Silver Linings – CI Financial

Few companies took advantage of last year’s market decline the way CI Financial did, by making smart acquisitions south of the border. Now, the vertical integration paid off. Amplus Fund PM Andrew James Labbad explains his winning trade on CI’s debt.

Back in September 2020, we took a bullish view on CI Financial debt. We sourced some of their 2021 and 2024 senior debt at attractive levels. At the time, this was some of the cheapest investment grade debt in the Canadian market. The story was simple: CI is Canada’s largest independently-owned asset manager, with a large pool of funds driving stable recurring revenue, and both their equity and debt were trading at depressed levels. The largest drawback was fund redemptions and compressing margins of their business. In 2019, CI’s board chose to bring in a new management team led by Kurt MacAlpine to turn their boat around.

Starting in 2020, with the strength of their balance sheet and recurring cashflows, they strategically started acquiring Registered Investment Advisors (RIA). RIAs are companies of U.S. independent investment advisors. Unlike what is commonplace in Canada, U.S. RIA acquisitions are on a profit-based multiple. This allowed CI to diversify their revenues and cross-sell their products. These acquisitions were being done at a time of depressed equity markets. As Warren Buffett says, “be fearful when others are greedy and greedy only when others are fearful.” When looking back at the average S&P 500 level in 2020, CI made smart acquisitions, especially compared to where the S&P is trading now at 25% higher. Since Kurt joined, CI has grown from $0 to $80 billion assets under management through the U.S. RIA channel.

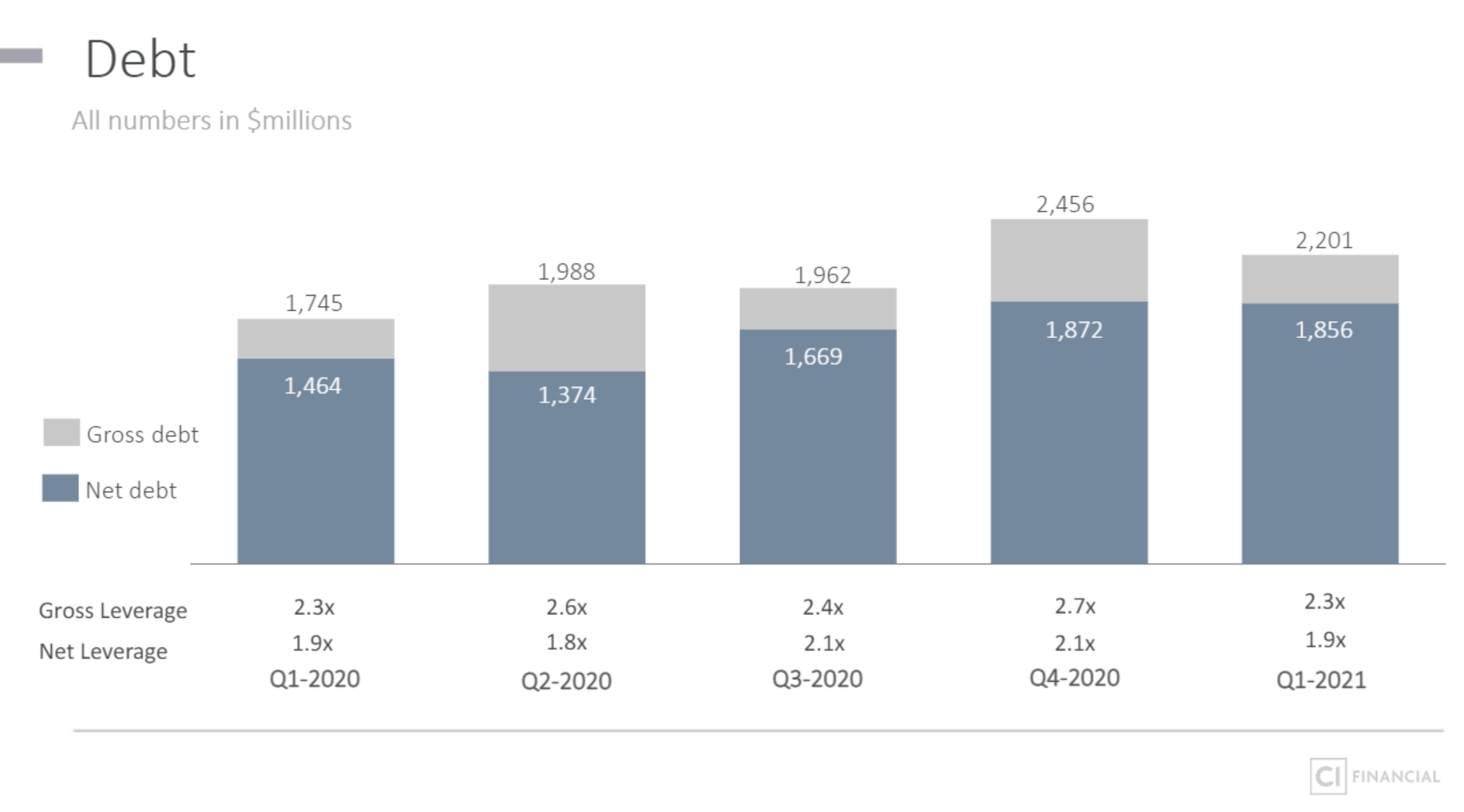

One of Wealhouse’s strength is the diverse expertise of our team where we have a good understanding of almost every asset class. By using our collective robust and comprehensive lens, we agreed that there is tremendous value in both CI debt and equity appreciation. CI management has grown their share price by +39% year-to-date and acquired many strong U.S. businesses, all the while keeping their leverage metrics healthy.

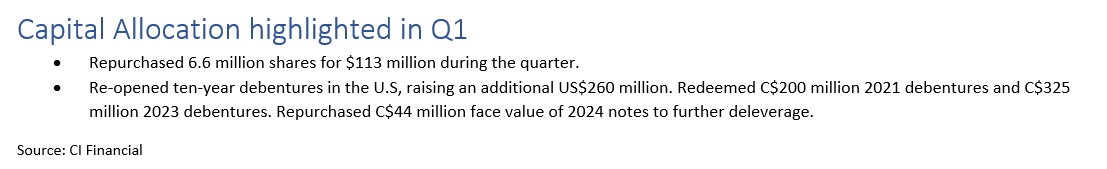

Since December 2020, CI broadened their funding options by tapping the U.S. bond market twice within one month, gaining access to a much larger pool of investors in the U.S. They used the proceeds of this debt financing to fund their U.S. expansion and extend their debt profile by redeeming their CAD$ 2021 and 2023 bonds. We saw this as an opportunity to add to our weightings in some of their remaining shortest-dated CAD$ 2024 bonds at levels that did not reflect the possibility of additional bond buybacks going forward. From a cross-currency perspective, CI’s Canadian bonds had underperformed the rally of their new U.S. debt.

Fast-forward to yesterday’s earnings which confirmed our conviction:CI reported record earnings, record free cash flows, with improved net fund flows. CI repurchased $44 million (13%) of their 2024 bonds outstanding, and CI bonds traded higher. We continue to see value in their debt which is currently trading at a discount to other similarly-rated investment grade credits. We expect them to continue to buyback short-dated bonds, replacing with longer-dated bonds, all the while taking out debt from the Canadian market.

To conclude, we see CI as an ideal investment for the multi-year economic expansion ahead. Owning an asset manager of their size should be seen as a good investment.