Panorama Half-Year Review

CIO Scott Morrison wraps up June with a comprehensive commentary on the first half of 2020 and where we can expect to head from here.

Panorama Fund is approximately flat for the first six months of 2020, the most volatile half-year of my 25-year career.

When clients ask why the fund has outperformed the majority of our peers and major global benchmarks by so much in 2020, I emphasize two simple end results of executing our research process and philosophy: balance and nimbleness.

When it comes to “balance”, I would remind clients that Panorama was balanced between companies and industries that we believe win, versus ones that we feel will lose. Most money in this country still only invests on the assumption that all will go right. Panorama’s strategy of periodically profiting from deteriorating fundamentals helped significantly on the capital preservation side during these volatile and uncertain times. Our Voyager Fund was up +1.79% in June, as it focuses on making long-only investments.

One unique aspect of this equity market slide has been how severe the economic collapse has been for some segments of the global economy. Certain sectors that we have met with in the past such as Ad Agencies, Banks, Department Stores, Oil, Television Broadcasting and Shopping Mall Operators, which were already experiencing secular headwinds before this collapse, are most definitely going to see business stagnation and/or absolute bankruptcies. Before Covid-19, there were certain companies that were already using technology to disrupt other less-digitized businesses. Covid-19 has now allowed those digital champions to flourish and take incredible market share.

| WORST OF TIMES | BEST OF TIMES |

| Department Stores | Online Retailers |

| Theme Parks/Live Events | Video Game Consoles & Software |

| Food Service | Grocery Stores |

| Internal Combustion Autos | Recreation Boats/Sea-Doos |

| Conference Centres | Virtual Meeting Technology |

| Cinemas | Video Streamers |

| Fitness Clubs | Golf, Hiking, Spinning, Yoga |

| Airlines/Aerospace | Bicycles/home delivery |

| Oil | Renewables |

| Urban Economy | Rural Economy |

In terms of “nimbleness”, we were quickly able to steer the fund’s investments in different directions, as company and geographic fundamentals changed as a result of Covid-19. At the same time, other larger investment pools were unable to exit their very large stakes. One thing I learned growing up in the mutual fund industry is that when you enter a crisis, it is a huge handicap to own 5-10% of a company. Due to the ever-present risk of underestimated technology disruption, we have felt for years that this was a prudent approach to take for clients. Luckily, for those who are very concentrated in companies on the left of the above illustration they saw the Central Banks and Governments throw trillions of dollars at the problem or it would have been a lot worse for their unitholders. We assume in the Fund that bad things can unexpectedly happen, such as that which we are experiencing right now. Now that the world is solving certain problems by adding more debt, we believe that this focus on liquidity will be even more important part of future investment processes.

Indeed, some recent changes we made to the portfolio leveraged our past research efforts. For example, for years we have bet against department stores, and as the crisis rolled out, we embraced the volatility and increased investments in companies that benefit from the pivot to online retail. We invested in leaders such as Alibaba, Amazon and Ocado from Asia, the U.S., and the United Kingdom respectively. Hopefully this illustrates the advantage of our global capabilities. We have kept these e-commerce holdings even as they have rallied materially, due to other investors realizing that there has been a massive shift to home delivery. We believe that a meaningful portion of this behavior will be permanent and lead to major market share shifts to these digital platforms. Case in point, even my 72-year-old mother has now become far more comfortable with shopping online.

Our governments have poured our tax money into the launch of advertising campaigns urging people to stay home, inadvertently creating a “fear factor” to the extent that individuals are now afraid to physically walk into stores. Just as we have to manage risk in your Panorama portfolio, individuals must now become Covid-19 risk managers. My own mother, like many others, is now asking me if she can go grocery shopping, visit her grandchildren, take her car in for service, etc. This is an example of how consumers are deciding to use their “Covid-19 risk budget”. We anticipate that consumers will come to view browsing the aisle of a retailer to be a riskier venture than ordering home delivery. As consumers increasingly work from home, they will buy more laundry detergent, dishwasher soap and other cleaning items, such as Lysol from our top-ten holding from the United Kingdom, Reckitt Benckiser Group Plc. This will also lead to more demand for industrial warehouses, and robots to work in those warehouses. The second-derivative impacts from how Covid-19 has changed the world will play out for many years to come. Unfortunately, there are simply some businesses, like department stores, that will not recover from the harsh realities of the experience.

