Volatility & Uncertainty for Risk Assets Continues

As recession fears trend higher, it is critical for investors to prepare for market risks. Senior Portfolio Manager, Andrew Labbad, breaks down what attributed to Amplus’ successful Q1 2023 performance (+3.49%) and why fixed income continues to be the most attractive it’s been in over a decade.

“Hoping for the best, prepared for the worst, and unsurprised by anything in between” – Maya Angelou

Known for its excellent sports curriculum, Quebec’s College Notre-Dame was the natural high school for many student athletes. Their football program was amongst the best in the province having won 14 provincial championships since 1987. I had the chance to play for their varsity football team and surrounded myself around sheer talent both in coaching and teammates. What really set us apart was the high level of preparation and commitment required to win championships. Practice was mandatory 4 times a week, Saturday was game day, while strength training and studying were expected during ‘off’ days. On defense, practice involved studying and replicating our opponent’s tendencies, favourite plays, in order to better predict their game day strategy. This level of preparation allowed us to have an edge over the competition. The end-result: 2 championship banners with a defense averaging less than 1 touchdown allowed per game. Looking back, I can confidently say that preparation for game day was critical.

Much like in sports, the most dangerous outcomes can occur without warning and are often due to unforeseen risks. Planning and preparing for the unexpected when it comes to investing, can be the difference between winning and losing. Since launching the fund in July 2020, we’ve repeatedly highlighted our priority of capital preservation. The Amplus mission statement has always been to maximize risk-adjusted returns in a rising market while protecting investors from market risk. To do so, much like studying film, we are constantly back testing, stress testing and playing out endless permutations of risk-off events.

Thanks to this level of planning, Amplus successfully handled March’s market reaction involving the sudden failure of three U.S. regional banks and the Credit Suisse blowup.

The Fund

We are pleased to announce that Q1 of 2023 saw gains of +3.49% after costs, including a gain of +0.21% in March. Both equities and fixed income benchmarks whipsawed between gains and losses during that time, ending mostly up. Canadian credit spreads were 4bps wider to closeout Q1. Most of the fixed income benchmark returns came from accrued interest and a move lower in rates, causing prices to go higher.

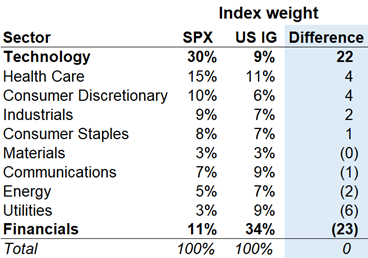

March saw a bifurcation between equities and IG credit, with equity indices benefiting from a much heavier skew in tech, and a much lighter skew in financials. Naturally, equity indices also inherently promote the most successful companies as weightings become a larger overall component over time, while credit indices give weight to the largest debtors.

WEIGHTING DIFFERENCES BETWEEN EQUITY AND FIXED INCOME

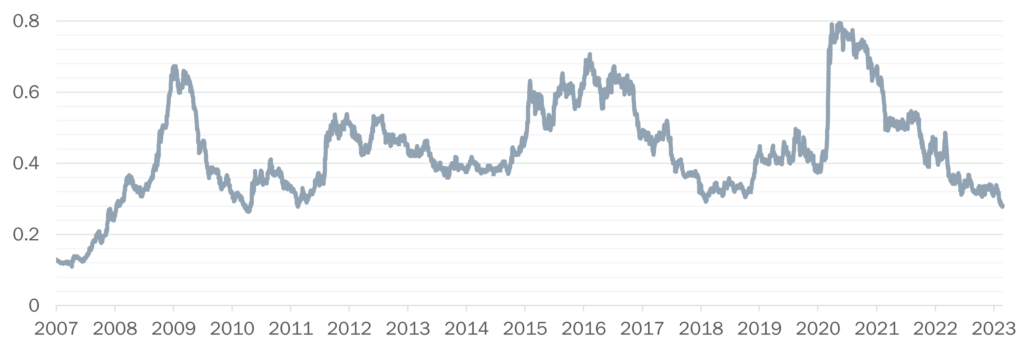

Heading into March, even though credit still looked historically cheap, we were also mindful of all-in yields and the marginal benefit that credit provided. In late January, we discussed our concerns with Bloomberg. As shown in the graph below, credit spreads only made up about 30% of the overall yield of a corporate bond, which was at the lower end of the historical range. We confidently increased interest rate exposure to the portfolio by unwinding some of our shorts in treasuries, allowing us to own corporate bonds outright. The benefits were two-fold: More short-dated yield in the portfolio and premium-free hedging in case of a major risk-off event as we saw at the onset of the pandemic. The same reasoning justified not owning too much higher beta debt; the marginal yield did not justify the additional risk.

