Up in the Air

In his latest commentary, CIO Scott Morrison discusses his new Air Canada Million Miler achievement, the lessons he learned from his travels, and how they may shape the decade to come.

In 2019, central banks around the world put in place easier monetary polices. These policies are the biggest driver of year-over-year change in most assets last year. If the Fed had not reversed course and lowered rates in 2019, the U.S. would have likely entered a recession.

Last year, the U.S. 10-year bond was 2.78%, versus 1.84% today. This decline in interest rates will stimulate the economy. As a result, the risk of a recession has been averted and allowed this economic expansion to enter its 11th year — the longest of my career.

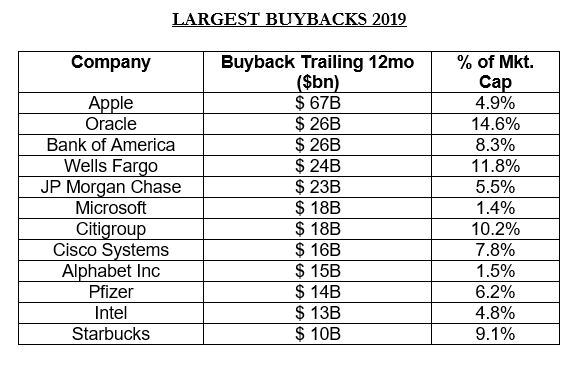

In 2011, a famous high-yield bond manager from a well-known U.S. based firm called Oaktree wrote a book called “The Most Important Thing”. The author/money manager is named Howard Marks and we listened with interest when he was quoted in a Bloomberg interview saying “…we’re in the longest bull market, the longest expansion in history, profits are not rising, stock prices are, it’s what we call a liquidity-driven rally”. When one looks at the buyback numbers below, it is very easy with 20/20 hindsight to understand in part what Mr. Marks was talking about. The “B” in the chart below stands for BILLION! Yes, Apple alone bought back $67 billion in stock.

As we start a new decade, our team is working hard each and every day to build better portfolios for our clients and families. In 2021, I will turn the big 50. Over the holidays, I was amused when I walked into our family living room to my 19-year-old son and beautiful wife watching an episode of “Friends”, where the characters were all freaking out because they were turning 30!

When I was 30 years old, I was lead manager for a multi-billion-dollar mutual fund at Investors Group and their Global Consumer Sector product. Before that in 1999, I was made lead manager of the CI American Smaller Companies Fund and then in 2000, their Global Technology Sector Fund. What unfolded in the long-only investing world in 2000 with the Tech bubble burst (remember Nortel?), 2001’s tragedy around 9/11, and the recession of 2002, heavily influenced the balanced and more defensive structure of this Fund. It also aged me! I am forever grateful for that real-world experience of having to deal with a market that simply did not go up and to the right.

To help highlight how much I have travelled around the world during all those market fluctuations, Air Canada was kind enough to send me a present for passing the “million miles” travelled milestone. For this painful accomplishment, I got some snazzy luggage tags and a guarantee that I will never lose the 50K elite status for the rest of my life! And oh, I almost forgot, if anyone wants an Air Canada toy airplane, they gave me one of those too. First come, first served, of course.

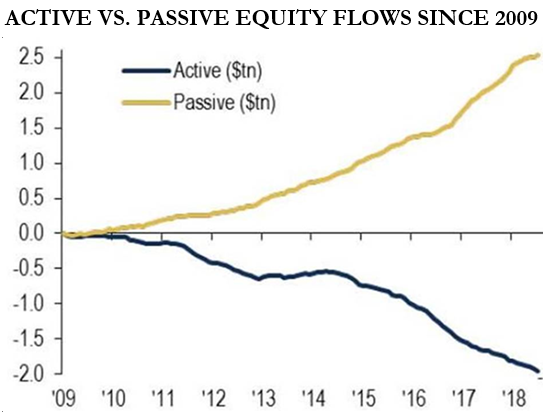

In the investment business, there are three significant secular trends taking place in my opinion that will be very advantageous to Wealhouse this decade. First, there has been a massive market share shift from the mutual fund industry I grew up in, into the Exchange Traded Fund (ETF) industry. The ETF industry is dominated by ONLY three firms: Vanguard, Blackrock and State Street. They have over 80% market share of a $4 trillion industry. Thus, as they grow, more and more money is being run by fewer and fewer firms. Traditional large firms like the ones I grew up at like CI Funds and Investors Group, are forced to lower costs to compete with these much larger players. As a result, we are incredibly excited that these firms are being forced to abandon the small- and mid-cap investing arena as they struggle to justify running smaller funds, or are forced to hold too big a stake in less liquid small public companies that makes risk management more difficult.

Globally over the last decade, investors have bought a cumulative $2.5tn of passive funds and sold $2tn of active equity funds. In the passive equity space, ETFs currently represent 45% of U.S. equity assets. In Canada, Canadian ETF AUM has grown to $250B from $32B over the last decade.

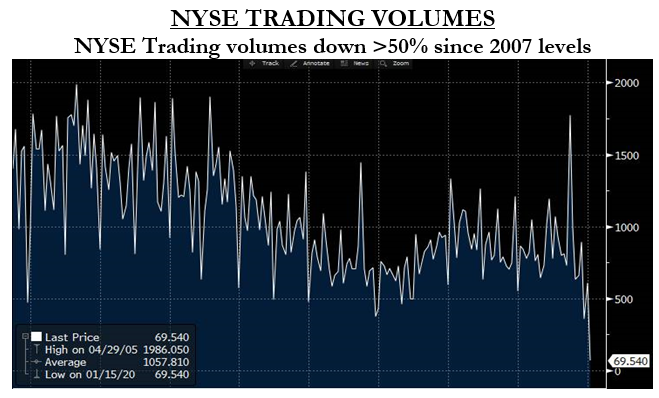

The second secular trend impacting capital markets structure is lower levels of liquidity. We saw this illustrated in December 2018, where the S&P lost 9.2%, the second worst December ever. December is usually a less liquid month as many participants shut down for the holidays. You may recall in 2018 when the U.S. Fed raised interest rates in December, the market reactions were so severe that I bought stocks aggressively for the first time on Christmas Eve and in Japan on Christmas Day for our funds.

