Quality-Control Investment Checklist: Liquidity

The Russian invasion of Ukraine has impacted the already volatile market. Gas, food commodity, and housing prices continue to increase. CIO & Founder, Scott Morrison, shares his thoughts and risk-management process.

First, our thoughts and prayers go out to those suffering in Ukraine. Like many others, we at Wealhouse have donated funds to charities that seek to support those in need. We truly hope that a truce and/or end to the war will come in short order.

Bond, commodity and equity markets have been incredibly volatile so far in 2022, as a result of inflation pressures, the Russian invasion of Ukraine and much tighter financial conditions for consumers and businesses. We continue to expect much market volatility until inflation peaks and central bank tightening expectations peak as well.

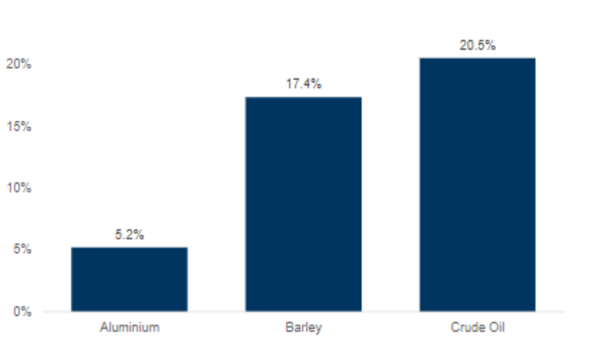

Many of us are bearing witness through media images to the loss of life and physical infrastructure in Ukraine. Much is also made of Russia’s internet hacking capabilities. We fully expect to hear about repeated attempts at western world targets as retribution for the economic sanctions being placed on Russia. There are other particularities arising from this conflict, however, that will prove problematic for allocators of capital. Russia is one of the world’s largest bulk producers of energy sources such as oil, natural gas, coal and uranium. Across these commodities, Russia is a double-digit market-share holder. Ukraine is a high single-digit or low double-digit global market share producer of agricultural commodities such as corn, wheat, sunflower seed and barley.

In last month’s commentary I shared my perception that inflation was likely peaking in the high single-digit range for the world during the first quarter of this year. That was before the invasion. Now I do not expect to see inflation peak until the second or third quarter of this year at the earliest. Many food commodity prices are spiking at the same time that rent and housing costs are increasing. And there is no need for me to point out that gasoline prices are at all-time highs before we enter peak driving season in the summer. These will all be head winds for consumers, governments and businesses and lead to demand destruction.

After the invasion of Ukraine, we hosted in our office the CFO of Carlsberg, one of the world’s largest beer brands, to discuss their input cost risks since barley and wheat are important ingredients in making beer. We then had a virtual meeting with the CFO of Holcim from Switzerland, one of the world’s largest cement producers, to discuss their cost pressures since energy is so important to make and transport cement. Fortunately for both companies, they had systematic hedging policies in place that will protect them in the months ahead. As these hedges roll off, however, they will pass on rising input costs to their customers. Hence, inflation has not peaked in our opinion.

SINCE 23 FEB, ALUMINUM PRICES ARE +5.2%, BARLEY IS +17.4% AND CRUDE OIL IS +20.5%

Throughout my entire career, I have witnessed the constant tug of war between inflation and deflation. Deflation has been the secular winner hands down because of demographics, China’s entry into World Trade Organization the year 2000, as well as other globalization efforts and technological productivity advancements. I now believe that we face an important inflection point, wherein investors underestimate the risks that face their savings if inflation is not brought under control. I cannot emphasize enough how tricky these times will be for savers, since we are coming from a world with the lowest interest rates ever, the highest amount of debt ever seen in the world and the highest inflation rates since I was born in 1971. This is in large part due to the fact that globalization has peaked, covid has shown its blind spots, and geopolitical tensions between China and the U.S. will force a return to domestic production of key goods in the U.S. versus lower-cost China. Add to this the efforts to decarbonize and inflation, in my opinion, will reach higher peaks for longer periods than in past cycles.

