The Next Ten Years Will be Much More Volatile than the Last

CIO & Founder, Scott Morrison, discusses the potential ramifications of the Silicon Valley Bank failure on the economy. How will this effect our investors? Due to Wealhouse’s thorough research process, clients should take comfort that we had minimal net exposure to banks in our equity and debt pools as we entered the month of March.

There is a famous saying from Warren Buffet which reads: “You don’t know who is swimming naked until the tide goes out.” As evidenced by what has happened with crypto, speculative 2020 and 2021 IPOs that are now mostly under water, and currently with Silicon Valley Bank (SVB), we are seeing plainly just how many nudists are out there. I first travelled to the California head offices of SVB in the 1990s before the NASDAQ bubble burst, when I ran the technology fund at CI Funds, because they were the primary bank backing the innovation economy. On their website is the following quote: “44% of U.S. venture-backed technology and healthcare companies that went public in 2022 are SVB clients.”

Fortunately, thanks to our research process, clients should take comfort that Wealhouse had minimal net exposure to banks in our equity and debt pools as we entered the month of March. In fact, after being short SVB in 2021 and 2022, we actually had some downside puts on SVB and other financial service companies in support of our risk management process. It is quite amazing that the 16th largest bank in the U.S. went to zero in less than 48 hours. This was much faster than what I saw happen in 2008 with Lehman. It is not lost on me, however, that SVB was founded in 1983 when interest rates were in the mid-teens and benefitted immensely as rates fell to zero. And now, only a couple of years after rates hit 40-year lows, they are bankrupt.

The ramifications of this bank failure will be felt for years to come, as it will likely take that long for them to settle their accounts and for unknown, second-derivative impacts to hit the economy. Since they were a leading financier to the innovation economy for software, semiconductor and life-science companies, there is the risk that many potential technological improvements will now face slow-downs. This is all very sad and we are thinking particularly of the families who face the loss of steady income in the near future.

Because we saw this froth percolating over the last number of years, I have been strongly advocating for our clients to do what I have been doing with my family’s money: “Have a Plan B.” I continue to strongly encourage Wealhouse clients to diversify their investments into funds run by my colleagues in Amplus and Lions Bay, both of which have performed fabulously by being nimble and able to short interest-rate and equity risks. We strongly believe that we will be living in a world much more volatile in the next ten years than in the last, and both Amplus and Lions Bay are better-positioned to weather that volatility. I call them the “Modern Day Balanced Fund”.

As a young investment analyst in the 1990s, my mentor taught me that the most money goes to the wrong place at the wrong time. Recall examples such as technology in 2000 or resources in 2008. As we have shown in numerous charts, there has indeed been too much money pushed into private assets. This is because the prevailing perception has been that since private assets are not marked to the market every day, they are somehow better investments. This caused major misallocations of capital in our opinion that was predicated on the assumption that access to easy money would be with us indefinitely.

We started a pool of capital almost five years ago whose purpose was to take advantage of this dislocation. We called it the Voyager Fund, since we saw public small cap securities trading at huge discounts to similar businesses in the private world. Our thesis has been validated and we have compounded money at slightly over 10% over those five years, despite all the public market volatility. An added and sometimes underappreciated feature of this fund is that we can turn it into cash if clients need their money back. Just think of how many people with money at SVB Bank, or in their venture capital funds, will not be able to access their money. This will be hugely beneficial to our Voyager holdings with excess liquidity on their balance sheets. We predict the pendulum is swinging back in favour of operating companies versus financially-engineered, private equity-levered companies. Many private equity firms will not be able to compete with our stable of well-managed and well-capitalized businesses.

