Lions Bay Q3 2022 Commentary

We believe that Lions Bay’s value to its investors is largely drawn from our ability to identify hedging opportunities with an attractive risk/reward proposition. Senior Portfolio Manager, Justin Anis, explains his process in identifying these opportunities and details his most profitable trade for the quarter.

Results

For the third quarter of 2022, Lions Bay was up +2.76%, bringing our gains through September 30th to +26.40% net of all costs. Over the same periods, the S&P 500 is -4.89% and -23.88%, respectively.

Fund Update

Lions Bay marked its 4-year anniversary this quarter, and assets under management now exceed $120 million, close to a 10-fold increase from the $13 million we managed on October 1st, 2018.

We’re proud to announce that Lions Bay was nominated as a top contender by the Canadian Hedge Fund Awards as an equity focused fund in the following categories: Best 1 Year Return, Best 3 Year Return and Best 3 Year Sharpe Ratio (which measures risk adjusted returns). Winners will be announced on November 22nd.

It’s Ugly Out There

The only years with higher volatility in stocks this far into the year have been: The 1930s (Great Depression, WW2); 2002 (Dot-Com Crash); 2009 (Global Financial Crisis); and 2020 (Pandemic).

In our Q4 2021 commentary, we stated that investors received a harsh wakeup call on November 10th, 2021, when President Biden gave a speech at the Port of Baltimore telling the world that fighting inflation was now his number one priority. The chart below shows what stock market volatility, as measured by the VIX, has done since the day of that speech. When looking at the below chart, please remember that the long-term average for VIX is 19.

Volatility Since Biden Prioritizes Inflation

The VIX has averaged a level of 26 since that speech, which is over 35% above its long-term average. This is what a market looks like when liquidity is tightening. It is the perfect market for Lions Bay.

This quarter, like the preceding two, was treacherous. Saying the S&P 500 was only down 4.89% for the quarter doesn’t do justice to how violent a period it was. For example, the quarter opened with a huge bear market rally, sending the S&P up 13.9% and the Nasdaq over 19% over the first 45 days.

Based on our study of past bear markets, we viewed this rally with suspicion, and barely participated, as investors can see from our 1.5% return in July compared to the S&P 500 being up 9.2%. We took the opportunity to sell some of our lower conviction longs, and layer on hedges aggressively to cover us into early September. It was important that we be well protected over the Fed’s marquee conference in Jackson Hole, Wyoming, where we were concerned the Fed would push back against market skepticism about their commitment to fighting inflation.

Our caution was rewarded, as the market started to roll in late August, then collapsed after a combination of hawkish Fed rhetoric, hot CPI readings and a massive blunder by UK politicians – more on that later. The S&P wound up declining over 16% from its mid-quarter highs, to close at the lowest levels since November 2020.

S&P 500 Quarterly Swings

Adaptive Markets

“You adapt, evolve, compete or die” – Paul Tudor Jones

Investing legend Paul Tudor Jones built a reputation as one of the top macro traders in the world by distinguishing himself in bear markets. His quote aptly summarizes the need to change your process when market conditions evolve.

Conditions have certainly changed since our last Q3 commentary. While it seems like a lifetime ago, we are only 12 months removed from a market characterized by low volatility, high complacency, rampant speculation in “story stocks” and incredibly rich valuations under any economic assumption.

Today, volatility is at extreme levels, fear is rampant, and valuations are starting to approach bargain levels – under certain economic assumptions. If one believes we will soon experience a soft landing and very mild recession, then stocks are arguably a buy today. This is not our assumption, we believe we are in for a long and drawn out period of economic malaise.

We thought it would be instructive for our investors to learn about how we’ve adapted each of our principal strategies in response to the changing conditions.

