Amplus Credit Income Fund October 2022 Commentary

The speed at which central banks are raising rates is slowing, many hope it has reached its peak. Senior Portfolio Manager, Andrew James Labbad, explains how Amplus strategically protects its investors from market risk.

TSN Turning Point: The highlight that most influenced the outcome of the game.

In May 2019, Kawhi Leonard hit perhaps one of the greatest buzzer-beater shots in postseason history to send the Toronto Raptors to the Eastern Conference Finals with a game 7 win over the Philadelphia 76ers. Eventually the Raptors went on to win their first ever NBA championship. For many, this historic shot against their most challenging playoff opponent was the “TSN turning point”. It took four bounces off the rim for it to eventually go into the net. Central banks have taken multiple shots so far this year at hiking rates to tame inflation. Eventually and forcefully, they will be able to achieve their goal. The question naturally becomes: “Have we reached the TSN turning point?” for central bankers.

Taking a step back and trying to make sense of this year’s market moves can be summed up as the effects of a perfect inflationary storm: war, geopolitics, hurricanes, persistent pandemic outbreaks, supply chains, fed policy errors. Each rally was met with a larger sell-off.

But the tone has recently changed with central bankers both in the U.S. and in Canada. First, the BOC surprised everyone with a 0.50% rate hike in October, 0.25% less than expected. Second, the FOMC decision to hike by +0.75% in early November did also come with signs of dovishness (even though it conflicted with Fed Chair Jerome Powell’s press conference shortly after). Together, there are early indications that the worst may be behind us – the speed at which central banks are raising rates is slowing and may be reaching its peak.

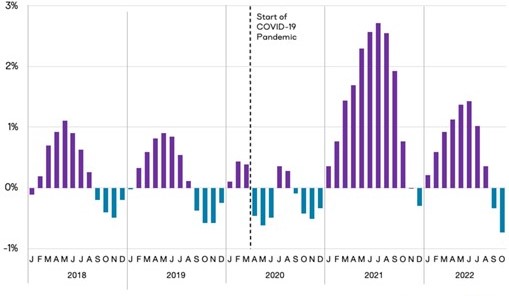

And finally, the October U.S. CPI print surprised to the downside. At long last, investors got some good news with lower inflation seen across many different goods and services. Shelter costs which contribute a big portion to overall CPI remained higher; we do get comfort in private-sector surveys suggesting better news in the months ahead on rents will help alleviate inflation in this subgroup.

MoM CHANGE IN NATIONAL RENT INDEX (2018-PRESENT)

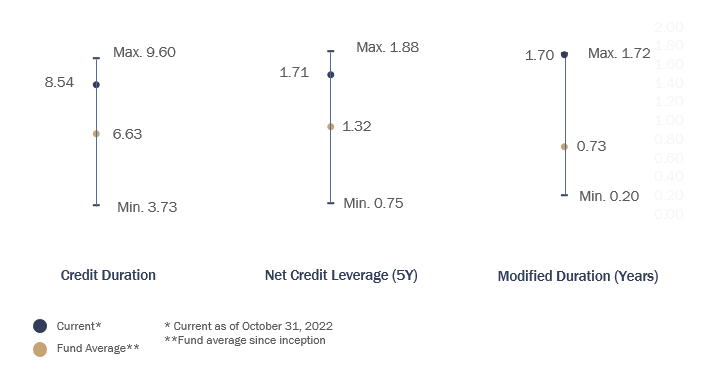

Will this be enough to finally see a sustained rally in both fixed income and equities? The good news is that regardless of the direction of the markets, your investment in Amplus Credit Income Fund continues to achieve positive returns. Current positioning will enable us to better participate in a sustained rally, all the while protecting your capital during downturn with continued volatility. As of early November, we are more bullish than at any point in 2022, while continuing to dynamically hedge and protect the portfolio from tailwinds.

