Silver Linings - Trisura Group

Since the pandemic started, businesses quickly realized that many events are not covered by traditional insurance. We discuss below how one undervalued company can take advantage of these gaps and continue its above-market growth.

One word we have all heard a lot of in the past year has been “uncertainty”. The disruption caused by COVID-19 has been extremely difficult for companies, as it has been difficult to project what the next week will bring, let alone the next month or year. Despite the uncertainty, one of our holdings that has been able to maintain consistent growth over the past year is Trisura Group. The company is a Toronto-based specialty insurance provider in Canada and the US that was spun out from Brookfield Asset Management in 2017. It has a strong management team and unique business model that combines high growth and profitability with an attractive risk profile.

Traditional insurance works on the principle of going through history and determining the frequency and severity of losses, then forecasting the likelihood of those losses in the near future. Thus, when it comes to a global pandemic like COVID-19, there isn’t much historical data. How can people supplement their policies for increasing uncertainty? Enter specialty insurance.

Specialty insurance involves insuring niche risks that traditional insurers typically do not usually underwrite. These include unique or large risks that are difficult to assess. The industry has historically grown faster with better profitability than traditional insurance, as underwriters have more pricing and policy flexibility. For example, construction companies typically take out specialty insurance coverage. Builders are frequently sued, so specialty insurance is needed to neutralize litigation risk.

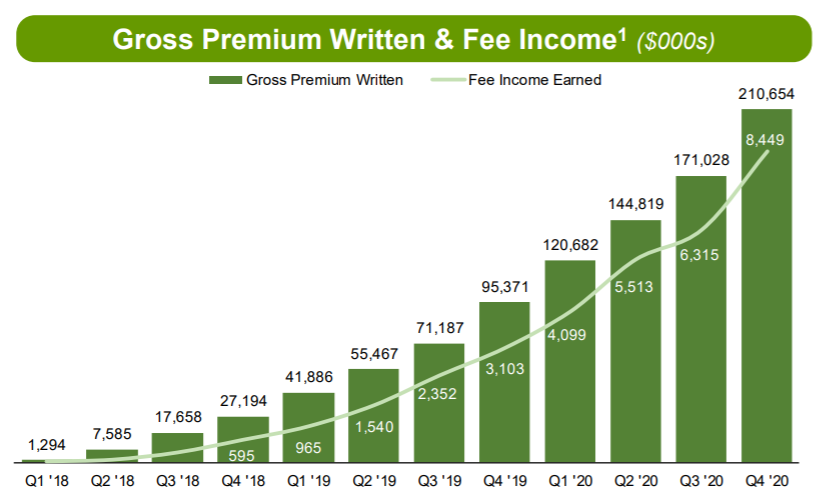

Over the past 10 years, Trisura has built long track record of above-market growth and profitability in the Canadian specialty insurance market. This growth was accelerated in 2018 when the company entered the US specialty insurance market with an innovative, fee-based fronting model. The business underwrites insurance on behalf of distribution partners and then passes on the majority of risk to reinsurance partners in exchange for a fee. As a result, Trisura retains minimal risk from each policy and instead earn a lower risk and more stable fee income. The business model is attractive as its more consistent and capital efficient than traditional insurance underwriting. As shown in the chart below, the growth in this business has been incredibly strong with gross premiums written growing from ~$53 million in 2018 to $647 million in 2020. Despite the uncertainty caused by COVID-19, Trisura was able to grow its fee income in this business 206% in 2020.

We believe Trisura has a long growth runway ahead of it in the US as it currently only underwrites a small fraction of the $50 billion addressable market. The management team has also consistently expanded its market by adding new distribution partners, underwriting new programs, and has recently entered the larger admitted market, which increases its total addressable market by 5X. As it grows, we expect Trisura’s profitability to continue to improve as well as it leverages the significant operational and technology investments required to build out its US division.

Trisura has a robust and capable management team, conservative balance sheet, and is well aligned with shareholders as management own 6% of the company. Despite its strong growth track record, the company trades at 20X next years earnings, which is attractive relative to its targets for mid-teens ROE and book value growth and is a notable discount to its US peers.