Be Greedy When Others Are Fearful

Panorama Fund is primed and ready to take advantage of the pandemic recovery. Find out more on his contrarian ideas in the latest commentary from CIO Scott Morrison.

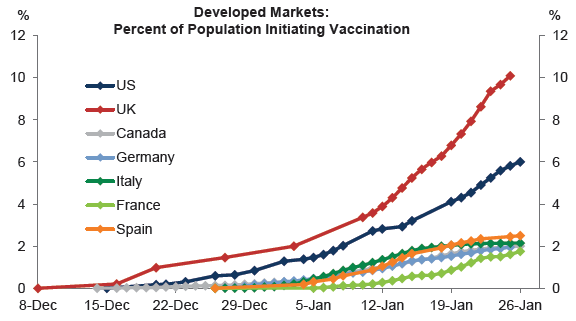

We have stipulated in previous writings that we believe the world will recover from COVID-19. Thus, allocating a fair amount of capital to some of the sectors of the economy that suffered as a result of the pandemic would be a wise, long-term contrarian investment opportunity. Some of those investments were hurt in January, as certain jurisdictions struggled with the ramping up of vaccine distribution to their populations. According to a recent Global News article:

“Canada’s vaccine rollout has been comparatively slow in relation to the rollouts of other major countries, with the country vaccinating 2.8 out of 100 people, according to the statistics publication Our World In Data. On the other hand, Israel has vaccinated 62.1, the U.K. is at16.9 and the U.S. at 11 out of 100 people.”

Bottom line is that we like charts that go up and to the right and as you can see in the one below, vaccinations are going up and to the right. We are operating on the assumption that it is a function of when, and not if, all developed countries will achieve herd immunity.

Source: Our World in Data, John Hopkins University, Goldman Sachs Global Investment Research

There is a lot of anxiety-inducing headlines at present referring to the speed of the vaccine rollout. The general population’s patience is running thin. As a result, there is a heightened level of uncertainty. It is in times like these that I turn to a couple of Warren Buffet quotes to steady my investment nerves: “Uncertainty is the friend of the buyer of long-term values” and “be fearful when others are greedy and greedy when others are fearful.”

We believe that these short-term setbacks should be aggressively bought and not sold. It is only natural to expect that politicians will overpromise and underdeliver when they are expected to manage a global crisis on such a large scale. As a result of this, you will see, later in the comments we speak to some of the investments we added to during January’s sell-off in industries that corrected as a result of the vaccine distribution delays. Some such companies are advertisers, alcohol producers, hotels, job recruitment firms, team sports retailers and theme parks.

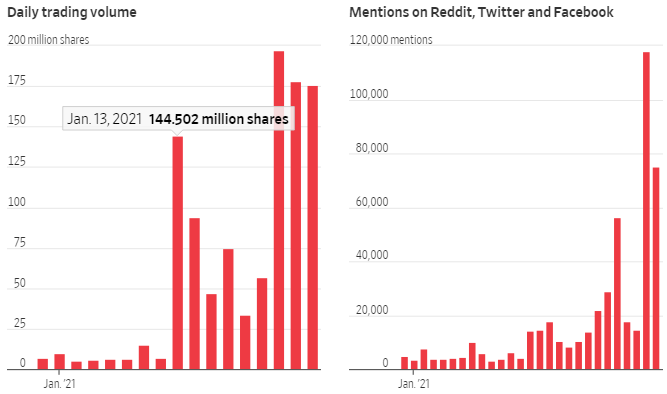

Also slowing down the fund in January was the impact of second-derivative effects of the “GameStop” short-squeeze phenomenon on some of our hedges. There was an insightful article on Bloomberg which highlighted that: “January’s histrionics propelled the market’s most-hated shares to their best month ever, with an equal-weighted basket of the 50 most-shorted Russell 3000 Index stocks jumping over 40%. The most expensive-to-borrow U.S. equities outperformed the least costly by 29% in January – also a record, according to a report from IHS Markit. Even with GameStop and AMC removed from the analysis, the return from expensive-to-borrow shares was still greater than 25%.” Melvin Capital, a very well-known and accomplished hedge fund from New York, was reported to be down over 50% in January due to the short squeezes. Generally speaking, I get most excited when I hear phrases like “best month ever” and “also a record” as they have typically foreshadowed oversold or overbought conditions to take advantage of for our funds.