It should be somewhat comforting to our clients and partners to hear that we keep a strict rule at Wealhouse on the liquidity of the investments we enter. We measure on a daily basis and generate a liquidity report that quantifies how long it would take to enter and potentially exit an investment position. 98% of the investments in Panorama could be sold within 24 hours without having to be more than 20% of the volume, based on the last 6-month trading average of our investments. The other 1-2% could be sold in a day or two. As we always say, liquidity is the number one item on our investment checklist. We are proud to say to our investors that if they needed their money back, we could likely meet their requests without negatively impacting the value of our other client’s investments.

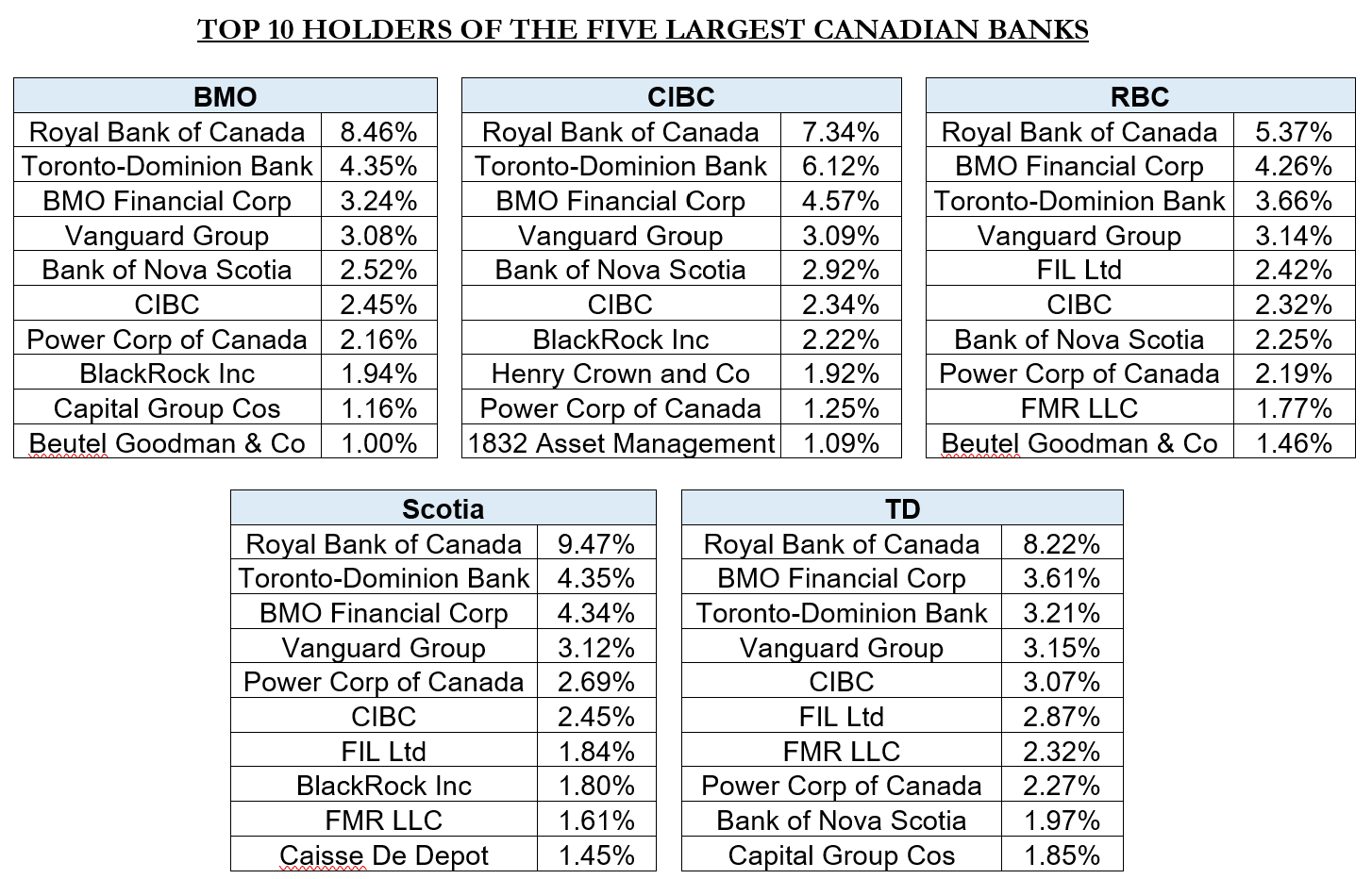

As discussed in previous comments, we are not very excited about the long-term profit prospects for most banks around the world, with a very low-interest environment and the likely bad debts they will face as a result of Covid-19 and technology disruption. We find it interesting to illustrate that in Canada, the largest banks are most often the largest shareholders of each other. If we apply the same risk-management discipline around liquidity that we discussed above, that would mean that Royal Bank would need over 100 days to exit their position in Bank of Nova Scotia if they felt there was a change in fundamentals! That is a clear example of a lack of nimbleness in what is one of Canada’s largest and most liquid companies!

We are not trying to be overly negative on the Canadian banks, and it almost feels unpatriotic to show fellow Canadians the slides below. However, we feel it is important to point out that Canadian banks really need the ill effects of Covid-19 to stop negatively impacting the many consumers and businesses they have lent money to. At the end of Q2, Canadian banks reported that over 15% of their mortgage book was in forbearance. We are left asking – what will happen when the forbearance period is over? I have little doubt that I will see the biggest realized losses by banks in my career. As well, as you will see in later charts, the Canadian consumer is over-leveraged, which will limit future growth potential from their massive retail franchises. Hence, we are avoiding investing our clients’ money into Canadian bank stocks. Yes, they look cheap on a price-to-earnings and price-to-book basis, but we believe that they deserve to be cheap, since their balance sheets are so risky and growth prospects limited. Another potential risk is that financial regulators will halt their dividends during the crisis, which we have seen in Europe and the U.S. We are not saying that this will happen in Canada, but it is a risk if a second-wave scenario plays out worse than expected. As always, we reserve the right to change our minds but we believe that the upside-versus-downside risks are pretty unanalyzable at this point. Stay tuned.

