Enjoy the Party, but Dance Near the Doors

Rounding up a turbulent 2020, Senior PM Justin Anis discusses why the current price action of the market may not align with that feeling in your gut and what this may mean for Lions Bay Fund in 2021.

For the fourth quarter of 2020, the Lions Bay Fund was up +5.32%, bringing the full year return to +10.84% net of fees and expenses. During such a volatile year, we were pleased to deliver double digit returns to our clients with significantly less volatility than the S&P 500. In 2020, the volatility of the Lions Bay Fund on a monthly basis was 57% lower than the S&P 500, consistent with our commitment to deliver equity-like returns without the turbulence of equity markets.

Gains in the quarter were driven by strong returns in our core investment portfolio. Hedging activities were a meaningful drag in the quarter, but were almost entirely offset by profitable trading in our transactional portfolio. Our largest source of returns was Brookfield Asset Management (BAM), our largest holding entering Q4. We had been adding to our position all summer as we felt it had incredible upside as economies reopened. We continue to believe that their diversified, long life, high quality asset base run by a top tier management team will thrive and gain market share from weaker competitors throughout the pandemic. Our patience was rewarded in early November, as shares staged a +41% rally off the lows of the month allowing us to realize substantial profits.

Our next top performers in the quarter compete in the same industry: Moelis & Co. (MC) and Houlihan Lokey (HLI). We have written glowingly in past commentaries about Houlihan Lokey, and it has long occupied a position in our top three holdings. One of the things we admire most about HLI is its cyclically balanced business model, as its restructuring business provides stability during economic downturns, offsetting any slowdown in their cyclical M&A franchise. As part of our ongoing due diligence with HLI and our conversations with industry participants, we recognized signs that the M&A market was rebounding dramatically. Given this insight, we invested in their peer Moelis & Co., which has a more cyclical profile than HLI given its larger corporate finance business and higher average transaction values. This higher torque played out in the share price, which was up 40% during the quarter. Despite a much smaller position size, the positive contribution from our MC investment in Q4 outpaced that of our HLI position, with the two combining to drive 149 basis points of gains. We anticipate the M&A market to boom in the coming months, as companies and asset managers are eager to deploy large amounts of capital raised over the last year (see Chart 1 and 2). In addition, we note that Special Purpose Acquisition Companies (SPACs) raised $73 billion in capital in 2020, up a staggering 462% over 2019. Of this capital, $63 billion is still seeking a merger target and represents potential engagement opportunities for HLI and MC. Lastly, with Democrats now in control of Congress, we expect business owners to want to get ahead of a potential tax increase in the second year of Biden’s administration, which could also spur deal making activity this year.

