Silver Linings - Suncor Energy

When the stars align – In our most recent credit notes, we highlighted an increasing number of Canadian companies redeeming their debt early. The incentive for energy producers to reduce debt could not be greater. Current WTI prices have allowed many energy producers to extinguish debt a lot quicker than anticipated. In May, both Cenovus Energy and Suncor Energy chose to take out debt 2-3 years ahead of schedule. Despite WTI dropping $20 from its local highs from about one month ago, the forward crude curve is trading higher the past 3 months. All this to say, the free-cash-flow being generated by many of these energy producers in this current oil environment should allow for continued aggressive pay down of debt.

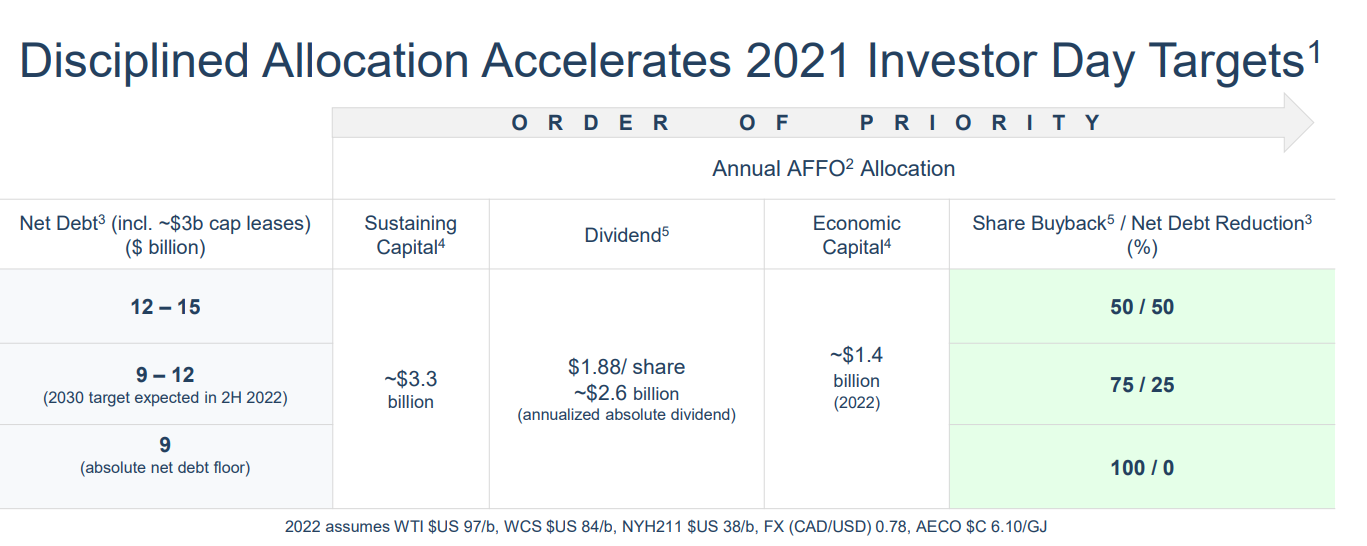

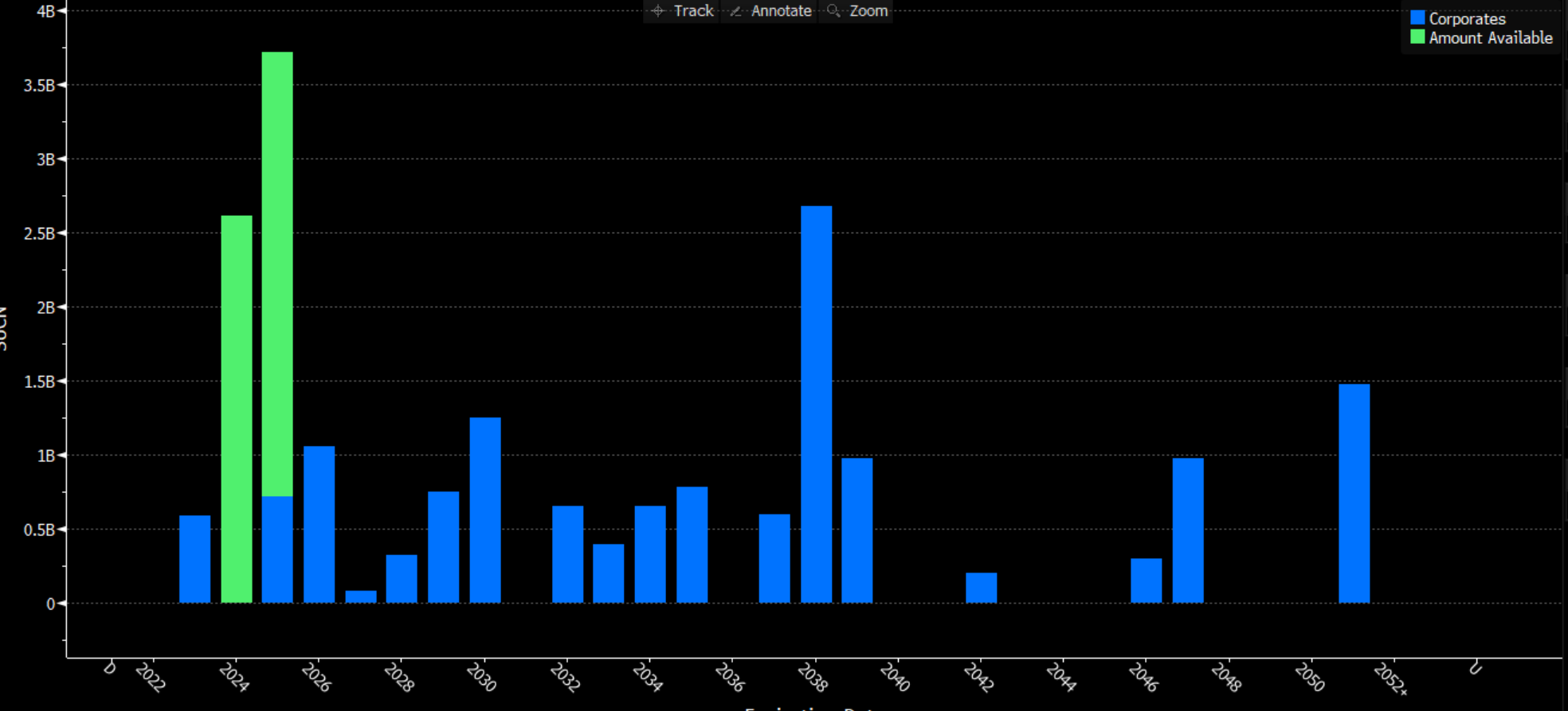

One of our top convictions for take out candidates includes CAD$ Suncor 2026 bonds. At their 2021 investor day, Suncor had net debt of $19 billion outstanding with targets to achieve net debt of $12-15 billion by 2025 and $9-12 billion by 2030. Fast-forward Q1-2022, with net debt of about $15.5 billion, management now expects to reach their 2030 goals by the second half of 2022 – 8 years sooner than expected. In not so many words, they expect to allocate at least $3.5 billion to their balance sheet by year-end. Having freshly announced the redemption of their 2023 and 2025 maturities totalling CAD$1.2 billion, the next obvious candidate would be the 2026 maturities.

