The Low Interest Rate Tide is Reversing

CIO Scott Morrison talks about how the Covid global crisis has affected consumerism and its impact on worldwide supply chains, as well as rising central bank interest rates and the increasing costs of food, energy and housing.

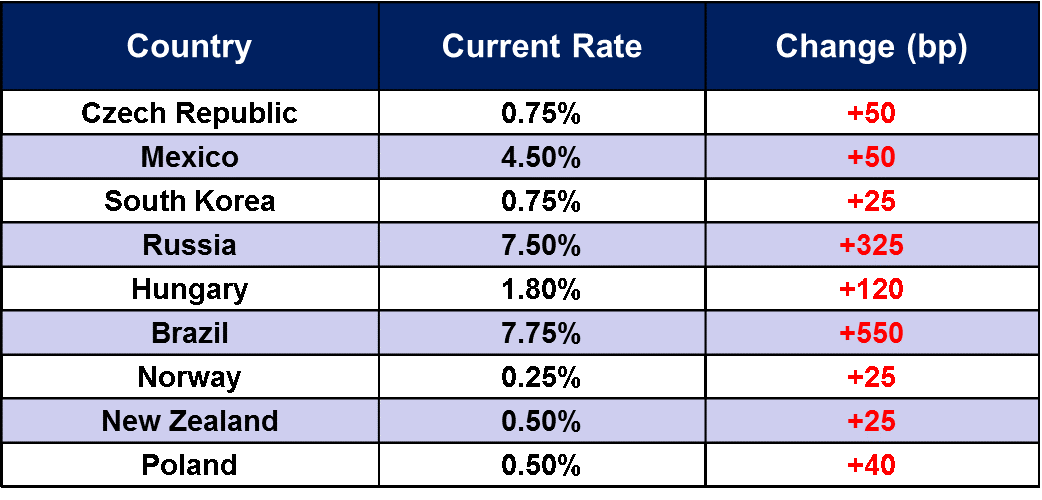

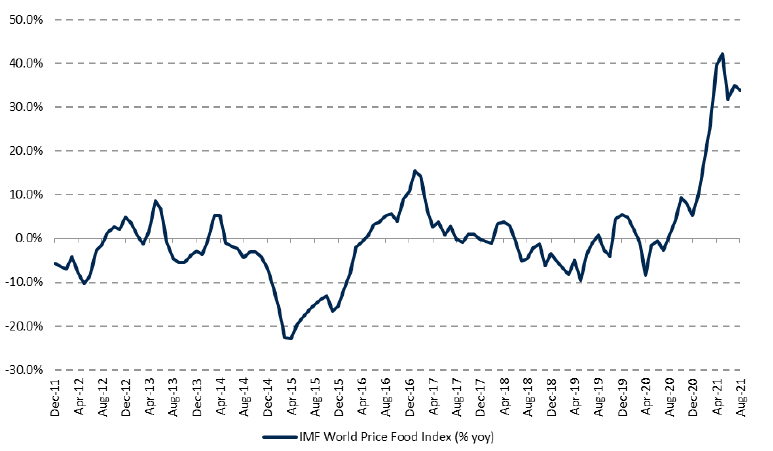

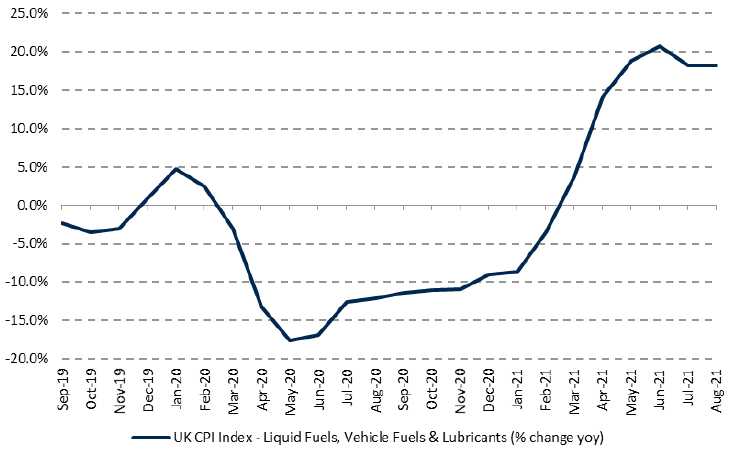

We believe that we are coming out of a 2020 crisis environment in which interest rates were pushed to the lowest levels ever and the world piled up the greatest amount of debt. As a result, we should expect in the future much in the way of interest rate and economic volatility risk. Over the course of my career, I have watched as volatility typically increases when interest rates rise. As Warren Buffet once said: “You don’t know who is swimming naked until the tide goes out.” Well, as is evident in the charts below, the low interest rate tide is reversing. Inflationary pressures are leading to these rising interest rates because there are runway costs occurring