On the Road to Recovery

With vaccination programs well on their ways around the world, CIO Scott Morrison talks about which stocks he is picking for Panorama Fund as the industries regain their momentum.

Last year during the first quarter, at the start of the on-going pandemic, the downside protection we put on helped the Panorama Fund against the major declines induced by COVID-19. In 2021, with the addition of a credit strategy in Amplus Credit Income Fund, I continue to advocate for our clients to be balanced across all our funds, as each are managed with different approaches to risk. For example, our long-only small/mid-cap fund, Voyager Fund, which I run, was up low-double digits during Q1 this year, giving my family a very barbelled exposure to markets.

I can completely understand why politicians and central banks feel very emboldened and justified to take on unprecedented amounts of debt in response to this tragic global pandemic. However, I do believe that there also will be unintended economic consequences and risks that Panorama Fund will primed to weather. There is no way in my mind that the massive surge in debt as a percent of global GDP seen in the last year, will not weaken global economic growth moving forward in the medium and longer-term. For now, we will continue to focus on buying individual companies that can grow earnings and free cash flow despite these macro headwinds.

Sometimes, when it rains it pours. During the first quarter, our investment in China’s e-commerce powerhouses, Alibaba and Tencent, got hurt as China decided to clamp down on businesses that they felt were growing too fast and too far in influence. As many have read over the last decade, “data” is the new gold. Last year, we took advantage of the global stock market sell-off to invest in the leading, very profitable, data-gathering franchises of Alibaba, Meituan and Tencent, that serve the largest and arguably the most sophisticated digital population on the planet. We had held onto our holdings in Alibaba and Tencent due to what we felt were still attractive valuations versus future growth potential. We exited the home delivery company Meituan because we thought its valuations went too far and competition for grocery delivery was increasing in a major way. Both stocks were down over -20% from their highs in February. We did trim some and take profits but have kept core positions that suffered as China started an inquiry about how to regulate companies like Alibaba and Tencent’s data accumulation competitive advantages.

At Wealhouse, we always look to invest in companies with significant competitive advantages. We are of the view that adding to our positions in these powerhouses at prices made attractive by regulatory overhang will be the appropriate contrarian approach. The Chinese authorities concerns only validate their significant competitive advantages. We know that it is not an apples-to-apples comparison to relate my experience watching Microsoft and Google continue to grow even after receiving negative fines for anti-competitive behavior, but we believe that this will be the case for Tencent and Alibaba longer term. Both Google and Microsoft have market caps well over a trillion dollars. We fully anticipate that Tencent and Alibaba will join the trillion-dollar market cap club in the years to come. As we write these comments, Alibaba has been fined over $2.5 billion dollars by China for limiting competitive choices of merchants that sell on their e-commerce sites, and the stock is up +7%! Longer term, we believe this will be a small price to pay for a fantastic set of franchises that will generate significant growth in earnings and free-cash flow as you can see by our estimates below.

Both companies have investments in other companies that make them look even cheaper from a sum of the parts basis when you consider their balance sheets. Alibaba owns over USD $90 billion in third party stakes versus its market cap of $655 billion and Tencent has over $200 billion in public traded company stakes in companies versus its market cap of $770 billion. Alibaba is set to generate over $20 billion this year in free cash flow while Tencent will generate over $25 billion. These companies are too important to the Chinese consumers they serve to be too harshly punished or disrupted if China wants to continue its push to being the number one economy in the world this decade in my opinion. As you can see in the numbers below, these companies can still grow earnings and generate material free cash flow growth moving forward.

An example of an individual company in which we have invested for the long-term is Dunelm from the U.K. It is a leading domestic U.K. home furnishings retailer. As the U.K. re-opens, our opinion is that Dunelm’s financials are more attractive looking going forward. Most of Dunelm’s sales come from brick and mortar locations that have been closed in the U.K. for much of the last year, due to the lockdowns around COVID. Our thesis in part is that from this point forward, Dunelm can outperform its competitors as consumers will return to stores to buy furniture. Yes, e-Commerce is here to stay and will grow, but we feel the premium is already priced into many online retailers’ stock prices. In Panorama, we admire that premium, we just do not want to pay any price for that growth.

