Full Steam Ahead

Lions Bay Fund had a record breaking Q1 thanks to the downside protection put in place in anticipation of the market-swinging headlines.

The Lions Bay Fund was up +16.88% in Q1, the Fund’s best ever quarterly performance both on an absolute and relative basis. The S&P 500 was +6.16% in what was a highly volatile quarter for equities.

There are two important factors relating to the Fund’s recent quarter that we want to highlight to our investors. The first is that there was not one or two significant outsized gains that drove our performance in Q1. To use the parlance of the sporting world, we hit a lot of singles and doubles rather than home runs. Our largest single contributor to performance during the quarter was AirBoss of America, responsible for +0.91%, followed by Moelis & Company at +0.54% and JP Morgan at +0.47%.

It was an exceptional quarter for our transactional portfolio, with short-term trading generating close to +10% for the quarter. During the quarter we had over 30 individual trades generate greater than +0.15%, which in aggregate, added +7.5% to our returns. We took advantage of what was truly a phenomenal environment for active traders.

The second factor is that the Fund had its best quarter on record while assets under management were at an all-time high. In general, as investment funds increase in size, their ability to generate excess returns suffers. At $46.8 million under management to start Q2, we have yet to encounter any constraints on our strategy.

Our number one responsibility is to take care of our existing clients. It was for this reason that when we drafted our Offering Memorandum in 2018, we included a provision giving us the ability to close the Fund to new investors once we reached $100 million under management. We included this provision to ensure that we can manage our growth and never compromise our ability to generate superior risk-adjusted returns for our existing clients.

The first quarter of 2021 was fraught with event risk. It started right out of the gate with the runoff elections in the Georgia senate race, the outcome of which would determine the Biden administration’s ability to pass their proposed fiscal stimulus. The Fund is designed to handle binary events such as this. Our view was that going into the event, one had to be pre-positioned in small-cap value shares and cyclical companies, as they would be very challenging to buy after the fact. We did so, while purchasing near-dated hedges in the event of a contested runoff or market negative outcome. This strategy succeeded, as small cap stocks rallied 7.6% in the three days following the election as the market scrambled to price in a massive fiscal stimulus.

The market reaction to the Georgia results foreshadowed a phenomenon we were to witness throughout the quarter: massive and violent rotations within the stock market. As a nimble fund, we love this. Trading liquidity in financial markets has been in secular decline since the financial crisis as a result of both higher regulations on market making and a trend towards more money being managed by larger institutions who don’t have the ability to rapidly adjust their portfolios. We believe this will continue to lead to many profitable trading opportunities for Lions Bay.

The market enjoyed a brief respite from volatility until late January, when retail traders and the Reddit army stormed the world of professional money management. Stimulus cheques made their way into Robin Hood trading accounts and money flowed into highly shorted small cap stocks like GameStop, driving one of the greatest short squeezes in history. We profited from this episode in two ways.

One of our trading strategies going into year-end is to look for beaten up and under-loved stocks that may be victims of tax loss selling, or simply money managers not wanting to show them on their year-end statements. In late December, we bought distressed retailer Chicos FAS and Canadian cinema chain Cineplex for this reason and were thrilled to see both get caught up in the short squeeze and enjoy significant rallies in late January.

The second way we profited from the Reddit episode was by being long volatility. Systematically buying index insurance is one of the strategies we employ at Lions Bay. The short squeezes in late January led to a dramatic de-grossing by hedge funds. Fear was rampant amid rumours of significant hedge fund losses, driving a dramatic rise in the price of portfolio insurance as measured by the VIX Index. As you can see below, as these events unfolded in the final week of January, the price of volatility spiked by over 77%, driving up the value of our index insurance. We were able to realize these gains and redirect the profits to add to high quality companies that were being liquidated by other funds.

Source: Bloomberg

Markets recovered from the GameStop fiasco in short order and were again at record highs by early February. Our biggest concern for equity markets at that point in time was a rapid and disorderly rise in interest rates as a result of emerging inflation fears. Rising rates hurt some parts of the market more than others. While value stocks and economically sensitive businesses like industrials and financials tend to benefit, companies with extremely speculative valuations and long duration cash flows often suffer as discount rates increase.