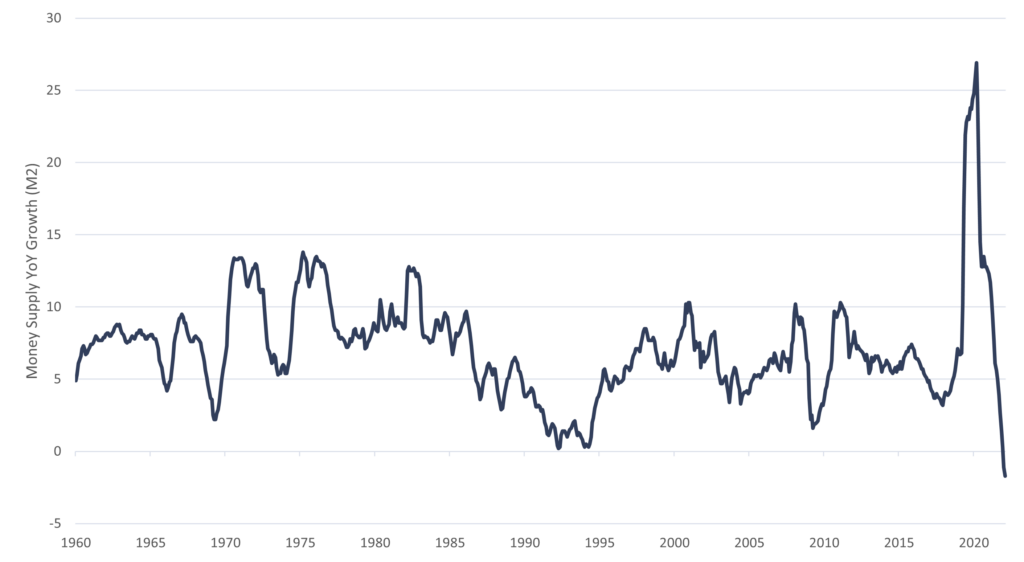

We all know that governments spent way too much money during the COVID crisis, in ways that only amplified labour shortages and supply chain challenges, which in turn led to the biggest spike in inflation in over 40 years. I firmly remember that point in April of 2020 when I began to suspect that government spending, and not the interest rate, would become the most important factor in the determination of prevailing economic winds. At this time last year, we ALL knew that there was a need for central banks to reduce those easiest global monetary policies in history. Directionally, we knew inflation was rising, since we saw shortages of goods and people everywhere we looked. And then inflation pressures spiked further, with escalating tensions between Russia and Ukraine, and we all became experts on how much of the world’s agricultural, energy and mining commodities came from Ukraine and Russia. We were also shocked at the length of time China remained in lockdown compared to the rest of the world. The good news is that China is now all-in on re-opening. The concerning news at home, however, as you can see in the below chart, is that money supply is now shrinking at historic rates.

MONEY SUPPLY YOY GROWTH (M2)