Source: Jefferies

Source: Jefferies

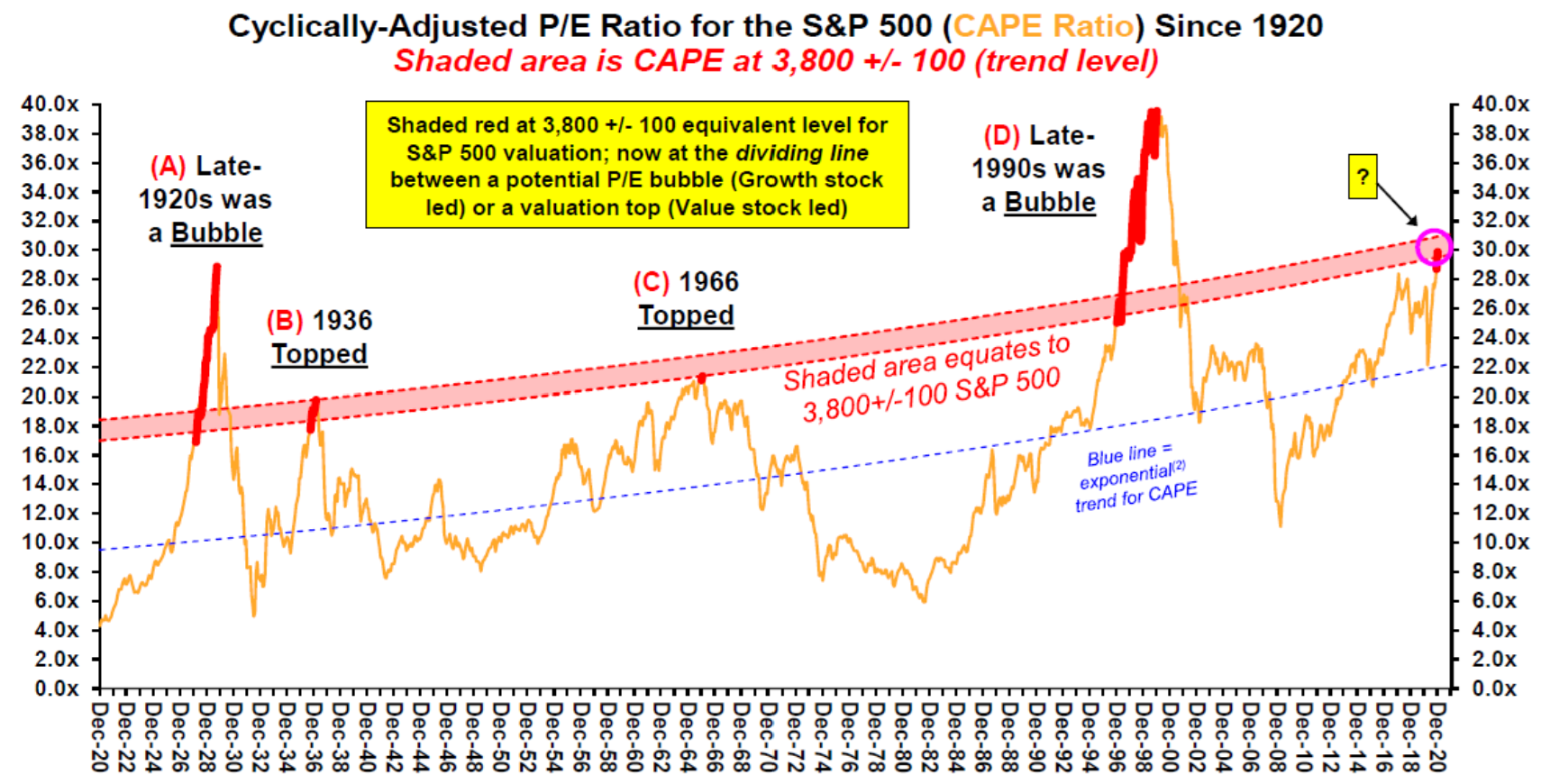

Just ten months removed from the depths of panic and despair, financial markets enter 2021 in a borderline euphoric condition. S&P 500 valuations have only been higher during the 1920s and late 1990s (Chart 3). Both of these periods are widely accepted as market bubbles and each was followed by a dramatic market crash. Financial conditions have never been easier according to the Goldman Sachs Financial Conditions Index (Chart 4). Past bottoms in this index, (September 2014, January 2018, and January 2020), proved to be very poor times to be buying equities.

It is important to keep in mind that both valuation and sentiment tend to be poor indicators for market timing purposes. Periods of exuberance such as the one the market is currently enjoying can last much longer than a rational investor would expect. In the late 1920s, markets doubled from the valuation levels seen today, while the late 1990s market had 50% further upside before each crashed. The best one can hope to do is employ effective risk management and have the ability to profit from volatility.

Source: Stifel Equity Strategy

Source: Goldman Sachs Global Investment Research

This type of investment landscape may lead our readers to believe that we are concerned about the prospects of investment gains going forward. For the bulk of institutional investors, this should certainly be the case. Deteriorating market liquidity and ever more investment dollars being managed by fewer firms (the overwhelming majority of which are long only investors) present these institutions with a significant challenge to adjust their portfolio exposure in a meaningful fashion. This is not the case for the Lions Bay Fund. We are highly optimistic about the return prospects in the current environment, given that we are a nimble fund with an unconstrained toolset that allows us to profit from market volatility. We intend to enjoy the party, but dance close to the doors. We will first discuss how the market has arrived at its blissful state before moving on to charting our strategy for navigating such a climate.