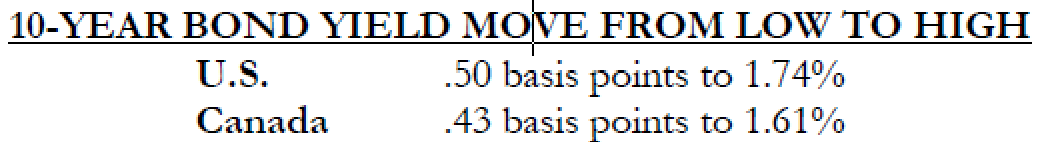

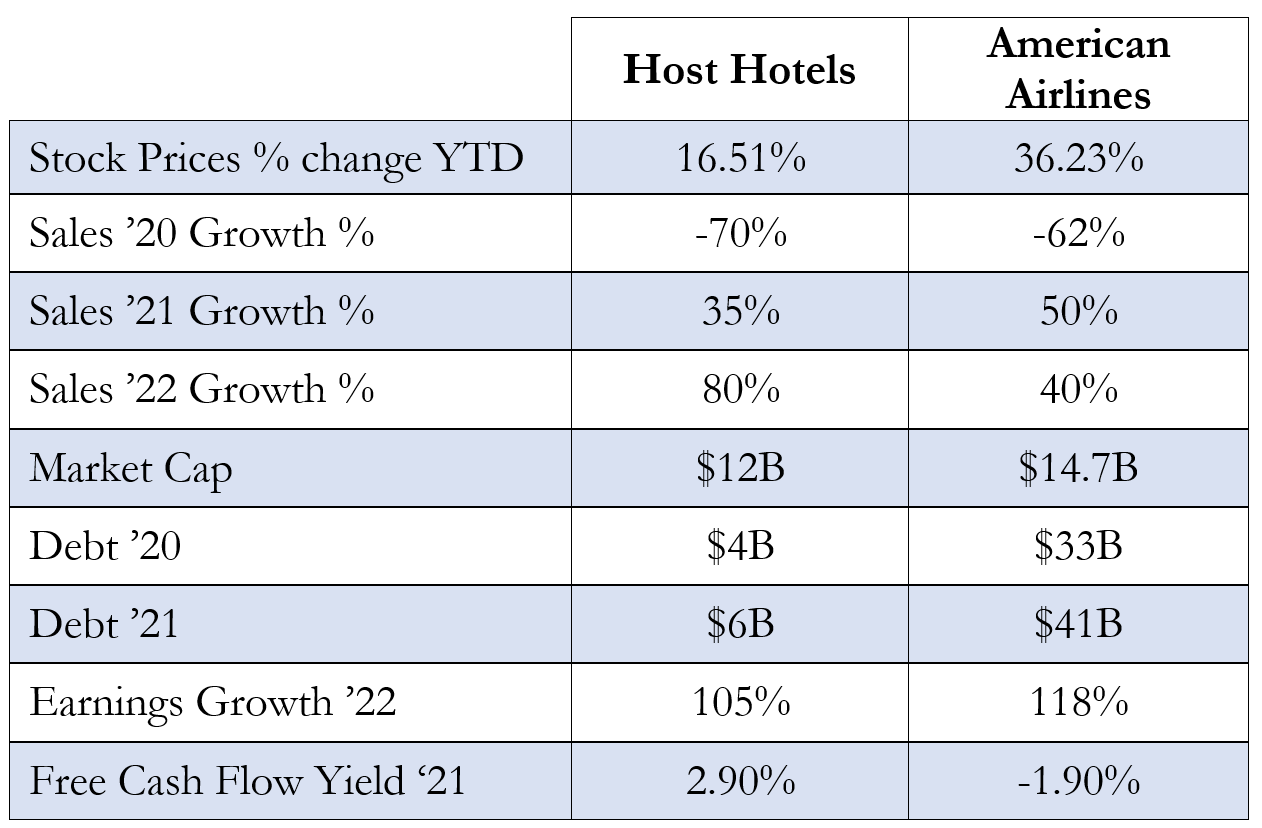

Another sector that will recover as more people get vaccinated is the travel industry. However, not all travel stocks will recover at the same pace. Let’s compare two companies we’ve extensively researched: Host Hotels and American Airlines. Both companies benefit from travel, whereas the quality of their respective assets is far different in our opinion. Host Hotels owns some of the most desirable hotels in the United States, in unique and irreplaceable locations, that sell way below replacement value. However, American Airlines has standardized planes that are significantly under-utilized and depreciating at present due to a lack of international travel, which we believe will remain depressed for longer than investors expect. When each company’s financial metrics are considered, as below, we would much rather own the company with the better quality balance sheet and potential to generate free cash flow due to having far less of a debt burden. And as you can also see in the two charts, our view has been validated by traffic and pricing stats for airlines and hotels. We stick to the view that hotels will benefit from those who fly, and those that are less than eager to fly – even when everyone is vaccinated – can still drive to hotel destinations. If there are unanticipated hiccups around the virus with variants, problems achieving herd immunity or the vaccines not providing anticipated coverage, things could go very wrong very fast for a very levered company like American Airlines, which is still bleeding money every day.

One area that helped the Fund during the first quarter were our investments in resource companies that are benefiting from a strong rebound in demand for their materials. For example, as the world moves more towards electrification for transportation, the Fund has benefitted from its investment in leading platinum and copper supplier, Anglo American, from South Africa. The stock was up over +20% during the first quarter and took its free cash flow from $1.5 billion in 2020 to over $6 billion this year, on a market cap of $52 billion. Our investment in these companies is not premised on seeing rampant inflation, because in my experience with commodities, if the price is high enough users will eventually find more efficient substitutes and/or the supply will increase as per Economics 101. Another company in which we have built a position based on this substitution thesis is Norsk Hydro. It is one of the world’s lowest-cost producers of aluminum thanks to its tremendous access to

hydroelectricity assets. At present, there is a secular move towards aluminum use over steel because of its lightweight nature and rising steel prices. Steel prices are rising in part because of a pivot and recognition in China, that producing commodity steel is a very high emissions-generating business. Unlike Norsk, China has very little access to hydro.