Source: Wall Street Journal, Dow Jones Market Data, Meltwater

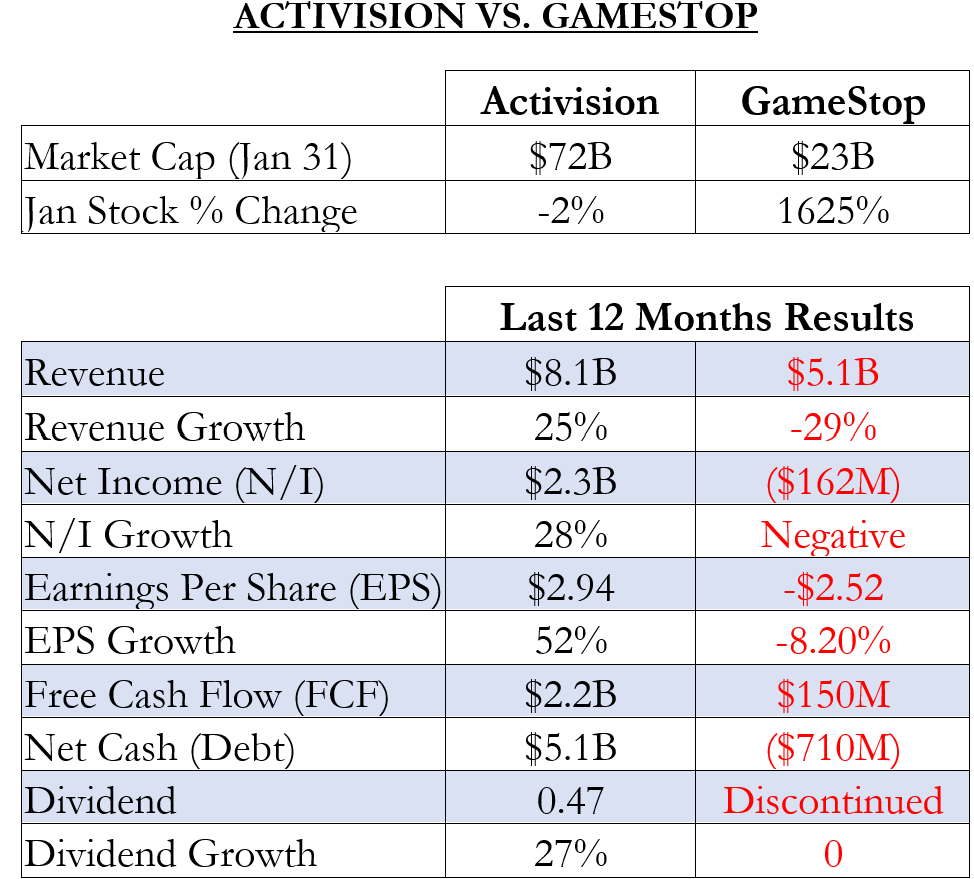

As you can see by our rebound so far in February, our risk management processes – focused on liquidity – once again minimized the damage and allowed us to take advantage of the extreme GameStop event. Years ago, we included GameStop as one of our hedges, as our research determined that there was going to be a massive shift of video game players procuring their games through digital downloads, as opposed to buying physical games from brick and mortar store locations. Our research was supported this past month when our largest video game investment in Activision provided examples of spectacular digital download growth. For example, when asked about their Call of Duty franchise, the CEO of Activision said on their most recent conference call that: “Call of Duty Mobile in the west has only been live for about, actually a little less than a year and a half. And in that time period … we quickly scaled over 300 million downloads.” We would rather own the company that owns the intellectual property of the content being sold. Both Activision and GameStop are in the video game distribution business, but Activision also designs and produces the games. We believe this shines through when you look at the fundamentals in the below illustration. We believe fundamentals eventually will win against overheated sentiment.

One positive takeaway from GameStop’s rise is the opportunity to include this company in our hedge-approved lists. We believe that many of our competitors like Melvin Capital have already adjusted their risk-management processes such that we are less likely to see a repeat of this type of short-squeeze again in the near future. As you can see below, the amount short on GameStop has collapsed significantly. However, I do believe that this event helps explain and reinforce changes to capital market structure that we have discussed in the past. As such, we will continue to follow our liquidity risk-management rules.