Likely as a result of stimulus cheques flowing into widely recognized growth darlings such as Tesla, Cathie Wood’s ARKK ETF and solar stocks, these securities were trading at all-time highs precisely at the time they were most exposed to major market risk. We utilized them as hedging instruments against a potential for a rate shock and shifted more of our index protection towards the Nasdaq. This was also out of respect for the large weighting of financial and industrial companies in the S&P 500, making this index a less viable hedging tool.

From mid-February to early March, we experienced yet another vicious rotation in the stock market. U.S. 10-year yields rose over 50% from February 11th to March 19th and the Nasdaq suffered a violent 10% correction. Gains on these hedges were more than enough to offset losses in our core portfolio from our long-standing investments in businesses such as Apple, Microsoft, Amazon and Google, while our economically sensitive investments in financials and industrial companies were relatively unfazed by the unwind. Many weak hands were shaken out of some phenomenal companies during that correction and we were well-positioned to add to our favourite businesses at attractive values.

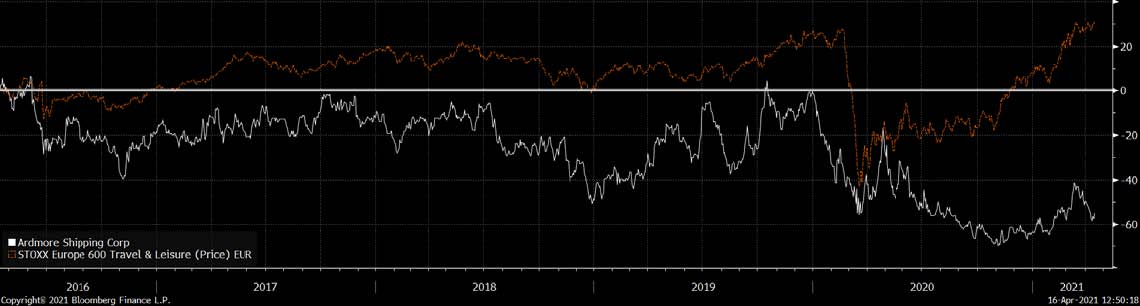

One of the welcome developments we’ve observed in the market lately is a breakdown in correlation amongst stocks. Equities currently seem to be trading more on fundamental-driven, idiosyncratic factors. This is in contrast to last year, when it seemed stocks were trading either in risk-on or risk-off mode – either the “re-opening trade” or the “stay-at-home trade” was driving the price action based on whatever narrative was dominant that week. Today’s environment provides more opportunity for active managers to distinguish themselves. We’ve been able to identify some unique businesses that have not yet priced in a meaningful economic recovery from the pandemic, in contrast to many travel, leisure and hospitality stocks that are trading at new record highs. We identified the maritime shipping sector as one such area, in particular tanker stocks.

Source: Bloomberg

During the quarter, we took positions in Scorpio Tankers (STNG), Ardmore Shipping Corp (ASC) and Diamond S Shipping (DSSI). We began buying these stocks in early January. We expect the fundamentals of the tanker market to improve as mobility rebounds and consumption of diesel, jet fuel and gasoline increase as economies re-open. In the meantime, the Suez snarl should provide a short-term boost to their fundamentals as re-routing of vessels will lead to increased miles shipped.

