Amplus Fund November Update

November saw a spike in volatility due to the new highly transmissible COVID-19 variant, Omicron. Senior Portfolio Manager, Andrew Labbad discusses his defensive view and what to expect heading into the new year.

“The best offence is a good defence” – principle from Sun Tzu

November experienced a significant onslaught of volatility, with the VIX reaching its highest level since January 2021. Markets focused on the sudden surge in a new highly transmittable COVID-19 variant, Omicron. The uncertainty of vaccine efficacy against this new variant has dampened investor sentiment. Governments responded quickly by limiting international travel causing a broader sell-off in risk. To make matters worse, Fed chair Jerome Powell, who has spent months arguing that the pandemic surge in inflation was largely due to transitory forces, finally threw in the towel. On November 30th, he chose to drop ‘transitory’ as an excuse for persistent inflation. This confirms the U.S. central bank’s shift towards a tighter monetary policy.

THE FUND

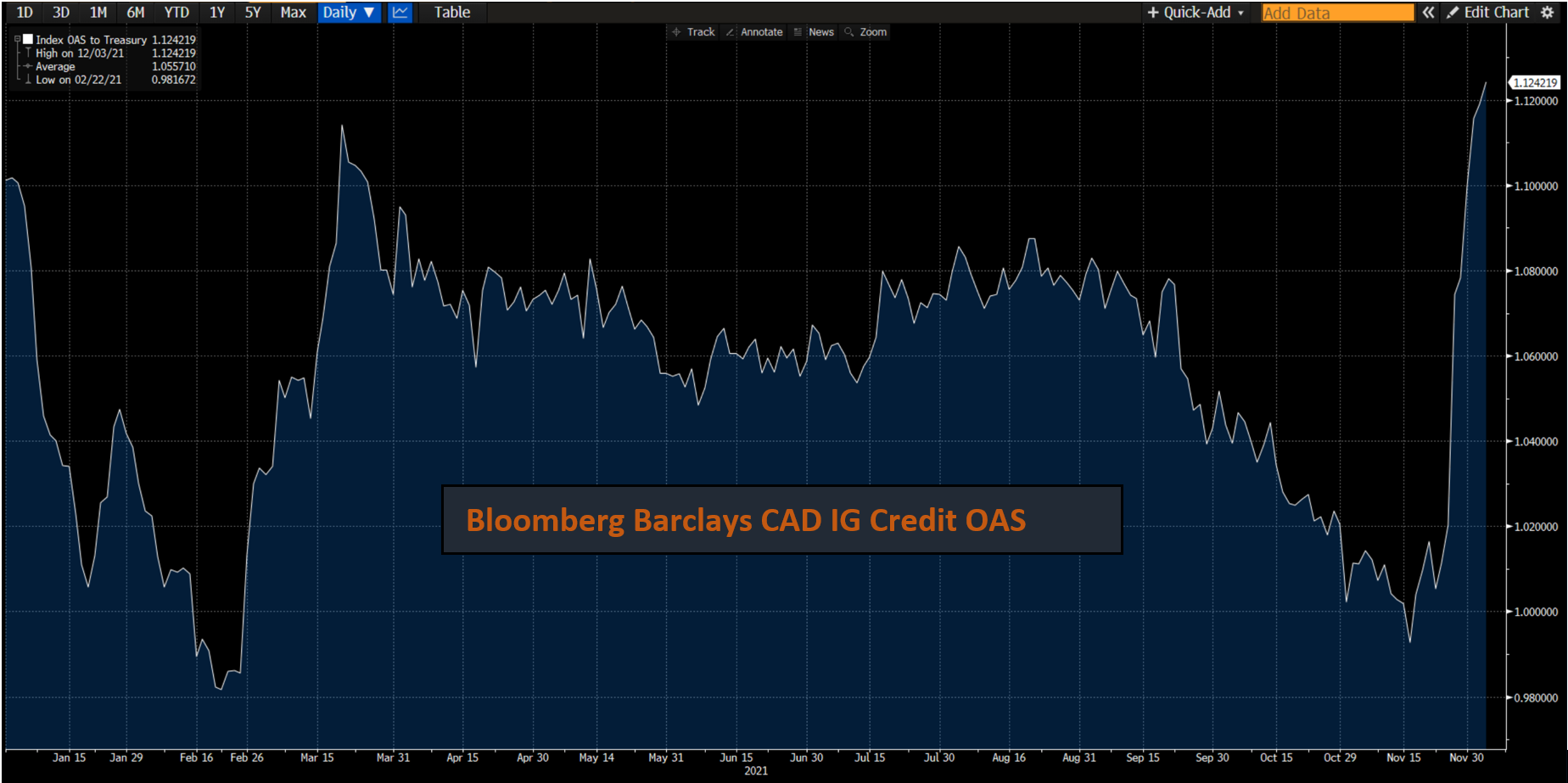

Amplus Credit Income Fund finished just slightly down -0.08% in November after costs. 2021 year-to-date growth is +10.39%. November saw a record $14.5 billion of CAD$ corporate debt supply. This weighed on credit spreads and dealer balance sheets. Coupled with a new variant and the Fed’s shift in policy, November saw the largest move wider in credit spreads for 2021, finishing +9bps wider in Canada and +12bps wider in the U.S.