I have always said that interest rates are the most important macro variable to consider. However, as a result of covid, I began to think that government spending was going to become more and more important, since world governments spent the most amount of money ever to ease the pain of their voter bases trapped in covid lockdown. As we all know, we paid employees to stay home and gave much money to many people who simply did not need it. As a result, we have experienced worker shortages and outsized consumer spending at a time when supply chains are suffering. This, I thought, would have normalized by now. I was wrong in this assumption, though, in part because there has been such varied government responses to covid lockdowns around the world. Just look at China’s recent lockdowns while we open up here again in Canada. If supply chains do not normalize relatively soon then inflation will prove itself a bigger problem than many anticipate. The central banks in particular have miscalculated when to take away very loose monetary policies.

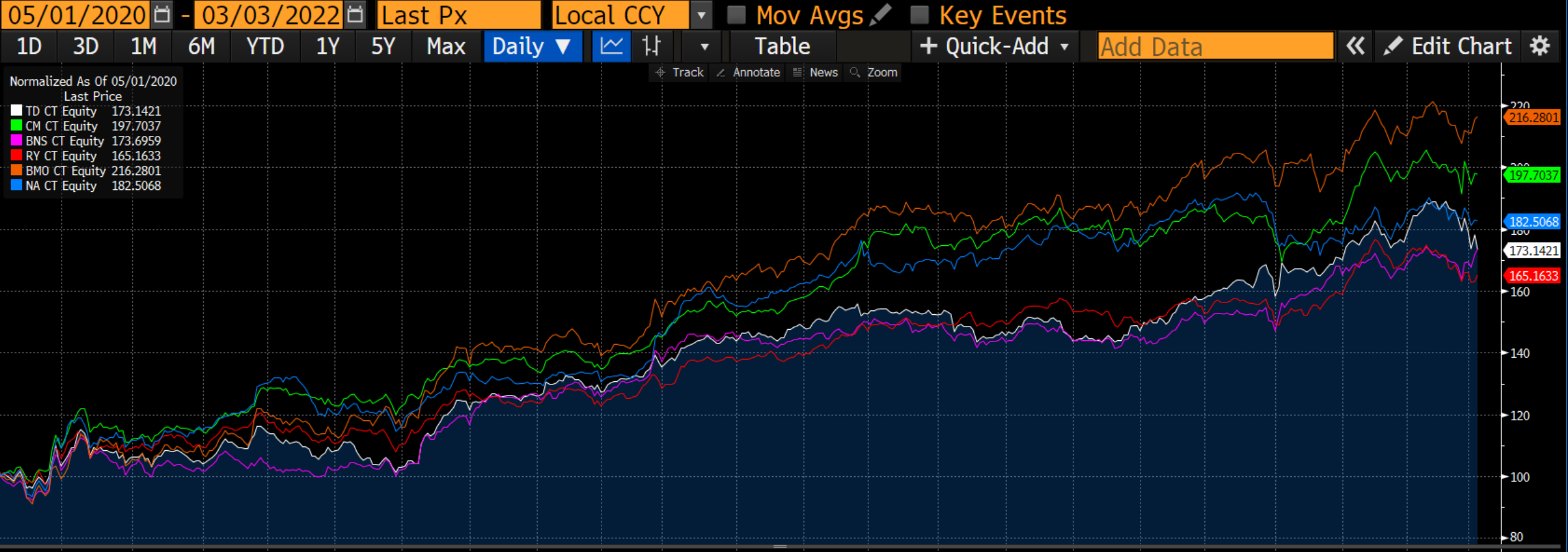

As many already know, the number one item on our quality-control investment checklist is LIQUIDITY. The second item is also LIQUIDITY. The first measurement we quantify as part of our risk-management process is how easy is it for us to enter or exit an investment. We keep a spreadsheet that we consult every day to make sure that we can sell any investment in short order. The second liquidity principle is ensuring that we own companies which have balance sheets that can weather unforeseen economic storms. We want to own companies that generate free cash flow and/or have cash reserves to buyback stock, grow dividends or make opportunistic acquisitions during tough times. I believe central banks have conditioned the investor base to become very complacent around these two liquidity measures of risk. Who can blame the population for its lack of fear, when central banks and governments keep bailing us all out from every crisis? As you can see in the below chart, more and more of our competitors have been taking more and more illiquidity risks. We DO NOT do this at Wealhouse in our pooled funds. This will not end well in my opinion.

IN 2021, HEDGE FUNDS PARTICIPATED IN ~1,400 PRIVATE MARKET DEAL…

TWICE THE 2020 LEVEL AND THREE TIMES 2019’S