Another company that, like Anglo American, has a double-digit free-cash flow yield is CI Financial, my previous employer. It has grown into our top ten this quarter. It caught my eye at the end of last year when I saw my previous boss step-up to buy shares personally. Every day at Wealhouse, I get an automatic email that highlights which management teams are buying their stock, both personally and at the company level. Over the course of my career this has been a useful tool to screen for potential investment opportunities. I note for our investors that since December, insiders have purchased over $11 million of shares and the company itself bought back over $50 million this past March alone.

After speaking with the relatively new CEO of CI Financial at the beginning of the quarter and going through his aggressive U.S. acquisition plan of Regional Investment Advisory (RIA’s) firms, we bought the stock and have seen it appreciate over 20%. We feel in many ways that the strongest of the headwinds for this mutual fund company came from Exchange Traded Fund (ETF) fee pressures and are now being more than balanced by the new expansion plans south of the border. This will help CI grow into the U.S., coupled with the fact that the new CEO hired his former colleague – the CFO of Wisdom Tree. When we find stocks that are cheap, it is an important part of our process to make sure a cheap stock also has a route to future growth, or we risk getting caught in a ‘value-trap.’ Overall, we believe that the wealth management business will continue to be a growth business moving forward, and CI’s platform can continue to expand its product line-up and geographic reach through their expansion plans, which can be funded in large part by their free-cash flow generation. As well, we believe that bringing on new management to its executive team and listing in the U.S. market could broaden its shareholder base over time.

One area of the market that hurt us over the first quarter is our small investment in the banking sector. We put about 5% of the portfolio in banks after the crisis which, versus the 15% to 20% for most major benchmarks, has obviously been too little. The best performing banks in our portfolios are Barclays in the U.K. and Resona in Japan. Both were up over +25% year-to-date. These banks are both benefitting from the improvement of underperforming divisions that previously lost money due to last year’s negative domestic interest rates. Those rates have now turned positive. And from a valuation perspective, both banks were trading far below tangible book value with the expectation that these would steadily climb in the years to come, as fundamentals improve through management self-help strategies.

