Note from the Credit Desk

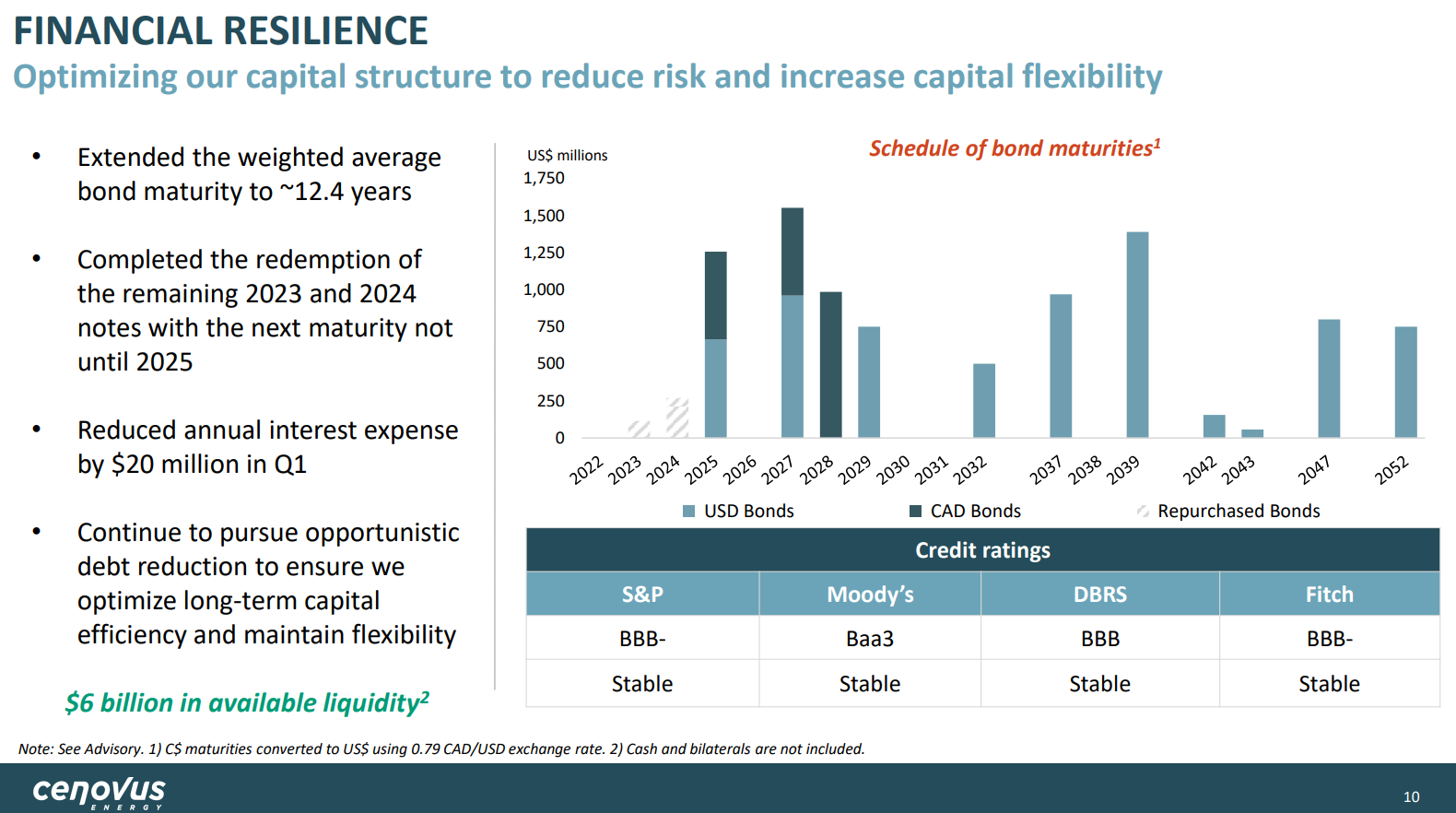

Our last credit note highlighted an increasing number of Canadian companies opportunistically redeeming their debt early at a premium. On that theme, Cenovus announced late yesterday that they were going to redeem early their CAD$ 2025 bonds on June 28, 2022. We held a core position in these bonds, and benefitted from this early redemption. Post-news the bonds traded up >2%.

Background on the trade:

On their Q1 2022 conference call held on April 27th, Cenovus openly highlighted their goal of reaching $4Bn in net debt by year-end. For reference, net debt, at the time, was reported at $8.4Bn. To achieve these goals, we had strong conviction that their earliest bond maturities would get taken out early at a premium. The company also had a history of taking out debt early.

