Silver Linings - German Auto Debt

For the first time in our Silver Linings series, we will be featuring a fixed income pick. This week, senior portfolio manager Andrew James Labbad, CFA tells us about his latest investment thesis.

At Wealhouse, we take pride in our ability to be agile – to recognize good investment opportunities and execute with speed and precision. During this economic downturn, one class of opportunities presented itself that was too good to pass up: credit. Central banks were providing ample support to the credit market through secondary buying sprees. We knew we had a limited window to execute and were able to snag up some great assets that were a part of these support programs.

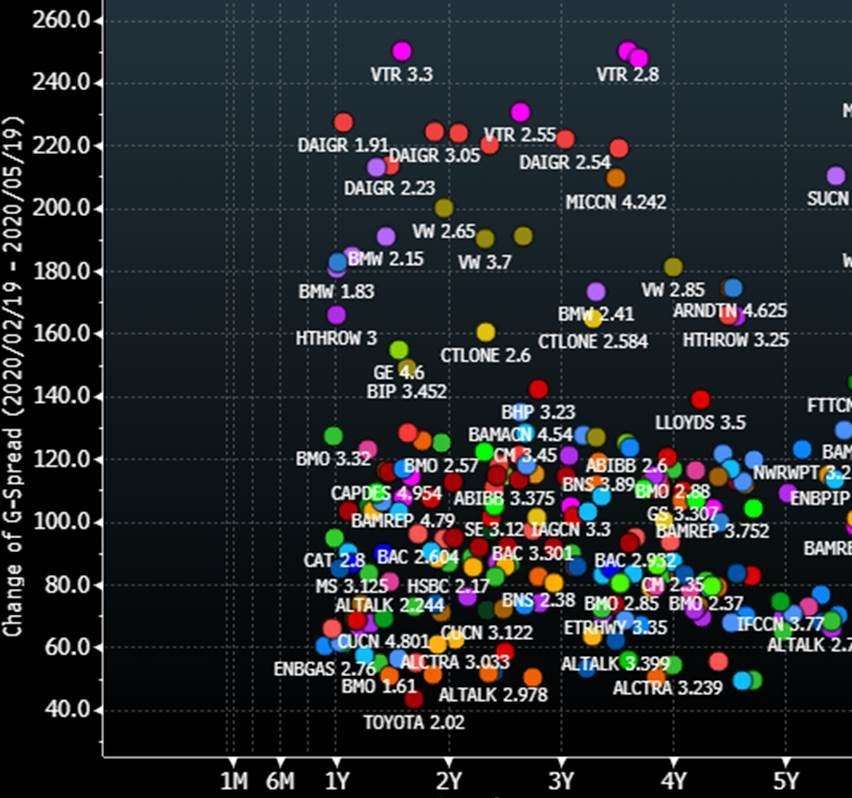

We took a bullish view on some cyclical names that got mistreated during the downturn and went long on several German auto bonds. These debt offerings were all given negative outlooks by the rating agencies, BUT the pricing of their securities assumed the worst was already baked in. As you can see in the chart below, the spread movement on BMW, Volkswagen and Daimler were the largest movers during the pandemic in the Canadian corporate bond market for BBB+ or higher. With most German auto names trading cheaper on a relative-value basis (in comparison to most, if not all, BBB/BBB- rated credits), they were a fantastic bargain. For example, between February and May, BMW’s spread was wider by +180 bps, Volkswagen’s spread was wider by +190 bps and Daimler’s spread was wider by +225 bps. These are all legacy, high-quality companies with secular growth opportunities.

In addition to the attractive spreads, many German auto debts traded significantly cheaper in Canadian dollars than other currencies. The three companies we mentioned above not only have explicit guarantees for their Canadian dollar debt, but also access to their central bank financing programs.

Lastly, one of most important factors that influenced our investment decision is what we keep stressing at Wealhouse: a company’s quality. These German auto companies are all major pillars of both Germany’s and Europe’s economy. Despite near-term operating headwinds and financial pressure, managements were able to preserve cash and liquidity throughout this downturn. Between cash, marketable securities and credit facilities, BMW, Daimler and Volkswagen currently have about €26 billion, €41 billion and €55 billion respectively in liquidity they can draw down on. The market downturn in March proved that balance sheets matter. German auto debts ticks all the boxes on our investment checklist and we expect the bonds to trade even better over time.