Murphy’s Law

The latest commentary from CIO Scott Morrison, CFA provides his take on the current coronavirus outbreak, as well as the market’s reaction to it.

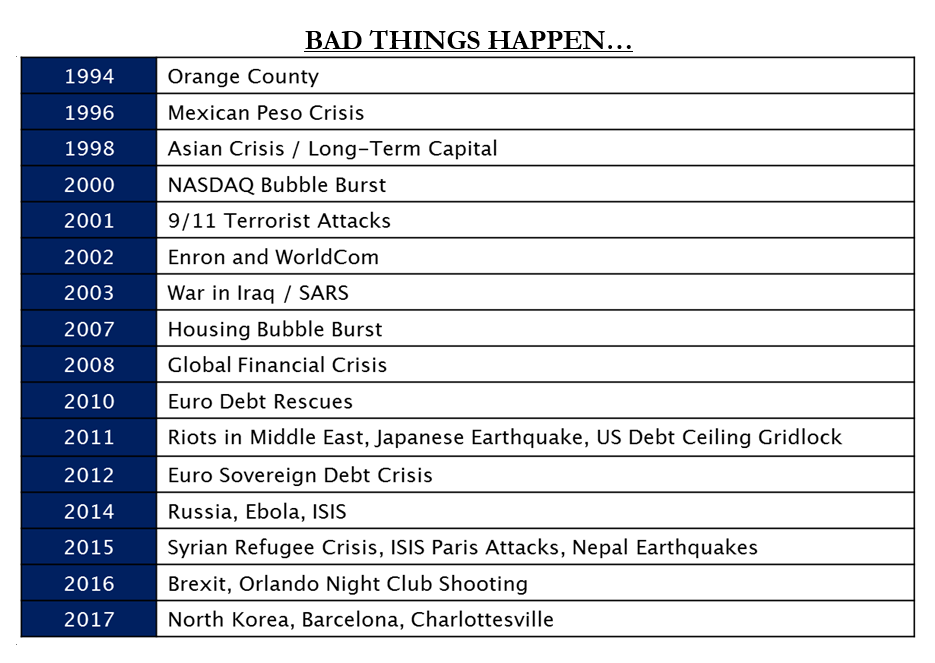

Longtime readers of our comments have seen our disaster tracker below. The chart is a list of negative events that have happened around the world, which impacted investor sentiment and market psychology during my asset management career.

In each and every case, they caused a market sell-off of a temporary nature. The start to this decade has unfortunately seen some very negative things happen. Our thoughts and prayers go out to the families of those aboard the Ukrainian passenger jet that was shot down over Tehran. Obviously, the military activities and fight between the American and Iranian powers led to this tragic loss of innocent lives.

Not long after this Middle East tragedy, the world discovered that China was battling the Coronavirus and as I write these comments, it has infected over 78,000 individuals on mainland China and is being attributed to the cause of over 2,800 deaths globally. This year is eerily similar to what happened in 2003, when there was the invasion of Iraq and the SARS outbreak in China. It is very difficult to predict these types of events but inevitable to assume that in each and every year, negative things will happen.