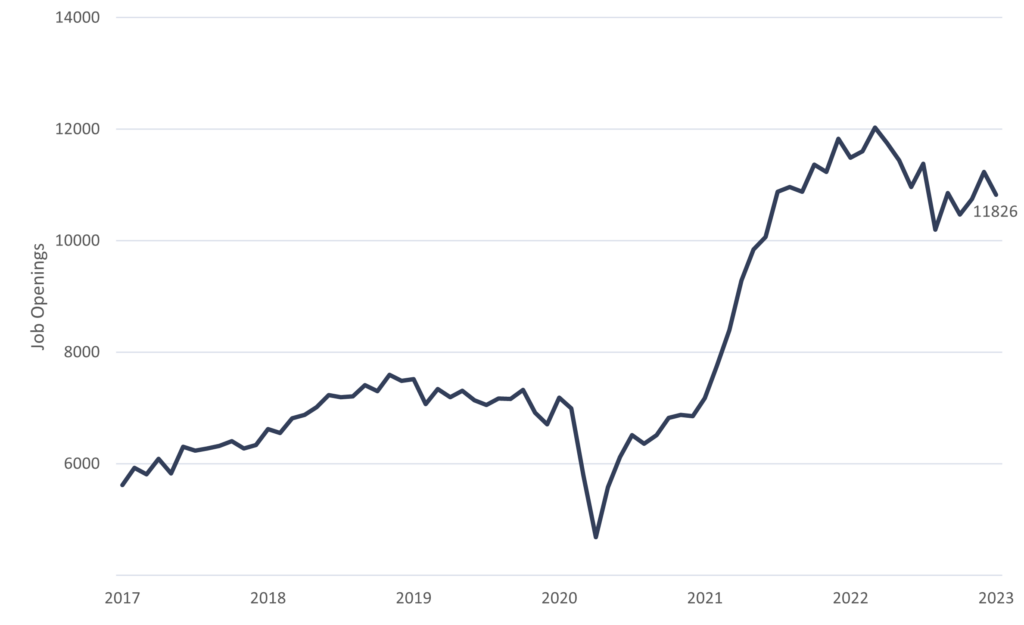

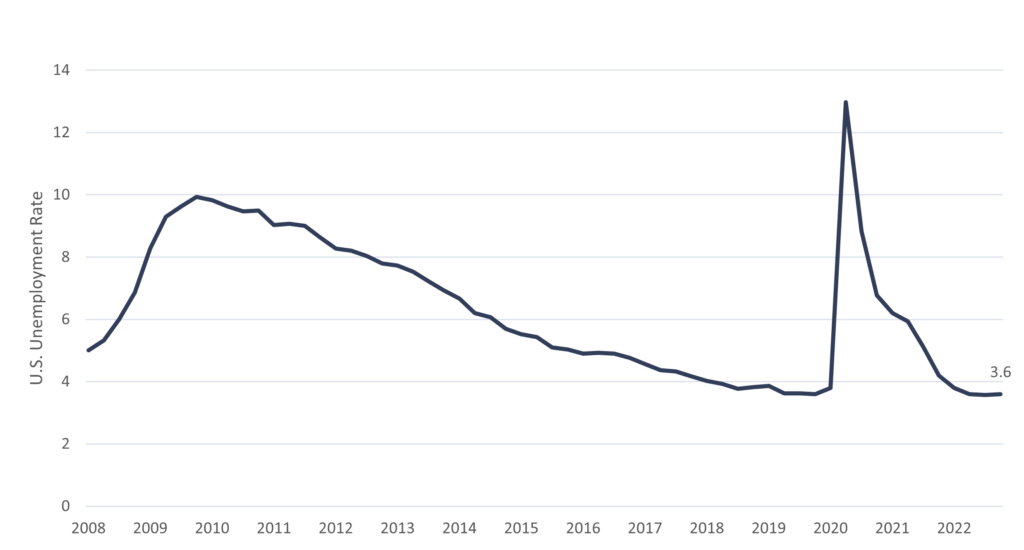

I believe that investors need to be very aware that governments have no idea of the unintended consequences of their extravagant COVID spending. Business after business report to me that they continue to struggle with labour shortages. Thanks to higher rates and failures such as what we are seeing with SVB, we believe this labour problem has peaked in some industries and that the Fed will get the higher unemployment they are looking for, namely in Technology and Private Equity.

I doubt, however, that the workers being let go from big or small technology and private equity companies are going to pivot into front-line service jobs like nursing, farming, plumbing, truck driving, etc. We experienced shortages in these professions even before COVID and they are now on the brink of experiencing serious crises. You cannot digitize a nurse or a plumber. And now, SVB, the biggest lender financing money-losing ventures to help provide nurses and plumbers with tools to become more efficient, is gone. As occurred in the post-Nasdaq bubble burst era, we believe that we will see many speculative technology companies go bankrupt and struggle to outperform other “old economy” industries for the next few years. We believe items on our investment checklist like free cash flow, pricing power, balance sheet strength and pricing power matter, and investors who have ignored these tenets over the last few years will suffer below-average returns.

Recently, I was very fortunate to be asked to accompany a very decorated 99-year-old Canadian military veteran, named George Beardshaw, to an event that honoured him and the collective, “British Home Children in Canada.” Home Children is comprised of a 100,000-strong group of disadvantaged British migrant children sent to Canada to work in the 19th and 20th centuries. George, like his two brothers, was brought to Canada as a Home Child when he was 14 years old. He was indentured to a Southern Ontario farm for five years before escaping at the age of 17 to join the Canadian war effort in WWII.