With our disciplined approach to investing, we were proactively shifting the portfolio into more liquid and higher quality credits before this recent sell-off. Our defensive view on the market, positioned us to protect investor capital, and be in a position of strength to take advantage of opportunities as they presented themselves. With credit indices trading at their widest levels for the year, as shown below, we chose to gradually add risk to the portfolio; most notably senior bank debt which has underperformed in 2021. Major banks are in a stronger position now compared to pre-pandemic. We take comfort in knowing that senior bank debt is defensive in nature, liquid, and cheap domestically compared to other currencies. Our preference lies in bank debt maturing in less than 3 years, as they trade at the largest discount to global comps.

Our fund also benefited from our tactical interest rate positions. Last month, we spoke about the opportunity of investing in Canadian treasuries, which were pricing in six hikes for 2021. Short rates rallied in November and benefitted our investors.

GO FORWARD OUTLOOK

Right now, Omicron is driving investor risk-appetite. While Omicron appears to be highly transmissible, early clinical reports out of South Africa compiled by Goldman Sachs show it as being less lethal than previous variants. The length of stay in ICU is significantly shorter, and ventilator usage is also lower. Recent data show that booster vaccines have 70% efficacy against Omicron.

While COVID-19 is not disappearing anytime soon, markets have been able to digest prior COVID waves including India’s surge in the more lethal Delta variant last spring. We do not see Omicron as being the reason why markets take a turn for the worse.

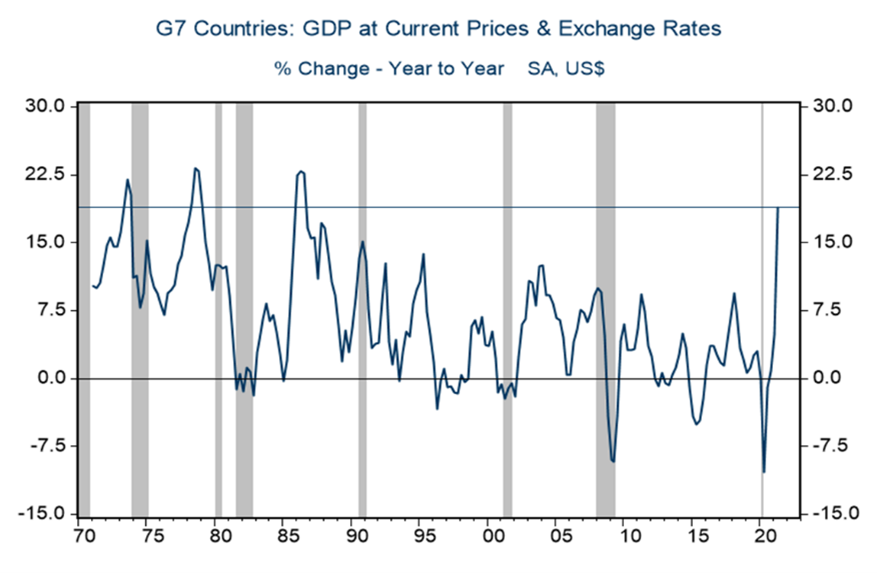

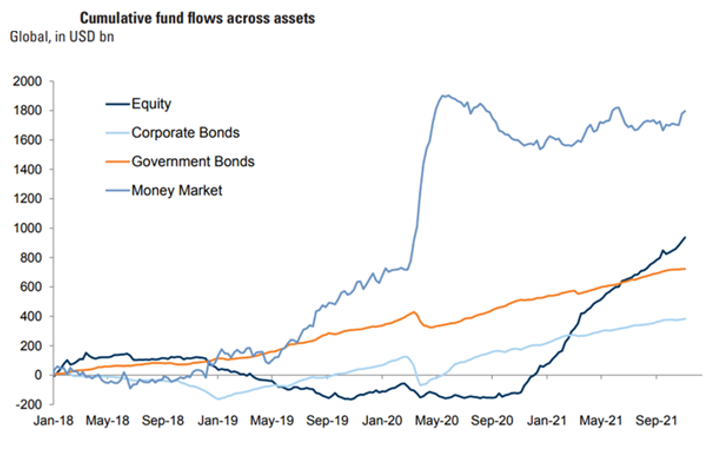

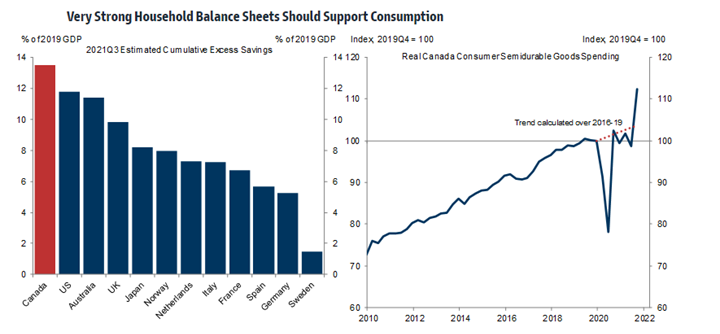

Heading into the new year, we anticipate tailwinds in credit driving positive returns for our investors. Developed nation GDP is growing, central banks remain supportive, consumer savings are at multi-year highs, and cumulative fund flows in corporate bonds trending higher are all positive for credit spreads.

For the year credit spreads are largely unchanged and overall yields are higher. During this time our systematic and disciplined approach continues to pay dividend and drive positive returns for our investors.