Inflation and Omicron Raise Fear in Global Markets

Interest rates and inflation continues to increase as Omicron emerges. CIO, Scott Morrison, shares his thoughts on how this will effect global markets.

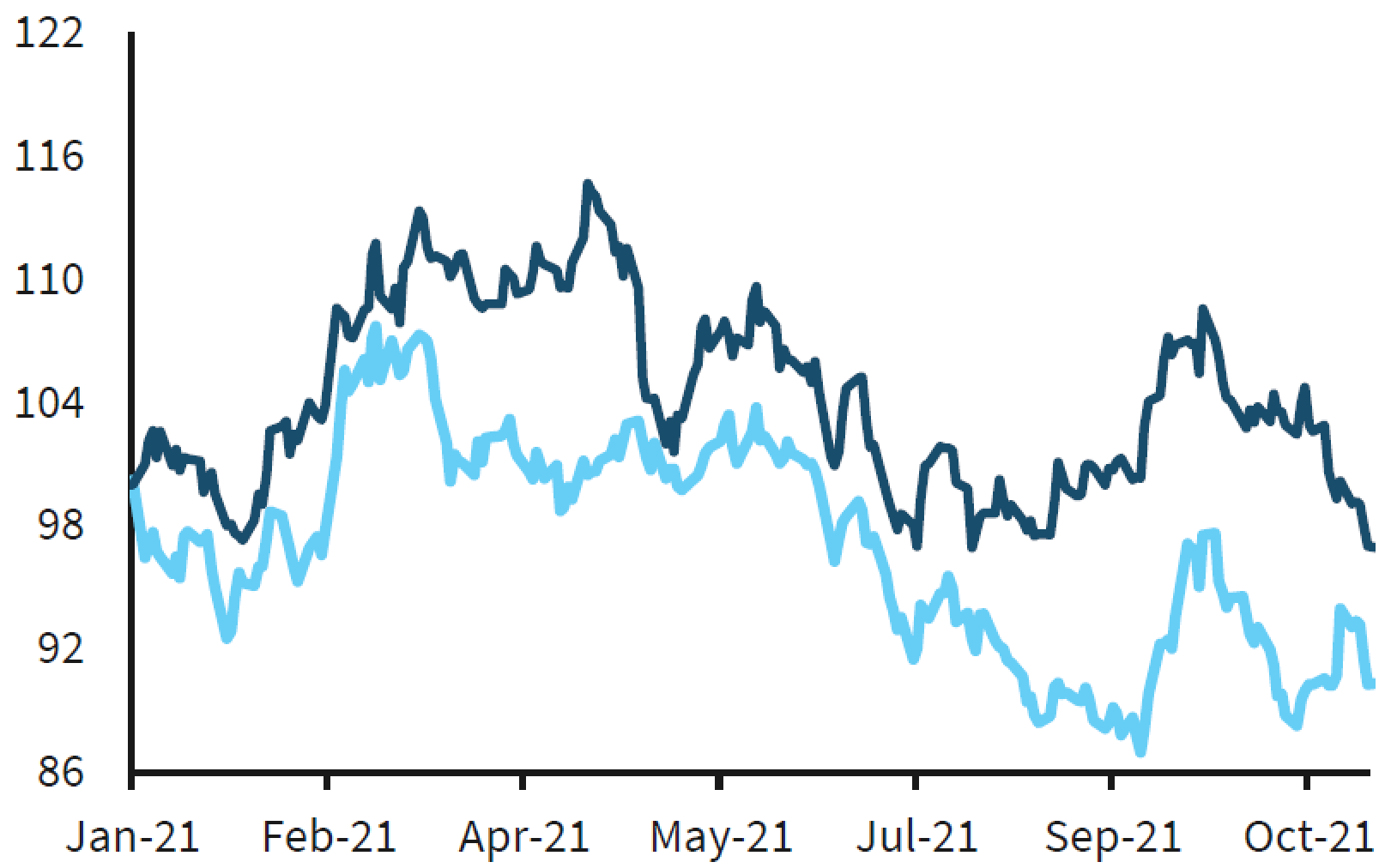

The emergence of the Omicron variant in November caused a meaningful change in the narrative of the global capital markets. We had been positioned for a return to normal in 2022, but instead we now have to watch politicians around the world re-trench based on fears over case counts and hospitalizations. The fact that this new growth headwind is occurring while interest rates in many parts of the world are now increasing due to higher levels of inflation is something to watch closely. It is our view that some areas of inflation (such as wages) will remain stubbornly high for years to come, while those resulting from global supply chain shortages will eventually return to more modest levels.