globally in food and energy. For example, gasoline prices are at their highest levels ever in Canadian history – even higher than when oil prices were some $50+ per barrel higher in July of 2008.

2021 CENTRAL BANKS RATE INCREASES

THE IMF WORLD FOOD PRICE INDEX HAS RISEN STRONGLY YOY

FUEL PRICES HAVE BEEN RISING SHARPLY IN RECENT MONTHS

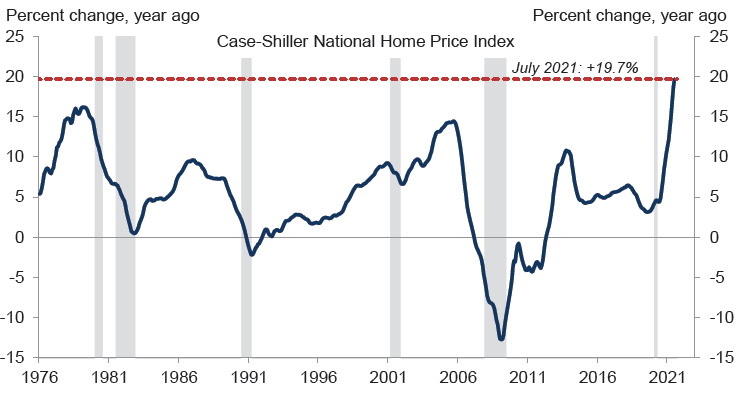

Most of the debt accumulated this past crisis was issued by governments and corporations. The majority of consumers actually saw their balance sheets improve immensely. If you owned a house, had a diversified investment portfolio and had a job, you would have seen your net worth blossom during Covid. Others who were less fortunate, suffered immense pain personally, financially, and professionally.

HOME PRICES HAVE JUMPED 20% OVER THE LAST YEAR

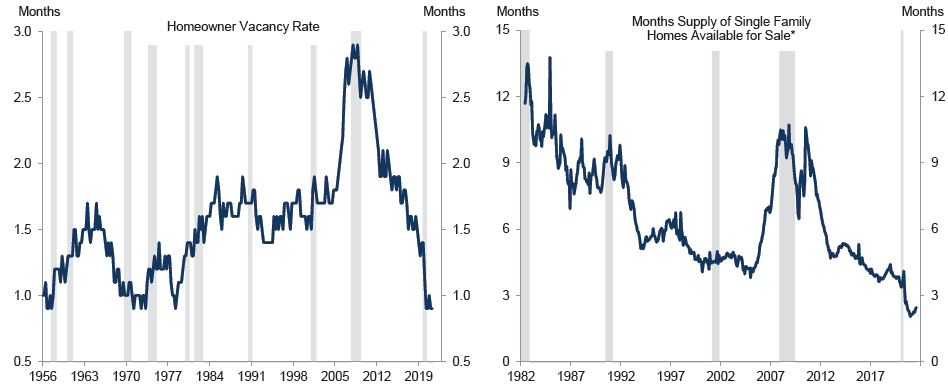

BOOMING DEMAND HAS REDUCED THE SUPPLY OF HOMES TO THE LOWEST LEVEL SINCE THE 1970s

Source: Department of Commerce, National Association of Realtors (NAR), Goldman Sachs Global Investment Research