I believe that it is important to realize and remember that George’s generation, and the generation before him who lived through both the Great War and the Flu Pandemic of 1918, had no supportive social programs such as we have today: the Canadian Emergency Response Benefit, Medicare, the Canadian Child Benefit, amongst many others. Thus, George and others like him were destined to begin building whatever success they could achieve in life as indentured children on unwelcoming Ontario farms. This 150-year-old scheme was obviously socially and morally flawed, and on the whole inflicted much psychological and physical pain, but investors should remember that from a financial perspective, governments are inherently organized to tax revenue and profits from each generation, and still, even today, are rarely able to illustrate effective and intelligent outcomes from many of their approaches and policies. We would be naïve to assume governments are better equipped to navigate modern day challenges.

I doubt that governments which paid employees to stay home for so very long, anticipated that so many employees would not return to work, or that their employers would cut their office space requirements and cause landlords to see a major decline in cash flow while interest rates were spiking. Office landlords will have as big or worse problems as did shopping mall owners when Amazon and Shopify disrupted brick and mortar retailing. There is no scenario in my mind where municipalities will not be forced to raise taxes on residential real estate owners, since many buckets of commercial real estate will see their asset values collapsing. And as governments talk about housing shortages all over the world, do they realize that the recent spike in interest rates is dissuading developers from starting new projects?

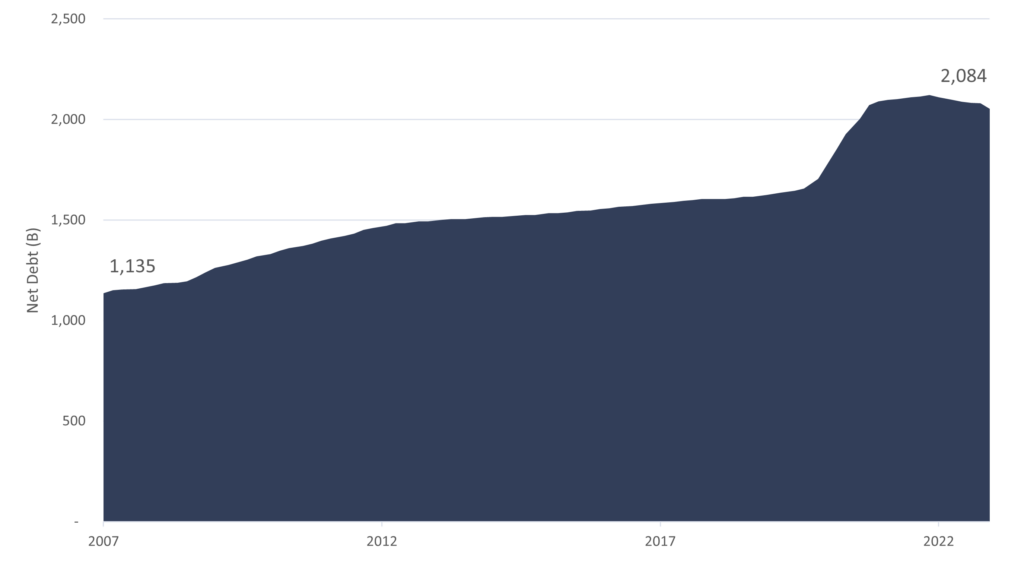

I have told many colleagues and clients before that I started Wealhouse in 2008 because I felt there was too much debt in the world, and I wanted to surround myself with tools and colleagues that can better navigate an over-leveraged world. This is why I read with interest a report by the Canadian think tank Fraser Institute entitled, “The Growing Debt Burden for Canadians: 2023 Edition.” In it was detailed that: “Since 2007/08, combined federal and provincial net debt (inflation adjusted) has roughly doubled from $1.1 trillion to a projected $2.1 trillion in 2022/23.” And since interest rates are now at levels not seen since 2007, this means that interest expense on the debt is on its way to doubling as well, as debt maturities roll-off in the coming years. Stay tuned for more tax levies, as there is a revenue and expense mismatch.