Source: Company data; Credit Suisse estimates

Source: Company data; Credit Suisse estimates

Source: Company data; Credit Suisse estimates

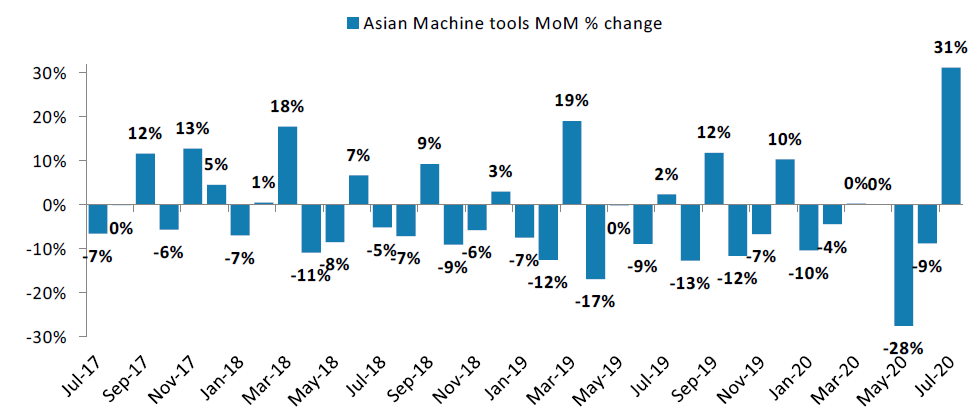

One area in which we believe there exists improving fundamentals is in Asia. It goes without saying that Asia has done a far better job managing the outbreak of Covid-19 than most of the rest of the world. For those who have travelled to Asia, you will have very likely seen that it is part of their culture to wear a mask when one has a common cold, let alone during a pandemic! As a result, they are returning to normal far faster than Western businesses, as evidenced by the below chart, which illustrates a marked improvement in Asian machine tool orders during the month of June. One company that we purchased in early April which benefits from this is called IPG Photonics (shout out to my colleague Justin who introduced them to me a couple years back). We took advantage of the global equity sell-off to buy them because the company hits so many of the items on our checklist: huge insider ownership, track record of free-cash flow growth, attractive free-cash flow yield, high returns on capital, global market-share leader, proprietary technology and net cash on the balance sheet to fund counter-cyclical growth. They make lasers that help in manufacturing goods for medical devices, telecommunications, materials processing, satellites, etc. We were rewarded when this American-headquartered company reported better-than-expected results on the back of increased demand in Asia. We truly felt comfortable investing in them because of their strong balance sheet, and they articulated why a strong balance sheet is beneficial on their most recent conference call:

“During this time of uncertainty, which is unlike any that we have faced before, it is unclear what will happen to global demand over the coming weeks and months. This uncertainty makes the forecast in our business very challenging in the near-to-medium term. Nonetheless, our strong balance sheet, ample cash reserves and minimal debt provide us flexibility in responding to Coronavirus-related disruptions and to emerge from the crisis with the ability to seize the many opportunities we expect to see. We plan to continue investment in a strategic research and capital project that will drive the next leg of market share capture for our fibre laser technology. Because our fibre lasers are a key enabler of automated precision manufacturing, we expect to disproportionately benefit from an eventual recovery in the industrial cycle.“

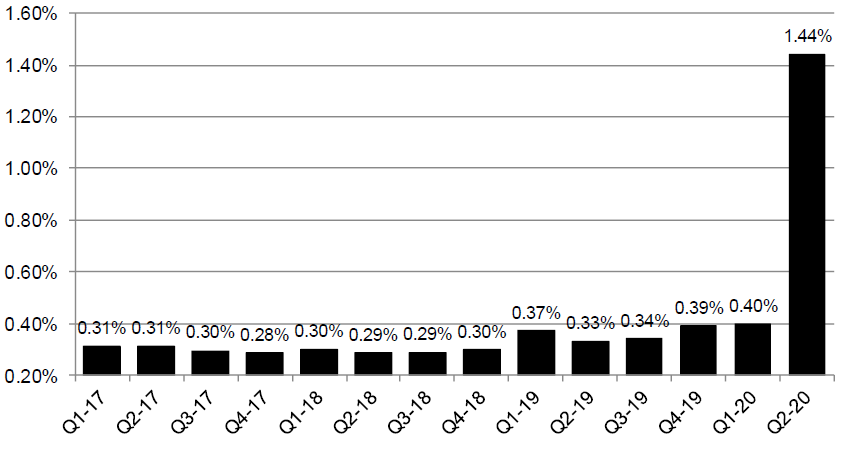

The fund is anchored in companies with strong balance sheets and proven free-cash flow generation, in order to weather and capitalize on uncertainty. We at Wealhouse recognize that, unlike IPG Photonics, there are many companies being caught with less-than-favourable balance sheets to deal with global uncertainties and the unpredictability of the future business environment. You can see this in the chart below that tracks the amount of uncertainty in the business world. It is clear that we are at all-time highs. As a result, in Canada we saw all-time-high debt issuance during the second quarter. According to an article in the Investment Executive, which quoted data from Refinitiv, there was “… $102.8 billion in issuance activity … [which marked] the strongest quarter on record.” Refinitiv also said that the proceeds in the quarter, “were 86% higher than the previous record.”

