A New Era for Alternative Investments

Both fixed income and equities suffered significant losses in the bear market of 2022. Balanced funds took a big hit and it seemed as if investors had nowhere to hide. For this reason, alternative investments are becoming an important option for investors. Amplus Credit Income Fund was able to finish 2022 +8.49% net of costs. In Amplus’ 2022 Q4 commentary, Senior Portfolio Manager, Andrew Labbad dives into what attributed to the fund’s exceptional performance over the year.

“Today I will do what others won’t, so tomorrow I will accomplish what others can’t.” — Jerry Rice

For American football fans, NFL playoffs is one of the most exciting times of the year. The competition leading up to the Superbowl is fierce. Historically, running the ball into the opponents’ end zone to score a touchdown was the most successful strategy. Defense played a critical role in winning championships. Since Tom Brady came into the spotlight twenty years ago, strategy of the game has changed and evolved. Recent Superbowl champions shifted their focus towards frequent passing, as opposed to running the ball, and as such, a new crop of talent and draft picks were targeted. A franchise quarterback to throw the ball, a set of wide receivers to catch the ball, a running back with good catching hands, and athletic offensive linemen to protect the quarterback, are all required. Teams who adapted won championships; those who did not, became irrelevant, suffering losses and injury.

Much like how football has evolved since Tom Brady, 2022 was a turning point for traditional assets. Typically, when equities experience losses and extreme volatility, fixed income tends to excel, benefitting from a rush to safety. The bear market of 2022 was unique in that traditional fixed income and equities both suffered significant losses. Balanced funds saw some of the worst returns in over 100 years. There was nowhere for investors to hide – a new game plan is required. Thankfully, alternative investments are increasingly becoming a more important and larger player in the draft. Investors have experienced a long and strong bull market for over a decade. Stable macro-economic activity, increased globalization, free trade, innovation, and disruption – appears to be coming to an end. And with it, 18 trillion dollars of negative yielding bonds inflated away.

In this new era, greater economic and geopolitical uncertainty is impacting investor returns and confidence levels. Traditionally safe assets have not played out that way, like football strategy, a new game plan is required to win. Central bankers printing endless supplies of cash is no longer a fallback option with inflation this high, as such, an ability to hedge becomes crucial. Amplus Credit Income Fund (ACIF) is designed to thrive in this new environment – having the ability to actively manage risks while quickly reacting to market conditions and opportunities.

The Fund

As we mark a new year, we are pleased to announce that December performance was up +0.99%, with 2022 closing out at +8.49% net of costs. We are pleased with these results and thankful to our investors and partners for their continued trust and confidence in Amplus. As we celebrate a truly exceptional year of steady positive returns, we are increasingly pleased that our unique approach allowed us to outperform. We continue to remain focused on the present-day investment climate, future opportunities, and our goal to continue to grow your wealth while protecting it from market risk.

The fund performance can be attributed to the following:

- We viewed limited upside ending 2021. We turned defensive by reducing overall risk in late 2021, while also rotating into higher quality and more liquid credits.

- Increased volatility created strong trading gains in the hedging portion of our portfolio.

- In the first half of 2022, many short-dated credit maturities got taken out early by issuers at a premium to be refinanced at better terms. We held positions in most of those securities with Bell Canada, Loblaws, Sobeys and Fortis being our biggest winners.

- Our capital structure trade relating to the Rogers/Shaw acquisition played out as expected, generating good returns for our investors.

- High quality energy producers delivered record levels of free cash flow, which was then used to clean up their balance sheet by taking out their debt early. Our positions in both Cenovus Energy and Suncor Energy bonds benefited from these early tenders and take outs.

Go Forward Outlook

We are preparing for a high degree of volatility and uncertainty for risk assets in 2023. The biggest challenges to the economy and capital markets might appear to be familiar culprits from last year: geopolitics, supply chain issues, continuing effects of the pandemic, rising interest rates, inflation, etc. However, many additional unknowns remain. Our focus is to plan accordingly, including:

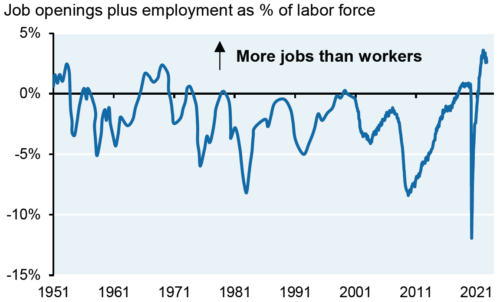

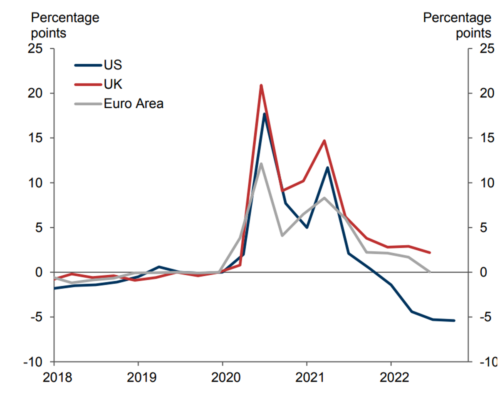

- Service sector inflation remaining stubbornly high, despite goods inflation falling sharply in late 2022. Post-pandemic pent up demand for travel and entertainment makes it that much more difficult this time around. Complicating the Fed’s efforts to slow the economy, a tight labour market has kept wage inflation elevated. By some measures, the U.S. has been facing the tightest labour market on record: the highest job shortages in the post-war era, the lowest “job fill” rate.

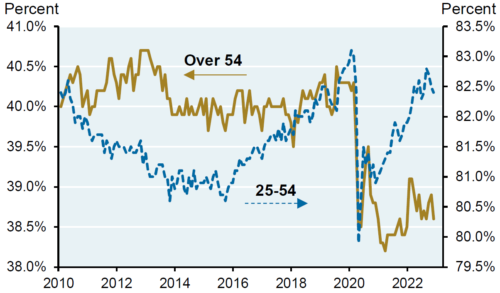

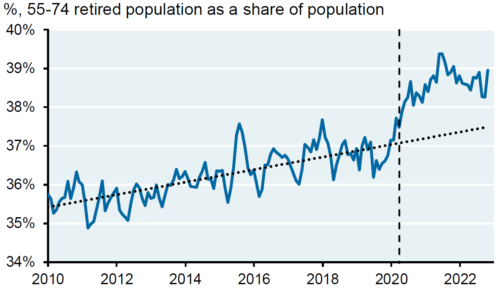

- An aging population has caused a shrinking workforce. Aging is bad news for future economic growth, too. The available workforce will expand much more slowly in coming years than it has in the past. Economies won’t be able to produce as much. More people aged 55 or older are retiring. Many people who left the workforce during the pandemic aren’t coming back. The Fed is trying to slow down hiring to curb inflation. Rate hikes are not having a notable negative impact on the labour market. We believe the Fed will have to keep its foot on the brakes for longer and stronger than is currently being priced into the market to slow demand for labour sufficiently. We believe there will be more ongoing inflationary pressures keeping interest rates higher over the next ten years compared to the last ten, as reduced production capacity struggles to keep up with demand.

LARGEST WORKER SHORTAGE IN THE POST-WAR ERA

LABOUR FORCE PARTICIPATION RATE

RETIREMENT RATE FOR WORKERS 55-74 YEARS OLD

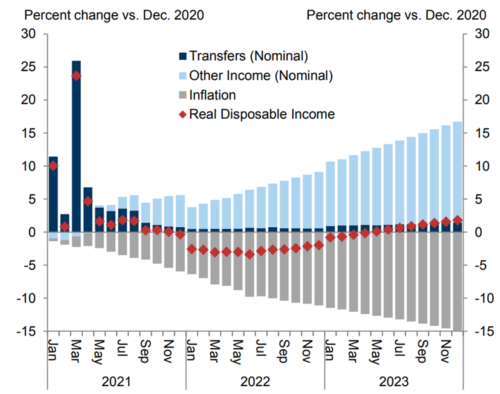

- Tightening credit conditions, higher interest rates, diminishing excess savings and its toll on the economy. Excess savings relative to the pre-pandemic trend, peaked at ~$2.1 trillion in the middle of 2021. These savings have been drawn down to around $1.1 trillion, with trendlines showing the excess savings totally depleted by mid-year 2023. As for liquidity, recall the Fed was still buying lots of bonds as of Q1 2022. Balance sheet runoff didn’t commence until the summer. The European Central Bank hasn’t even begun quantitative tightening, which will start in March. We are in the early innings of a global liquidity inflection point, and it’s not something we’ve experienced in conjunction with sharply higher interest rates and tightening of bank capital. Unlike recent history, we believe the Fed must continue to tighten into a slowdown, as the inflation target remains 2.5x too high.

