Panorama First Tracks 2021

All four Wealhouse strategies returned double digits in 2020. With another strong performance year behind us, CIO Scott Morrison addresses the next global economic challenge: deflation.

Happy New Year. I am very glad to report that all Wealhouse strategies returned in the double digits for 2020.

The world of science also had a great year. In less than 12 months, the hardworking scientists at Moderna and Pfizer came up with an effective vaccine for Covid-19, the worst global pandemic since the Spanish Flu in 1918. During my career I have seen tragic natural disasters, horrible terrorist attacks, company frauds and bankruptcies, wars and many other negative macro events. On the other side, I have seen people, industries and companies recover from these negative events. Thanks to the hard work of the frontline workers and scientists, we also expect to recover in 2021 and the years beyond.

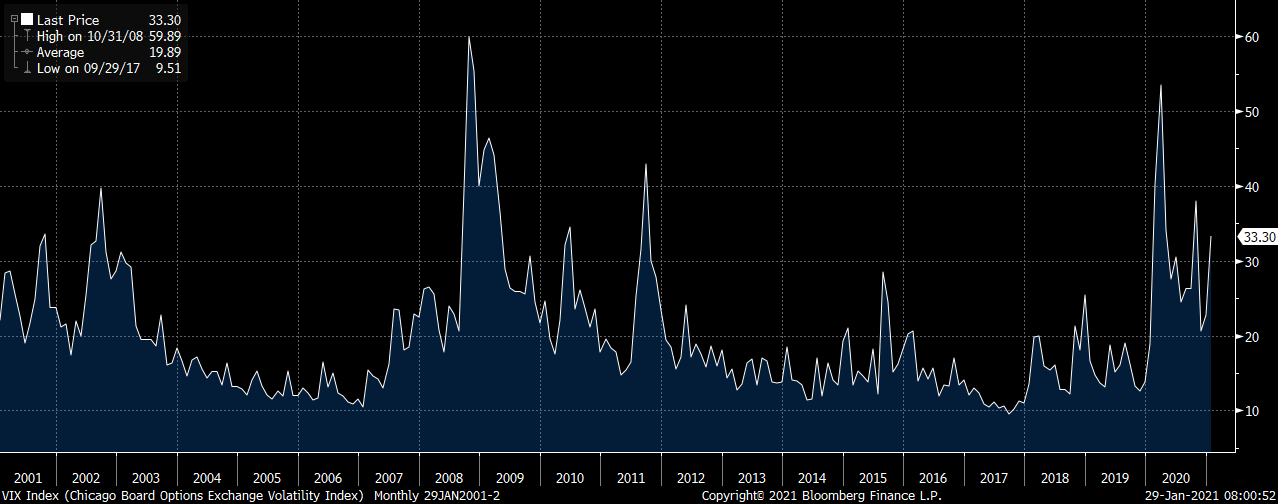

We naturally expect that there will be setbacks as people question the efficacy of these vaccines against new strains of the virus. We will take advantage of these dislocations to add to businesses from our approved list that we expect will emerge stronger on the other side of this crisis. The chart below illustrates how volatility (which is a proxy for fear) is approaching historical highs. 2020 was a year in which they, who invested against the fear, won. We will become much more conservatively invested when we see signs that fear is too low. Until then, we will embrace the volatility as it spikes and causes pull backs in companies that meet our bottom-up investment checklist.

Source: Bloomberg

Our team performed well and made money for clients for the year. More importantly in my mind, we protected that money during the biggest market sell-off since World War II. I started Wealhouse and Panorama Fund in 2008, founded upon the thesis that there was too much debt in the world, and corresponding impending risks to the financial system. I wanted to have a product with tools and investment flexibility that was not available to me in the mutual fund industry in which I grew up in. Twelve years later, I am amazed that the amount of debt in the world has grown exponentially.

My New Year’s resolution is to stop showing debt charts from governments, since everyone knows that they have gone way up and to the right –- way, way up. And as we have seen year after year, increasing debt levels does not mean that equities and bond prices will go down. As we leave 2020 behind, it is important to realize that the tremendous value opportunity set from six to nine months ago is not as prevalent. Based on our bottom-up research, there are still strong opportunities to invest in businesses that can continue to grow earnings and free cash flow, especially as the economy will likely recover stronger in 2021 and 2022 than many would believe.

Unfortunately, I truly think that central banks have completely underestimated that the more debt they print, the more deflationary it is. I am always surprised at how many market commentators simply consider that the printing of more money will be reflected in inflation numbers. The reality is that more and more money is being invested in new technologies that cause disruption and deflation. In December, we saw Airbnb go public. By using the internet, its founders built and scaled a business that allows individual real estate owners to offer overnight accommodations and compete with hotels. It is not lost on me that they built a business more valuable than Hilton, which was founded after the Spanish flu epidemic. On the other hand, Airbnb was founded in 2008, the same year Wealhouse was founded, and just went public with a market cap of $112 billion.