Core Portfolio

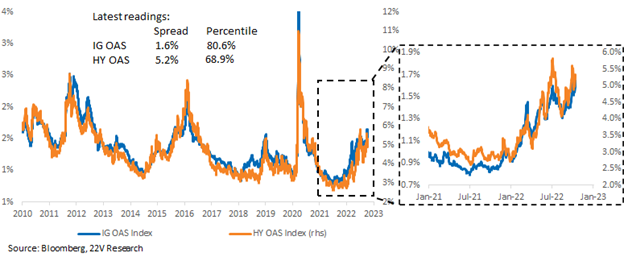

Within our long-term investment portfolio, we have followed the recessionary playbook and “high graded” our portfolio. This means we do not want to own any businesses that have excess balance sheet risk, so we can minimize exposure to any distress in corporate credit markets. The chart below shows how much spreads have widened already. For more detailed insights on corporate credit, we would highly recommend our readers review Andrew Labbad’s commentary, who runs the Wealhouse Amplus Credit Income Fund and has been generating industry leading returns.

Credit Spreads Widening

We are also cautious on businesses that cater to the lower-to-middle income consumer, where sadly, the bulk of the coming economic pain will be felt. We used the bear market rally in August to trim or completely sell many of these positions. Stocks we’ve trimmed or sold in the past three months include Uber, Brookfield Asset Management, Disney, IPG Photonics, Visa and Mastercard.

We want to own businesses with high margins, strong pricing power and a high degree of recurring revenue. We are willing to pay an above market multiple for some of these franchises because we suspect that as growth slows and treasury yields peak, the multiple compression from higher discount rates should be less of a headwind going forward. These are the type of businesses capable of gaining share through a downturn and emerging in a stronger competitive position.

Transactional Portfolio

The active trading portfolio is understandably, more active. We are taking profits quicker on short term trades and sizing them smaller. In a market characterized by sustained higher levels of volatility, wider trading ranges and violent intra-day reversals, we feel this is a more prudent approach to our tactical trades.

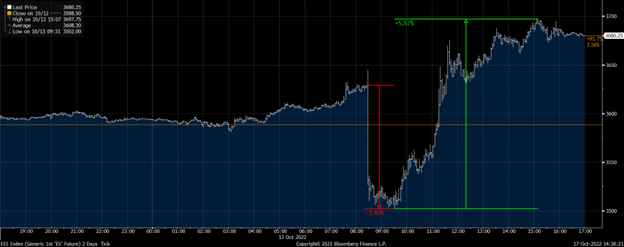

Our activity on October 13th is a great example of this. The widely anticipated CPI report was due to come out at 8:30 that morning. The S&P sold off over 4% on the day of the prior months release after the print came in hotter than expected, suggesting a need for tighter policy. VIX was extremely elevated going into the event as hedging activity was at record levels. The CPI print came out, and it was hotter than expected – bad news. S&P 500 futures plunged over 100 points in a manner of minutes, but VIX, the ‘fear gauge’ or price of volatility, was still down on the day. To us, this was a screaming signal that people were over-hedged going into the event, which motivated us to put on some tactical longs at the open. We had expected to hold these for a more than a few hours, but the market staged a 5% rally intra-day and were happy to take profits on those trades when we experience a months worth of price action in a manner of hours. Opportunities like this have led to a very strong start to Q4 for Lions Bay.

S&P 500 Futures on October 13th, 2022

Hedging Portfolio

We have also made meaningful changes to our hedging activities. Unlike this time last year, the riskiest areas of the market are no longer an attractive hedge. In a welcome return to reality, many of the high-flying, money burning story stocks have been crushed and now have high levels of short interest and richly priced volatility – not a market we want to trade.

For example, our go-to short from Q4 2021 and Q1 of this year, the ARKK Innovation ETF, is down 65% in the past 12 months. A reminder to our readers about the perils of downside compounding – it would take a 225% return just to get back to even from these levels.

So, where do we turn if we can’t hedge our portfolio by betting against bad companies? At this point in the bear market, by betting against good ones. This shift in strategy led to our most profitable trade for the quarter, as we will explain below.

