Lions Bay Q1 2020 Commentary

For the first quarter of 2020, the Lions Bay Fund declined by 8.76% as global financial markets unraveled in anticipation of the economic fallout from the Coronavirus. The S&P 500 entered a bear market, declining 19.6% for the quarter.

Our largest portfolio holding, Houlihan Lokey was a bright spot for our investors during the quarter with shares up over 7% year-to-date, our best performing investment over this time period. We had the opportunity to speak with the CFO of Houlihan Lokey during the quarter and he confirmed that their Financial Restructuring team is busier than at any other time during the 30-year history of the company. We are confident that Houlihan Lokey will weather the current crisis and emerge from it as a stronger franchise. Unfortunately, declines in our Core Portfolio were driven by unrealized losses on long-term investments directly or indirectly as a result of a slowdown in travel and leisure spending, led by our holdings in Disney, MasterCard and Brookfield Asset Management. Clearly all of these businesses face significant challenges in the short-term, yet we consider them all unique assets with strong competitive positioning and therefore the ability to weather the downturn. The Coronavirus has not altered our view of the long term values of these businesses, and has provided what we view as a generational buying opportunity into premier franchises.

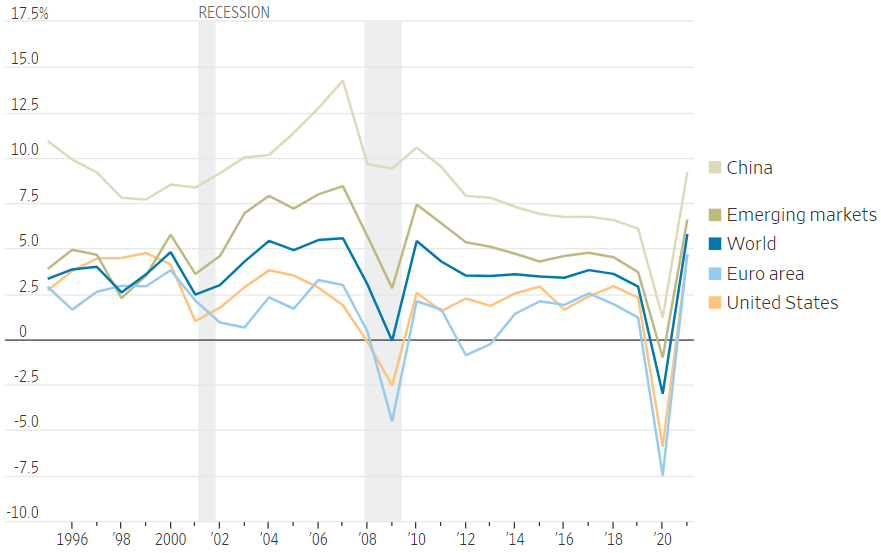

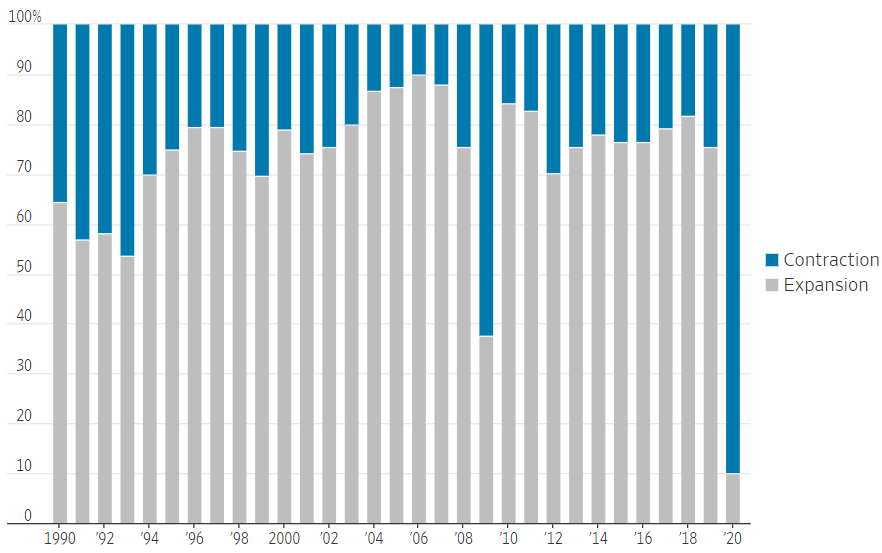

The global economy is almost certainly entering a severe recession, significant both in its depth and its breadth. The IMF recently estimated that the pandemic will cause a global GDP contraction of 3% compared to the 1% decline in 2009 following the global financial crisis. In terms of breadth, they expect 90% of countries to experience GDP contraction whereas in 2009 some 40% of countries were able to post GDP growth.

PERCENTAGE CHANGE IN REAL GDP

PERCENTAGE OF COUNTRIES WITH EXPANION AND CONTRACTION IN PER CAPITA GDP

One of our concerns about the ability of the market to recover and to trade at multiples seen prior to the outbreak is the challenge companies are going to face to return capital to shareholders. Almost all major U.S. banks have suspended their buyback programs. According to Goldman Sachs, over a quarter of last year’s buyback total has already been pulled by S&P 500 companies, and according to Bloomberg Intelligence dividends and share repurchase commitments are being cut at the fastest pace since 2006. The coming fiscal bailout will aim to reward stakeholders over shareholders, thus we can expect more dividend cuts and buyback cancellations from businesses requiring government assistance. This will remove an important pillar of support for equity markets and presents a challenge for companies achieving the same trading multiples that they enjoyed prior to the crisis.

During the quarter, we increased our net exposure significantly in mid-March, raising our exposure over 80% to take advantage of what we viewed as liquidation and forced selling. As evidence has begun to appear of the virus plateauing in major hot spots and in response to unprecedented fiscal and monetary stimulus, markets have rebounded strongly over the past few weeks. We began to layer hedges back on and manage ongoing market risks through ETF overlays to lower our exposure further, to take advantage of the buying opportunities we see ahead once as the global slowdown is truly felt in corporate earnings and economic data. We believe prudence is the best approach to protect capital over the coming weeks and months.