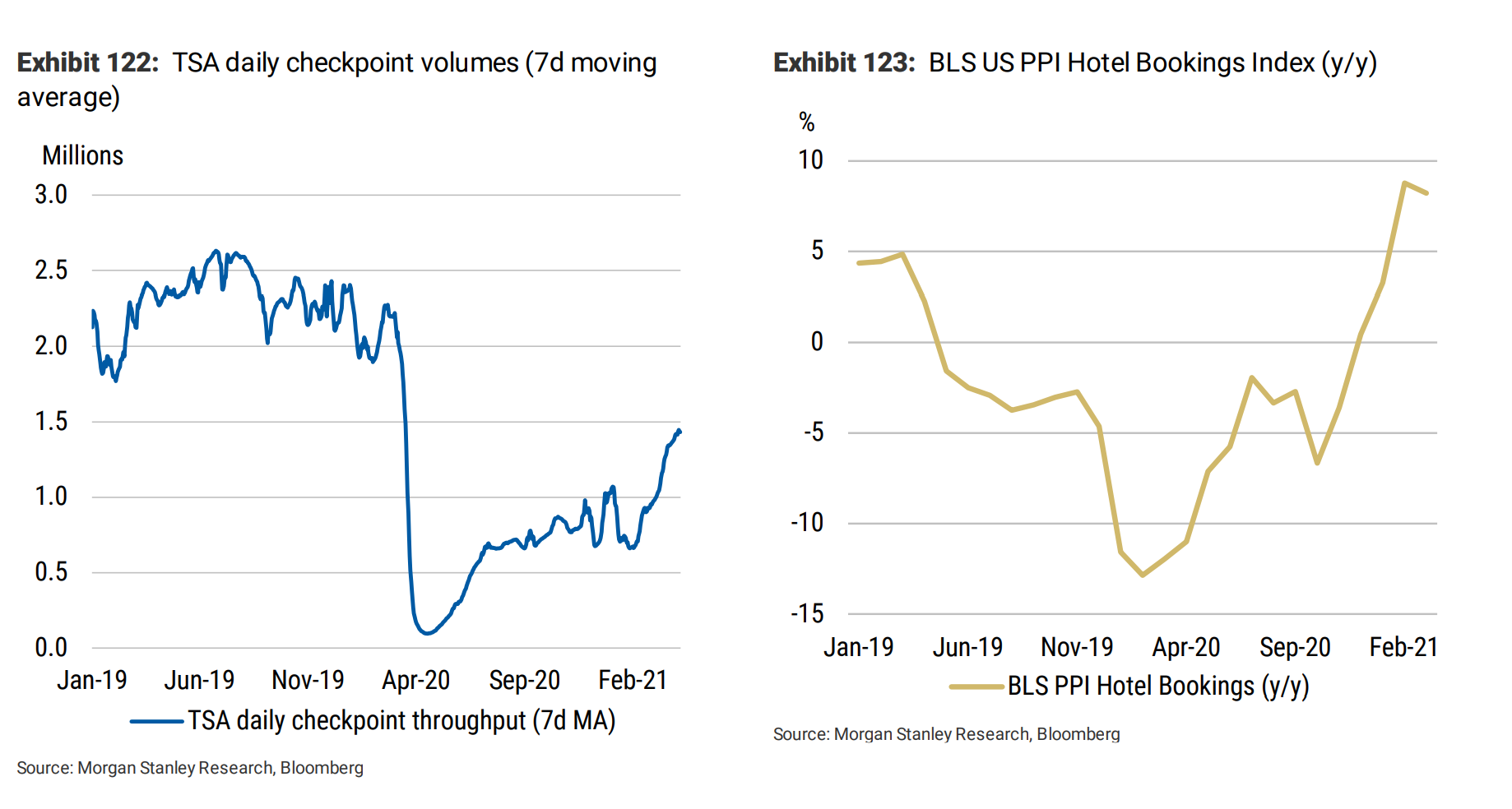

I have to admit that I was very biased against banks pre-COVID. Our research indicated secular declines in net interest margins due to both an increase in Fintech companies and direct lending from new entrants such as private equity firms. Further, there was evidence of increased underwriting risks due to the technological disruption of counterparties. All these trends meant that many banks in the world would likely see a declining return-on-equities. Over the short-term, we underestimated the magnitude of the impact from government stimulus programs. Never before in my career have I seen such large amounts of money given to prevent individual and corporate bankruptcies. According to a recent article in Bloomberg, and as you can see in the below chart, “Canada’s central bank has been buying a minimum of $4 billion in government bonds each week, accumulating more than $250 billion of the securities over the last year. It currently owns a little more than 35% of the total market of outstanding debt of the government of Canada.” As a result, the capital structures of Canadian banks have weathered this financial storm better than we assumed would be possible during a recession. We still believe, however, that over the long-term, banks face the same structural headwinds that make us less inclined to chase new investment in them.

As I write these comments, populations that have received their first shots of the vaccine, according to research obtained from Goldman Sachs, stands at 61.5% in Israel, 47.3% in the U.K., and 35.9% in the U.S. According to the government of Canada website, 15.2% of Canadians have received their first vaccine. In part because we