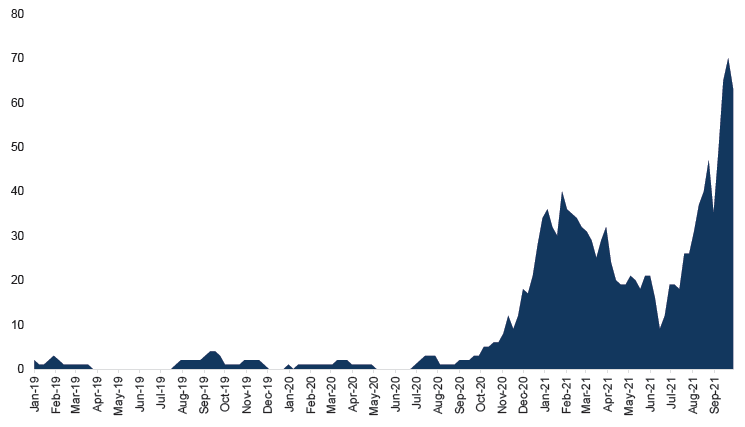

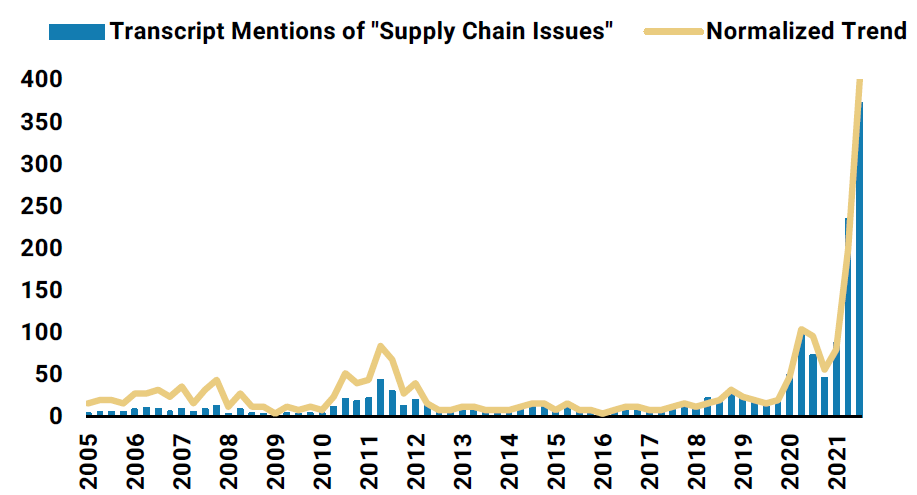

Central banks find themselves in a very tricky situation. Many who suffered have not yet seen a personal recovery, while those who blossomed have spent so much money that the elevated level of demand for goods has clogged the ports of the world, as is illustrated in the below chart. We recently held a call with the CEO and CFO of Roots in Canada and they referenced having to use airfreight to make up for delays in their supply chain in order to meet demand for this upcoming holiday season. As I write these comments, we are in the middle of earnings season and company after company is referencing supply chain issues and delays. It remains difficult to tell whether this will be rectified in a quarter or two, or perhaps longer.