Source: highcharts.com

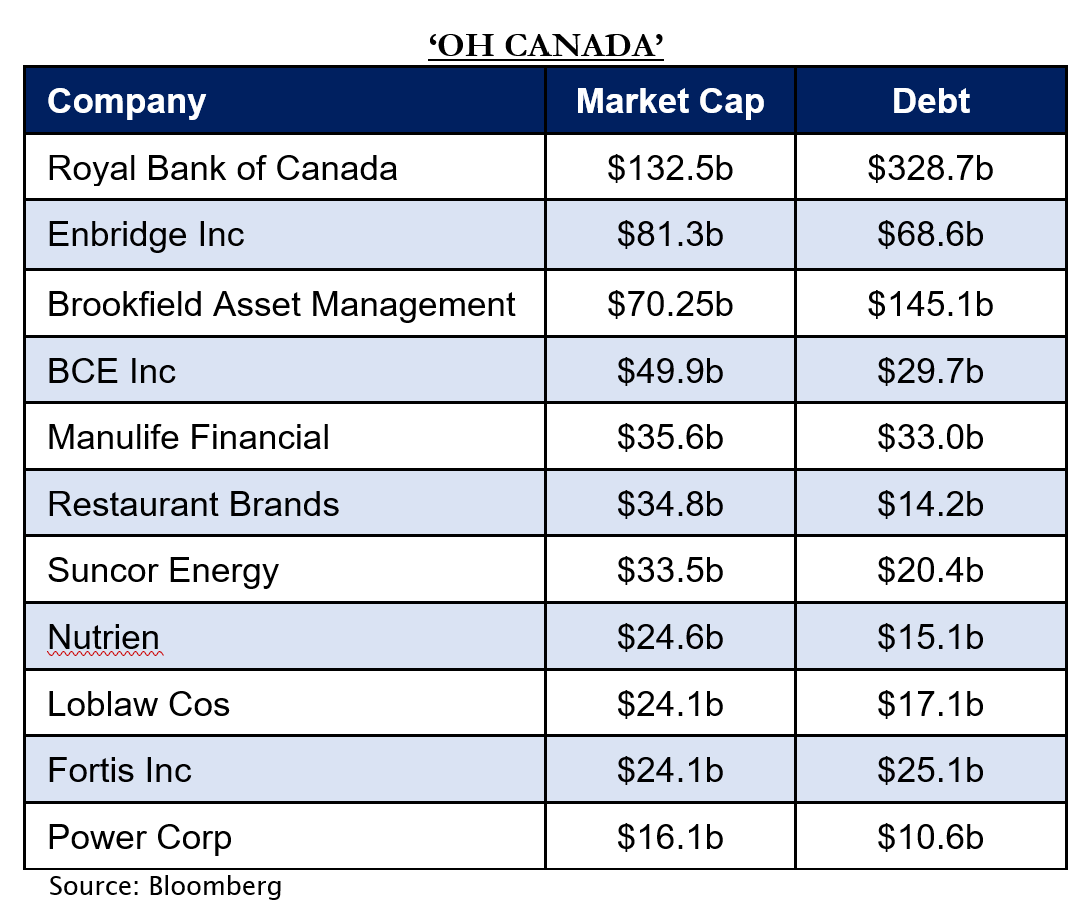

In anticipation of the above trend and an assumption that uncertainty will remain elevated, you will notice on the Wealhouse website that we have added a new member to our team, and that we have launched a new credit fund. Andrew Labbad is our new Senior Portfolio Manager and comes to us after a distinguished career at TD Bank. We have been very impressed with his money-making skills out of the gate. I have invested personally in this Fund and our marketing colleague Jane looks forward to introducing Andrew to you in the coming months. I am very convinced that there will be a new need for increased debt and adding someone to our team who can take advantage of the inefficiencies in this segment of the capital markets will be a good investment for our clients. As you can see in the chart below, some very large, quality Canadian companies have much debt for Andrew to profit from. Again, I thank the Wealhouse team for executing for our clients during these difficult times.

