Debt Used to It

In his latest commentary, CIO Scott Morrison, CFA warns against “buying the dip” on cash-strapped companies with too much debt.

By the end of March, most people clearly understood why the market went down. The companies that were worst hit in March were the companies with the most debt. Simply put, if a company’s revenue and cash flow collapses, it then experiences difficulty in paying its debts. The counterparties to whom that company owes money then have their own problems, and the cycle continues until it negatively impacts the entire economy. This ultimately leads to staff layoffs, cutbacks in capital spending, reduced inventories, drawing-down of credit lines, renegotiation of covenants with banks, etc. Thus, the number one question asked during the month of April was: why did the market recover so much so fast, since we are still seeing so many signs of the ill-effects of the virus and its impact on a slowing economy? The simplest answer is that central banks stepped up and governments were not far behind with fiscal stimulus efforts. Indeed, governments around the world realized that they had not provisioned their health care systems to adequately handle this type of pandemic, despite heroic efforts from front-line workers.

Very few people before March were afraid, or aware, of how much debt underlaid their investments. Either they did not know how much debt there was, or they did not respect the dangers of such debt levels. Most investors and speculators subsequently received a wake-up call about the strength of their balance sheets – or lack thereof. Many people understandably are still afraid, left shaken by their experience of the downside of taking risk. However, I have learned over the last 25 years that you must fight the fear at times like these and actually embrace the volatility. Yes, it seems counterintuitive, but it is better than giving in to panic, which accomplishes nothing positive.

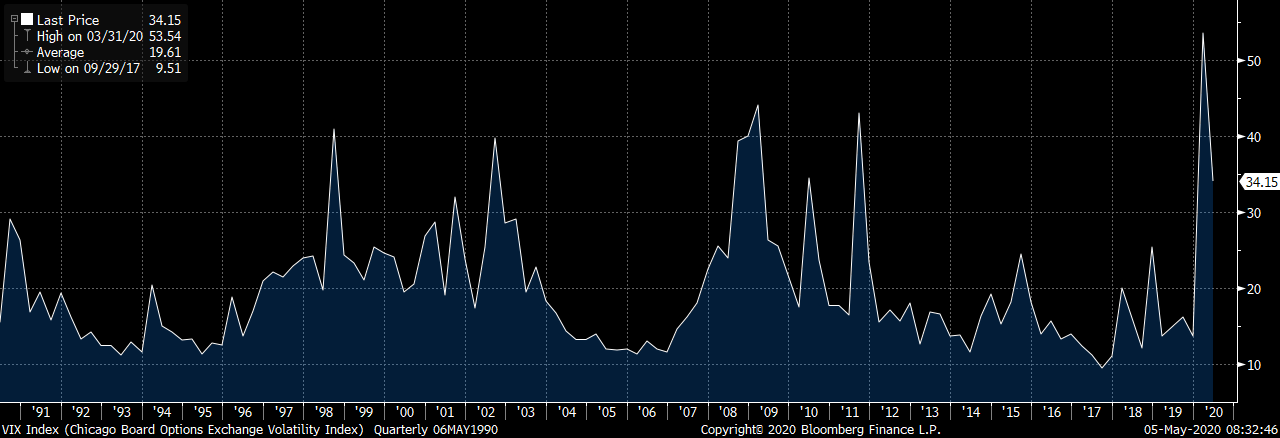

As illustrated in the chart below, the CBOE Volatility Index (VIX) is at its highest level since I entered the business 25 years ago. Volatility is a measure of fear and it is apparent that fear levels are very high. However, over the course of my career, I have been most successful when it was the most gut-wrenching time to invest. It is precisely at these times that we lean heaviest on our approved lists for investment – lists that were researched and thought through in less emotional times. This is when we reflect on those face-to-face meetings with smart management teams, the site visits to competitively-advantaged asset bases, the many discussions with competitors and suppliers, the one-on-one meetings in our offices, the many analyst day trips and tours, annual reports and financials that we have studied, our spreadsheets built over time, and so much more. We look to execute our sound investment process as we patiently wait for future performance results.