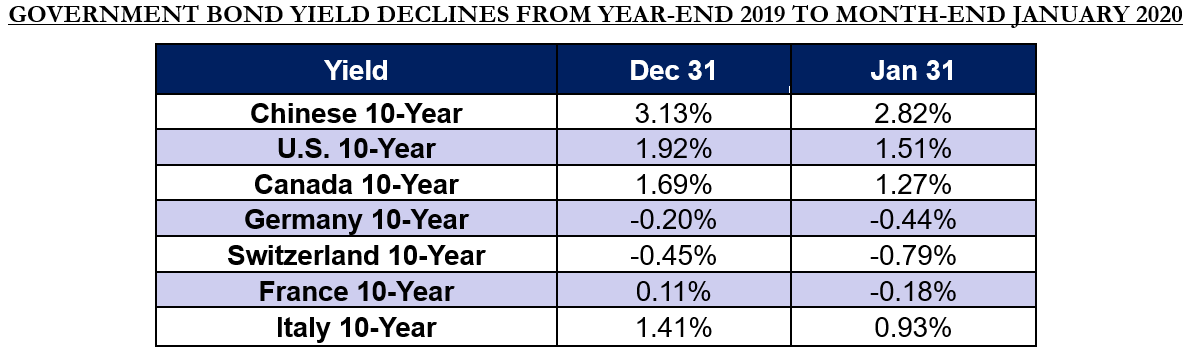

During January, we profitted on just over a third of our bond holdings when news of the coronavirus caused a major rally in bonds. Every night before I retire for the evening, I always look at our equity, fixed income, currency and commodity watch lists from Asia. On January 27, I was particularly struck by the magnitude of the rally in the Australian bond market, when the 10-year yield collapsed 15 basis points to a lower yield of 0.93%. The continued collapse in global yields is incredibly bullish for those who need to borrow money, and not very helpful to those who lend money, such as banks. The stats below highlight why rates are staying lower for longer. According to a February 4th article in Bloomberg, there was “a $2.7T jump to almost $14T over the past two weeks in negative yielding debt”. And yes, the T stands for trillion! Wow!

If we learned anything about how interest rates trade since the global financial crisis, it is that lower interest rates overseas typically foreshadows interest rates moving lower here in North America. The past year has seen a massive improvement for the U.S. homeowner’s cost of mortgage financing. For a brief moment in January, the U.S.30-year bond fell below 2% and as a result, American citizens can now borrow money in the low 3.6% range. This is very bullish for our long-term holdings in the housing sector as we enter the seasonally strong spring home-buying season.

Another positive economic tailwind, we believe, that will result from the tragedy in China is that fuel prices are coming down. Unfortunately, this is not very good news for the long-suffering energy sector, but it is great news in the short run for consumers’ pocketbooks. It is beneficial to leading retailers like Amazon and Home Depot, who will save cost on their global logistics, shipping to customers who now have increased purchasing power.

In January, I attended an analyst day sponsored by one of our Canadian-listed investments — Tricon Capital. Although Tricon is listed in Canada, the vast majority of its assets are in the U.S. More specifically, their assets are located in the “Sunbelt Region.” There is a major secular trend of increasing population growth south of the border in states such as Arizona, Florida and Texas because of their more favourable tax rates, warmer climates, and lower cost of living. Tricon made a strategic investment decision during the first half of 2019 that negatively impacted their stock price in the short-term, when they bought a 7,289-unit portfolio for $1.4 billion. This created a short-term overhang on the stock during the second half of the year, as they used Tricon shares to purchase the portfolio of assets. This represented a meaningful strategic pivot from their other businesses that included single-family rental, Toronto multi-family rental development and third-party private real estate asset management.

I believe that I understand how the second-generation CEO of this company is trying to position the company for the longer-term, in order to make money for his shareholders. It reminds me of a similar investment I made in Brascan in the early 2000 stretch that eventually became Brookfield Asset Management, one of the most successful private equity investment firms in the world today. We are still shareholders, but back in 2000, it was a similarly complicated and misunderstood investment thesis. We believe Tricon will simplify their business plan and continue to grow its most compelling asset classes.

Tricon is the first company listed in North America that has a greenfield land bank for future development of dedicated single-family rentals. Combined, this reflects ownership of over 20,000 rental houses and over 7,000 apartments for rent. The analyst day trip to meet their deep executive team highlighted their innovative use of technology to source and manage their properties. The proprietary platform they have built will allow them to attract outside investors and leverage their asset and property management teams to outperform peers who cannot scale technology initiatives. We believe that this will increasingly become an important competitive advantage as they harvest data from their tenants and asset base to become more efficient and popular landlords.