COMBINED FEDERAL AND PROVINCIAL NET DEBT (IN BILLIONS OF 2022 DOLLARS), 2007/08 TO 2022/23

As we entered 2023, GDP growth expectations were not very high, because last year, interest rates rose so far and so fast. This is fairly obvious to me, since we are currently witnessing central bank after central bank indicate that they will slow or stop raising rates in 2023. For example, in Canada this January, our central bank chief raised rates 25 basis points and said to reporters: “We’ve raised rates rapidly, and now it’s time to pause and assess whether monetary policy is sufficiently restrictive to bring inflation back to its two per cent target,”.

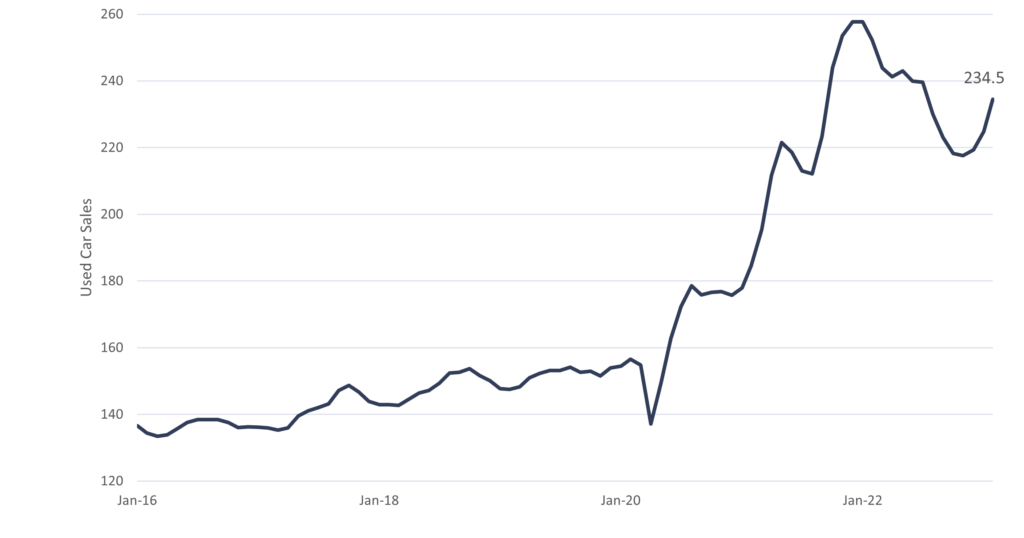

There are many, many signs that inflation has peaked and is declining rapidly in different parts of the economy. The one exception to this, which we will discuss later, is labour inflation. As you drive by car dealer lots you can see that their inventories have been replenished, which has led to used car prices falling from their earlier highs. As winter has been warmer than expected in both North America and Europe, we have seen a major decline in natural gas prices as inventories are bulging at time when they should be drawn down. Lower natural gas prices will be beneficial to consumers who need to heat their homes, and farmers who need to buy fertilizers made from natural gas to grow their crops. As mortgage rates spiked last year, new home construction decelerated and lumber prices subsequently fell.

Whole Foods grocery, which is owned by Amazon and was often referred to as “Whole Paycheque,” due to its high-priced healthy food offerings, was highlighted recently in the Wall Street Journal for asking its suppliers to lower prices for consumers as supply chain costs come down for Amazon. “We know our customers are weighing the impacts of inflationary pressure on their buying choices,” Alyssa Vescio, Whole Foods’ senior vice president of merchandising of center store, said to suppliers at the virtual meeting in December.