Source: Bloomberg

We have spoken much in the past about the secular decline in the mutual fund industry, where I grew up as an analyst and money manager. Even before this latest crisis, the industry was reducing research budgets by downsizing its research teams. Indeed, the Globe and Mail reported in March that Canadian mutual fund companies saw net redemptions of over $14 billion. Considering that a number of mutual fund companies were down in the high double-digits, we must conclude that they will be left with no choice but to continue to reduce their costs. This will be a major competitive advantage for Wealhouse, as it primes firms like us to run sizeable money with less proprietary research efforts in a new, uncertain world.

The most important things in the financial world, as we have said many times, are interest rates and access to capital. A May 1st Bloomberg article stated that, according to its calculations, there has been $8 trillion in fiscal measures implemented since the crisis began! According to a CNN article, non-financial sector investment-grade debt issued in 2020 is at $425 billion, 2X what was issued at this time last year. The $300 billion issued in March and the first three weeks of April have amounted to the two biggest months for corporate debt issuance on record. High yield or junk debt has added $91 billion in debt year-to-date. The article also highlights that companies have drawn down $220 billion on existing credit lines since March 11. Before all this happened, corporate bonds were at $9.6 trillion heading into 2020, a 20% increase over the last five years.

Panorama Fund continued to outperform the market in April and was up 6.74% for the month. The reason we are beating the market this year is because we strive to own companies that have strong balance sheets and/or business leadership/plans that will enable them to improve their balance sheets. As all the aforementioned debt gets issued, our investable universe is shrinking and allowing us to focus more on companies that will emerge from this crisis with less debt. We will leave the balance sheet speculation and gambling to others, since no one can accurately predict the type of recovery necessary for companies to service all their debt. The entire world must truly hope that interest rates do stay lower forever.

Chairman Powell announced on April 7 that the U.S. Federal Reserve intends to buy junk and municipal debt – a move that will go down in the financial history books as one the most significant central bank decisions ever made. Wealhouse will be writing about the unintended consequences of this decision for many years to come. How it will be judged in the long-term is impossible to predict, as it pertains to geopolitics, cost of capital, government regulations, pensioners, currencies, and much else. As I saw the headline come across my Bloomberg database, I screamed out loud “I can’t believe it!”. I thought to myself, the U.S. Fed just changed the rules of finance, AGAIN!

I was struck by the fact that in recent interviews, Powell consistently maintained that: “The Fed’s role is to provide as much relief and stability as we can during this period of constrained economic activity, and our actions today will help ensure that the eventual recovery is as vigorous as possible.” There is no doubt in my mind that most businesses will recover. Some of course will not – they will default on their debts despite what the central banks have done. And in still other cases, all the Fed has done is to delay the inevitable, essentially allowing certain companies and maybe municipalities to just “kick the can down the road”, AGAIN.

I say “again” because there were many large, publicly-traded companies that entered this recession with too much debt. And, there were many overconfident investors who invested in such companies on the assumption that the debt was manageable. What the Fed has essentially done is to rescue many cases of balance-sheet mismanagement, and their respective aggressive capital-structure investors, with additional leverage. In Panorama Fund, we aim to invest in companies that can weather not only this present crisis, but future storms that we may not see coming. At the heart of our strategy is the assurance of capital strength, which is wholly unlike the strategy of those central banks (like the U.S. Fed) who enable companies to accumulate layers upon layers of debt and are subsequently forced to stimulate the strongest possible recovery. There will be good opportunities for Panorama Fund to profit from such companies with too much debt and too little a recovery. Stay tuned.

I received so many calls in March and April from friends and friends of clients who were looking for advice on their finances. Many were horrified to see the rate at which their investments declined during the sell-off in March. As I delved deeper into their holdings, I was particularly struck by the level of risk to which many people were exposed to – owning companies with so much leverage – and how little of their worth was allocated to managers who could hedge and protect their life savings.

In 1990, I was 19 years old, and I took a great course on finance. In it, the professor made us study articles on personal finance from those ancient things called newspapers. Some of the topics we studied were Registered Retirement Savings Plans (RRSPs), the Home Buyer’s Plan (HBP), life insurance, wills, etc. I always recall an article that spoke to a concept from a great Canadian book called, The Wealthy Barber – The Common Sense Guide to Successful Financial Planning by David Chilton. I have never met Mr. Chilton, but if I ever do, I will thank him because I have tried to follow his very simple advice: “Save 10% of all that you earn and invest it for long-term growth.” I realize that in a consumer-driven society such as ours, this might be easier said than done; but if it can be managed, it grants you the ability to sleep at night, knowing that you have a nest egg to withstand those inevitable times when bad things happen.