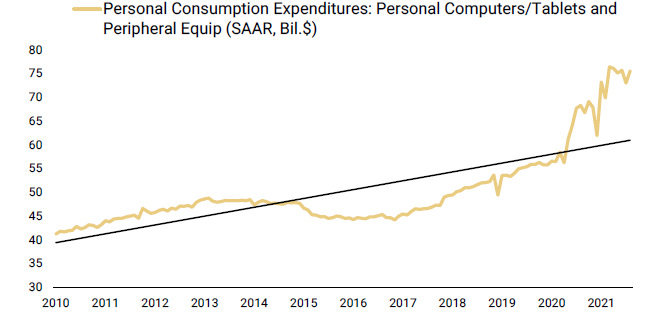

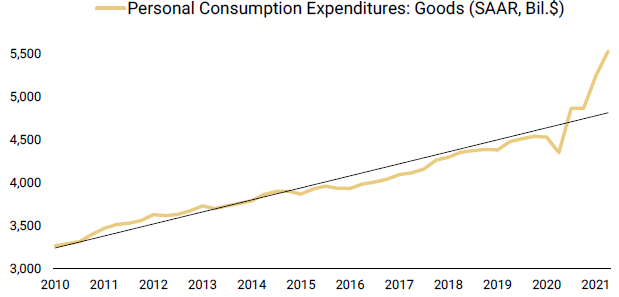

PERSONAL CONSUMPTION FOR GOODS IS RUNNING SIGNIFICANTLY ABOVE TREND…

…SIMILAR DYNAMIC IS EVIDENT WITHIN SEVERAL POCKETS OF TECH HARDWARE

WEST COAST PORT DELAYS HAVE FURTHER DISRUPTED SUPPLY CHAINS

SUPPLY CHAIN ISSUES ARE BEING DISCUSSED BY COMPANIES AT AN UNPRECEDENTED RATE

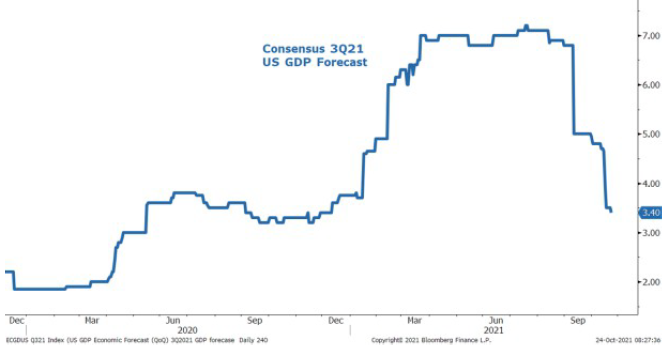

There are two ways for supply chains to become unclogged: either increase supply and/or decrease demand. As many of the tailwinds that resulted in this outpaced demand decrease — think government stimulus, elevated levels of corporate debt issues, initial public offerings, etc. — we should not be surprised to see a slowing economy.

3Q21 GDP FORECASTS HAVE CRATERED

We also expect to see earnings slow as the economy slows. As a result, we will remain defensively balanced in the Panorama Fund. One of our best performing investments over the last decade is Microsoft. The stock has seen its multiple expand from below 15x earnings to over 35x, and its free-cash-flow yield goes from high single digits to below 3%. We sincerely apologize for every time we took profits in this investment over the last number of years. During the first 20 years of my career, I could count on one hand the number of businesses I would ever own in a portfolio that traded above 20x earnings and/or below a 5% free-cash-flow yield. In many ways, Microsoft might be deemed an investment grade bond since so much of its cash-flow is recurring and it has a dominant, seemingly indisputable lead in so many sectors of technology.

I feel compelled to point out to investors that as valuation multiples expand and interest rates perhaps stop going down as much as in the past 25 years, we may have a valuation problem brewing. The current S&P 500 multiple is over 22x and the earnings yield is below 4.5%. Sometimes things that go down will eventually go back up. And even though that is often an over-simplified observation, I would argue for remaining diversified across assets that can protect volatility risk. In this potentially volatile monetary environment, we advocate for balance and diversification across assets that can generate significant earnings and free-cash-flow growth. We are wary of simply being overweight on what has worked in the past, since many financial drivers have changed as a result of the huge central bank debt accumulation during Covid.