Enjoy the Party…

In his recent book, “Apollo’s Arrow: The Profound and Enduring Impact of Coronavirus on the Way We Live”, author Nicholas Christakis notes that periods of plague-driven austerity have often been followed by periods of intemperance, risk taking and liberal spending. He quotes Agnolo di Tura, a shoemaker and tax collector who chronicled the Black Death in 1348:

“And then, when the pestilence abated, all who survived gave themselves over to pleasures: priests, nuns and lay men and women all enjoyed themselves, and none worried about spending and gambling. And everyone thought himself rich because he had escaped and regained the world, and no one knew how to allow himself to do nothing.”

Add in (i) The advent of self-directed trading platforms that are designed to enable and encourage retail investors to speculate with call options (ii) Stimulus cheques landing in bank accounts and (iii) Central Banks with ultra-loose monetary policy, and it is easy to envision a-post pandemic period of excess and intemperance such as that observed by our friend Agnolo. Each of these three factors merits further comment.

Last Wednesday, January 6th, was the fourth-busiest day ever for call trading in the U.S. (the other three occurred in 2020). We note, with some concern, that this occurred the same week that the most recent stimulus cheques began to arrive (more on that below). Individual investors now make up a fifth of equity trading volume, according to Bloomberg, double the share from a decade ago. On a global basis, trading account openings tripled from 2019. The largest 100 stocks in the Russell 3000 saw a 32% rise in trading volume this year, while the smallest saw volumes jump 70%. Wall Street is working its hardest to provide this neophyte investing cohort with new supply to trade. U.S. companies sold $368 billion in new stock last year, 54% more than the prior high. IPOs raised a record $180 billion, and retail participation helped drive an average jump of 41% on the first day of trading. 80% of the companies that went public last year were unprofitable in the 12 months prior to their IPO – the record set in 2000 was 81%.