indeed thought that Canada would lag behind vaccine rollouts, we kept our foreign-content exposure in Japan, the UK and Europe. Longer-term, we feel that Japan’s economy will outperform that of Canada, as they sell more to fast-growing countries such as China, and to companies with more proprietary technology such as our technology-related holdings in Shin-Etsu, Disco, Sony, Toshiba, Fuji Electric, Recruit, Hoya and Square Enix.

As the vaccines continue to roll-out, we believe that Hugo Boss from Germany is one company that will benefit our portfolio. Hugo Boss sells higher-end clothes not typically worn when so many of us are prevented from heading into the office or socializing. We believe that there will be pent-up demand for such clothing as normal socialization patterns return in the quarters and years to come. I turned 50 this past month and was obviously limited to close family attending this milestone birthday celebration. My colleague Justin, who runs the Lions Bay Fund, similarly had to downsize his wedding plans near the end of last year. We believe that the Hugo Boss brand will survive and benefit from the re-opening of the economy, as people update their wardrobe and once again buy attire for special occasions and smart casual for the return to offices. Hugo Boss has also brought on new management from Tommy Hilfiger to help them improve their penetration into larger markets such as the United States and China. Soon after announcing this, the new CEO put in place his former architect of digital strategy in order to improve Hugo Boss’s online distribution capabilities. Hugo Boss should also benefit from rent reductions for their traditional brick and mortar business locations.

