The SPAC is Back

In the the latest Panorama commentary, CIO Scott Morrison explains the hottest trend in the equity market: SPACs. What are they and are they worth investing in?

I often flashback to a vivid memory from early in my career – watching one of my mentors pile heaps of new equity issue prospectuses in his office. Typically, these documents are 200-500 pages long. He considered it a form of visual temperature gauge of the market’s frothiness. The higher the pile got, the more conservative he positioned his portfolios. This came to mind because never before in my career have I seen so much capital being raised in so many different asset classes at the same time; nor have I seen this scale of global central banks stepping in and backstopping debt issuance. If we were still receiving prospectuses in physical, printed form, the pile for the third quarter would have been mountainous.

As I learned from my mentor, we have been positioning Panorama Fund more cautiously, as we have seen a tremendous amount of capital being raised globally by companies, private equity firms and a booming sub-sector of finance called “SPACs” or special-purpose acquisition companies. According to stats from Refinitiv published in the Financial Times, “SPACs” are responsible for raising “$51.3 billion in the U.S. this year, the highest amount on record and almost half of the $111.6 billion in initial public offerings.”

SPACs are also referred to as “blank cheque companies” because investors give a company their money and then wait for that company to find another company with which to merge. Since the SPAC gets listed on public capital markets at the outset, it presents an alternative way for private companies to go public without going through the traditional IPO process. In essence, SPACs are now competing with traditional private and venture capital equity for businesses to buy. The good news for owners of private businesses is that this means there will be more capital potentially bidding on their businesses when they want to sell or raise equity.

A standard due-diligence question we pose to every CEO and CFO concerns how much internal growth, versus acquisition growth, opportunities they have. Over many years, we have consistently heard from publicly traded companies that they were seeing more and more competition when it came to making acquisitions. This competition was coming from the private equity and venture capital firms who have had a lot of success raising a lot of money the last number of years. The bad news for these same public companies is that the above-mentioned SPACs are going to add a new level of competition, as they try to put the recent monies to work. We anticipate that this may make public companies more susceptible to becoming takeover targets themselves as certain private equity vehicles get crowded out.

As a result, we have become less bullish on the private equity business and its return prospects. We do not deny that private equity businesses will be able to raise a lot of money in a very low interest rate environment. However, during a call in September with a former CFO of a large European private equity firm, he admitted to us that they believe the high returns they have generated in the past will likely be cut almost in half – in part because of increased competition to source deals.

When interest rates are close to zero, any return is going to look good, so even as private equity returns diminish, they look better than other asset classes such as government bonds. You can see this illustrated in the chart below for the U.S. 10-Year Bond. Recall that most business students are trained in school to use the 10-Year Bond as the risk-free rate when building their financial models to buy and/or invest in a business or asset. Thus, as the risk-free rate keeps going lower and lower, many buyers of assets are lowering their so-called hurdle rates over the risk-free rate. This, in turn, leads to higher and higher asset prices. As a result, we anticipate an increased number of bidding wars for assets in this lower-for-longer interest rate regime. Typically, we do not like entering bidding wars, since the only way to win a bidding war is to pay the highest price. We prefer not to pay high prices.

Source: Federal Reserve, Haver Analytics®, Credit Suisse

It is also important for public market equity participants such as us to realize that if a lot of money is being raised by Initial Public Offerings (IPO’s) and SPACs, it has to come from somewhere. For instance, money managers would need to sell existing holdings to subscribe to these transactions. As a result, it is only natural to expect to see the market tread water during these periods of increased new issuance excitement. It was once told to me that if investment bankers are good at one thing, it is giving investors what they want. This year, there has been no shortage of opportunities to invest in software and health care companies that are thriving in this type of crisis. Eventually this will lead to saturation and too much supply.