Source: Bloomberg

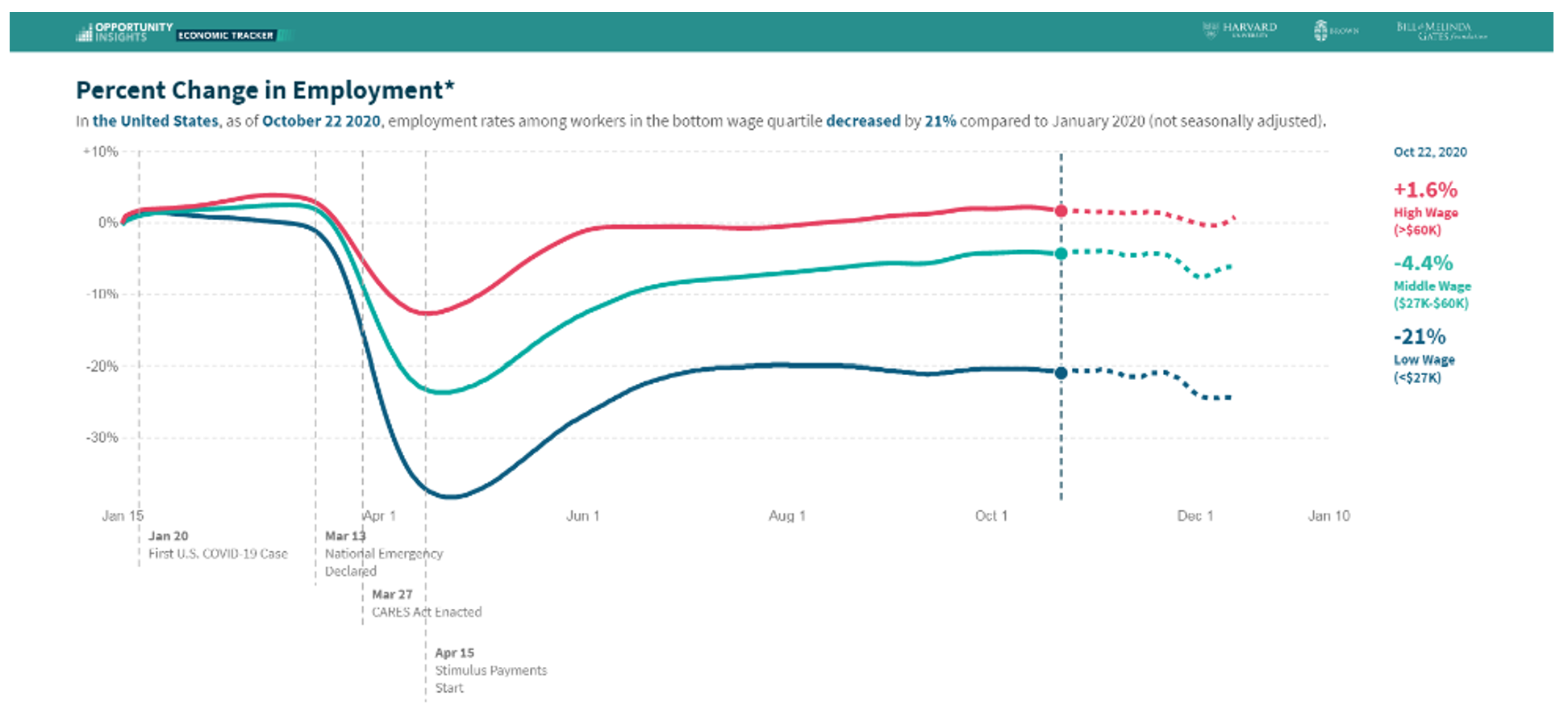

In enacting the CARES act to support the economy from complete collapse last March, the U.S. administration sent direct payments to citizens at a time when consumer confidence had plunged and unemployment was at a 70-year high. Congress has now decided to send a second round of $600 cheques at a time when consumer confidence has rebounded and unemployment has stabilized significantly. In fact, the recession has essentially ended for high-income workers, with their wages up 1.6% since January 15th, 2020 (Chart 6).