GameStop’s Short Interest Plunges as % of Shares Available for Trading

Source: Bloomberg, IHS Markit

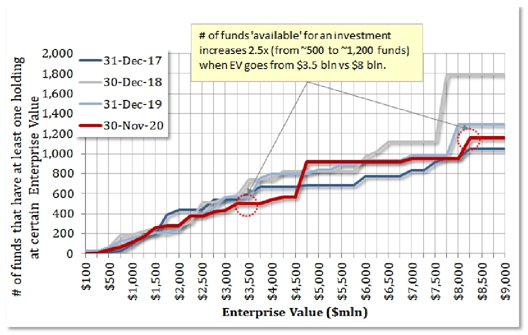

I have pointed out in past comments that markets have steadily become less and less liquid, as more and more money is run by fewer and larger institutional money managers. As a result, I believe that this contributed to the online crowd being able to punch above their weight class and cause the short squeeze(s) we saw this month. I believe that this was also responsible, in part, for why we saw the largest and quickest sell-off since World War II last March and a very speedy recovery in many parts of the market. As I wrote last month, when you combine this amount of illiquidity in individual capital market positions with the vast increase in the amount of debt in the global economic system, we should not be surprised to see more violent moves in the market over short-term stretches. Therefore, I have pivoted Wealhouse into different products for clients that can be nimble and take advantage of these dislocations and embrace the volatility. Many investors believe that bigger is better in the fund business. I personally believe otherwise as we move forward and highlight once again the other funds Wealhouse has to offer to those looking to diversify their nest eggs. Voyager, our long-only small- and mid-cap fund was up +1.15%. during January, my colleague, Justin, at Lions Bay was up +2.81%. Our newest team member, Andrew, was up +1.38% with his newly seeded credit fund, Amplus.

I always track the liquidity of the investments that I make. Very simply, we keep a spreadsheet that takes the average trading volume of a security over the last six months and calculates how long it would take for us to get into and out of a position if we were 20% over the average trading volume. One reason we do this is in case our investment thesis is wrong. For example, last year at this time we were shareholders in Air Canada. Oops. Because of our liquidity discipline we were able to exit our position in less than a day as we realized the virus was spreading. I remember sitting next to a fellow portfolio manager at one of the country’s largest asset managers in 2001 when 9/11 happened and seeing them struggle to exit their position before it went bankrupt. This is why at Wealhouse, we have liquidity at the top of the risk management checklist.

Below we show an illustration of an example how important market structure has become to a company if it wants to attract new shareholders. In the below graph, you can see an analyst from Raymond James illustrate how many potential investment funds are willing to make an investment in a company from the Canadian energy sector. “As seen, when a company has an enterprise value at $8+ billion, there are approximately 1,200 separate funds that could potentially make an investment (given other holders of similar size). When a company is only around $3 billion, there are only 500 funds that look at companies of this size.” In essence, this illustrates one of the top reasons why we started Voyager at Wealhouse. We want to have a fund that is willing to assume much risk down market to buy companies before they hit bigger competitors of ours and their more cumbersome liquidity thresholds. This is a clear example of how size really, really matters. I cannot emphasize enough how important this is going to be in the future for how your money is taken care of in a world with so much debt and more technological disruption coming.

Source: BD Vision, Raymond James Ltd.

Our investments in natural gas are rebounding strongly in February as what started off as mild start to winter in December and January has turned downright FROSTY in February. It seemed counterintuitive to start buying natural gas stocks a couple years ago when prices literally hit ZERO in Alberta but as we always say, it is best to buy a low-cost commodity company when the average producer of that commodity is not making any money. As you can see in the below chart, natural gas prices have rebounded quite nicely. We remain bullish as the industry has been starved of capital for too long and leading producers to remain disciplined on supply response. We also anticipate more consolidation in the energy sector based on discussions with leading companies in the sector.