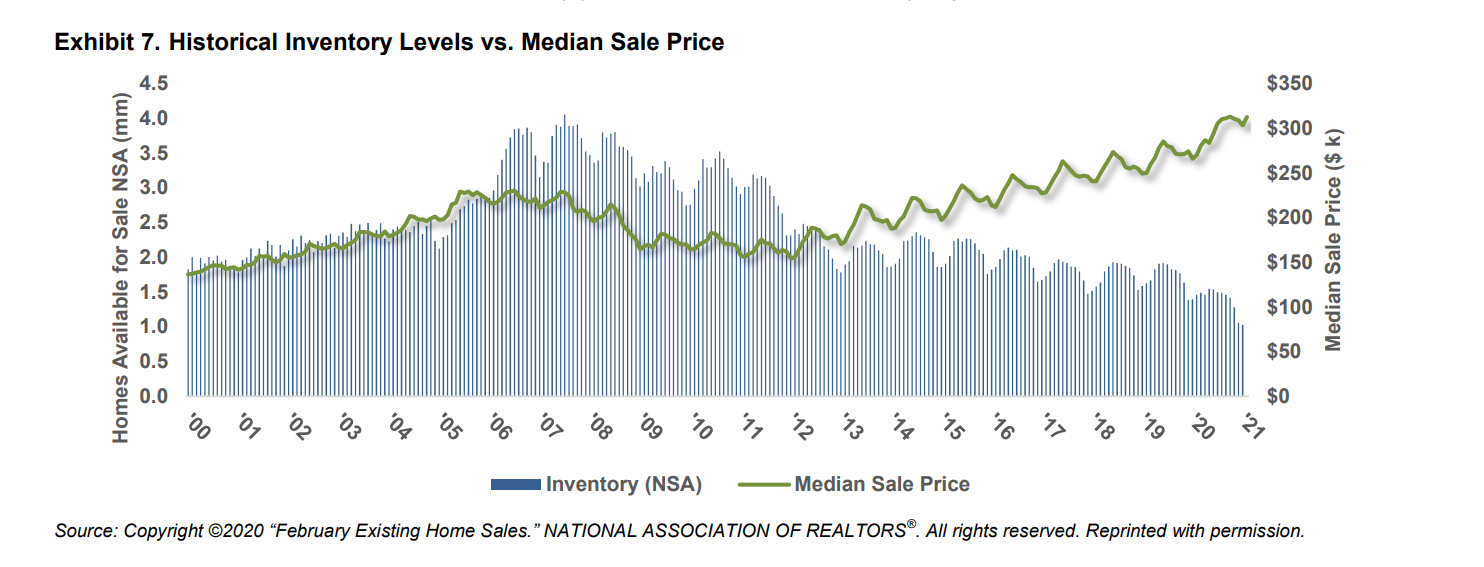

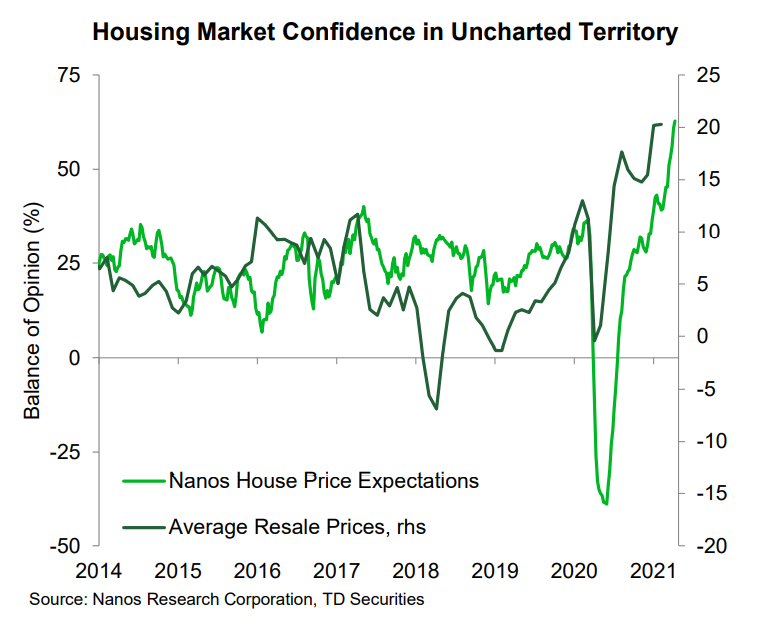

Companies related to the supply of new homes, as illustrated in the chart below, continue to benefit positive areas of our portfolio. Our investments in building materials businesses, single and multi-family rental companies and home improvement retailers are such examples. We must be watchful if interest rates continue to rise but as you can see below, there is a structural shortage of homes in the U.S., versus the demand of new household formation. The chart from TD Bank shows demand and expectations for house prices in Canada are at all-time highs. This is contrary to what we heard from CMHC CEO, Evan Siddall, who forecast last May, “a decline in house prices of 9 to 18 percent in the coming 12 months.” As previously mentioned, we, like CMHC, underappreciated the amount of government bail-out money that was thrown at the economy. We must now admit that banks will actually be better positioned to lend money to would-be home buyers.

In the end, Panorama is diversified around the world and more exposed to Asia and Europe than most of our Canadian peers. It is thus exposed to businesses not typical here in Canada, which in our opinion results in better long-term growth prospects. We have confidence in the earnings and free-cash flow growth potential of our long-term investments. We are balanced between some growth companies that we believe have been sold off too much because of a fear of much higher interest rates and some more value orientated businesses with opportunities to recover and improve their fundamentals moving forward. As well, we believe that our hedges will pay-off during market pullbacks and bring good balance to the Fund, despite their short-term costs this past quarter.