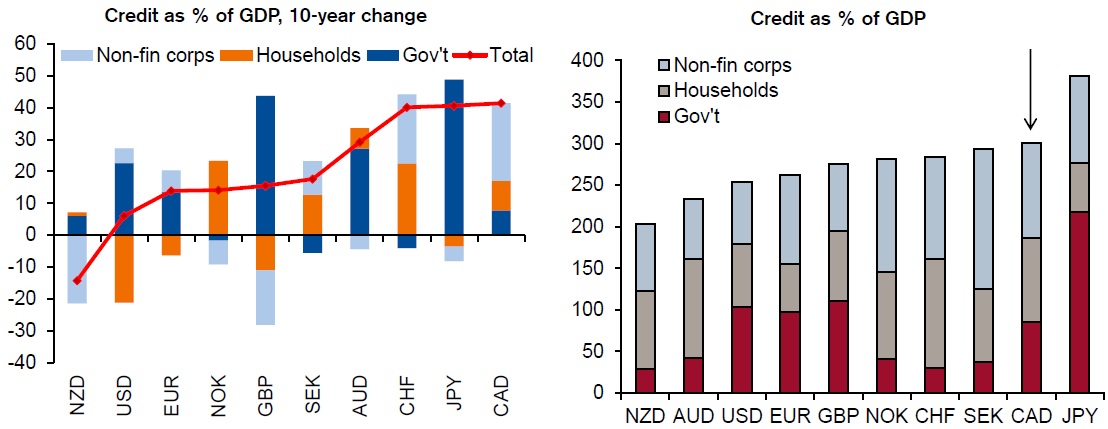

As a result of the record debt issuance in Canada mentioned above, we saw the Government of Canada’s debt downgraded by Fitch Rating agency. Canada’s debt was downgraded to “AA+” from “AAA”. According to an article on Yahoo finance, “Ottawa is rolling out more than C$150 billion in direct aid to support the economy, and Fitch said this would drive the general government deficit up to 16.1% of GDP in 2020. Canada is expected to have a consolidated gross general government debt of 115.1% of GDP in 2020, up from 88.3% of GDP in 2019, Fitch said.” And as you can see in the chart below, all of a sudden Canada is ranking very high globally when it comes to Credit as a per cent of GDP. That harkens back to why we are being very cautious on Canadian banks.