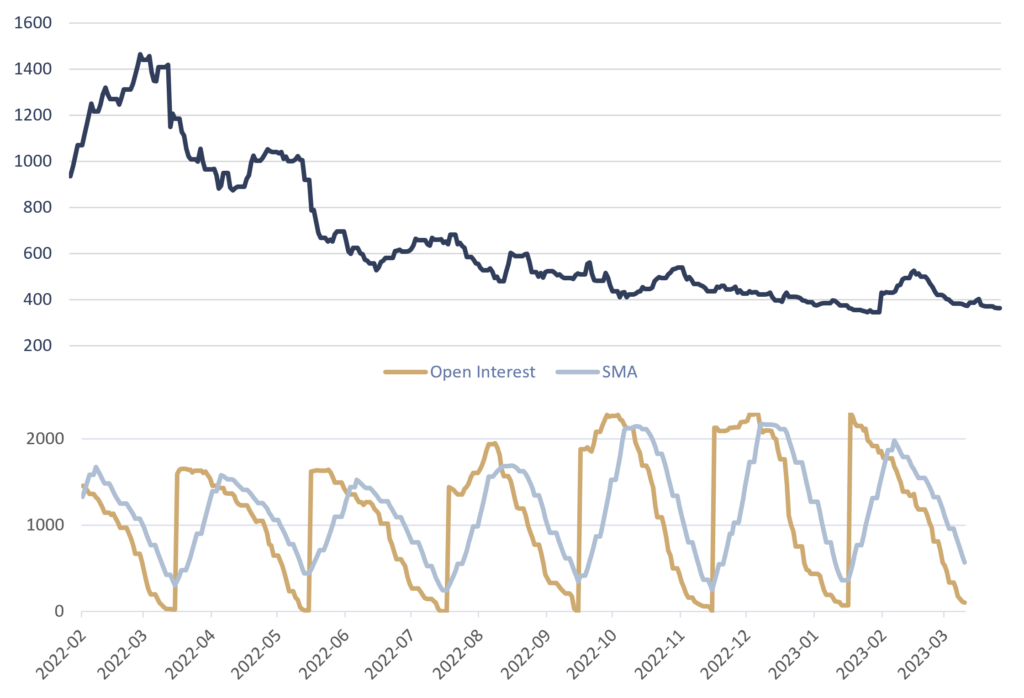

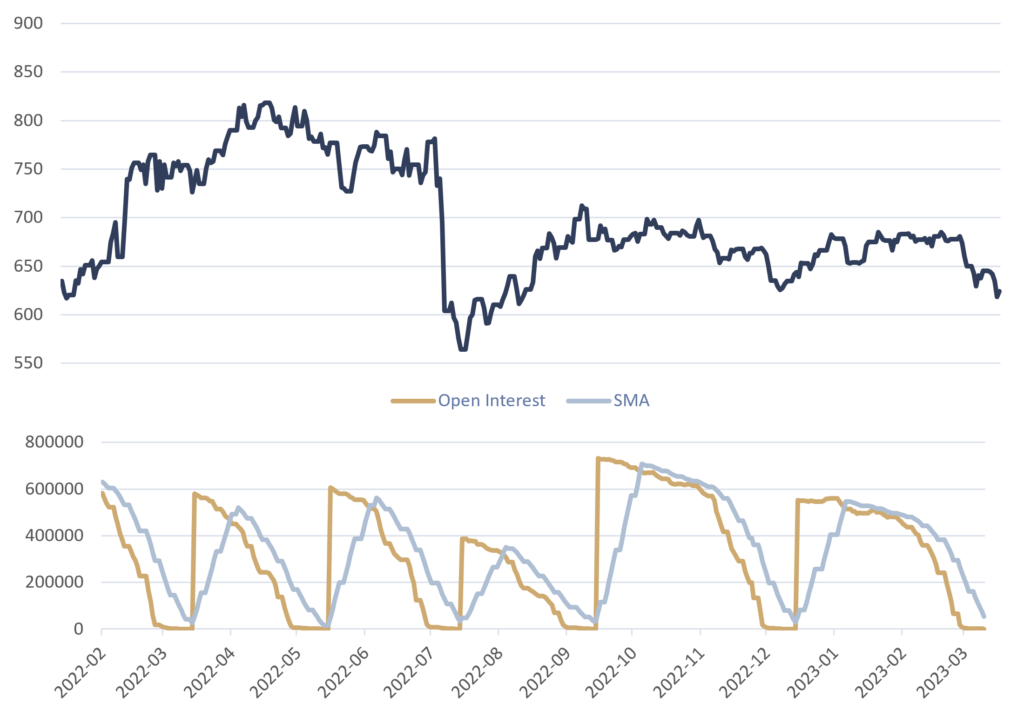

USED CAR PRICES

NATURAL GAS PRICES

LUMBER PRICES

CORN PRICES

Throughout my career, commodities like the ones mentioned above have tended to be very cyclical and we have seen their prices bounce up and down as supply and demand oscillates. I believe that this will generally continue to be true moving forward. However, I do believe that there will be more volatile moves for structural reasons such as increasing levels of debt in the world, which means that there is more sensitivity to moves in cost of capital for producers of these commodities and the currencies with which they are purchased. As well, I do believe, based on my many conversations with smart insurance underwriters, that the ferocity of weather events will continue to be elevated versus the past and cause major supply dislocations. Lastly, I also believe that there will be increased geopolitical supply chain tensions in the world in the next couple of decades, as China and the U.S. fight over economic top spot and old foes like Russia and Germany posture for regional dominance.

U.S. JOB OPENINGS

U.S. EMPLOYMENT RATE

Because of the large swaths of debt in the world, I feel that investors must appreciate that governments have fewer and fewer fiscal stimulative bullets to use with respect to future economic pull-backs. My instincts tell me that there is a chance that governments are in a pickle and will have to stop spending. The good news for those willing to work is that there are jobs to be had and wages to earn. I will always remember saying to my three adult children and any of their friends who would listen to me during COVID, to be very careful in assuming that the government will always be there to bail you out, since their cost of debt may eventually become a true burden. I am not sure if we are there today or will be there in 10 years from now, but that day is coming and maybe the debt-ceiling debate later this year in the U.S. will be that catalyst. My continued message is to have a Plan B, like our long/short credit fund Amplus, or long/short fund, Lions Bay. If kicking the can down the road continues to work, then Voyager will also do very well as a long-focused, small cap fund.

At present, we still advocate for caution, since as you can see in the below tabulations, there is a risk that investors have not fully baked in the higher cost of capital, when some free cash flow yields of some very large and successful companies are considered. As we always say, we like to find growth without having to pay too much for it. Today, we are finding fewer companies that pass that test as rising rates slow growth rates.