The Panorama Fund is balanced between companies that are doing very well in this current environment and companies that will recover from present low levels of end-demand for their products. The portfolio is balanced versus fully invested in either one or the other. In comparison, our small/mid-cap product, Voyager Fund, is focused more on companies that will recover because it is by nature a more aggressive fund. It was up 15.5% in April and is invested in a diversified set of companies with good medium-to-long term growth prospects. For those investors who have a long-term, positive view of the world and want to be invested alongside some great entrepreneurial management teams, we would be happy to share more insights. Personally, my family follows the savings rule advocated by The Wealthy Barber and every month allocates monies to both Panorama and Voyager systematically. Tactically I will over allocate to the fund that underperforms the other over short-term stretches, with the idea that in the long run I will end up with a prudent mix between the two. This is the simplest advice and discipline I could share with investors to help control those two biggest enemies: fear and emotion.

Speaking of “fear”, Bank of Canada (BoC), the Canadian central bank is very afraid of what is to come for the Canadian economy, as evidenced by the extraordinary interventions it is taking in the bond market. Sadly, in a world where medical technology is what any country needs most in order to deal with this present crisis, our economy is still far more levered to resources. On April 16, the outgoing head of the BoC said to the House of Commons Standing Committee on Finance: “The Canadian economy is experiencing a significant and rapid contraction. The shock is a global one, affecting all countries, but commodity-producing countries like Canada are being hit twice… The market for Government of Canada bonds is foundational – it forms the basis for many other financial markets. So, we launched a program to purchase at least $5 billion of these bonds per week to support the liquidity and efficiency of this market. In yesterday’s announcement, we stressed that we can increase this programme at any time, should conditions warrant it. And we announced that we will increase our participation in the federal government’s treasury bill auctions to 40 percent of each new issue. The bank is also helping ensure proper functioning of provincial debt markets by buying up to 40 percent of new provincial money market securities and up to $50 billion of provincial government bonds.”

The Bank of Canada will thus begin in May buying the corporate debt of investment-grade companies outside the financial sector. Let me illustrate one potential political risk that Canadians will now face: on the last day of April, Loblaws issued $350 million of 10-year bonds at 147 basis points over the 10-year government treasuries that the Bank of Canada was already buying. The deal was 15X oversubscribed according to the five Canadian banks who collected a multi-million-dollar fee for selling the issue. This is great for Loblaws and its employees, bondholders and shareholders, who can now see the company take the money and pay down shorter-duration debt, reinvest in the business and/or pay some rent to their landlords. A potential dilemma that we will face as capitalists, however, is the smaller non-public grocers who do not have the same access to capital, and therefore will be at a significant capital-structure disadvantage to Loblaws. The fact that Loblaws is controlled by one of Canada’s wealthiest families will surely be highlighted at some point by anti-capitalists. As we head towards the U.S. election in the fall and see record numbers of bond deals, we would expect to also see significant geopolitical impacts on the volatility of the stock market. I am not trying to pass judgement, but it would be naive of capitalists not to consider future risks that may arise from such actions. Stay tuned.

We continue to research businesses that we feel are strong and will continue to get stronger and/or recover faster in this environment. We have sold all our bank holdings. We instead own financials that will not suffer from the risks of non-performing loans. Instead, we like companies that will actually benefit from this–such as restructuring firms, and private equity companies with dry powder. As discussed above, there is now more debt than ever. U.S. investment-grade bond issuance is up over 50% as companies have quickly raised capital to ensure they have enough cash to weather the current crisis. The central bank action discussed above also will help to keep credit markets functioning and reduce credit spreads for corporate borrowers, as shown in the chart below.

