Tax Me Later

One year into the pandemic of a lifetime, ripples are still being felt today. CIO Scott Morrison discusses how he positioned Panorama Fund to benefit from economic fallouts; as well as the dreaded tax increases to come.

The Panorama Fund was up +5.32% for the month of February.

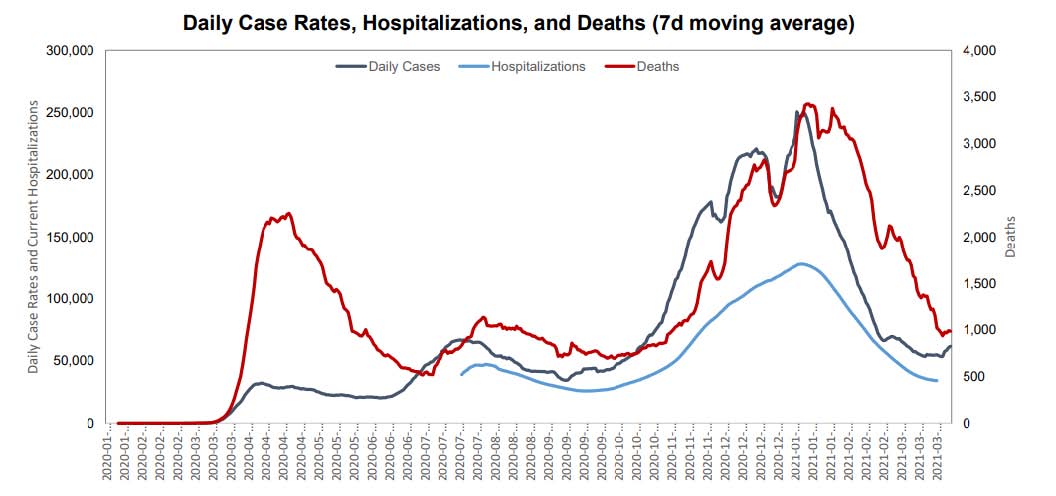

The success of COVID-19 vaccines versus the variants will be a key driver of a sustainable economic recovery over the medium term. In the short-term, the economy is recovering because of massive global government spending.

The U.S. government just passed its third round of stimulus cheques, after the first round was distributed last spring. As President Joe Biden said, there will “shots in arms and money in pockets” after the passing of his latest $1.9 trillion bill. Only time will tell how much of this money will flow into spending versus savings.

As a result of this mountain of money printing, we can see the sovereign bond markets selling off. Below you can see the bounce in the 10-year bond yield, off the lows over the last year. The sovereign bond market has therefore priced in the effect of a lot of shots going into a lot of arms and the corresponding costs to governments, which require the issuance of a lot of future debt to pay for it. We have been very happy to see how the hedging strategies of our Amplus Credit Income Fund has kept the fund making money for Wealhouse clients since its launch last year. Congratulations to portfolio manager Andrew James Labbad on this accomplishment.

During the major recent upward move in bond yields, we sold off some hedges that we tied to a rise in the 10-year yield. Unfortunately, we unwound this hedge at 1.5% on the U.S. treasury. There will come a point later this year when we will feel it makes sense to again have an allocation to outright fixed income instruments for hedging purposes in Panorama. However, our many conversations with companies are pointing to a steady increase in inflation pressures, caused in part by rebounding demand and in other ways resulting from unintended COVID disruptions. For example, company after company we speak with tells us freight costs are very high. As you can see in the below chart, airline traffic is still at very depressed levels. This is very beneficial to our investment in FedEx, which benefits from fewer overseas passenger flights offering up underbelly capacity to ship goods. We believe that the rebound in oil prices from zero during the last year will obviously lead to a year-over-year uptick in inflation numbers as prices rebound. Oil is always tricky because of the potential for OPEC nations to turn on the taps and make this type of inflation pressure very transitory in nature. Overall, we believe rates can move modestly higher as the economy rebounds strongly in 2022, but we feel that the Central Bank will have to act if rates move too far, too fast from here.

Source: IATA, Jeffries estimates

Personally, I took my 73-year-old mother for a vaccine shot at our local community centre in Markham, Ontario this past Saturday. I do not often have the opportunity to comment positively on government-sponsored initiatives, but I was generally impressed with how smoothly run the operation was. I was particularly grateful for all the front-line workers who made it easy for my mother. A shout-out to Moderna and the other vaccine makers that are set to accelerate deliveries of vaccines to Canadian citizens over the coming months.