BIG COMPANY FINANCIALS

U.S. EQUITY RISK PREMIUM IS BELOW POST GFC LOWS

As I mentioned above, we believe that there is a structural labour problem in the world. In the past, we have highlighted China’s failed one-child policy, the aging populations in countries such as Japan and Europe, and the unintended consequences of COVID causing workers to leave the workforce because of free money, retirement spikes, fears of working in customer-facing service industries and obviously the tragic loss of life from COVID deaths.

I sadly add another item that is negatively impacting labour availability. I have been researching the opioid crisis after watching the Apple series “Dopesick” that chronicles the drug company and family management team that pushed hard for easier access to prescription opioids beginning in the 1990s. Below, I show a very sad chart illustrating the massive secular increase in opioid overdose stats. I have not yet reached a conclusion regarding its impact on labour shortages, but my thesis is that it is significant. When President Biden visits Ottawa in late March, the opioid crisis is on the agenda for discussion between him and Prime Minister Trudeau. As illustrated in the series, opioid addiction wields a far worse impact on the brain than recreational drugs like alcohol or marijuana. Essentially, opioid addicts become unemployable in a world that currently so desperately needs more workers. I write all this to emphasize that every investor must have a Plan B if central bankers stick to the narrative that we are going to keep interest rates higher for longer.

HISTORIC SPIKE IN U.S. DRUG OVERDOSE DEATHS

Having said all of this, we at Wealhouse are balanced across longs and shorts and anticipate that more central banks will soon realize that they need to stop raising interest rates, or else risk more bank collapses. Again, I emphasize that through the study of history, and by understanding the effects of inflation spikes such as we have seen, future volatility can be expected. Because of the level of debt burdening our systems, we suspect that this volatility will be above-average for some time. This state of affairs can be very beneficial for some, such as my colleagues leading the management of Amplus and Lions Bay, who have much better tools and liquidity to navigate choppy waters where the tide will keep going out until central banks are forced to cut interest rates.