Note from the Credit Desk

Here is a quick update on the live market conditions from Amplus Credit Income Fund’s Senior Portfolio Manager, Andrew James Labbad.

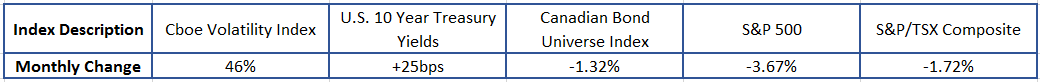

For the month of September, we have seen some notable moves in different indices and asset classes as shown below. Volatility has picked up with headlines involving Evergrande’s debt burden, the effects of possible bond tapering starting in November and a sudden surge in bond yields. This has caused investors to reposition their portfolios which we have previously touched on in our August Fund update.

On September 28, 2021, we saw equities indices lose generally 1-2%, with 10-year treasury yields rising 5bps.

Amplus has been well-positioned for this type of market move. Hedging out the underlying interest rate risk has protected our investors from this month’s draw-down due to a rise in yields. Our tactical hedges for heightened volatility have paid dividends. We are pleased with the performance in our credit strategy for the month, and we look forward to updating you next month with our performance and outlook.