RATIO BETWEEN BLOOMBERG CANADA AGGREGATE CORPORATE SPREAD & ALL-IN YIELDS

The fund performance in Q1 can be attributed to the following:

- We had a healthy position of early 2024 maturities that produced strong returns to start the year. This part of the credit curve saw credit spreads tighten by as much as 70bps in the first two months of 2023. Many traditional yield buyers took advantage of the inverted yield curve to buy short-dated corporate bonds which were the highest yielding options available. We significantly lightened our exposure into the rally as the move felt overdone.

- In the first week of March, we continued to reduce our credit exposures taking opportunistic sales while increasing our interest rate exposure by 70%. The collapse of Silicon Valley Bank (SVB) caused credit spreads to widen by 30-40bps and negatively impacted our portfolio. However, we benefitted from the high margin of safety in owning a portfolio that yields ~9%, while also participating in the 100bp+ rally of short-dated treasuries.

- We had zero direct exposure in the U.S. regional banking collapse and the European Banking crisis surrounding Credit Suisse. We did not own any AT1 securities, and we had sold all our (limited) regional Canadian bank positions by early March.

- We had zero direct office real estate exposure.

Go Forward Outlook

We believe that a high degree of volatility and uncertainty for risk assets continues well into 2023, despite volatility measurements recently resetting lower. Many new unknowns remain. As we plan accordingly, a few new areas of concern include:

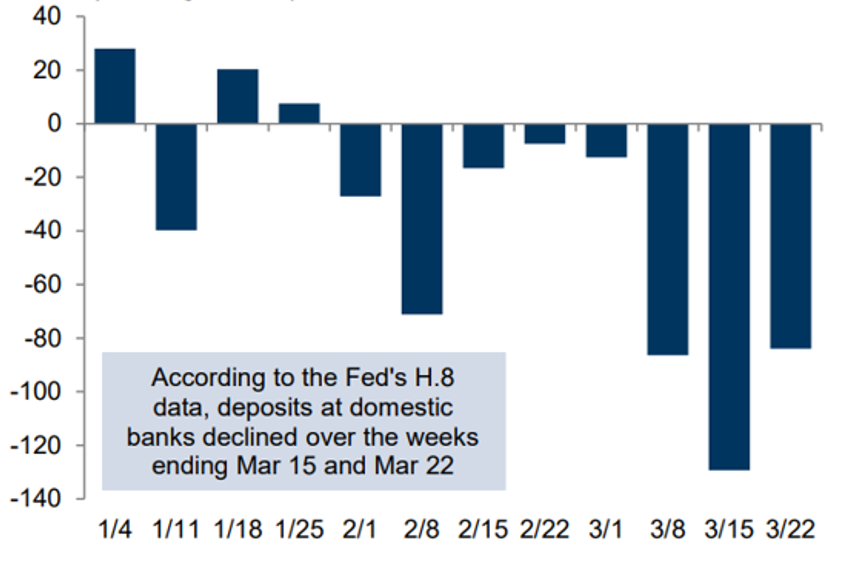

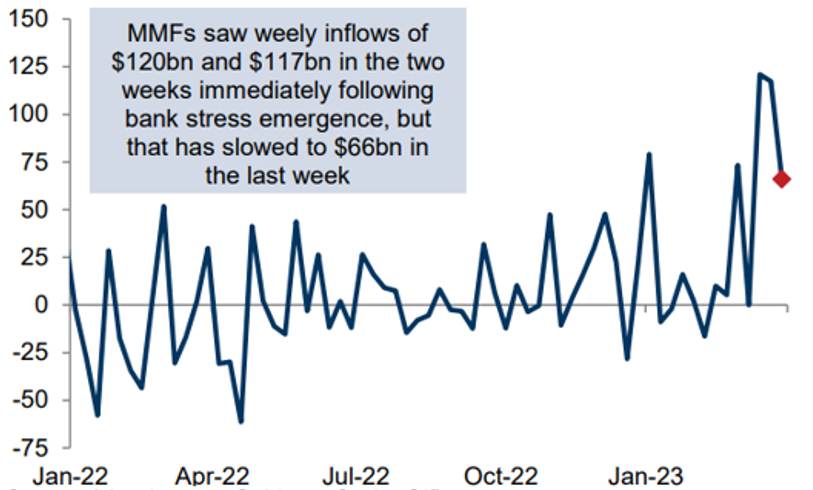

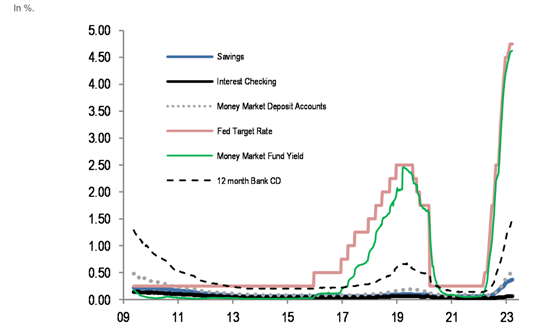

- U.S. regional banks and deposit outflows: U.S. policymakers have taken aggressive steps to shore up the financial system but concerns about stress at some banks persists. The genie is out of the bottle and the only way to put it back in is an explicit deposit guarantee or an increase in coverage. Until then, raising capital for regionals will be even more challenging and costly as deposit trend uncertainty will cause hesitation for investors and clients. U.S. money markets funds are yielding close to 4.85%, naturally drawing flows their way, to the detriment of bank deposits and equity funds. It’s hard to see a more compelling option for many investors, as the current incremental 0.1% earnings yield of the S&P is at multi-decade lows compared to money market yields.

WEEKLY CHANGE IN DEPOSITS AT US BANKS, $BN

MONEY MARKET FUND (MMF) NET FLOWS, $BN

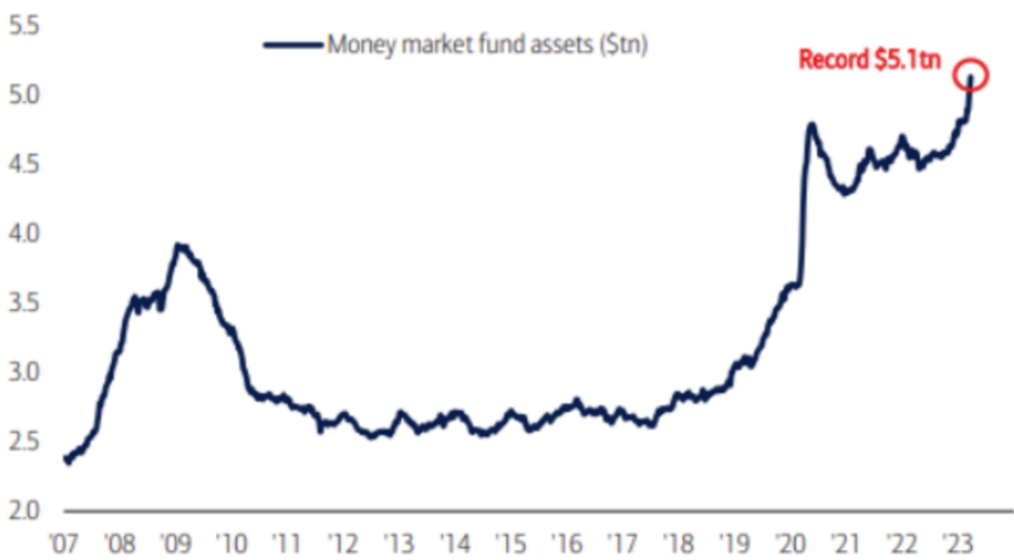

MONEY MARKET CUMULATIVE FUND ASSETS

U.S. MONEY MARKET FUND YIELDS VS U.S. BANK DEPOSIT RATES

- Credit contraction and its impact on commercial lending: As deposit uncertainty continues, and access to competitive funding remains difficult, it’s fair to assume a serious contraction of bank lending is upon us and avoiding a recession then becomes hard. Until these trends change, headwinds remain for risk markets. Small and medium-sized banks play an important role in the U.S. economy, making up 50% of U.S. commercial & industrial lending, 60% of residential real estate lending and, 80% of commercial real estate lending and 45% consumer lending. The comforting reality is that bank lending standards had already tightened significantly over the last year to levels unseen outside of recessions, presumably because bank risk managers saw how aggressively central bankers were raising rates and tightening monetary conditions. This leaves room to believe that any incremental credit contraction may be limited.