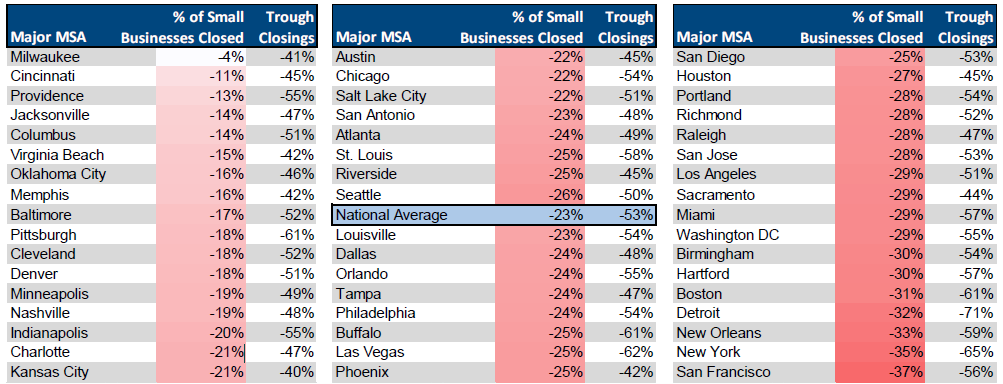

Source: Credit Suisse, Bloomberg

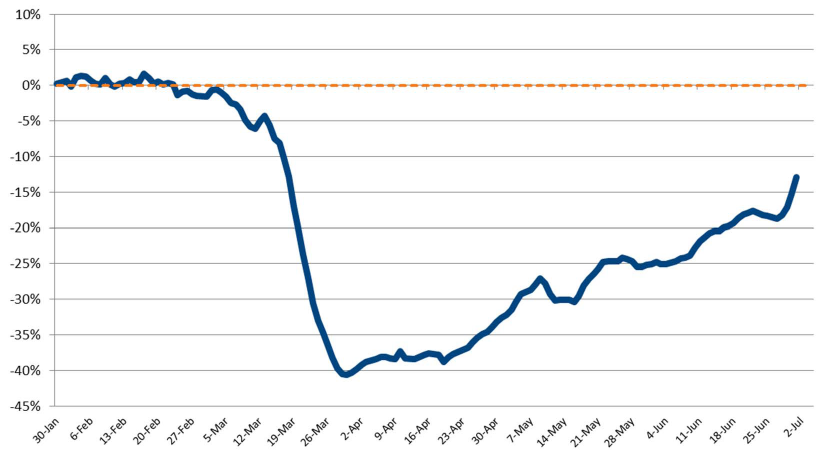

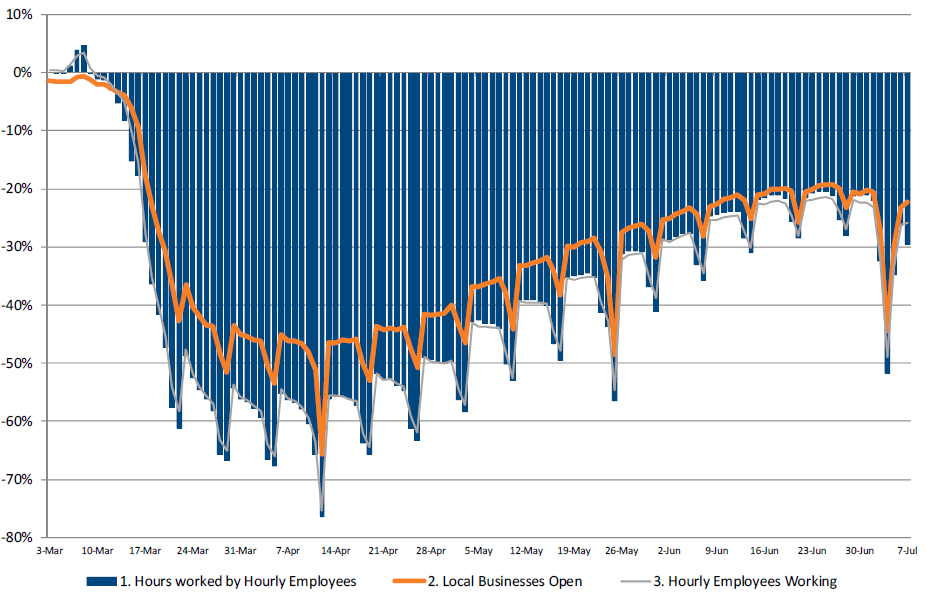

In the end, we do believe the world has seen the worst of the Covid-19 impact on the economy in that different parts of the world came to a grinding halt. It happened in China in January and early February, spread to Italy and Spain in February and March and gained momentum here in North America in March and April. Yes, we are seeing an unfortunate acceleration in parts of the U.S. that attempted to re-open too liberally. However, I do believe as you can see in the below U.S charts that worst is over in terms of number of business closed, consumer spending and hours worked by the population. As we speak with companies we are hearing about a lot of uncertainty and trepidation as we move into the fall and winter. As such, we remain vigilant and balanced for you and our families.

The next chart shows 1010 data’s panel of US consumer transactions that tracks the credit and debit card spending of 5 million US consumers. It is representative of year over year transactions and is not adjusted for cash or store credit spend.

Source: 1010 Data and SunTrust Robinson Humphrey Research

Source: 1010 Data and SunTrust Robinson Humphrey Research

Source: 1010 Data and SunTrust Robinson Humphrey Research

At my home where I have been spending a lot more time lately in this new found work-from-home environment, I have a collection of books by many of the world’s greatest money managers that I have studied to become a better allocator of capital. I have learned from these readings that there are many different ways to make money. There are those styles who practice purely growth investing and some who are purely value focused. There are those who invest in one country or one sector. Other investors will narrow the investable universe by market capitalization in either small, mid or large cap market capitalization companies. Increasingly there are those who will screen the investable universe by factors tied to Environmental, Sustainability and Governance issues. At Panorama, we look for one idea at a time, build a globally diversified portfolio by industry and market cap. We are neither pure value or pure growth – we simply look for growth where we are not asked to pay too dear a price for that growth we believe will occur. And ideally, we find growth in earnings and free cash flow that is not fully appreciated by other investors.