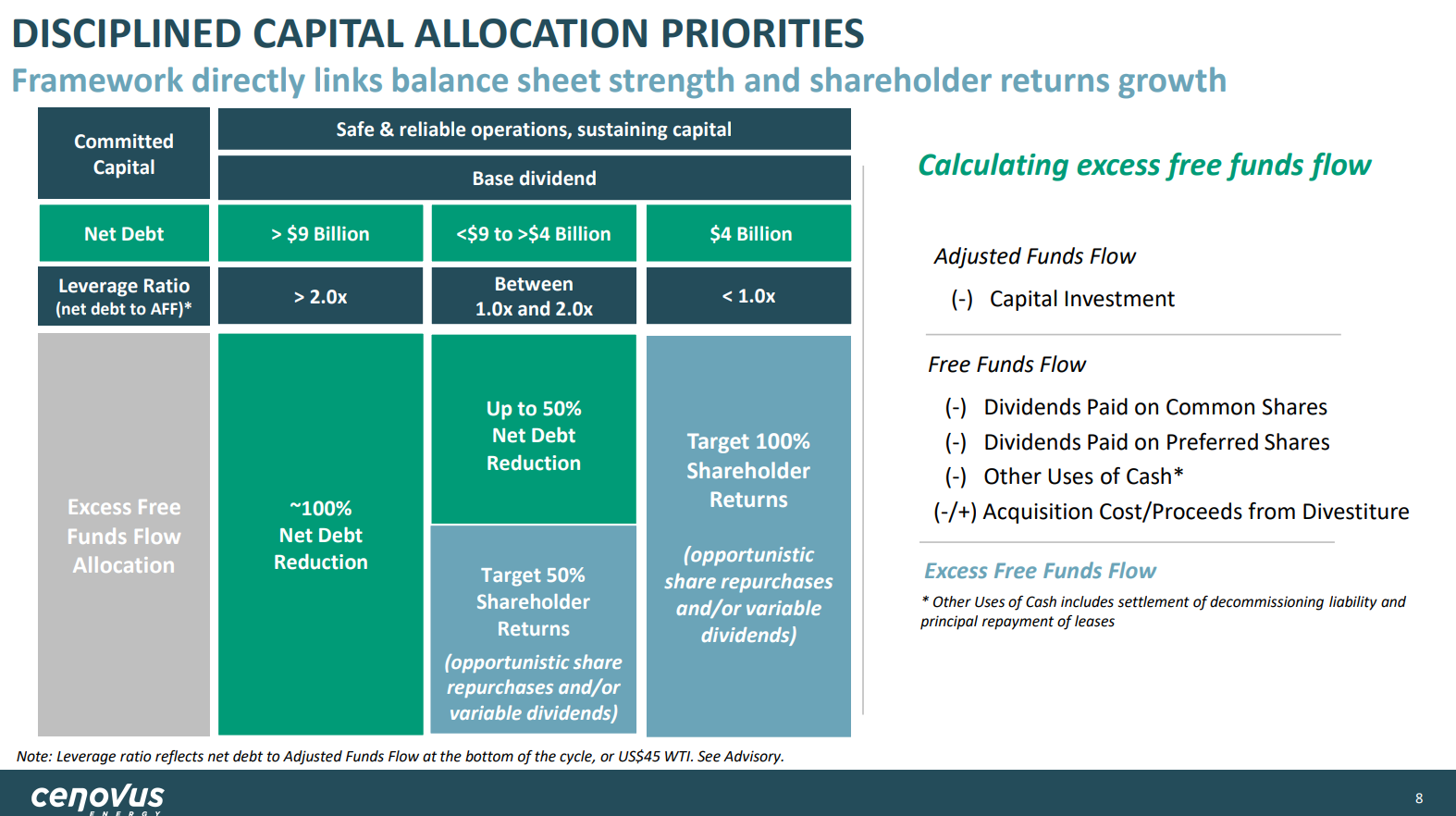

As the conference call ended, we started to aggressively buy their 2025 maturities. We saw these maturities as the highest likelihood of getting taken out before year-end. We also took comfort in our view when digging into the latest Cenovus presentation – up to 50% of excess free cash flow was to be used for debt reduction until $4Bn net debt is achieved.

Bigger picture:

At current WTI levels, the free-cash flow that many energy producers are generating should put them in a position to aggressively reduce debt and prioritize their balance sheet. We hold specific bonds in other energy producing companies that benefitted from yesterday’s announcement and we expect to see the same industry dynamics continue to play out in the near future.