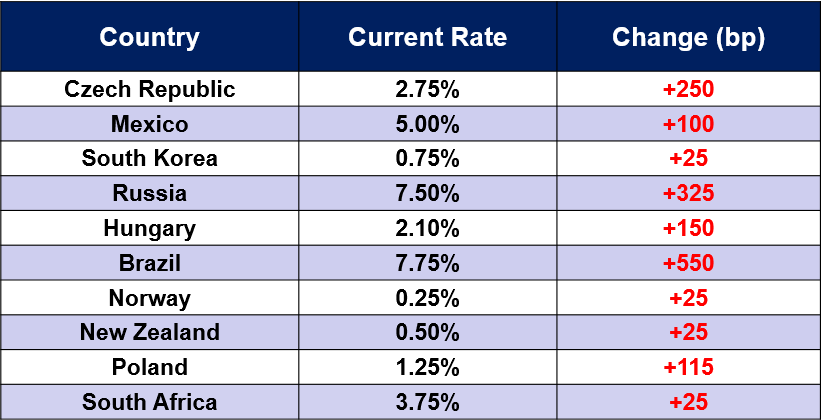

2021 CENTRAL BANK RATE INCREASES

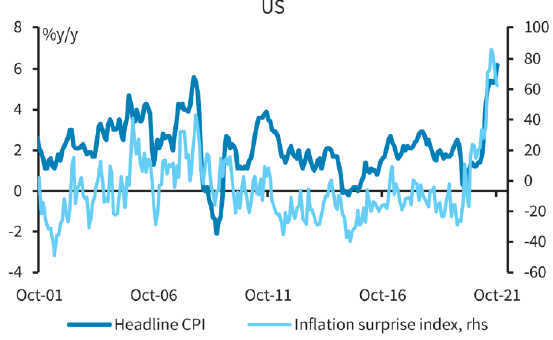

INFLATION CONTINUES TO SURPRISE ON UPSIDE, REACHING DECADE HIGH

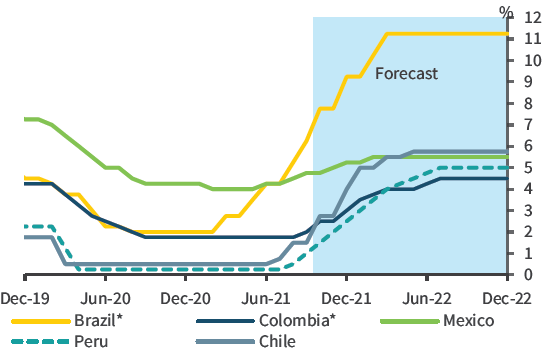

PERSISTENT INFLATIONARY PRESSURES ARE FORCING CENTRAL BANKS

TO BE MORE AGGRESSIVE IN THEIR RATE TIGHTENING

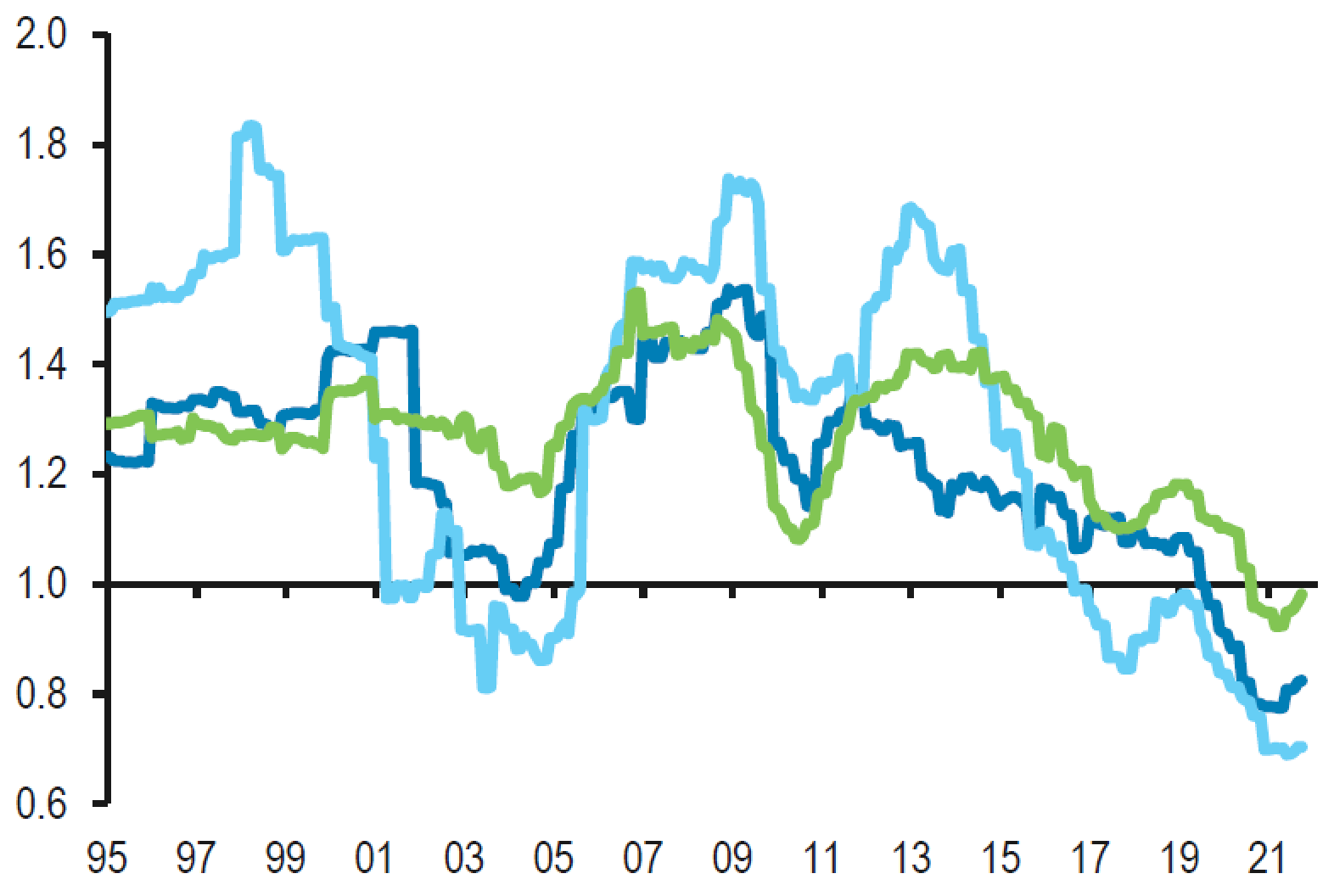

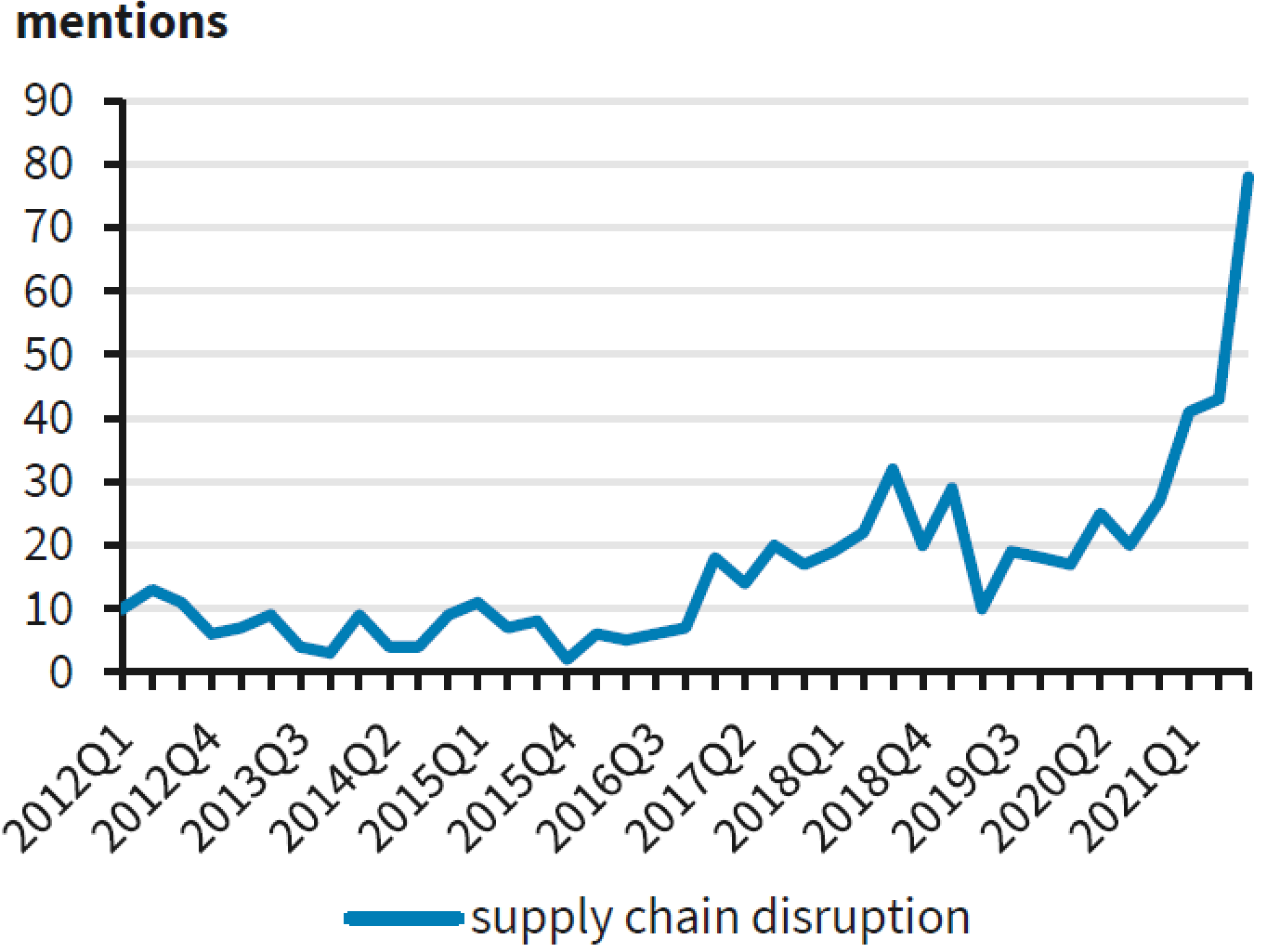