With that said, we believe that once the market digests this new issuance cycle, there will be a wave of mergers and acquisitions in the public markets, in which companies are susceptible to takeover proposals. In particular, we expect that once there is more certainty around the political landscape in the U.S. and a potential light at the end of the tunnel with regard to the pandemic, we will likely see a very sharp uptick in transactions. This is will be one significant positive supporting publicly traded valuations.

One new issuance that is benefitting our fund is our investment in Hong Kong-listed Alibaba, the internet giant of China. Alibaba has been one of our best performing holdings this year, as it has benefitted immensely from the quick rebound in China from the woes of COVID-19. Alibaba has a stake of over 32% in soon-to-be publicly listed Ant Group, China’s largest fin-tech and mobile payments company. Ant Group is looking to raise approximately $35 billion, making it the largest IPO ever in the world. This further reinforces our view above that there is increasing competition for access to capital. It also confirms that China’s increasing importance economically in the world. It is only a function when, and not if, they will be the number one economy in the world, so it almost seems fitting that they will have had the largest IPO in the investment universe.

We have kept our holdings in businesses levered to the Chinese economy as China has obviously managed to do a better job at recovering from the virus. In October, during China’s Golden Week national holiday, it was reported in the Financial Times that there were 637 million trips in China over the eight-day holiday versus 782 million trips last year. In percentage terms that is only 22% fewer trips than last year. In comparison, most of the stats coming out of the U.S suggest that, at best, travel activity has returned by approximately 50% over major holiday weekends like this past Labour Day. With the second wave currently accelerating, we believe that the U.S and Canada are nowhere near the recovery levels we are seeing in China. As a result, economic performance in China will be much, much stronger than here in North America.

As you can see in the risk chart issued by the Texas Medical Association, air travel ranks as one of the riskiest forms of travel. I personally have not been on a plane since the middle of March. As a result, we at Wealhouse are saving a lot of money by not flying and staying in hotels. This is truly tragic for those poor individuals and families who work in the airline and hospitality industries. Therefore, ahead of Thanksgiving weekend this past October, all Wealhouse employees were asked to pick a charity that they wanted to support, in order that we may give back to those in need. These are truly difficult times for so many.

One industry that we believe is benefitting materially from the world’s unwillingness to travel is natural gas. When people fly less and do not commute to the office as much, there is less demand for oil. When there is less demand for oil, there is less drilling of new oil wells. When companies drill for oil, they typically find what is called associated gas. If you go to the website for the oil and gas services company Baker Hughes, they show the below year-over-year changes in active drilling rigs:

As a result, there is a decreased supply of natural gas at the same time as consumption increases, since we needed to cool our houses this past summer and will need to heat our houses in the winter. We are therefore expecting the potential for natural gas prices to increase in the coming months, which should benefit our natural gas holdings such as Tourmaline and Arc Resources based in Calgary, Alberta. Tourmaline also benefitted from a recent spin-off of their infrastructure assets at higher valuations than what was being discounted in their stock price. This should position Tourmaline to consolidate companies with less capital strength in the future. Overall, we like industries where supply is going down while demand is steady to growing. Stay tuned for higher prices if we get a cold winter after what was a warmer than usual summer.