Source: Bloomberg

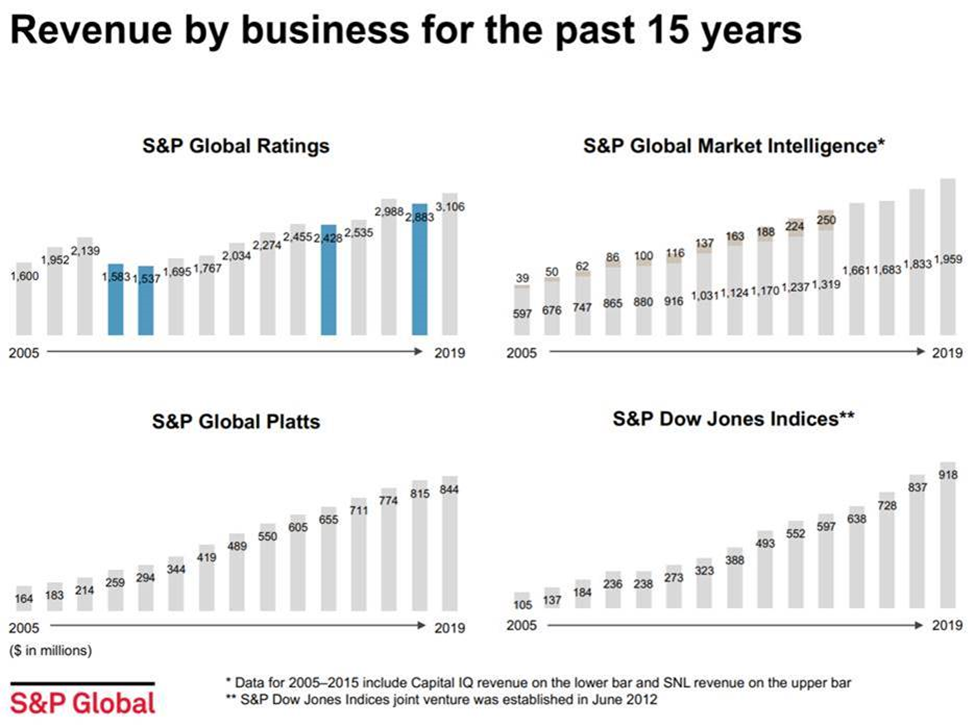

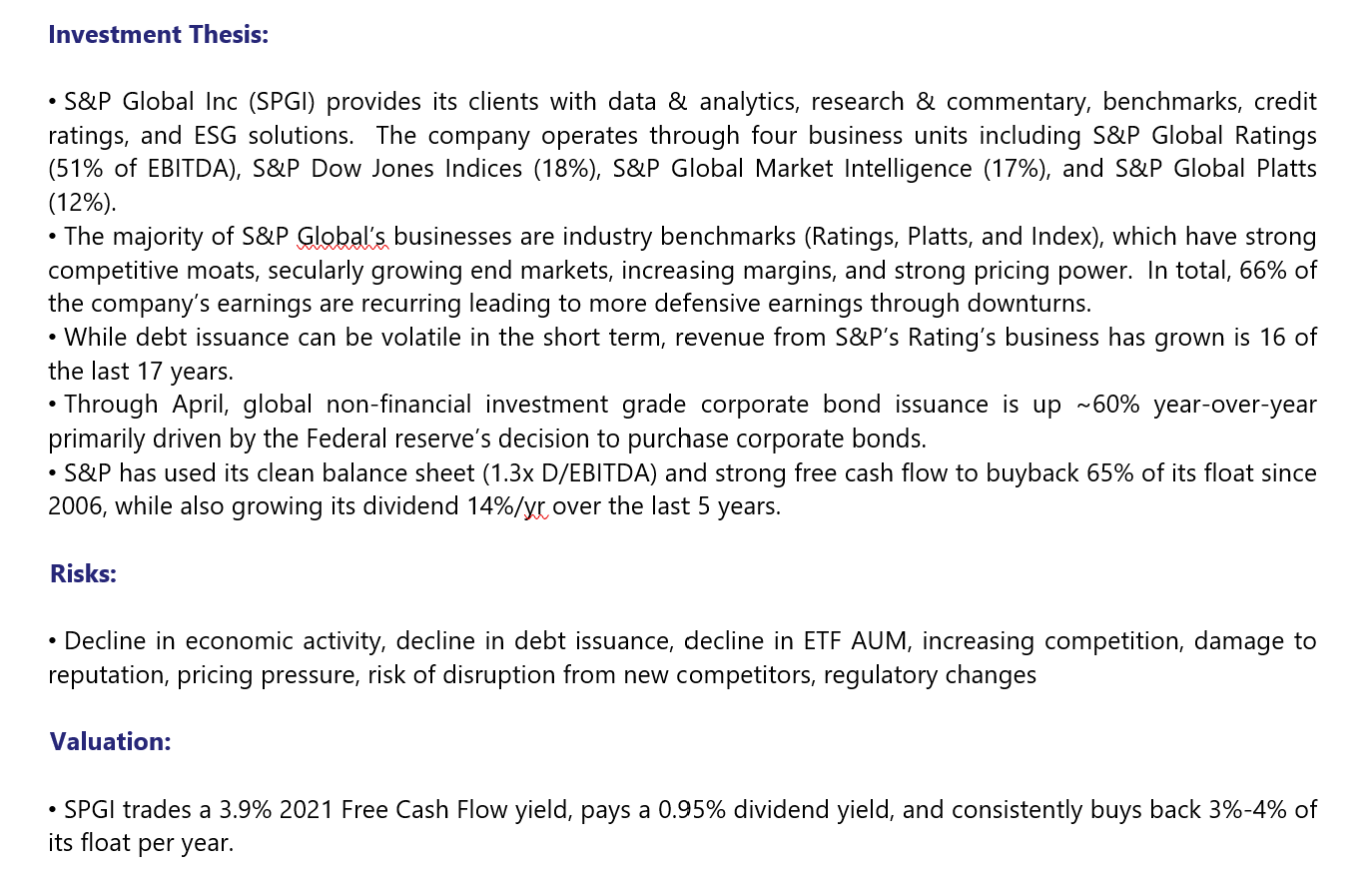

At Wealhouse, we look to invest in companies that will maintain their conservative balance sheets through the crises so they can come out stronger on the other side of the downturn. One example of such a holding is S&P Global, which not only has a conservative balance sheet, but also benefits from the wave of increased debt issuance. The company generates over half its earnings from global credit ratings business, which grades the credit worthiness of corporate and government bonds. The industry is consolidated with high barriers to entry, as S&P Global and Moody’s both rate 99% of U.S. bonds and represent over 80% of the ratings industry. S&P Global’s remaining earnings come from a broad mix of leading fintech info service franchises (Dow Jones Indices, Platt’s, and Market Intelligence), with leading competitive positions, and consistent growth as shown in the chart below. The company has a conservative balance sheet at 1.3x D/EBITDA and 66% of its revenues recurring, which help it weather economic downturns. It also has a long history of returning capital to shareholders as it has repurchased 65% of its float since 2006 and has grown its annual dividend payment for 47 years. In the future, we expect S&P Global to maintain its innovation spending, as management noted on its recent Q1 earnings call that, “…what we’re not going to do is stop investing in the business… it’s very important to continue our $150 million investment in 2020 growth programs.” It will use this crisis as an opportunity to launch new products and gain market share versus competitors.

Since it looks like we are setting up for pockets of increasing inflation in the years to come, investors should be very wary of holding too much cash that is depreciating in real terms. There was a recent article from Bloomberg that cited EPFR Global data in the week through April 29th showing that, “…cash funds continue to rise, with money-market funds increasing to $4.7 