CURRENT POSITIONING

The Fund

October performance was up +0.39%, with 2022 year-to-date growth of +5.23%. In a surprise move, October saw equities, credit and fixed income move in different directions. Equities rallied over 5%, while credit and fixed income traded lower. Canadian credit indices closed 7bps wider. Meanwhile, fixed income closed about -1%.

The fund continues to outperform and finished with positive returns for the following reasons:

- Amplus benefits from a portfolio yielding 9% after costs, creating a larger margin of safety for market swings, in both credit and interest rates.

- We were taken out of our full position in Suncor debt after the previously announced debt-tender offer by the company and made an additional 0.15% on the trade over and above the returns captured in September.

- Headlines regarding the Rogers/Shaw acquisition continued to pay dividend for our investors.

- Our interest rate exposure performed nicely as interest rates rallied on a smaller than expected hike from the Bank of Canada.

Our hedging through insurance-like contracts did drag on performance by about -0.15% in October. That being said, over the long term, strategically protecting our investors from market risk using these tools has well-benefitted them in 2022.

Go Forward Outlook

We are often asked to quantify the current margin of safety in the fund, or how much credit spreads need to widen before our investors lose money. We believe that margin of safety is +165bps of widening over a one-year period. Incorporated in our calculation is the assumption that the move would be the same across all bonds.

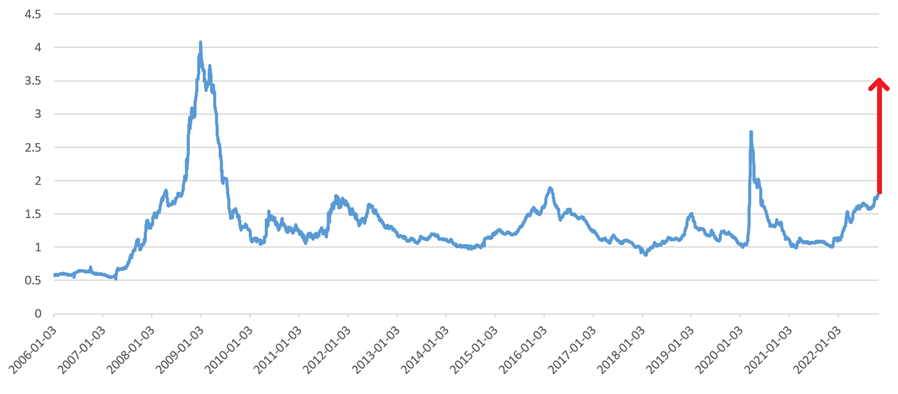

The red arrow shown in the Canadian corporate spread index chart below illustrates what a +165bp move wider looks like. This takes us back to levels seen during the global financial crisis. This chart alone makes us very excited about future return potential for our valued investors.

BLOOMBERG CANADIAN CORPORATE OAS (SPREAD) HISTORY

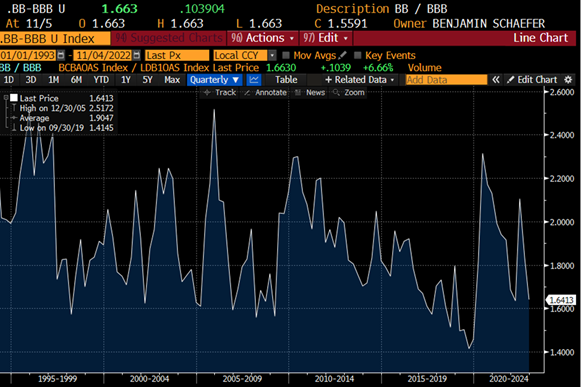

The upside of owning high-quality investment grade credit is reinforced when comparing it to high yield credit. Current valuation specifically between BBs look expensive in comparison to BBBs, as the yield difference between the two is at the narrow end of the range.

YIELD DIFFERENTIAL BETWEEN BBBs AND BBs

Our portfolio continues to hold investment in many high-quality companies that may stand to benefit from elevated interest rates and strong commodity prices. We remain excited about credit and future return potential.