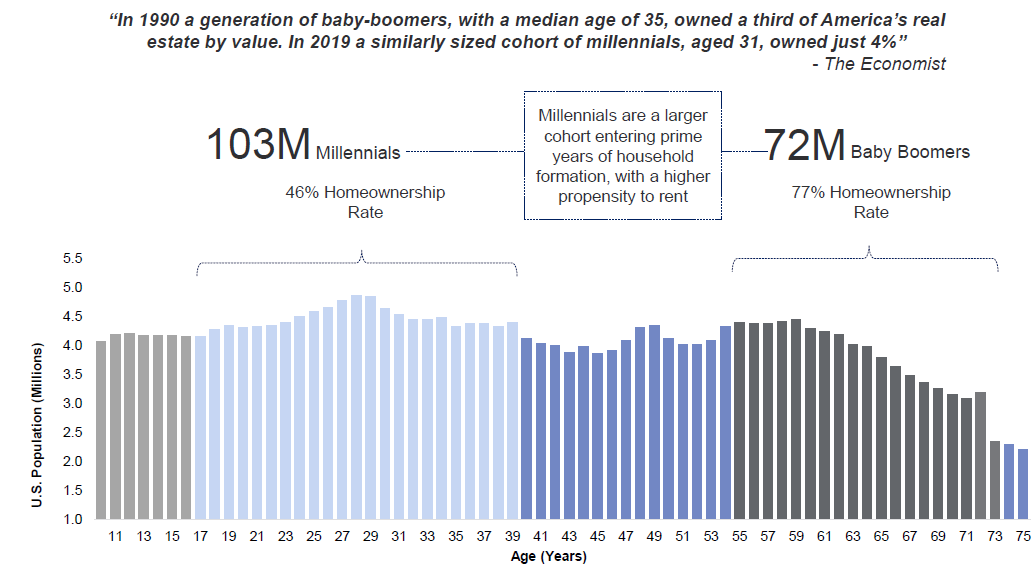

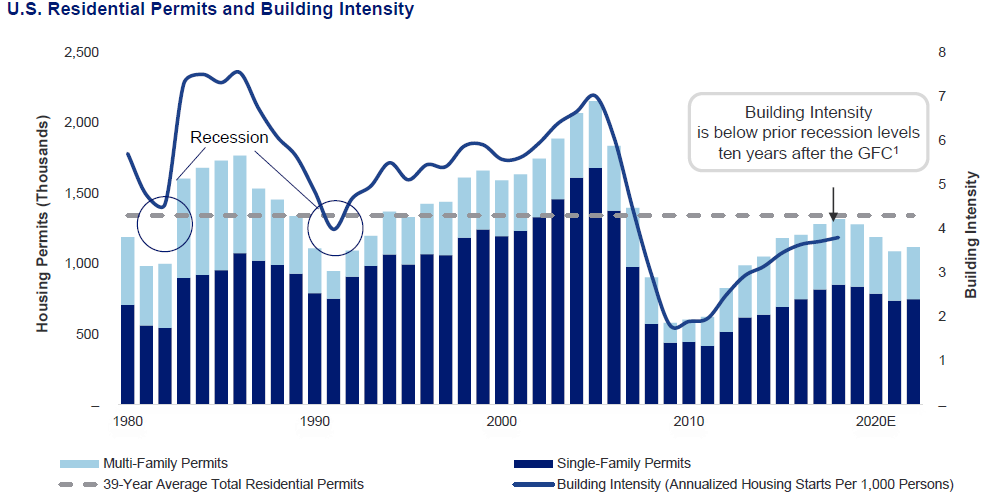

I especially like that the CEO owns $10 million of his undervalued stock personally and has made sure that his executive ranks are incentivized to grow value of the shares. What I like most of all about this investment thesis is that the end-market fundamentals are incredibly compelling from a supply/demand perspective. We like to find opportunities in which we can see that demand for a company’s goods and services are rising faster than supply of competitive offerings. As you can see in the two charts below, the U.S. demographic picture is favouring growth in rental housing while the supply is not keeping pace.

As you see from the graph above, millenials are driving housing demand, forming new households with a higher propensity to rent than their boomer parents. Because of this, U.S. new housing supply is struggling to keep pace delivering entry-level homes.