Chart 6: Percentage Change in US Employment Rates since January 2020

Source: Opportunity Insights

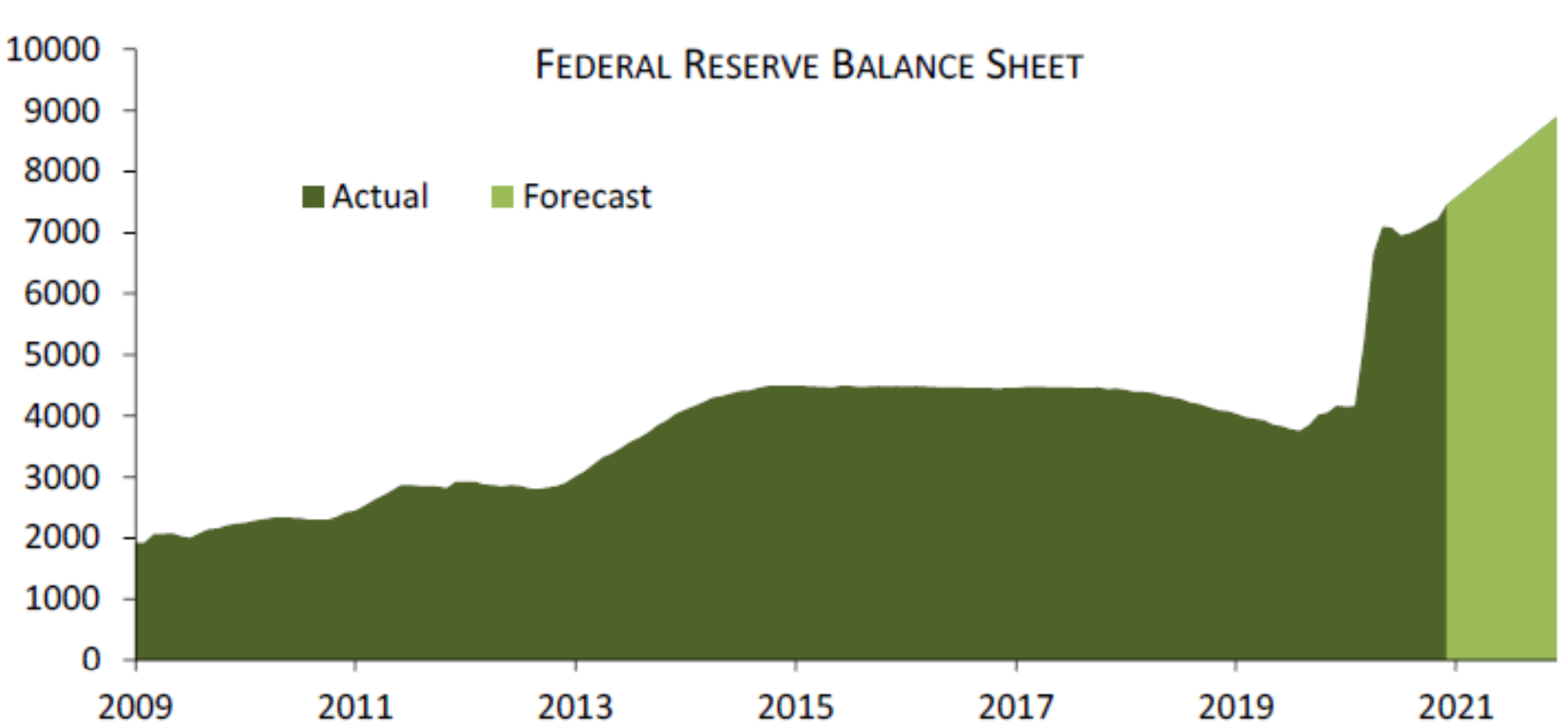

In addition to the stimulus cheques sent last week, the Biden administration has publicly announced plans to send out a total of $2,000 in individual stimulus payments. It remains to be seen whether this is an additional $2,000 or more likely a grossing up of recent stimulus cheques by $1,400. These cheques are reaching consumers at a time when willingness to spend has increased significantly, the savings rate is extremely high and multiple vaccines have been developed and are being administered. There is no question that these payments are finding their way into financial assets and fuelling speculation. We are well-positioned for a boom in consumer spending, with the consumer discretionary stocks the largest sector weight in the portfolio. The aforementioned fiscal support arrives while central banks around the world continue to expand their balance sheets. Recent comments from U.S. Federal Reserve officials indicate no willingness to begin tapering their purchases this year, suggesting they will continue to buy a combined $120 billion a month of Treasuries and Mortgage Backed Securities. Cornerstone Macro estimates that the Federal Reserve balance sheet will grow to about $8.9 trillion this year, or about 40% of U.S. GDP (Chart 7). Continued liquidity from global monetary authorities is further encouraging speculative spirits.

Source: Cornerstone Macro

…but Dance Near the Doors

As mentioned in the introduction, we recognize that periods of exuberance in financial markets can last longer and drive asset prices higher than a reasonable investor could imagine. We have no interest in fighting this wave of liquidity, and are excited about the trading opportunities a continued melt up would present. We would remind readers that during the 350% NASDAQ rally from 1998-1999, there were seven occurrences of 10%-to-20% corrections which lasted one to two weeks. As a nimble fund with an unconstrained toolset, we have the ability to adjust our exposure rapidly, and to structure trades and hedges in a fashion that allows us to profit from rapid declines in the market without taking a net short position against equities. We relish the challenge and trading prospects such an environment presents.

Despite excessive valuations in the general market, we continue to find attractive investment opportunities, and stocks that we still view as underpriced. One recent investment we have made is in a business which faces secular headwinds due to technological disruption, whose shares were already discounting dire prospects before the pandemic hit.

The company is a household name: Walgreens (WBA). When we began to buy the stock in late December, we were paying 8.2x this year’s expected earnings and shares offered a dividend yield of 4.7%. Despite growing revenue and EBITDA from $103bn and $6.8bn in fiscal 2015 to $139bn and $9.4.bn in fiscal 2020, the P/E multiple has been cut in half from 16x in 2016 and remains well below the five year average of 11.2x. We believe the headwinds to brick and mortar retail are well understood by the market at this juncture and at 8x earnings we feel are well discounted. Since the start of the New Year, WBA has reported a strong quarter that beat estimates and announced the sale of their wholesale business for proceeds of $6.5 billion. This provides the company with financial flexibility to pursue strategic initiatives to optimize their retail business, and may open the door to share buybacks in the coming fiscal year. At the time of writing, shares are up 20.2% year-to-date. We believe our clients will continue to benefit from both rising earnings and an expanding share multiple.

As the year unfolds, we will continue to hunt for attractive long-term investments as well as shorter-term trading opportunities, while maintaining a disciplined approach to employing low cost structures to hedge out broader market risk. We suspect 2021 will present us with profitable opportunities for all three of our strategies. As always, please do not hesitate to reach out with questions, comments or ideas.