It is amazing that during a global recession and travel depression how a company levered to the travel economy was able to have such a successful IPO event. The numbers below illustrate that Airbnb did not make money in 2019, nor in years prior. Since 2008, the company raised over $2 billion in funds to cover its losses, and grew its capabilities to better compete with and disrupt the other longstanding companies mentioned below.

| Company | Enterprise Value | Revenue (2019) | Profits (2019) | Year Founded |

| Airbnb | $114B | $4.8B | ($675M) | 2008 |

| Bookings | $80.6B | $15B | $4.3B | 1996 |

| Marriott | $49.5B | $21B | $1.3B | 1927 |

| Hilton | $37B | $9.5B | $0.9B | 1919 |

Airbnb also encouraged real estate investors to buy condos and homes with leverage, and become real estate landlords in popular cities. I personally met a woman last summer who owned 65 condos in downtown Toronto – all financed with debt. When the world shut down and people no longer travelled to international cities like Toronto, the market was flooded with new rental accommodations to compete with the apartment industry. According to Global News, “the average condo rent was down [in Toronto] by 16.5% year-over-year.” The article stated that, “…new data showed 12,584 condos were rented in the quarter, up by about 86 per cent from the 6756 rentals in the same period last year.” It is interesting to note that despite the many more condos for sale, prices fell only 1-2% according to this source. In my opinion, this supports the theory that the collapse of interest rates opened up a buyer pool that could afford to buy from those who needed to sell, with a view that the deflationary price decrease is only temporary.

I return to the lady who owned 65 condos, with debt. Was she smart to end the year in a position to sell her condo assets with only a modest hit to her equity — or was she lucky? Personally, I think investors were very fortunate that global central banks saved the day back in April/May with the unprecedented printing of money. As a result, many sins were forgiven. Investors who owned companies with much debt got very, very lucky in my opinion. During March, I was very comfortable with our investments because I knew they had truly clean balance sheets with little to no covenant risks. That is not luck. That is a capital preservation strategy and conservative investing process. At Wealhouse, we prefer not to depend on central banks to rescue our investments.

I question why anyone might expect otherwise of the central banks, after what they did following the 2008 financial crisis. I also ask myself why anyone would be afraid to take financial risk, when it seems that central banks always have our backs? Why would an ordinary citizen feel the need to save for a rainy day when governments keep handing out cheques? As investors, I feel that we should be aware of how governments and their central banks take such actions seemingly heedless of the potential for unintended consequences. I believe that we should stay tuned for the aftershocks and ripple effects of such monetary and fiscal policies, because there is more debt today than ever before.

I have long been witness to the debate about inflation versus deflation. Markets seem perpetually engaged in a tug of war between whether or not monetary stimulus will create a runaway freight train of price increases and wage pressures. My view is that we will see some pockets of inflation in 2021, but no rampant inflation. I say this in part because we own certain companies from around the world that are inventing technology that will allow for more and more automation in the future. This will stymie wage inflation like we saw in the 1970’s. We read with interest a CBC article summarizing the comments of Canada’s central bank chief on the subject:

“Inflation numbers out Wednesday showed prices rising at the slowest rate since the financial crisis of 2009, plunging in December to an annual rate of 0.7 per cent — well outside the central bank’s target range of between one and three per cent. The Bank of Canada expects that number to bounce back this year to an ostensibly comfortable two per cent, but as Macklem described, that will be deceptive. ‘This is expected to be temporary,’ he said. ‘The anticipated increase in inflation reflects the effects of sharp declines in gasoline prices at the onset of the pandemic, and as those base year effects fade, inflation will fall again, pulled down by the significant excess of supply in the economy.’“

Below we have put up two slides we keep up to date on a regular basis as part of our research process and to serve as guideposts. As a quick reminder, a green check mark “✓” means we are bullish, an “N” stands for neutral and a red “X” means we are bearish. As you can see below as we ended 2020, we see more good than bad when it comes to future prospects for stocks. The second chart also helps to show that lower bond yields are supportive of stocks from around the world. We are looking to take advantage of contrarian opportunities in 2021 where we don’t believe the recovery is fully reflected. We wish everyone to stay safe as we are in for a long winter and that next year at this time that everyone who wants a vaccine will have received one.

| Index | Earnings Yield | Dividend Yield | 10Y Gov’t Yield Today | 10Y Gov’t Yield 04-2011 |

| S&P 500 | 5.1 | 1.56 | 1.05 | 3.4 |

| S&P TSX | 6.8 | 2.95 | 0.81 | 3.23 |

| FTSE | 8.0 | 3.21 | 0.29 | 3.56 |

| CAC 40 | 6.8 | 1.98 | -0.31 | 3.61 |

| DAX | 7.4 | 2.62 | -0.54 | 3.25 |

| NIKKEI | 4.7 | 1.44 | 0.03 | 1.25 |

| HANG SENG | 8.9 | 2.33 | n/a | n/a |

| ASX | 5.3 | 2.76 | 1.12 | 5.5 |