Silver Linings - Intercontinental Exchange

Welcome to our new series, Silver Linings, where we discuss areas in the market that are or will be positively impacted by the current economic crisis.

In recent days, volatility measured by the VIX index has reached levels that surpass even 2008 extremes. One holding that we have been adding to our portfolio during the sell-off that benefits from the heightened volatility is Intercontinental Exchange, Inc (ICE).

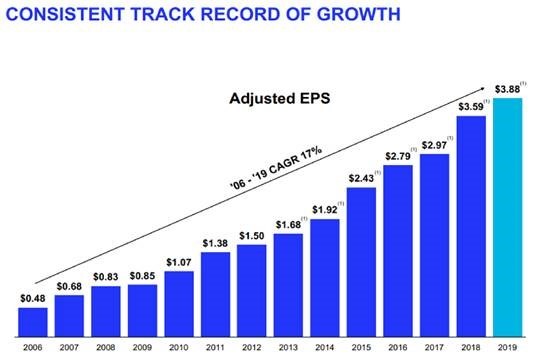

ICE is a global operator of exchanges, listing venues, and clearing houses across multiple asset classes. Half of its revenue is from transaction-based trading, which is counter-cyclical and benefits from recent volatility with February average daily volumes up 39% year-over-year. The other half is from stable, subscription-based, recurring data and connectivity fees. This has allowed it to sustainably grow earnings every year since going public in 2006, even through the recession in 2008-2009.

The company was founded in May 2000 by the current chairman/CEO Jeffrey Sprecher, when he acquired Continental Power Exchange, Inc, with the objective of developing a more efficient, electronic platform for Over-The-Counter (OTC) energy commodity trading. He’s since built the company into the second largest global exchange in the world through acquisitions and leveraging the distribution and infrastructure to create new solutions for customers. We like entrepreneurial, founder-led companies with significant insider ownership (Sprecher owns >$350mm in equity) as they are aligned with equity owners.

Overall, we view Intercontinental Exchange as attractive long term holding as it has high barriers to entry, 58% operating margins, a strong balance sheet, and sustainable free cash flow, which gives it the ability to opportunistically buyback its stock during times like now, when the market is selling off. Speaking at a conference on March 2nd, 2020, Scott Hill, ICE’s CFO mentioned “In a world where we’re setting records in our revenue in January and positioned well for February, and the share price is going down, we’ve got flexibility to be opportunistic and buyback stock.”