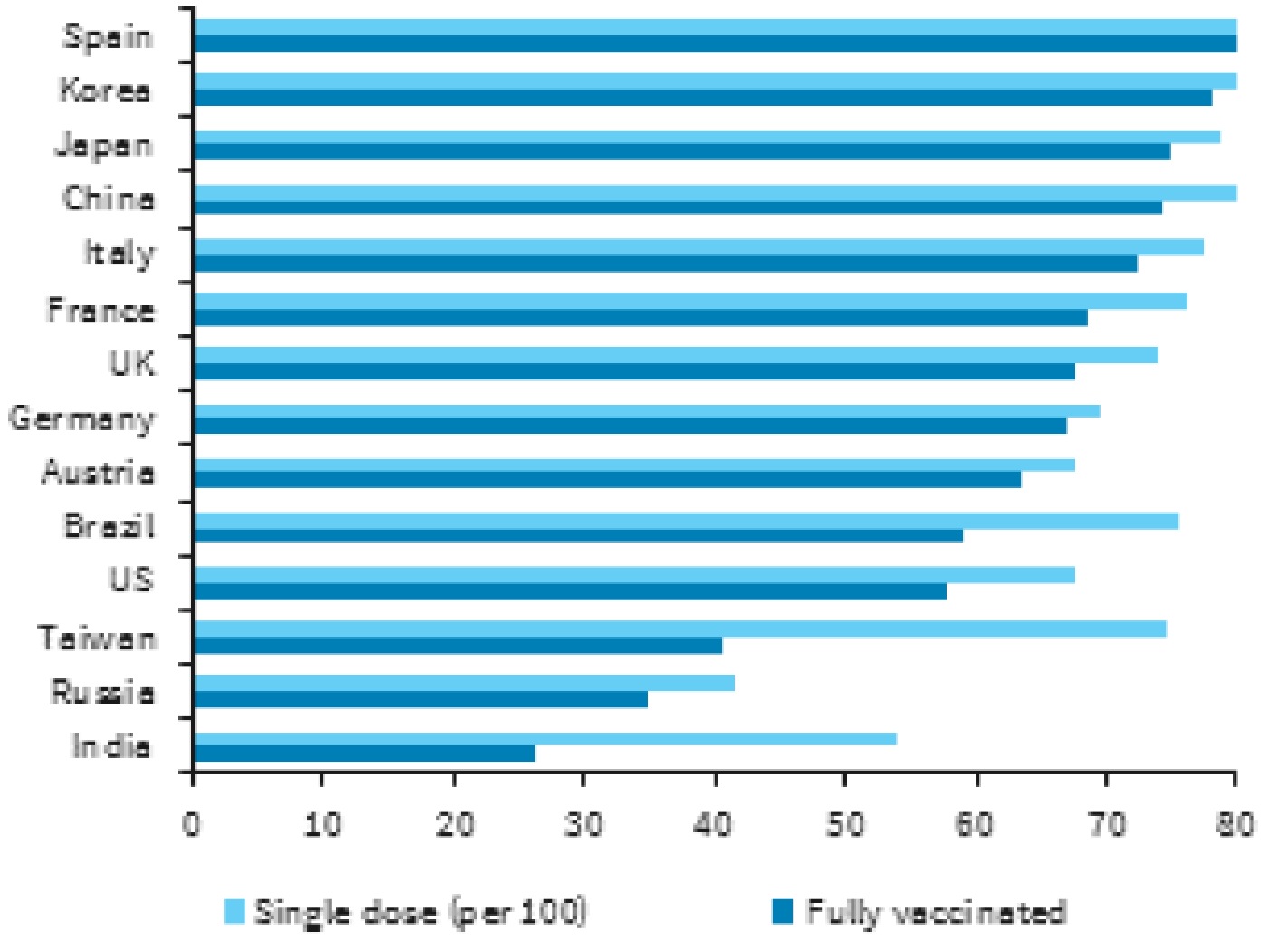

One reason why the world has stumbled into this inflation dilemma is because the business world has been investing less and less in physical capital spending for over a decade, as you can see in the chart below. As well, cap ex has occurred in lower-cost global production bases in emerging markets despite most of the consumption still occurring in developed markets. It is in these emerging markets that the virus’ curtailment has been less supported by vaccine roll-outs. The second chart shows how often “supply chain shortages” were discussed during the most recent third-quarter earnings season. With recent talk around the world of interest rate increase and Omicron growth headwinds emerging we are definitely at risk of stagflation as we head towards 2022.