Note: Capital invested represents total capital raised in deals that HFs have participated and includes both HF and other investors

On a recent due diligence trip to a European Financials conference, I met with a publicly traded private equity company from London, England. At one point during the meeting, I was taken aback to hear a company representative claim that their private direct-lending fund had proven its great underwriting abilities in 2020 when their fund returned 2% on the year. As politely as I could, I reminded the host that they may have gotten quite lucky, since global central banks rode in on white horses and bought up so much debt. Recall that 2020 was the first recession ever where bankruptcy filings actually went down! At Wealhouse, all our managers manage their position size risk very carefully. We do not have to depend on central banks and/or government to save our financial miscalculations.

To no surprise, we are hearing more and more politicians announce plans to subsidize voter cost of living increases. Similar to their pandemic reaction, whereby which our health care systems did not have the capacity to manage the increased demand, our politicians are now having to make up for ill-conceived energy supply management blunders. I was very sad to see while I was in the U.K. that their Prime Minister was forced to pander to the Saudi King for better access to their energy supplies. The German leadership hustled over to Qatar to secure an alternate plan for Russian gas, and our neighbours to the south sent a delegation to Venezuela. How could you paint a better picture for our friends in Alberta?

In high school I was made to study Latin, and there is one Latin phrase that I believe is pertinent to how Western governments will need to shape policies in the future: “Si vis pacem, para bellum — if you want peace, prepare for war.” It is important to note that Germany announced soon after the invasion of Ukraine a €200 billion fund, in part to modernize its military. Stay tuned for more of that from many governments. Everywhere I look I see politicians wanting to spend more and more money. Again, if you increase the supply of something, one would think that the price of that asset should go down. Think government bonds to finance all of this spending.

