Amplus Credit Income Fund August Commentary

Senior Portfolio Manager, Andrew James Labbad, explains how he has been able to produce steady returns while minimizing the downturns in today’s climate. This month’s commentary dives into Amplus Credit Income Fund’s forward outlook with expectations for rates to remain high and Russia’s continued threats.

“Canada’s Wonderland, It’s Amazing in Here” – Wonderland’s Theme Park Slogan

For our kids, a highly anticipated event this summer was our trip to Canada’s Wonderland. What’s not to like? My childhood memories on theme parks were very positive. But now, I have a very different perspective on them, given we spent an entire day waiting in huge lineups, listening to kids screaming while taking non-stop selfies, eating overpriced hotdogs, being hunted by wasps while trying to consume said hotdogs, and limited ride options for kids under four feet. Our children had a blast, screamed when we had to leave, and can’t wait to go back; most parents do not share this sentiment.

The stock market has been acting a lot like a theme park recently, with roller coaster-like swings experienced throughout the summer months. Most investors have a hard time stomaching such volatility. Fortunately, with a wide array of tools at our disposal, and the ability to deploy different hedging strategies, Amplus Credit Income Fund has been able to minimize stomach-churning downturns. We have produced stable positive returns that would compare more closely to a gondola or a sunny lazy river for our valued clients.

THE FUND

Our August performance was up +1.17%, with 2022 year-to-date growth of +3.95%. Meanwhile both equities and fixed income indices gave up most of the positive returns from July, adding to mounting losses seen for the year. Credit spreads held in very well, ending the month on average 2bps tighter in Canada and 3bps tighter in the U.S.

The fund continues to outperform and finished with positive returns for the following reasons:

- Amplus benefits from a portfolio yielding over 8.5%, creating a larger margin of safety for market swings.

- Our overweight exposure to financials and energy producers generated positive gains with both sectors tightening 4bps and 7bps respectively.

- We held positions in 3 bonds that benefitted from corporate headlines:

- Cenovus Energy tendered and took out the equivalent of USD $2.2bn of debt at a 30bp premium. This included our position in 2025 bonds.

- Rogers Communications paid a consent fee to bondholders for debt issued to finance Shaw’s acquisition. The fee was to extend and amend certain covenants.

- Loblaws refinanced their 2023 maturity paying bond holders a small premium to take out the debt early.

Our interest rate exposure, though minimal, did drag on performance as interest rates moved higher. We view this exposure as a natural hedge in the event of a large risk-off move.

GO FORWARD OUTLOOK

Last month, we spoke about the misinterpretation of Powell’s comments in July and the significant move higher in both equity and fixed income markets. We took this as an opportunity to lighten up on risk and buy protection on the cheap.

Yesterday’s FOMC decision, outlook and comments from Chair Powell drew the line in the sand leaving no reason for doubt. Getting inflation back to 2% was a top priority at risk of drawing a recession. It was made clear that rates would need to remain higher for longer to combat current inflation. This was viewed as very hawkish by the market and it forced yields higher. The median forecast now calls for U.S. overnight rates to reach mid-4% by the end of 2022 and remain there until 2024.

Our biggest concern remains to be Russia. More specifically, Putin’s continued threat of nuclear action towards Ukraine and its allies – recently emphasizing it is ‘not a bluff’. We do believe that remaining invested is important, as we cannot predict the future. To combat this, we are buying insurance-like contracts to protect as much of our capital as possible.

Our second biggest concern is the major risk to the upside. As we saw at the end of June, overall economic and market sentiment is so bearish and positioned for further downside. With record levels of cash on the sidelines, any hint of a risk-on event would cause a massive move higher. The charts below illustrate this well.

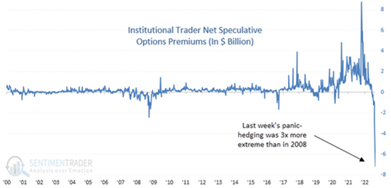

- Record levels of hedging in September: $8.1bn worth of put options versus less than $1bn in calls.

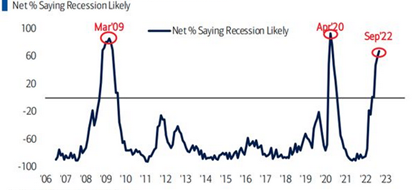

- Highest expectations for a recession since April 2020 and March 2009 – both market bottoms.

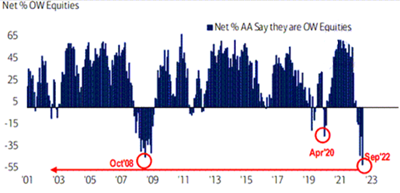

- Lowest percent of managers overweight equities since 2008.

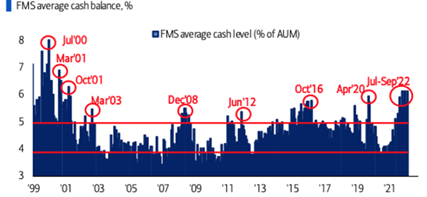

- Highest cash positions since 2001. Higher than the global financial crisis and pandemic lows.

INSTITUTIONS BOUGHT A RECORD AMOUNT IN HEDGES

RECESSIONS ODDS STILL RISING FOR FMS INVESTORS

NET OVERWEIGHT EXPOSURE TO EQUITIES BY FUND MANAGERS

FMS INVESTORS RAISED CASH IN SEPTEMBER

We continue to see tremendous value in high-quality credit versus other asset classes. Historically, wide credit spreads and elevated yields provide us with a large margin of safety. The inversion of the yield curve allows us to own shorter-dated debt at greater all-in yields, with lower duration and a higher break-even compared with longer-dated bonds. Our portfolio continues to hold investment in many companies that stand to benefit from elevated interest rates and strong commodity prices. We remain excited about credit and future return potential.