CAPEX TO DEPRECIATION IS STARTING TO REBOUND FROM HISTORICAL LOWS

MENTIONS OF SUPPLY CHAIN DISRUPTION THEME

VACCINATION PROGRESS STILL UNEVEN ACROSS REGIONS

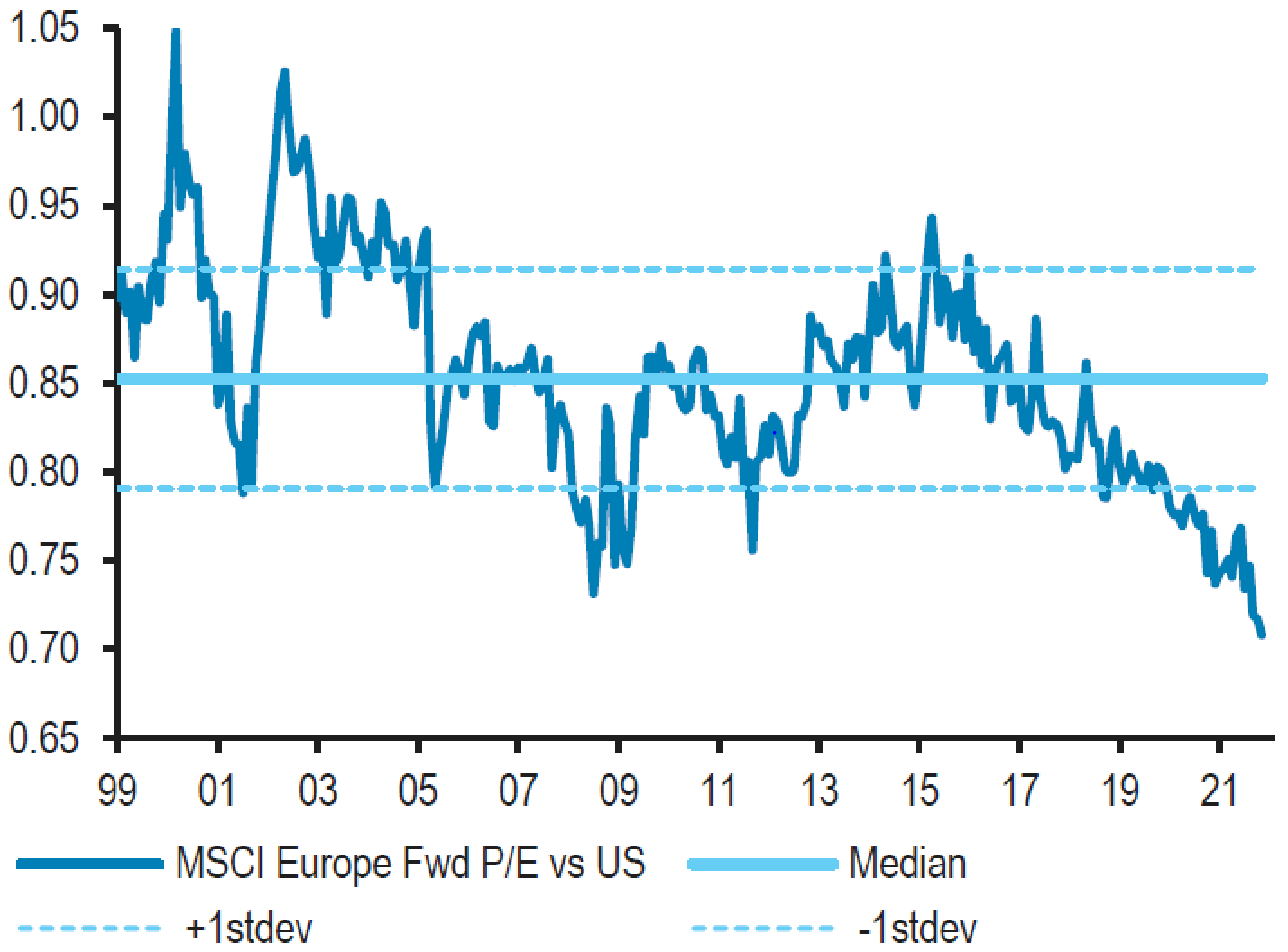

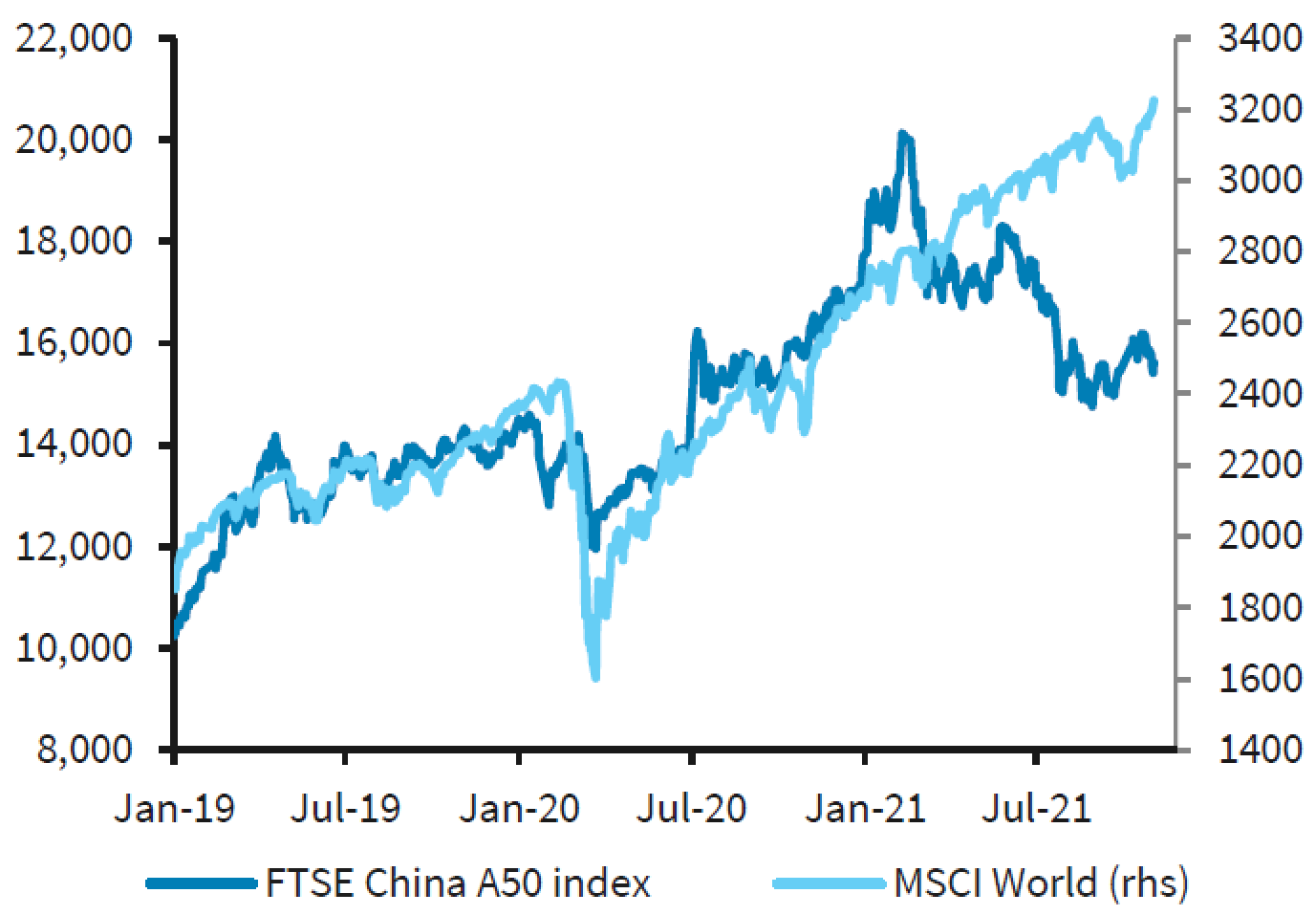

We have moved to be underweight the United States in part because we believe that there is better value to be achieved in other parts of the world. As you can see in the below charts, the valuation gap between the U.S., Europe and Asia is very wide. In China, we believe that their very, very restrictive travel policies have caused the economy to slow further than we had anticipated. By contrast, efforts in Europe to re-open quicker have proven too liberal. Whichever way you spin it, our investments in Europe and Asia look much cheaper than comparable companies in the U.S., but we do note that other investors continue to stay overweight the U.S. companies even at more expensive prices. We believe a tightening monetary policy in the U.S. should be a catalyst to normalize asset flows in 2022 to an area like China, that is now loosening policy.