Figure 1: Q1 2022 Capital Allocation Plans for Suncor Energy

Figure 2: Debt Maturity Profile for Suncor Energy

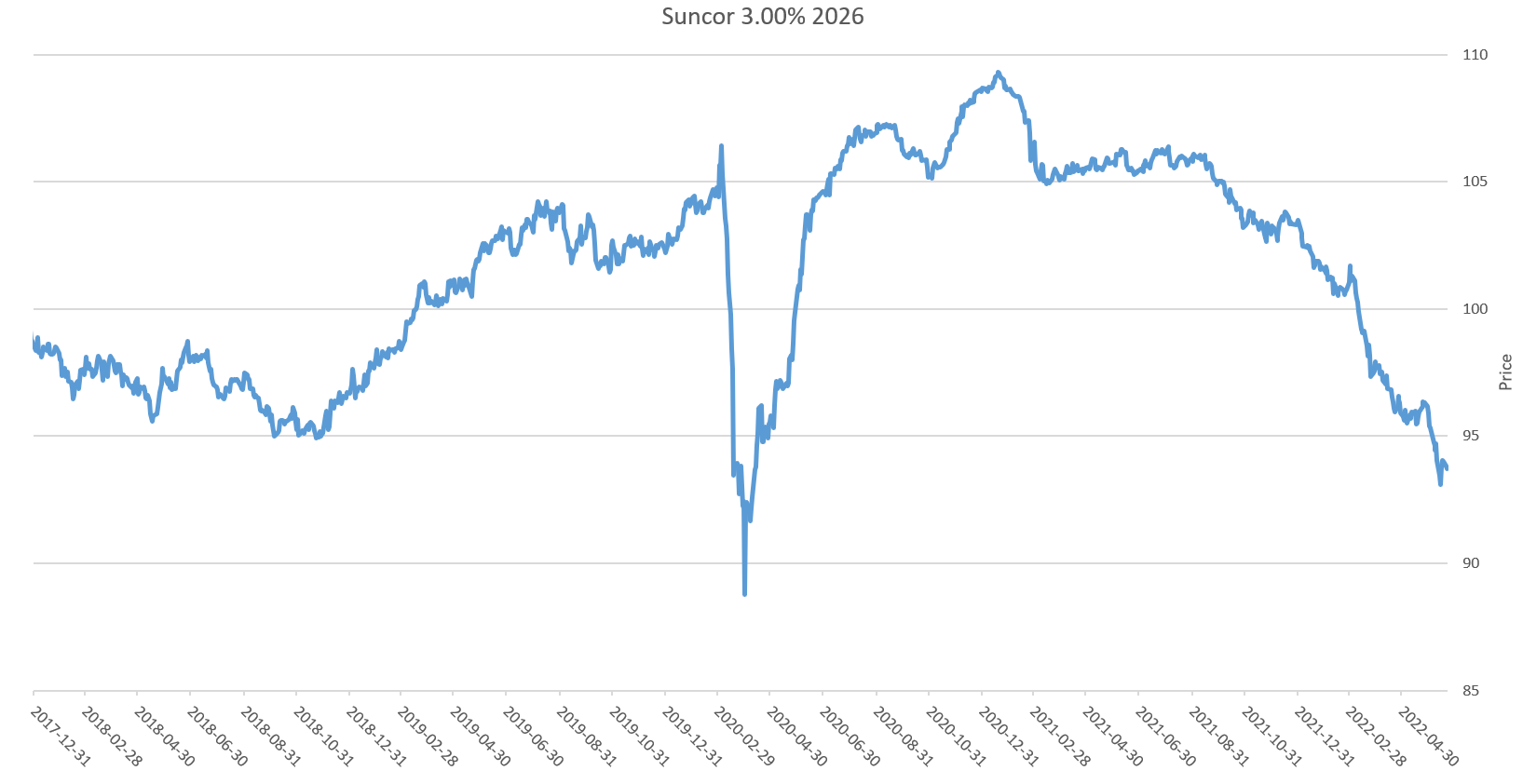

Benefitting from higher interest rates, redeeming debt opportunistically is that much more attractive given the lower dollar price of the bonds outstanding. Looking at the price history of Suncor 2026 bonds, current pricing is comparable to March 2020 pandemic lows. Since then, WTI has done a complete 180, going from below $0 per bbl to $100+ per bbl. From a credit spread perspective, these bonds are trading 50bps wider since their October 2021 tights. Meanwhile, WTI is 40-50% higher in price.

Figure 3: Price History of Suncor 2026 Bonds

Figure 4: Spread Historicals of Suncor 2026 Bonds

A changing political environment can bode well for debtholders. This morning Fed Chair Powell testified before the Senate, with many questioning the record amount of buybacks and return of capital to equity holders from energy producers at the detriment of inflation. The question now becomes whether shareholder return policies are re-evaluated, possibly creating an environment for even more debt reduction as shareholder returns will be limited.