This past August, we witnessed one of the biggest bond market rallies of my career, in what is typically a less liquid month as many investors are on vacation, especially those in Europe where the European Central Bank (ECB) is buying their debt market through quantitative easing. Therefore, when investors recession risk fears increased due to the U.S./China Tariff war, the bond market had an accentuated rally since it is a traditional safe haven during times of fear.

For those who have followed our comments over a long period of time, we have highlighted how the banking regulatory environment combined with rapid growth in the ETF and private equity industries have led to lower liquidity in the capital markets. As a result, we anticipate there will be increased volatility in the capital markets moving forward like we saw in December 2018 and August of 2019. This will present great opportunities to invest in go-forward drawdowns in great companies that meet our checklist.

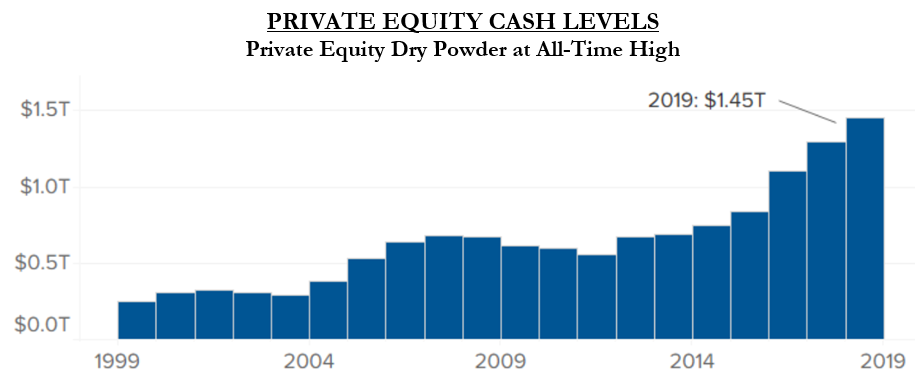

The third trend that benefits Wealhouse is the rapid growth in private equity. This is creating inefficiencies for our investment team to exploit in the small- and mid-cap investment universes. We have discussed this trend in the past as we have highlighted our holdings in leading players such as Partners Group, Blackstone, and Brookfield Asset Management. In a lengthy quote from Bruce Flatt of Brookfield Asset Management, one of the best investors Canada has ever produced, The describes how attractive current valuations are for smaller companies and the increased M&A appetite by private equity due to the record amounts of capital to be deployed.

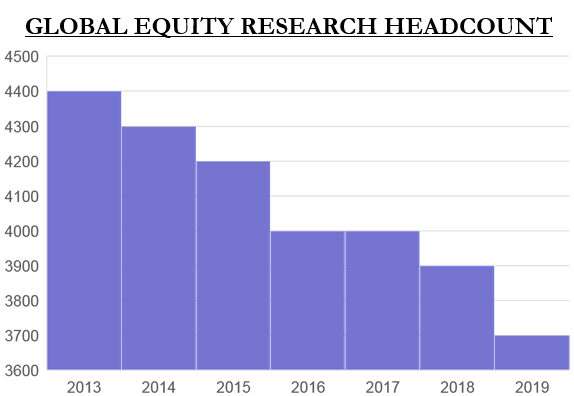

“Increased program trading and passive indexing is creating greater volatility in the stock markets — and in many cases, increasing discrepancies between a stock’s trading price and its true value. For example, a stock that is in a ‘hot’ industry, or fits neatly into an index, may trade at greater than intrinsic value because of these non-company related influences. On the opposite end of the spectrum, smaller companies or those that do not neatly fit into indices may trade at a significant discount to fair market value. This has been compounded by the reduction of investment research caused by changes to global securities regulation, which in turn has impacted brokerage firms’ ability to provide research in exchange for commissions. As a result, substantial coverage for smaller companies has been reduced or dropped altogether. Despite this, the underlying businesses are often doing well; this has led in some cases to excellent value purchases in the stock market, compared with what might be considered fair market value.”

To help illustrate the point form above, in 2019 we saw bank after bank announce layoffs from around the world. In fact, global banks laid off over 77,000 employees in 2019 — the most since 2015. The largest was coming from Deutsche Bank who cut 18,000 employees in 2019. We weren’t immune to this in Canada either as this past December, BMO announced that it was cutting 5% of its workforce or 2,300 positions. This was the largest the number of jobs cut at a Canadian bank in more than 15 years.

These layoffs are a very real side effect of the ETF and private equity industries which are causing lower trading volumes. As a result, banks have been steadily reducing their research budgets. This means for experienced research teams like ours at Wealhouse will have less competition. We always like to look for reasons to invest in businesses that face less competition. This allows us to get better access to management teams to gain proprietary insights on their businesses.

Going forward, we believe the above secular trends will continue based on our research. We continue to hear from companies that they are seeing modest growth in global economies overall. This, in our opinion, is supportive of a low interest rate environment. We will continue to build diversified portfolios that have individual investments that meet our checklists to take advantage of the above trends and weather any unforeseen economic and/or geopolitical negative events.