trillion, up $1.1 trillion in past 9 weeks.” The same article highlighted that, “equity funds saw $6.7 billion of outflows and bonds getting $10.6 billion of inflows.” Although the yields available in the bond markets are so very low, we think they could fall even lower in Canada and the U.S. if Japan and Europe are a potential precursor. At present, our biggest asset class preference is equities, since we have built portfolios of companies with mid-to-high single digit free cash flow yields. Yes, there are more risks in equities. However, we believe that we own a portfolio of companies that can grow free cash flow by launching new products, growing market share, and raising prices. As such, we think it makes sense to continue to seize such opportunities that present themselves during high-risk events, and to work those approved lists from our proprietary research efforts to benefit our clients.

Our goal at Wealhouse is to always balance between prudent and appropriate risk management. We created Voyager Fund to emerge from the next economic recession, skewed towards taking some risks for clients. This Fund will not take as much risk, but will have risks nonetheless. Last month, we compared this virus to what took place in World War II – the market had its biggest drawdown since the Germans invaded France in June 1940. Also reminiscent of the Second World War era, the world has begun to fight back against the effects of the virus, and as a result, the capital markets are recovering ahead of the war being won. The war against this horrible virus continues to be waged and some of the companies we own are making the medical weaponry to combat the disease for the sake of humanity. As well, central banks are fighting to minimize financial distress. Yes, we anticipate that there will be both positive and negative surprises in the months and years ahead; certainly, it will not be a straight-line recovery. However, we do believe that many companies will see some form of recovery in earnings and cash flow from the second quarter and beyond.