Taking Out the Generals

There’s an expression on Wall Street to “beware when the generals start marching without the soldiers.” This charming expression is used to describe a market that has poor ‘breadth’, a market where the index is being dragged higher by only a few mega cap companies. This implies that investors are ‘hiding’ by rotating into some of the largest and safest companies in the world; thus, index level strength driven by gains in these large companies should be met with suspicion. Eventually, they’re going to shoot the generals.

Apple is the largest company in the world. It rallied 34% from mid-June to August 17th. This 8-week move represented a market cap gain of $700 billion. For context, this market cap change on its own was worth about half of the entire value of Amazon, was greater than the entire value of Berkshire Hathaway, and was twice the value of Walmart using their Aug 17th share values.

Apple through August 17th, 2022

By mid-August, Apple had outperformed the S&P 500 for 9 straight weeks and had reached the highest weighting in the S&P 500 of any company in history. The general was marching!

Apple share price relative the S&P 500 past 10 years

If a multi-week rally is being driven by the largest, ‘safest’, highest-quality company outperforming the broader market, then we view it with skepticism. We found the risk/reward dynamics of using Apple as a hedge at this time to be compelling. Either we would be right, and the bear market rally would fail and the stock would fall, or we were into a new bull market, in which case Apple would be facing a period of relative underperformance as investors rotated into riskier assets as belief in the recovery grew.

We took a shot at the general, and bought put options expiring September 9th, October 7th and October 14th. As Apple declined over 20% into quarter end, these puts generated approximately 50 basis points for our investors, and helped us weather the ugly September market sell-off.

Apple Through September 30th, 2022

We believe that our value to our investors is largely drawn from our ability to identify hedging opportunities with an attractive risk/reward proposition. In our last commentary, we profiled our most profitable trade which involved betting against a very low quality, highly speculative security. This quarter, our most profitable trade was betting against an outstanding company. We will always be on the hunt for these opportunities and are not dogmatic about the type of stocks that we utilize to manage risk.

Putting Out Fire with Gasoline, Revisited

In our last commentary, we discussed a recent bill passed in California to provide “inflation relief” to citizens by sending them stimulus cheques. We wrote that we would become very concerned about the prospects for a market recovery if fiscal and monetary authorities can’t stay on the same page in combatting inflation. Unfortunately, authorities in the U.K. quickly provided us with a case study to prove our point.

Newly appointed Prime Minister, Elizabeth Truss, and Chancellor of the Exchequer, Kwasi Kwarteng unveiled a budget proposing the biggest tax cuts since 1972, with scant details on how it would be financed. Financial markets recoiled at the prospect of an inflationary fiscal move at a time when the world is struggling to contain rampant inflation. Investors voted with their feet, dumping UK bonds, and crushing the value of the British pound. This, and systemic risk emerging in UK pension funds, forced the Bank of England to step in and buy bonds at a time when they were doing their best to get out of the business of quantitative easing.

While it may seem counter-intuitive, we view this as a highly positive incident. In recent weeks, Truss has completely back pedaled on these policies, and Kwarteng has lost his job. The fire alarms in the financial market went off loud enough to force a humiliating U-turn with the entire world watching. We would be far more concerned if there were no backlash, and this type of decision making was able to gain traction. The result of this debacle is that there is now a higher likelihood of global monetary authorities coordinating their efforts to inflation.

Looking Ahead

We expect choppy markets to continue well into next year. Unlike past bear markets, there is no silver bullet for the problems facing global financial markets: it will simply take time for tighter monetary and fiscal policies to impact the real economy, and that process has historically resulted in many unforeseen consequences. We expect we will see a bear market bounce this quarter as we enter a period of favourable seasonality from a highly oversold condition accompanied by atrocious sentiment. We aim to realize trading profits off such a move but will not meaningfully increase our net exposure. For investors who are looking for greater exposure to rising markets, we highly recommend the internationally focused Wealhouse Voyager Fund, our long-only product managed by Scott Morrison. Please contact Emily Newman at emilyn@wealhouse.com to learn more.