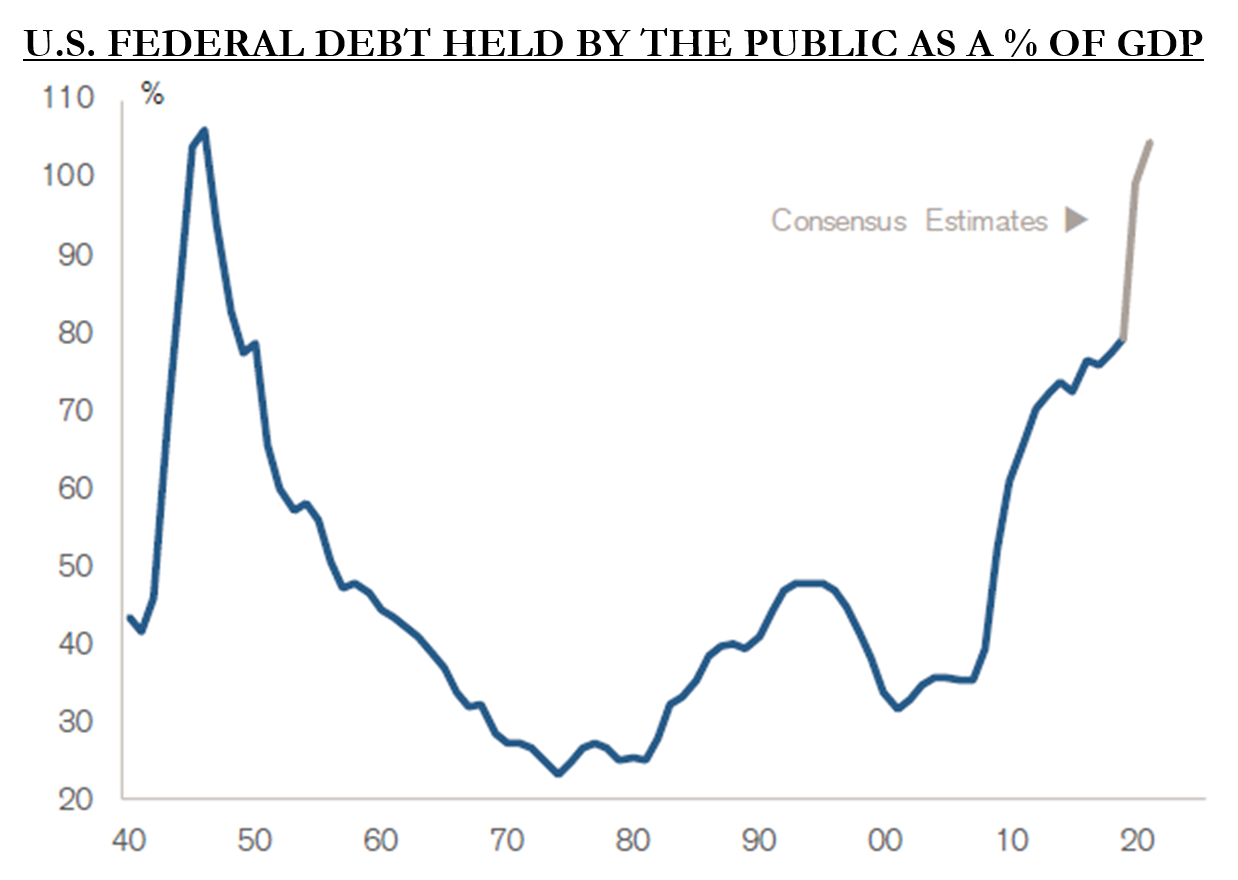

It is difficult to tell how sustainable current government deficit spending trends are, as you see illustrated in the below charts. Not since World War II have we seen debt levels as a percent of GDP climb to such high levels. I am not trying to sound negative, but generally speaking, I have never felt that governments are very prudent when it comes to the spending of tax money. At Wealhouse, we always try to assume that the money we are trusted with be treated like it is our own, and all of us have investments alongside our clients. Unfortunately, politicians often drive decisions to spend based on their own re-election cause, teeing themselves up for nice pensions in the process. I am growing a little concerned that the central banks are pushing on a string by encouraging politicians to grow their fiscal spending initiatives.

Source: OMB, Credit Suisse

Once again, there are very serious macro risks ahead – not the least of which are the U.S. election, tensions between the U.S. and China, U.S. fiscal stimulus negotiations and the Covid-19 second wave that is causing renewed lockdowns. Since we cannot anticipate the success of a vaccine, or if and when one might even be developed, we cannot forecast month-by-month or quarter-by-quarter market returns. However, we will do our best to navigate risk-versus-opportunity, as always, by remaining focused on businesses with improving fundamentals.