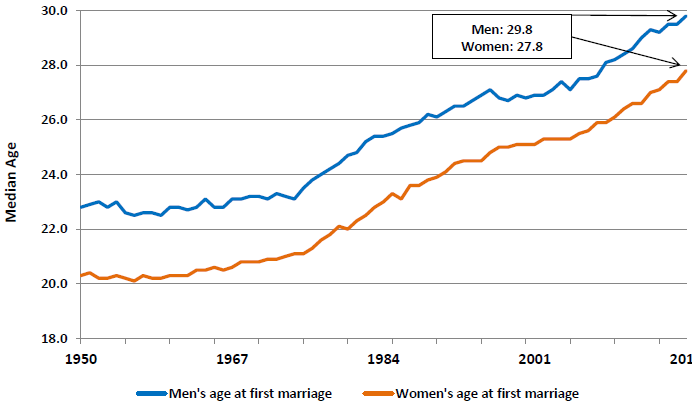

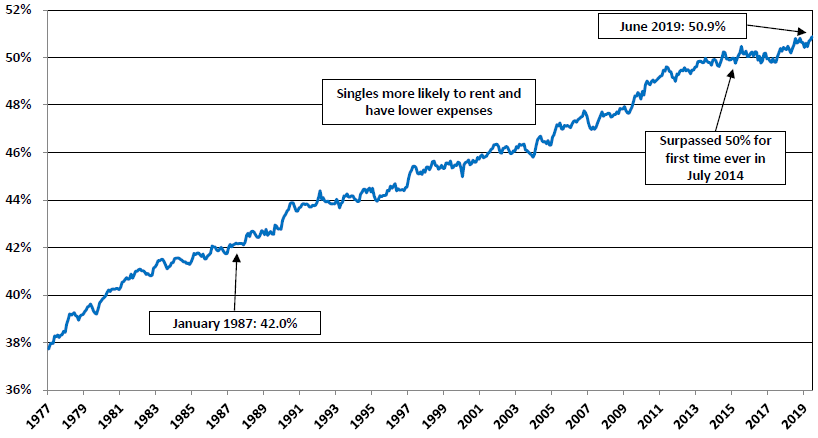

The two charts below are also supportive of our secular thesis of an improving better supply/demand equation for Tricon’s asset base. The first chart shows that subsequent generations are waiting longer and longer to get married, leading to a larger rental cohort. The second chart further substantiates that there are more people who need to rent. Specifically, you can see in the last footnote of the second chart that the percentage of the population that is separated, divorced or widowed continues to increase as well.

Source: U.S. Census Bureau, Raymond James, September 2018

The above chart ilustrates that both men and women are waiting longer to get married. We believe this is reflecting a societal shift as many young men and women are delaying marriage in order to focus on their careers. For many young people, marriage is a major milestone on the path towards purchasing their first home. The median age at first marriage has increased by 7.0 years for men and 7.5 years for women since 1950. This trend has led to a slower rate of household formation and an increase in the renter population, as singles are typically renters and many of them live with roommates.

Single Americans comprise over half of the adult population, having surpassed 50% in July 2014 for the first time since the government began compiling such statistics in 1976. Singles, especially younger adults, are more likely to rent than to own and less likely to have children. Singles also typically have less household earnings than married people, but also have fewer expenses, especially if there are no children in their households. Roughly 131.8 million Americans were single in June 2019, or 50.9% of those who were 16 years or older. The percentage of Americans who have never been married has risen to 31.5% from 24.2% in 1987, while those divorced, separated or widowed increased to 19.5% from 17.7%.