EUROPE VS. US P/E HAS NEVER BEEN SO DEPRESSED IN THE LAST 20 YEARS

MIND THE GAP BETWEEN CHINA EQUITIES AND GLOBAL EQUITIES…

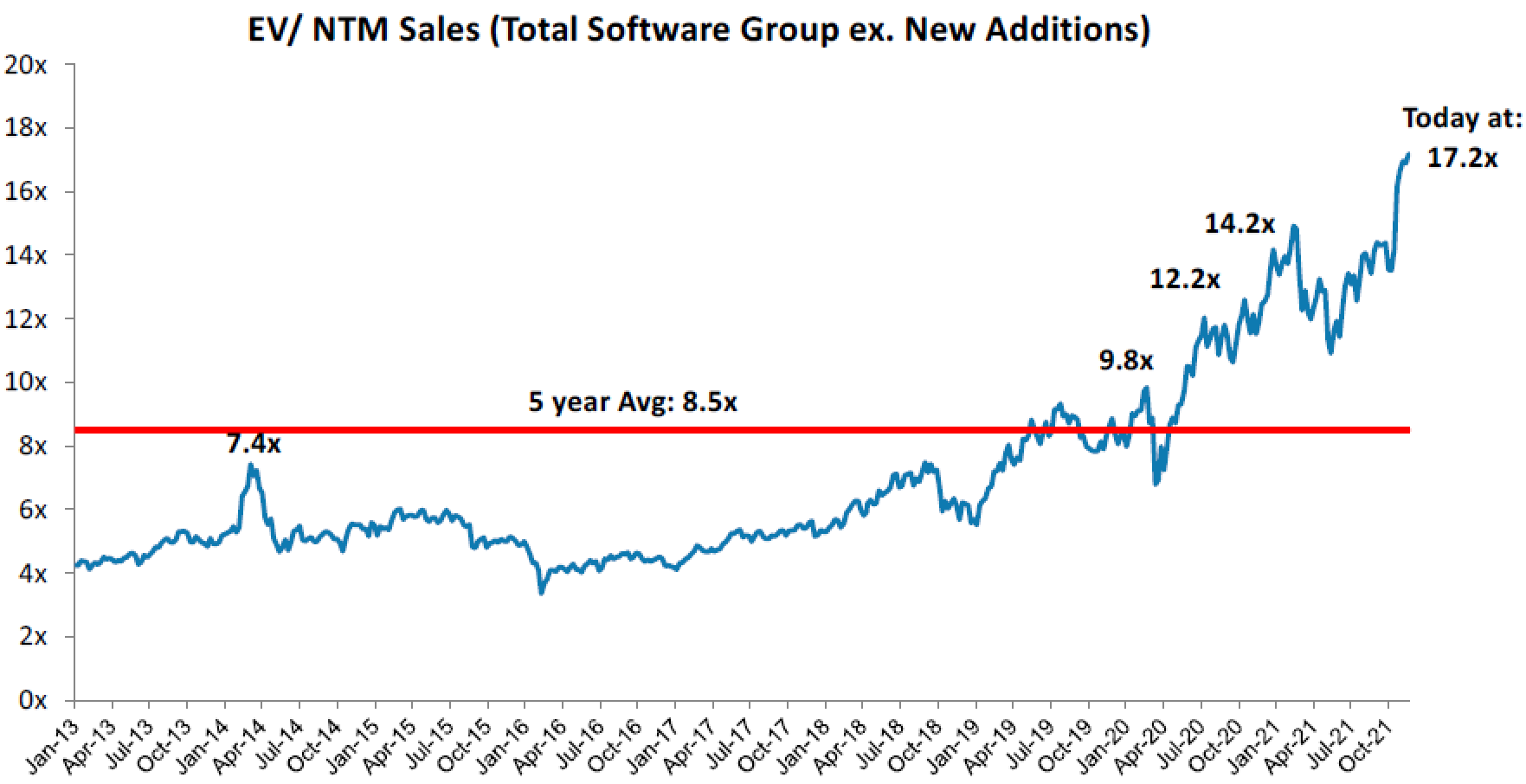

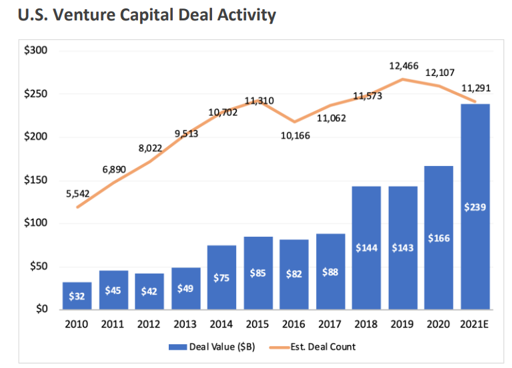

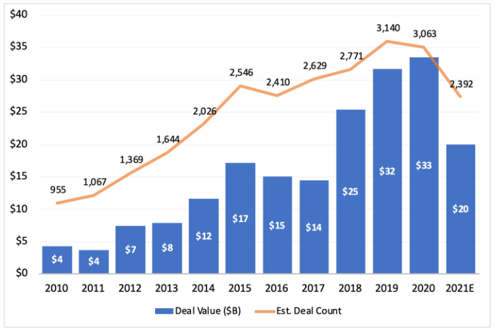

In a lower-growth-rate environment and with interest rates moving off zero levels, we believe that parts of the investment landscape have capped price performance upside. For example, as you can see in the chart below, valuations amongst software companies have expanded to very high levels. As much as we completely understand that “software is going to eat the world,” there does come a point, as illustrated in the second chart below, where venture capital spending on new software companies will eventually lead to major competitive friction between software players. As their software packages begin to overlap and they compete for talent to execute their ambitious growth plans their growth should normalize. Not everything can grow to the sky. We find it interesting to note that we have seen an uptick in senior leadership stock sales at some notable software companies we follow. For example, Satya Nadella, the CEO of Microsoft, sold over $285 million worth or just over half his personal stake in the company. This is not a guarantee the stock has reached peak but it is another yellow flag on software valuations.

OVERALL SOFTWARE MULTIPLES NOW AT 17.2X, DOUBLE THE 5-YEAR AVG.

LARGE & GROWING VENTURE CAPITAL ECOSYTEM PROVIDES TAILWINDSTO VENTURE LEADING

U.S. VENTURE CAPITAL DEAL ACTIVITY

U.S. VENTURE DEBT LENDING ACTIVITY

During the November sell-off we added back to our holdings those companies that we believe stand to benefit from economic re-opening in the travel and leisure industries. We agree that Omicron is a negative. However, we do note that hospitalizations and severe reactions to infection are much fewer than they were at this time last year. I just got my booster shot last week and completed a couple of business trips to the U.S. this past fall. I anticipate that next year business will return to the next normal after we get through this unpredictable winter. I am not saying that it will be back to 2019, however, I do not anticipate improving fundamentals.

REOPENING PLAYS ARE STILL TRADING AT DEPRESS CAPEXED LEVELS