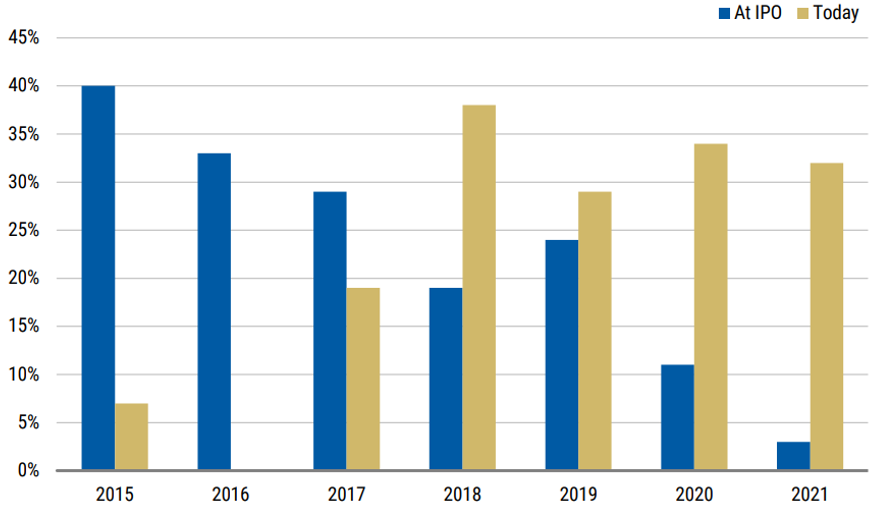

As yields move higher, longer-duration assets such as money-losing venture capital and private equity-backed start-up companies should see material multiple contraction. This is before we factor in major operating margin risks as costs such as salaries go higher. I found it incredibly interesting to read an article on Bloomberg recently that spoke about one of the leading tech investors in private markets, a hedge fund called Tiger Global. The article from Bloomberg spoke to a billion-bond offering Tiger recently did, to replace a line of credit they had with JP Morgan with floating-rate debt. Locking in interest rates makes sense to me but borrowing money to invest in money-losing businesses seems very, very risky. From a lender perspective, I struggled to see how secure this collateral would be if they were forced to liquidate? Hence, we are not surprised to see that Tiger’s flagship hedge fund was reported by Bloomberg as being down 23% year-to-date. And with a less robust IPO outlook for technology moving forward versus the last few years, I would expect major banks to be less willing to put on these risky loans if they will not be able to get paid elsewhere in their banking franchise with juicy underwriting fees.

PROPORTION OF TECH IPOs TRADING BELOW LAST DISCLOSED PRIVATE FUNDING ROUND

Today the investment world is full of many younger investors and financial advisors than me who have not witnessed bankruptcies since central banks and governments have sheltered many from insolvency for so long. I have seen Nortel go from being the largest company in this country to bankruptcy at the beginning of this century. I will always remember working with colleagues who built a Discounted Cash Flow Valuation of Nortel saying it was worth $125 a share in the year 2001 and then seeing it collapse to zero a couple years later. I remember meeting Bernie Ebers from WorldCom before it went bankrupt. I remember seeing Eaton’s do an IPO with a major Canadian Bank in 1998 and then go bankrupt a year and change later. These were the old days when companies with too much debt and flawed business models were allowed to fail. Only time will tell if this survival of the fittest mindset is allowed to happen again in the financial system. I believe we will soon see bankruptcies and investors learn that companies that over earned during the free money years actually sell to one another in many cases and represent what is called counter-party risk. I believe this because I believe the U.S. Fed will be forced to raise interest rates 50 basis points at the next meeting. The last time I saw this was in the spring of 2000. We then had a recession in 2001 and the bankruptcy cycle began.

To help protect our investments from inflationary cost pressures, we have been allocating more and more capital to businesses with royalty business models. One great example is company listed in the U.K. called Anglo Pacific Group PLC. They collect royalties and streams from the mining of natural resources. The company has a double-digit free cash flow yield and mid-single digit dividend yield. We anticipate that there will be many new projects needing their help to bring on production in this rising commodity environment that should allow them grow their royalty streams into the future. Another example is IMAX, which we believe will benefit as consumers return to watching blockbuster movies in theatres. The company has a very strong balance sheet and significant growth potential in emerging markets, as new movie screens using its proprietary technology are installed. Filmmakers like to use their technology to show off their creative genius and wow audiences with visual effects that cannot be replicated in a living room. I anticipate that the recent success they have realized from movies such as the latest releases of Batman and Spiderman will continue, as we see upcoming releases such as Top Gun 2, Jurassic World, Doctor Strange, and Morbius hit movie theaters.

As always, we believe we run diversified portfolios to outperform when “Bad Things Happen” such as wars or pandemics and/or interest rate increases that go too far and too fast. From a counterintuitive standpoint, we believe that we are seeing many interesting opportunities emerge. For example, there are so many companies that went public in the last couple of years that are currently trading at much more attractive valuations than previously. We anticipate talking to you more about these new opportunities in the quarters ahead. Meanwhile, we will hope for the best (the pandemic ends, Putin loses and/or inflation/interest rates peak) and have a plan for the worst by staying disciplined in owning very liquid companies.