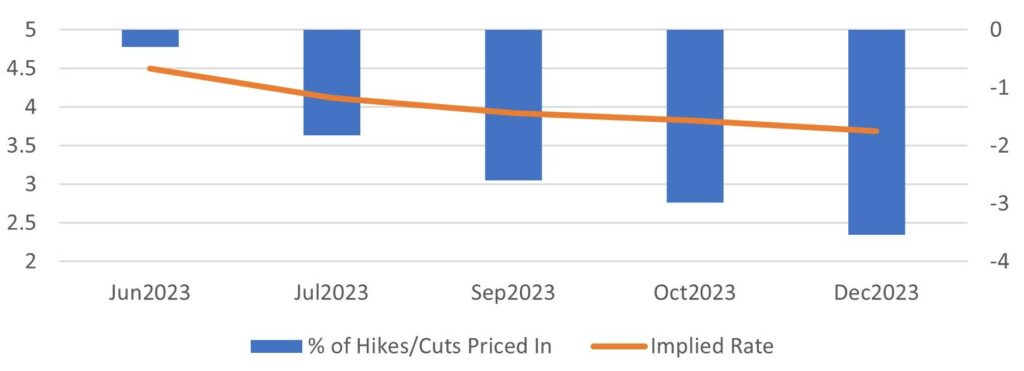

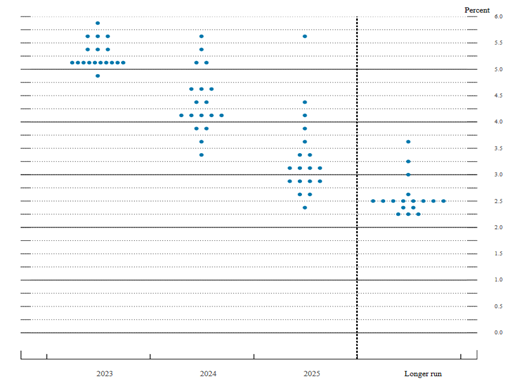

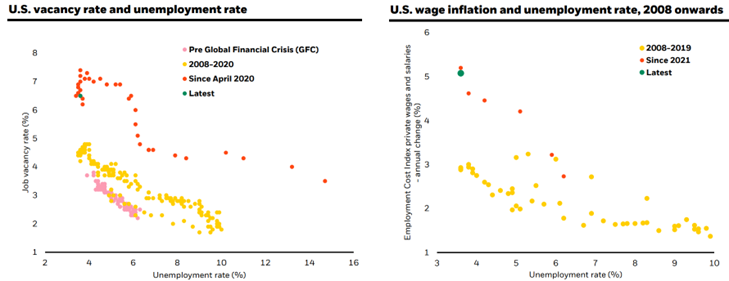

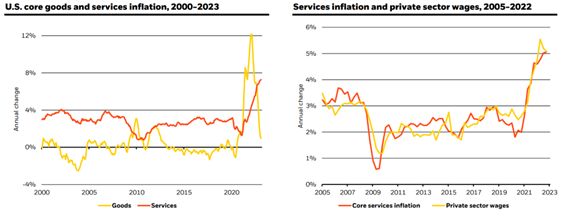

- Sticky inflation, tight labour markets and the Fed dot plots disagreeing with current market pricing: For the second half of March, fixed income markets were pricing 3 to 4 rate cuts by year-end implying a federal funds rate of 3.5 to 3.75%, whereas FOMC participants were still targeting well over 4.5% on the year. Since then, recent data still justifies additional hikes, as a strong jobs market and sticky inflation related to the service sector and wages have not abated.

IMPLIED OVERNIGHT RATE & NUMBER OF HIKES/CUTS

FOMC PARTICIPANTS’ ASSESSMENTS OF APPROPRIATE MONETARY POLICY

A TIGHT LABOR MARKET IS KEEPING SERVICES INFLATION ELEVATED

STUBBORNLY HIGH DM INFLATION DRIVEN BY SERVICES

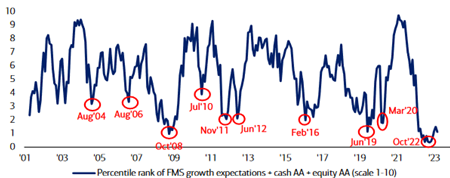

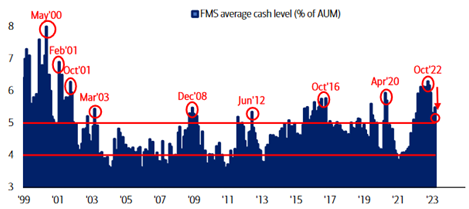

- Market positioning and fund flows being overly defensive: Our last concern is the major risk to the upside. As we saw at the end of August 2022, overall economic and market sentiment was so bearish and positioned for further downside. With record levels of cash on the sidelines, any hint of a risk-on event would cause a massive move higher. The charts below illustrate this well.

- Investors are currently the most bearish all year, while recession fears are trending higher

- Cash positions on the rise, with a record setting $5 trillion in money market.

INVESTORS NOW THE MOST BEARISH THEY HAVE BEEN SINCE START OF ’23

CASH ALLOCATION ON THE RISE AGAIN

Opportunity Set

With interest rates having risen sharply over the last year, fixed income securities are yielding approximately just as much as the earnings yield of the S&P 500, and surpassing the dividend yield of most equity indices. The opportunity set of owning fixed income continues to be the most attractive it’s been in over a decade. The inversion of the yield curve benefits owners of short-dated debt. Carry strategies such as Amplus are designed to thrive in this type of environment, designed to own short-dated high-quality credits, which combined yield over 9.5%. We believe this should provide a high margin of safety for investors.

Thank you for your support and interest in Amplus.