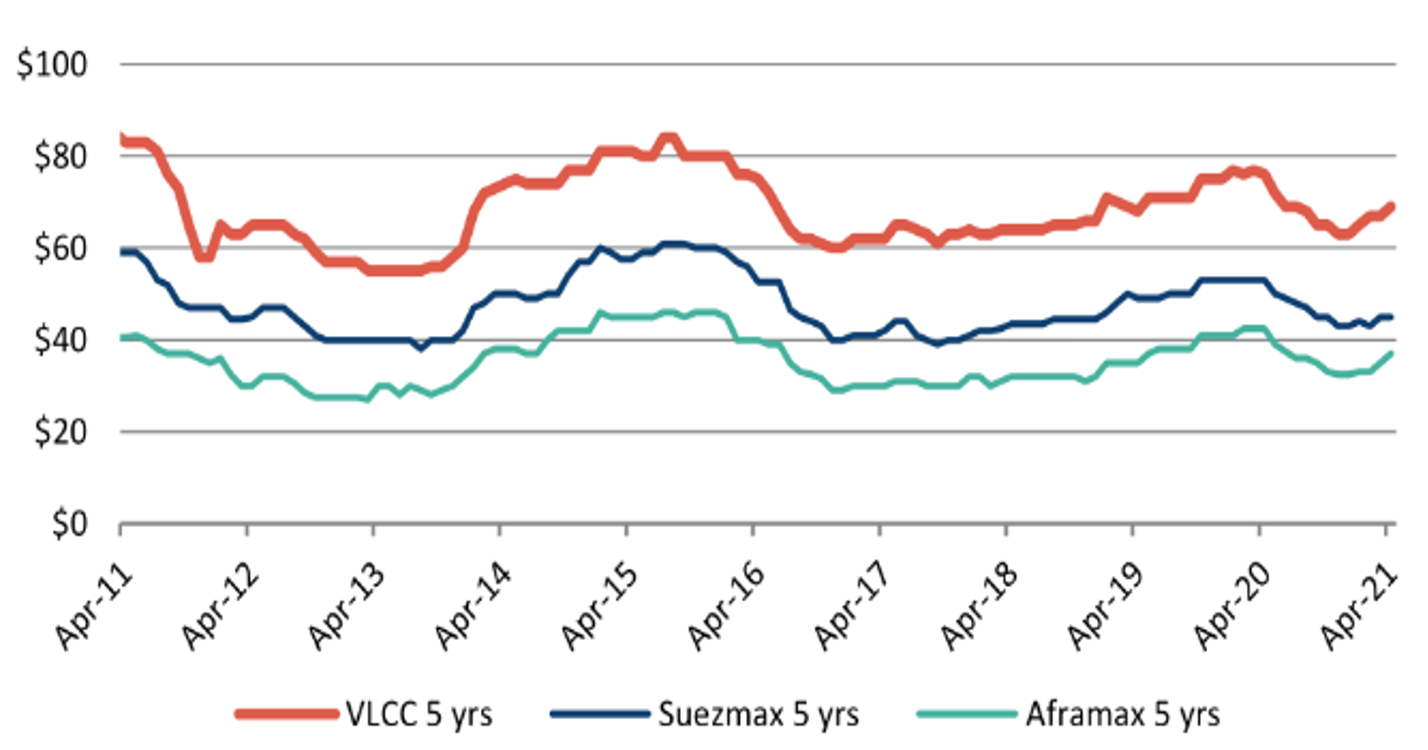

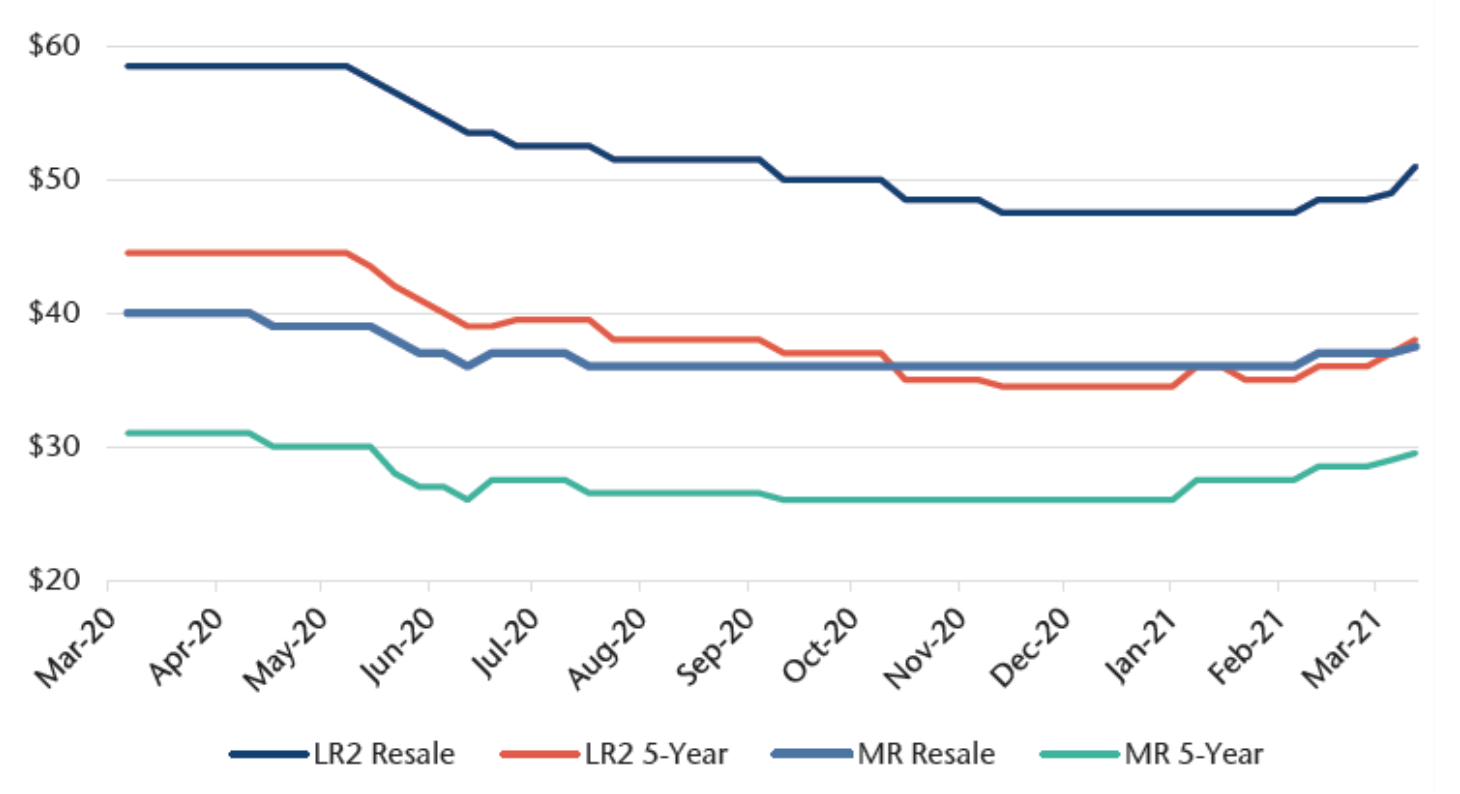

We believe the supply-demand dynamics for the tankers are poised to improve dramatically in the coming quarters, yet the shares are still trading close to all-time lows, both in price and relative to their net asset values. The supply picture is the best it has been in decades, with the order-book-to-fleet ratio below 7% and the average age of fleets very high – over the next four years more than 450 Medium Range tankers will be retired from service as they turn fifteen years old, more than offsetting deliveries of new vessels. As such, it looks like asset values for vessels are now past the trough of the cycle as the chart below shows. Shares in these companies still trade at a meaningful discount to net asset value and we believe our patience will be rewarded as the discount to net asset value compresses and improving business fundamentals drive earnings growth.

Source: Jefferies

As we look ahead, we remain optimistic about the opportunity set for the Lions Bay Fund. We believe in the coming months, the narrative will increasingly be dominated by potential tax increases as well as inflationary pressures (transitory or not). Each of these factors will cause investors to question whether corporate profit margins have peaked, and we anticipate a good deal of volatility over the summer as this discussion unfolds. We intend to be aggressive when we see a disconnect between richly-valued equity markets and low-priced index insurance, just the type of market we find ourselves in at the time of writing.