Source: RBC Capital Markets estimates, Our World in Data

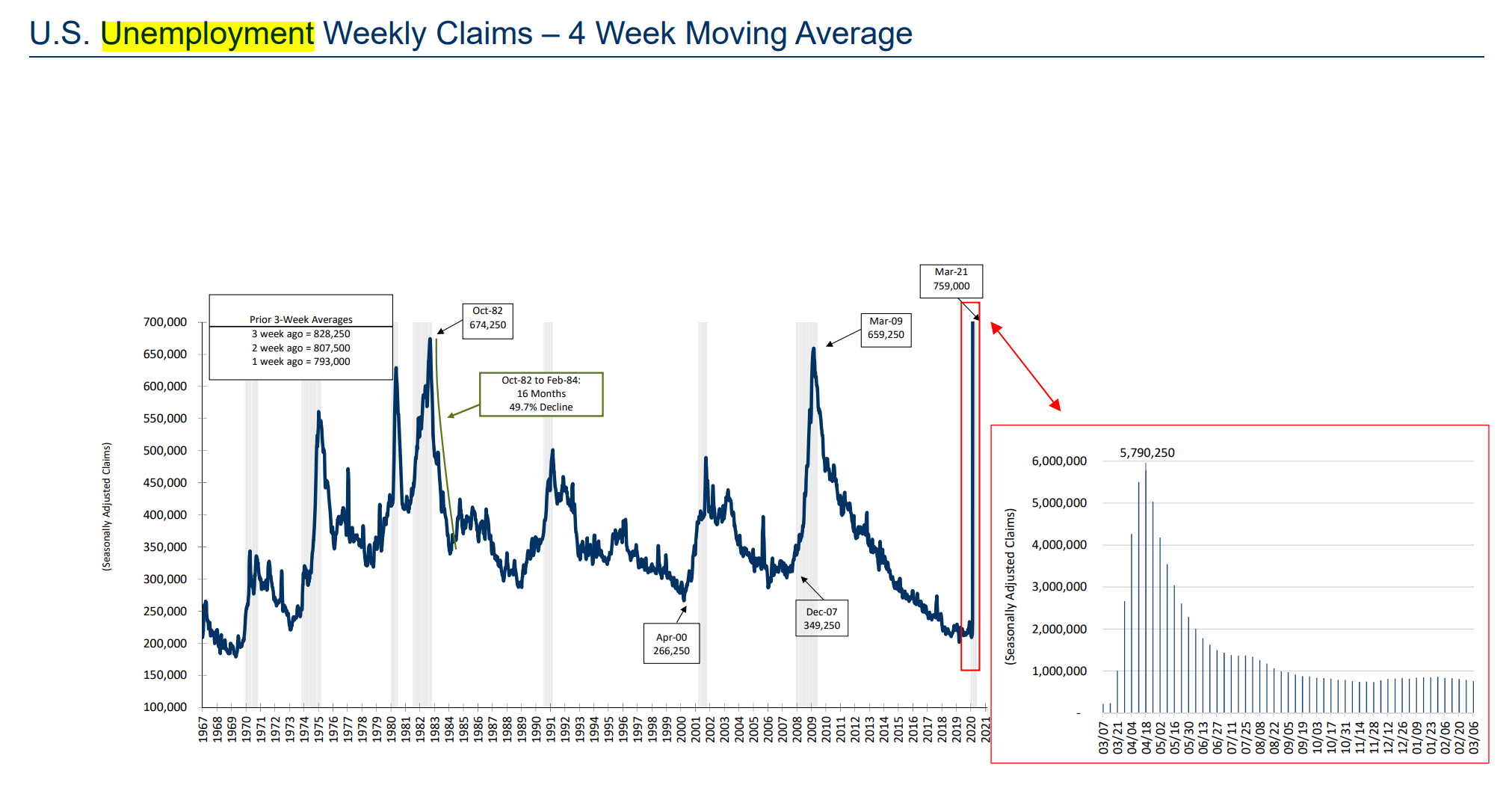

Incidentally, I happened to be standing in the same community centre where my 17-year-old daughter was laid off from her lifeguarding position at the start of the COVID shut-downs a year ago. I have since watched her go through an extensive job search and see her frustration in having to face so many rejections. One company we own that benefitted from high levels of those looking for a job, like my daughter, is Recruit Holdings from Japan, who helps match up companies with full- and part-time workers for a fee. It goes without saying that I can only imagine what is like for all those adults out there who worked in professions that have been put on hold due to COVID-19 closures. Time will tell what second-derivative, socio-economic consequences we will face because of it. For example, I recently had a conversation with one CEO who said that they are seeing an increase in drug-related issues at their company, as workers return to work after the second wave. These are some of the reasons we thought it prudent for our team to step up our charitable donations at this time last year.

