. Overall, however, central banks continue to underestimate how they are actually causing large swaths of deflation to play out in industry after industry, as they try to induce inflation through easy monetary policies. This money printing and bond market manipulation is allowing very unprofitable and money losing business models to disrupt historically profitable business models. Not all these new business models can become platform powerhouses like we have seen with FAANG and Microsoft. Central banks will continue to be unsuccessful in normalizing inflation levels as long as they inadvertently allow newer money losing platform business models to raise endless amounts of capital. There is a good example of this on our Wealhouse website from December of 2019, in a brief book review we did on Capitalism without Capital, we review how this phenomenon has been stimulated.

We enter 2021 mindful that investors at times have shown euphoric optimism for capitalism during 2020. This very high level of optimism is brought about by unprecedented fiscal and monetary stimulus in the TRILLIONS that will peak early this new year. The concept of privilege versus inequality in the world’s capitalist societies under the dark shadows of COVID-19 has led to a high level of discontent. Politicians have spent most of the last few months in the U.S. arguing about how much money to send out to those negatively impacted by the pandemic. It was not a function of if cheques should be cut, but how big the cheques should be. The respective heads of the Republican and Democrat parties saw their houses vandalized by those apparently looking for more stimulus than was agreed to with the “$600” cheques in the mail. Moving forward, there is a massive medium-term risk that we have conditioned many parts of society to expect the government to rescue them from the world’s problems. Many know that I keep a book on my shelf called The Pessimist’s Guide to History. I am not quite sure if citizens should expect to always be bailed out by government if and when bad things like pandemics occur.

2020 will truly go down as a year where “the rich got richer.” We saw U.S. wealth creation in the capital markets significantly outpace the rest of the world by a large margin, despite the U.S. struggling to control the outbreak of the pandemic. In the U.S., it almost seems that wealth begets wealth. Only time will tell if the strategy of the government literally cutting cheques is going to provide true tail winds to the economic recovery from COVID-19 and help structural problems around income inequality in the medium- and long-term. Higher taxes are most definitely on the way for those who did well in 2020.

In Panorama, we will hope for the best but plan for a less optimistic reality playing out. Our Voyager Fund, which was up approximately +20% in 2020, will continue to focus on the higher-risk global small- and mid-cap stock universe, and avoid trying to provision for bad macro-risk events. This riskier segment of the market into which Voyager invests can continue to outperform if the optimistic vaccine-led economic recovery scenario plays out in 2021 (and monetary policy remains very loose). The well-balanced global Panorama Fund exceeded our annual performance goal of 7-8% returns for 2020. Panorama again delivered on it its goal of being a “keep-you-rich” product.

Our near 50% average allocation to U.S.-based companies helped performance. Panorama was also aided by its near 15% allocation to Asian equities levered to China’s better handling of the spread of COVID-19 within its borders. Aside from my travels to the U.S., there has been no country I have travelled to for business more than China during my 25-year research and investment career. It has been obvious that it was a function of when and not if China would become the largest economy in the world. Thus, we read with much interest an article from Bloomberg that said:

“The Chinese economy is set to overtake the U.S. faster than previously anticipated after weathering the coronavirus pandemic better than the West, according to the Center for Economics and Business Research. The world’s biggest and second-biggest economies are on course to trade places in dollar terms in 2028, five years earlier than expected a year ago…Chinese President Xi Jinping said last month that it was ‘entirely possible’ for his economy to double in size by 2035 under his government’s new Five-Year Plan, which aims to achieve ‘modern socialism’ in 15 years.”

In an effort to understand differing views on capitalism, I consume a variety of media across the political spectrum, including the left-leaning Canadian Broadcasting Corporation (CBC). Recently, CBC’s chief political correspondent, Rosemary Barton, conducted an interview on her show with well-known Canadian journalists who were asked what subject they felt was NOT covered enough during 2020. The first two journalists spoke to the harsh 2020 plight of the elderly population and the plan around the roll-out of the vaccines. Barton said she felt the growing divide between rich and poor was a topic that did not garner enough attention. We agree that these subjects are very important and believe that as a Democratic Biden administration takes over the reins in the largest economy in the world in January 2021, there will be a brighter spotlight put on those three topics.

At Wealhouse, we spend most of our time analyzing businesses from the bottom-up and attempting to come up with valuations for their assets. By default, we are focused on seeking out leadership teams who will create wealth for our clients, partners and families. Over the years I have been invited to many functions with political leaders from many different countries. I do not mean to sound negative but simply realistic when I say that politicians have rarely been good allocators of capital. Not since World War II has the Western world seen so much government spending supported by the printing of central bank money. We will vigorously research where easily-allocated monies will create excesses and negative inefficiencies. In particular, we will need to monitor how efficiently the vaccines are distributed across the world, and the taxes that are enacted to pay for the wide-reaching social support and recovery programs.

Long-time readers will know that we have spoken negatively about the automotive industry, which is seeing many of its industry participants being disrupted by electrification, forcing them to write-down legacy internal combustion assets and increase research and development in electrification know-how. In 2020, however, when the auto industry was forced to shut production for an entire quarter, we saw a supply disruption occur that caused us to invest because we saw demand of drivers going up. Namely, lower interest rates made cars easier to buy, and consumer fears around public transit and living in urban cities stimulated car sales. We love when we see investment opportunities where demand exceeds supply. However, we do believe that longer-term, structural supply problems are coming for the auto industry. Easier access to money from debt markets, private equity and SPAC investors will encourage new start-ups to emerge between 2023 and 2025. This will cause further pressure on the profitability of legacy automobile manufacturers who went bankrupt in 2008.