U.S. HOUSEHOLD DISPOSABLE INCOME

CHANGE IN THE U.S. HOUSEHOLD SAVING RATE SINCE 2014Q4

ANNUAL MORTGAGE COST AS A PERCENTAGE OF A HOUSEHOLD INCOME, PERCENT IN THE U.S.

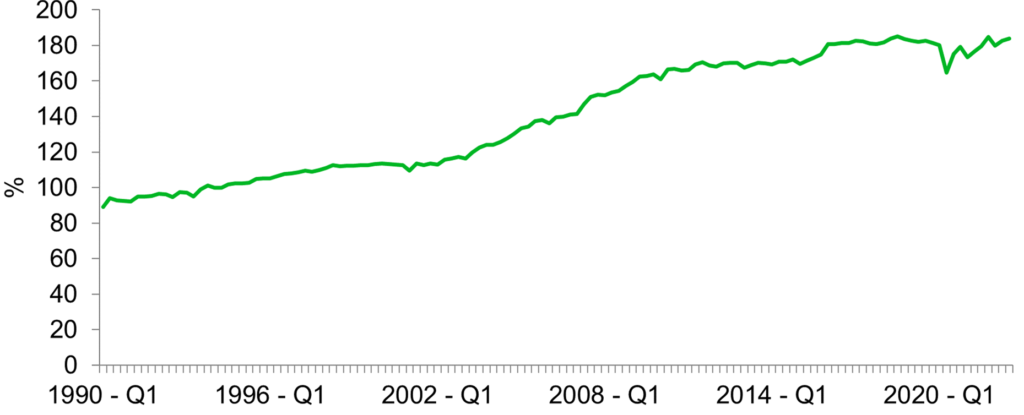

CANADIAN HOUSEHOLD DEBT TO DISPOSABLE INCOME

Opportunity Set

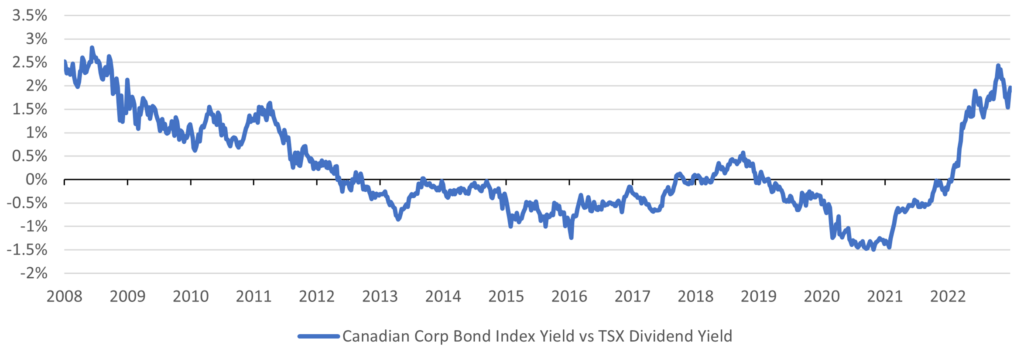

Bond yields rose sharply higher in 2022, surpassing the dividend yield of most equity indices. The opportunity set of owning fixed income is the most attractive it’s been in over a decade. Historically, wide credit spreads and elevated yields combined with the inversion of the yield curve allows us to own shorter-dated debt at greater all-in yields, with lower duration and a higher break-even compared with longer-dated bonds. Our portfolio continues to hold investment in many companies that stand to benefit from elevated inflation. We view energy, infrastructure, and banks as favourable investments. Carry strategies such as Amplus are designed to thrive in this type of environment, currently yielding over 9.5% and providing a high margin of safety for investors.

CANADIAN CORP BOND INDEX YIELD VS TSX DIVIDEND YIELD

YIELD DIFFERENCE BETWEEN 2YR AND 10YR CANADA BONDS

RATIO BETWEEN BLOOMBERG CANADA AGGREGATE CORPORATE SPREADS & ALL-IN YIELDS