Source: RBC Capital Markets, U.S. Department of Labor

(shaded areas indicate U.S. recession Data as of March 6, 2021)

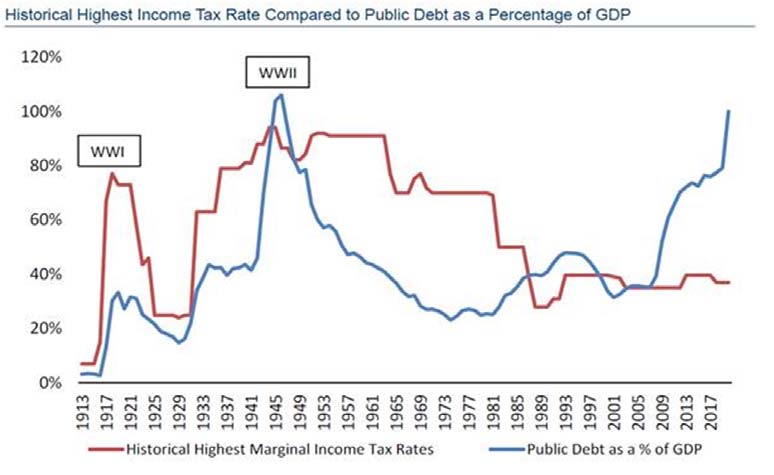

At this time last year, we were drawing analogies between the pandemic and the First and Second World Wars. Below is an interesting chart to see that following the increase in government debt post those conflicts, there was a material increase in tax rates for the wealthy. Much of this government money has flowed into stocks and as such benefitted investors. That said, it would be terribly naive of investors to assume that the government will not take back a cut through increased taxation.

Source: RBC, Tax Policy Center, Congressional Budget Office

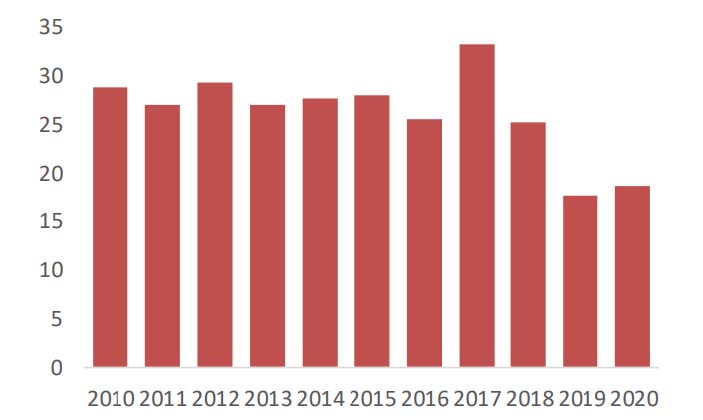

The second tax-related chart below shows that the corporate tax rate decrease under the Trump administration is obviously going to reverse itself in the coming years. We will be buyers of the market if there is a sell-off in the short-term, as we believe earnings and free cash flow will move up and to the right over the medium and long term. It always amazes me how we as voters elect a political leader to take our policies in one direction, and then when that leader loses popularity, we elect the next one to do everything they can to reverse many of those initiatives. How inefficient is that? This trend is especially important to contemplate as there will be many increased friction costs that dilute the collection of extra taxes to service extra debt. This surely will be an economic growth detractor on the other side of all the stimulus mentioned above. This is one reason why we will unquestionably see China become the largest economy later this decade.

Source: Bloomberg, Jefferies

I would be very remiss if I did not highlight the very strong performance of my colleague Justin Anis who runs Lions Bay Fund. I have put a material amount of my family’s money with him because he has a very disciplined approach to structuring his portfolio between core high quality companies and a transactional portfolio, where he deploys tactical trading strategies. The third piece of his investment process is to employ a disciplined risk management strategy that has done a very a good job of protecting during market drawdowns. So often, clients will come to me and ask them to generate upside returns with no downside risk. I have worked beside over 50 portfolio managers in my career and Justin has been the best manager I have seen at protecting on down days in the market. I truly believe this market environment is very well-suited to Justin’s philosophy and approach because of major changes that are occurring in the economy and capital markets as a result of COVID.

In an effort to allow for proper diversification, I can honestly say that as CIO, I do not interfere in the way Andrew and Justin run their portfolios, to avoid group think developing at Wealhouse. They are very good at hedging. I strongly recommend Andrew and Justin to all our clients to take care of a portion of their savings. Once again, I feel our funds own many businesses that will recover and grow their earnings and free cash flow in the quarters and years ahead. Panorama is diversified around the world and increasingly overweight overseas companies as we are finding better values there and feel that some of these jurisdictions will catch-up in COVID recovery in due course. As more vaccines rollout and the economy recovers, we anticipate that volatility and uncertainty shown in the below charts should improve in the next twelve months versus what we have seen in the last twelve months.

Source: Bloomberg

Source: Bloomberg