Source: Bloomberg

Panorama is invested more globally than most of our domestic and North American-focused peers. As illustrated in our first slide of these comments, the U.K. is having much more success than other G-7 countries with regard to vaccine distribution, so we decided to invest more capital there during January’s correction. During January, we saw Whitbread, the U.K.’s largest domestic hotel operator, trade off over 9%. On past research trips, I have visited many of their hotels across the country. Most of their locations also have a bar and restaurant attached. After selling their Costa Coffee franchise to Coca Cola in 2019, they entered this crisis with an industry-leading balance sheet that will allow them to gain market share and develop new hotels while others re-trench. As the leading domestic hotel franchise, we believe that they will turn around quickly as domestic travel rebounds in 2022 and 2023.

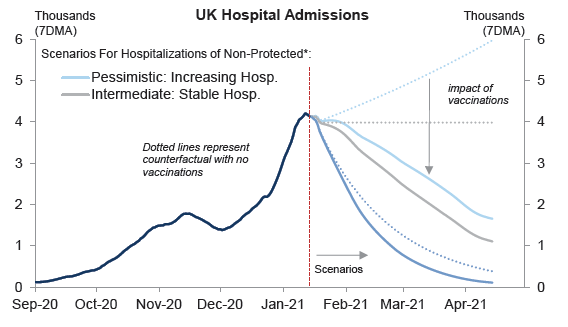

HOSPITALISATIONS HAVE ALREADY PEAKED IN THE U. K.

Source: Goldman Sachs Global Investment Research

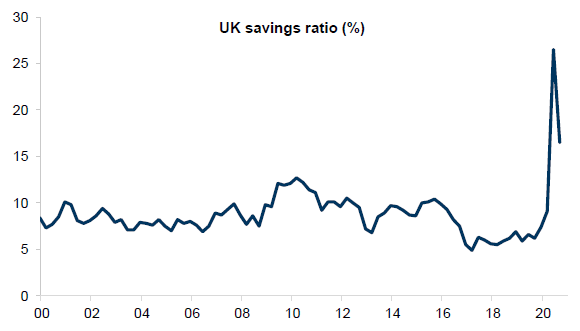

THERE SHOULD BE STRONG PENT-UP DEMAND

Source: ONS , Goldman Sachs Global Investment Research

One of our larger holdings, Teradyne, reported a great year-end in January, delivering 67% year-over-year earnings growth. Free cash flow for this $20 billion market cap company went from $444 million in 2019 to $687 million. Despite these great results and a very promising outlook for many years to come, the stock traded off over 10% in January. Teradyne sells collaborative robots to help businesses automate elements of labour, and semi-conductor test equipment that will benefit in the decade to come from the adoption of 5G technologies. As a result, you can see that we took advantage of the short-term sell-off and boosted it to a top-ten position. The company has over a billion dollars in net cash on its balance sheet in order to fund a share buyback program and fund a dividend that has grown in the low-double digits for the last five years. Below we show some very powerful secular charts illustrating the future growth potential of 5G adoption, which will be very beneficial to its lead testing franchise.

Source: ReportLinker, Jefferies

Source: Company data, Jefferies estimates

Source: ReportLinker, Jefferies

Generally speaking, we are taking profits from some of the steadiest performers, in order to rotate into less obvious investments in the immediate future. We believe that short-term uncertainties will provide us the best long-term opportunities to rotate more capital to tomorrow’s leading companies that have better growth potential. For example, you may have noticed that Microsoft is no longer in our top ten. Microsoft is a fantastic company and still remains a core investment in our fund. We took some of the proceeds from our sale after Microsoft reported another excellent quarter of free cash flow and earnings growth in January to boost our smaller position in an advertising and ecommerce platform company we first met last year in San Francisco called Pinterest. Based on our conversations with many companies, we believe that advertising on social media platforms outside the controversies being faced by Twitter and Facebook will gain digital advertising market share in the years to come. As we write these comments, we are pleased to see that according to the Financial Times, Microsoft has apparently approached Pinterest as a takeover target. Our funds own many businesses that will recover and grow their earnings and free cash flow in the quarters and years ahead. Rest assured that we will buy from our approved list of companies when markets sell off during months like January. In order to soften drawdowns, this Fund will continue to maintain some macro hedges against potential unforeseen risks. However, we are generally long and bullish on the recovery scenario.