Most businesses operate in cycles. In the short-term, we are bullish on the auto industry and its leading global suppliers, but medium-term we believe that this traditionally cyclical industry will eventually roll over hard. This is an example of how nimbleness at Wealhouse can serve us well. As more and more money is run by fewer and fewer money managers, there becomes an inability to realize profits for clients in cyclical industries. The auto sector will see a true divergence in the coming decade between winners and losers. We will endeavor to profit again from both sides of the coin.

| 2020 Equity Capital Raised | Year End 2020 Enterprise Value | Year End 2021 Forecasted EV/Sales |

| $12.3 Billion | $670 Billion | 15 X |

| $5.2 Billion | $489 Billion | 16 X |

| $2.6 Billion | $159 Billion | 9.4 X |

| $0 | $61.3 Billion | .54 X |

| $0 | $28.4 Billion | .20 X |

Below you can see a sample list of new entrants and capital raised during 2020. To me, the capital-raise of the year, and likely the decade when we look back many years from now, will be the 3 million shares raised by Tesla at $153 (split-adjusted) on 14 February 2020. This enabled Tesla to survive and thrive in the COVID-19 crisis, to the long-term detriment of some legacy auto competitors. It is important to note that a legacy auto company like Ford has only two electric vehicle models in its future pipeline, versus twenty from rival General Motors. It is also important to understand that Ford and GM have respectively $6 and $11 billion in unfunded pension liabilities. This is an example of the unintended consequences of the U.S. Fed keeping interest rates artificially low. They are allowing new entrants, such as those below, to become capitalized and disrupt legacy companies with real stakeholder liabilities…unless the government plans to bail them out again? A December rumor had it that Apple plans to enter the auto industry. This makes sense since cars are slowly becoming giant computers on wheels. Stay tuned for more auto sector disruption.

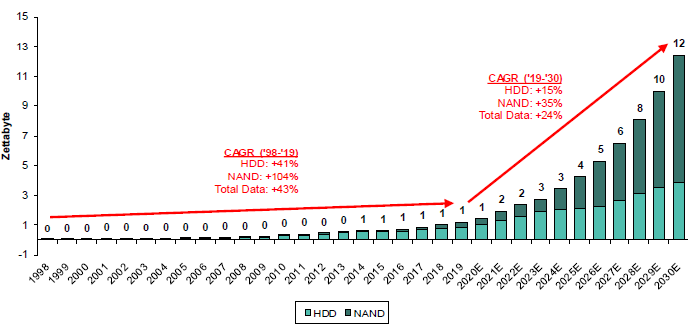

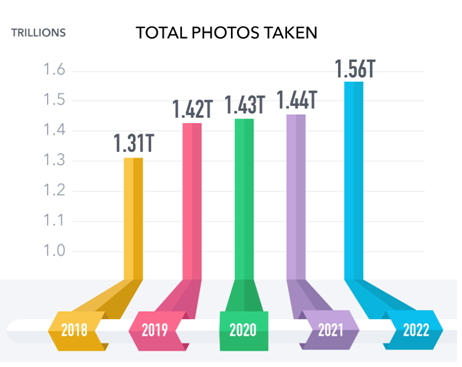

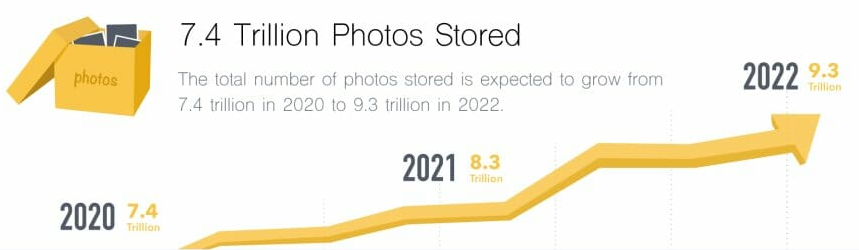

We believe some of the best areas of value and growth in the market right now are in cyclicals with secular tailwinds. For example, one powerful secular trend is for increased data storage needs. As the world digitizes and businesses build platforms that allow consumers and businesses to connect more and more, they will all need to store that data. Who from my polaroid-camera generation has not been amazed at the number of photos exchanged on various media platforms, on an almost hourly basis? Near the end of 2020, our holding in semiconductor wafer materials, Siltronic, a German company that benefits from this secular trend, received a takeover offer from Global Wafers from Taiwan. We plan to take the profits from this takeover once the deal closes to buy another holding that benefits from the same thesis. We will discuss this in future write-ups. Meanwhile, our largest holding, Shin-Etsu from Japan, will also benefit from the trends that caused Global Wafers to buy Siltronic and the improving oligopolistic structure of their industry.

Source: Gartner, Bernstein estimates and analysis

As you can see from the graph above, from 1998 to 2019, total data storage shipment (HDD + NAND) p.a. increased 43% CAGR and is expected to increase 24% CAGR from 2019 to 2030; with lion share of growth going to NAND-based SSD storage. (Note: Note: ZB = Zettabyte; 1 ZB = 1,000 EB = 1 million PB = 1 billion TB = 1 trillion GB).

Source: Mylio.com

Source: Mylio.com

Hopefully, re-initiated social distancing measures will slow the spread of COVID-19. As well, we anticipate initial trip-ups in the distribution of the vaccine will become smoother as 2021 progresses. We fully anticipate hearing the words “double-dip-recession” mentioned more and more as winter progresses which will cause continued levels of market volatility. However, we do not anticipate 2021 to be volatile as 2020. We are diversified by geography, industry, market cap and type of businesses in the fund. We hope that everyone has a much better 2021 than they did a 2020.