Optimism that Just Won’t Quit? Or is the Market Getting Ahead of Itself?

In his Q4 commentary, Lions Bay Fund portfolio manager Justin Anis, CFA discusses his views and outlook on the continued bull market.

Lions Bay ended 2019 with a very strong year. At the start of last quarter, the investment community was fretting over an imminent global recession after a slew of deteriorating economic data, an escalating U.S./China Trade war, protests in Hong Kong, impeachment proceedings in Washington, and disruption in obscure overnight funding markets — just to name a few!

Markets were pricing in a lot of bad news. Within weeks, many of these concerns were resolved and the market broke out to new highs in dramatic fashion. The United States and China reached meaningful progress on trade, agreeing to strike a partial trade deal.

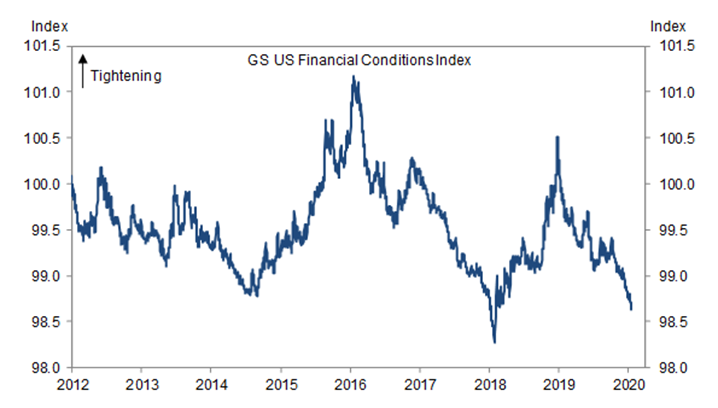

On October 30th, the U.S. Federal Reserve cut rates for the third time that year and instituted a treasury purchase program to address funding concerns, which many market participants have interpreted as a form of quantitative easing. The below chart of the Goldman Sachs Financial Conditions Index shows how dramatically financial conditions have eased in the past quarter.

2020 has had a very eventful start to the year. The U.S. and China at last signed a “phase-one” trade deal in China, taking some U.S. tariffs off the table while China committed to increased purchases of U.S. agricultural products to narrow the trade deficit. Tensions in the Middle East flared following a U.S. drone strike in Iraq resulting in the death of a top-ranking Iranian general followed by the tragic downing of a Ukrainian airliner. Impeachment articles were sent to the Senate and the trial is now underway. Fears are emerging over an outbreak of a coronavirus in China. All in just three weeks! However, despite of all these events, markets have been very resilient in the face of negative news and are close to all-time highs.

We see reasons for caution in the face of the markets’ optimism. The rebound in stock prices has largely been driven by multiple expansion, in our opinion, meaning investors are pricing in a rebound in sales and earnings. As such, we think high valuations leave little room for upside surprise should corporate earnings deliver, while exposing investors to considerable downside if earnings growth doesn’t arrive.

The charts below do a good job of highlighting the valuation risks in the market at present. The first chart shows the historical Price-to-Sales ratio of the S&P 500 over the past 20 years. As you can see, the chart is close to its all-time highs meaning investors have never been willing to pay more for a dollar of revenue. The second chart shows Enterprise Value/EBITDA over the same time period, which is another valuation measure that considers the total value of a company’s debt and equity relative to their operating earnings. This ratio is also showing valuations at close to 20-year highs. Investors have rarely been rewarded for buying at the highs on either of these charts. We will be eagerly watching the Q1 earnings season for evidence to justify the high level of optimism.

We have come a long way from the synchronized global slowdown narrative that dominated this past fall. Markets are a discounting mechanism, and they have discounted a fairly robust economic recovery. We do not know if such a recovery will materialize, but we see one increasingly getting priced into equities, leaving an uncomfortable level of downside risk should the lacklustre data continues.

The chart below shows the Citigroup U.S. Economic Surprise Index, which has yet to show a recovery in hard data. Positive readings on this chart indicate that economic data is coming in ahead of analyst expectations, indicating robust economic growth, with readings close to 80 occurring in past expansions while negative readings indicate contractions.

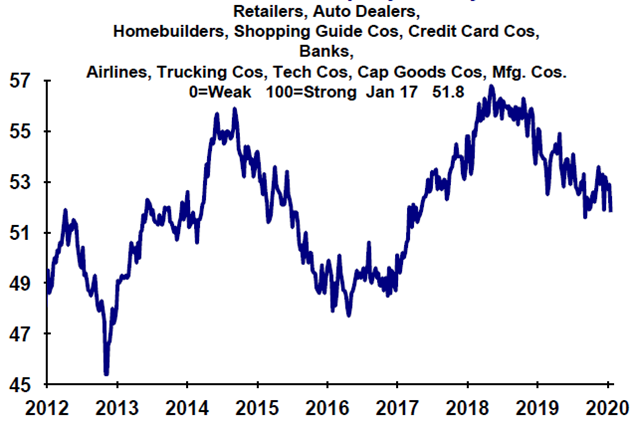

Another interesting chart is a higher frequency data set gathered by ISI Group which surveys U.S. businesses across a diverse variety of industries. This data tends to be more coincident with business recoveries, as illustrated by the robust move in 2017 which coincided with a terrific year for equity markets.

We certainly hope that investors are proven correct in their optimism and that we are in for a robust economic recovery and continued bull market. However, at current valuation levels we do not intend to take the same level of risk as we did last year and anticipate maintaining lower exposure levels in the near term. We will not take risks that we do not feel we are being compensated for. If the markets’ high level of optimism transforms into full blown euphoria, we would get very excited for the contrarian opportunities available given the unconstrained tool set of the fund.

Please don’t hesitate to reach out if you have any questions about the commentary. I look forward to reporting to you at the end of Q1.