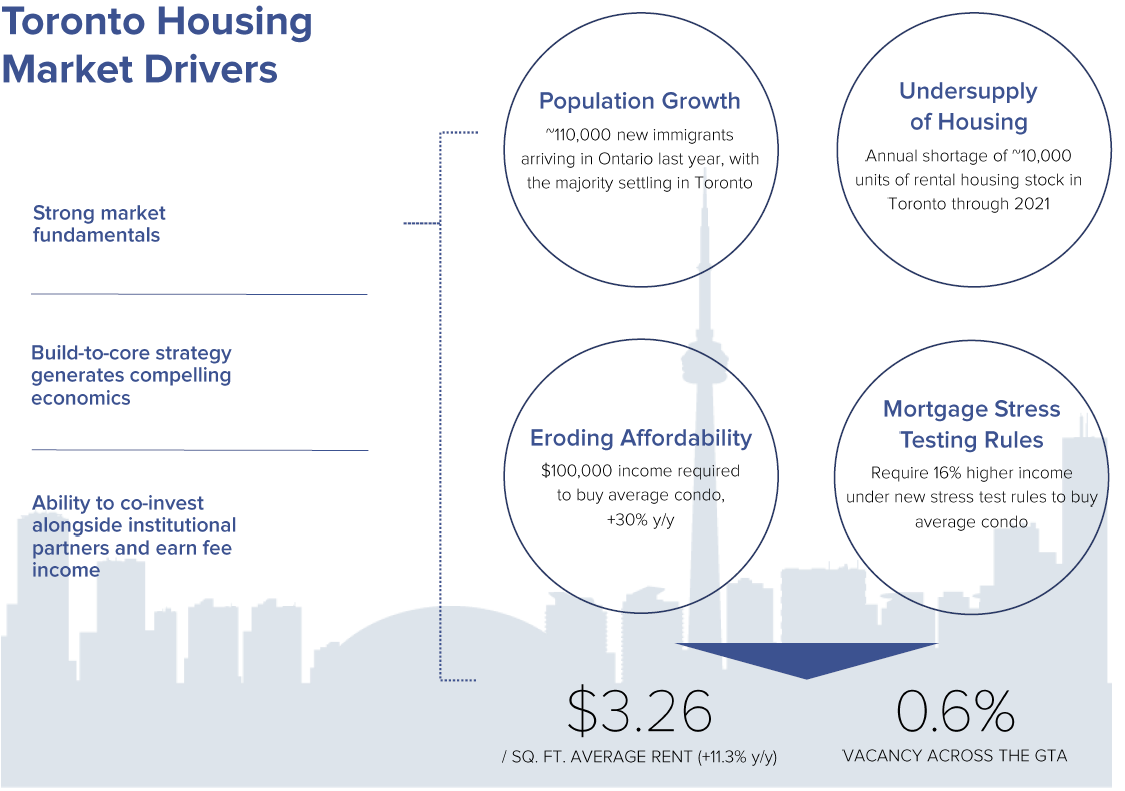

Lastly, a hidden asset on Tricon’s balance sheet, in our opinion, is their Toronto rental apartment land development bank. Tricon spelled out at their analyst day in January that they have 30% ownership in 3100 suites under development and 500 suites in lease-up mode at present in Toronto. Once again, the supply/demand picture for Toronto apartment suites is very compelling. As the next three charts demonstrate, demand is outpacing supply for rental units in Canada’s largest city. As Tricon brings on these assets that currently do not produce cash flow, their balance-sheet metrics will materially improve. In our opinion, this should serve as a further catalyst for the medium-term performance of the stock.

Source: Urbanation Q4 2018, Statistics Canada, Tricon

Source: Census Bureau, Statistics Canada, Goldman Sachs

We are monitoring the coronavirus and carefully investing in some great businesses with strong Asian franchises (if we feel too negative a scenario is reflected in their share prices). We have not elevated any of these investments to our top 20 holdings yet. Last week, a conference in Japan I registered for was cancelled, but fortunately we can leverage our years of due diligence trips without having to travel there in person for the time being. We will only invest in companies with earnings and free cash flow if conditions worsen. We want to invest in firms that can weather any financial dislocation and take advantage of others’ capital structure mismanagement.

Across our diversified portfolio, we have been happy with the earnings and free cash flow generation reported thus far in earnings season for Q4 2019. As we discussed last month, we continue to anchor the portfolio in companies that have earnings power and balance sheet strength, in order to carry out buybacks and/or grow dividends if the economy struggles to grow. Once the coronavirus situation improves, we anticipate seeing an uptick in mergers and acquisitions activity, since interest rates are so low. As well, with wage pressures increasing due to a strong employment market, we believe companies will look to merge in order to gain access to talent and added capacity, all the while being able to extract synergies to protect profit margins.

Also discussed last month, we have continued to witness the capital markets trend of less and less sell-side coverage of companies. For example, this past month the top-ranked Swiss sell-side research team from Vontobel was disbanded due to the trends we discussed in length in last month’s commentary. I do not always have the best things to say about research quality on the sell-side, but I would say this firm was consistently top of the pack. Additionally, another firm in Canada I was chatting with in January disclosed to me that they are downsizing their research team and moving to smaller offices. These trends we believe, will truly benefit our proprietary research experience and disadvantage competitors who were used to relying too much on sell-side research as part of their investment analysis process.

We wish everyone and their families a safe winter, especially if you are travelling.