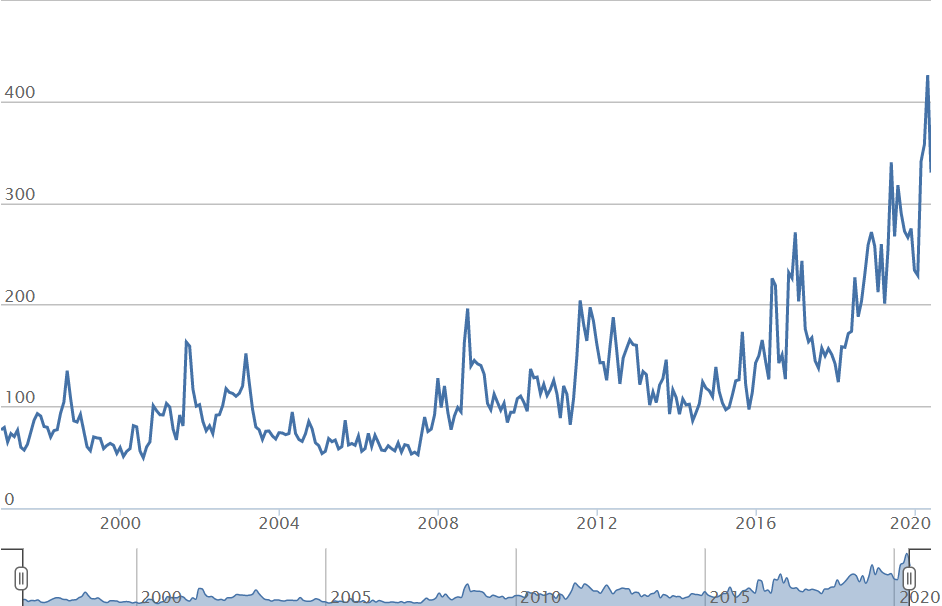

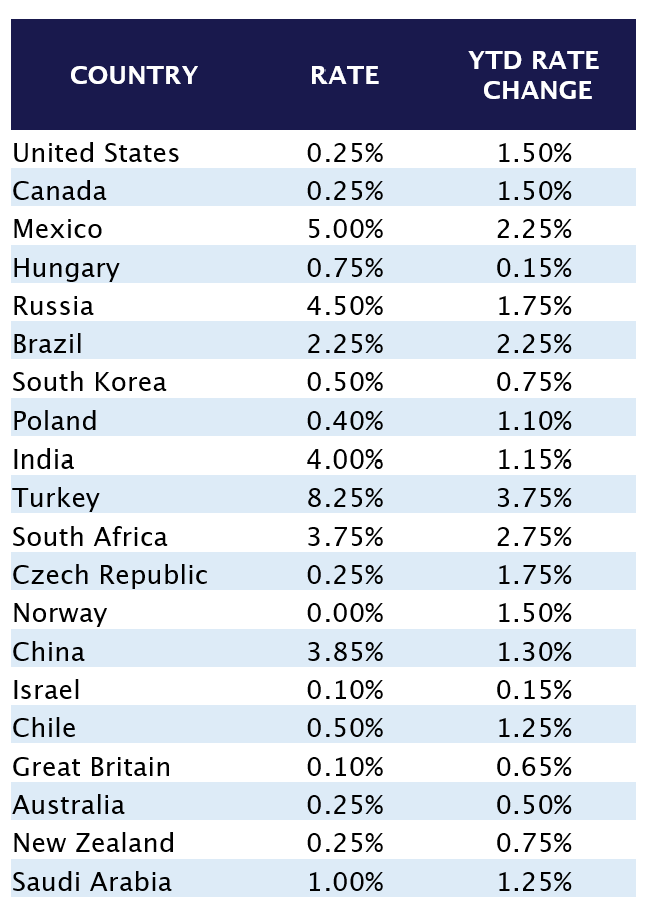

One definition of Panorama is “an unbroken view of the whole region surrounding an observer”. With the Panorama Fund we have an investment process and approach that hunts for opportunities that hopefully broadens the opportunity and risk management set for clients. Our team is executing its research process to look for situations to go long with likely improving fundamentals from an earnings and free cash flow perspective into 2021 and beyond. We will look to avoid companies with deteriorating fundamentals and poor capital structures. The really positive news in the first six months is that we have seen a global synchronized interest rate cutting exercise by central banks take place as shown in the chart compiled by my colleague Colin. This is good news for equities moving forward since rates will need to be ‘lower for longer’ to help those industries truly in trouble as a result of the crisis. We continue to thank our clients for their support and confidence in our research process and continue to donate a portion of our income to local charities to help those families so negatively impacted by this global pandemic.

Source: Wealhouse, Bloomberg