Amplus Fund September Update

After recently being recognized as a top credit strategy of 2021 by Alternative IQ, PM Andrew James Labbad shares his views on the recent moves in rates and the new opportunities presenting themselves in this market environment.

“Compounding interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t…pays it.” – Albert Einstein

Benjamin Franklin is known as a great inventor, most notably for his works in discovering electricity. Franklin was also fascinated with compounding interest. He discovered the power of compounding and its ability to create exponential growth if held for a long period of time. In 1788, Benjamin Franklin set up two philanthropic trusts of $5000 each. These trusts were designed to last 200 years. The funds were to provide small 5% loans. In doing so, Benjamin Franklin wanted to publicly illustrate benefits of compounding interest. In 2008, one of the trust’s had grown to over $431,756 (8600% growth). Franklin described it best when he proclaimed, “Money makes money. And the money that money makes, makes money.” Interesting to note that 90% of Warren Buffett’s total net worth was accumulated only after he turned 50. Time and patience eventually fueled the powers of compounding interest to his wealth. We put into practice this philosophy everyday.

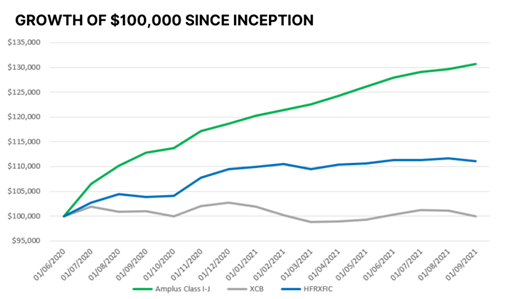

Since its inception, Amplus has produced positive returns every month. Consistency is critical for the life-changing magic of compound interest. We spend significant resources and foresight on a diverse tool chest of hedges to protect our investors from unforeseen risk. When combining these steps, we create a formula for success. After 15 months of performance, we start to clearly see the benefits that Albert Einstein discovered. The outperformance continues to increase over time.

THE FUND

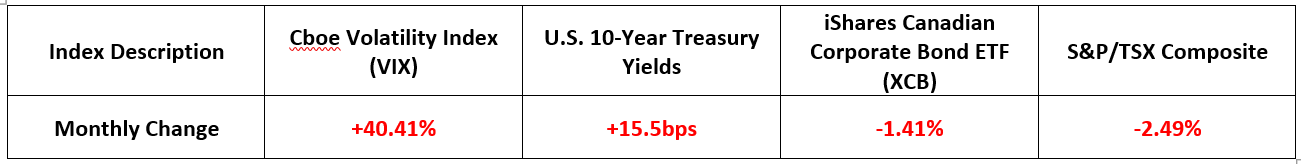

We are pleased to announce that Amplus Credit Income Fund finished up +0.84% in September after costs. Our year-to-date returns in 2021 are +10.21%. September can be summarized by heightened volatility and negative returns in both equity and fixed income markets due to several uncertainties. The Canadian election, Chinese developer Evergrande’s debt saga, ongoing supply chain disruptions and a more hawkish view were all factors that finally tamed the bull market.

Our fund was well-positioned for this type of market move: minimal interest rate exposure, hedges that benefitted from heightened volatility and credit spread compression. The market turbulence observed was not a credit story. The unprecedented support from central banks has in fact helped most investment grade companies strengthen their balance sheets. Their credit metrics are stronger now compared to pre-Covid.

GO FORWARD OUTLOOK

October has proven the correction as being short-lived. The pullback was the right opportunity that many were waiting for to deploy some of the trillions of dollars patiently waiting on the sidelines. With rising inflation continuing to trump market expectations, being uninvested can erode wealth very quickly. As such, we get a growing sense that fund managers will be forced to invest their dry powder sooner than expected. With Amplus, we don’t have those same limitations. We benefit from a flexible mandate, having several tools at our disposal, all of which can benefit our investors regardless of market direction.

October has also seen interest rates rise meaningfully in Canada, mostly in shorter-dated debt. The current rate environment in Canada has priced in 3-4 rate hikes for 2022 compared to only 1 hike in the United States. Canadian rates are being priced to perfection: the economy would have to see no hiccups in job creation, unemployment, Covid-19 related setbacks in order to raise rates 4 times next year. We see this as an opportunity to own short-dated corporate bonds outright. The net benefits (break-evens) far outweigh any hedging protection. Our active interest rate exposure remains significantly lower than fixed income indices.

Overall, we continue to see tailwinds in specific credits driving positive returns for our investors. Central banks continue to be accommodative, robust inflows in U.S. fixed income and a rising rate environment are all positive for credit spreads.

______________________________________________________________________________________________________________________________

DISCLAIMER

The Hypothetical Growth of $100,000 chart reflects a hypothetical $100,000 investment and is intended for illustrative purposes only. It assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted. Unlike an actual performance record, hypothetical results do not represent actual performance and are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk. There are frequently differences, including material differences, between hypothetical performance results and the actual results subsequently achieved by any particular fund. Since trades have not actually been executed, hypothetical results cannot account for the impact of certain market risks such as lack of liquidity. There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of hypothetical results and all of which can adversely affect actual results.

INDEX DESCRIPTION

iShares Canadian Corporate Bond ETF: The iShares Canadian Corporate Bond ETF (XCB) seeks to provide income by replicating the performance of the FTSE Canada All Corporate Bond Index, which includes investment-grade corporate bonds denominated in Canadian dollars with at least one year to maturity.

HFRX Fixed Income- Credit Index: HFRX Fixed Income – Credit Index includes strategies with exposure to credit across a broad continuum of credit sub-strategies, including Corporate, Sovereign, Distressed, Convertible, Asset Backed, Capital Structure Arbitrage, Multi-Strategy and other Relative Value and Event Driven sub-strategies. Investment thesis across all strategies is predicated on realization of a valuation discrepancy between the related credit instruments. Strategies may also include and utilize equity securities, credit derivatives, government fixed income, commodities, currencies or other hybrid securities. Hedge Fund Research, Inc. (HFR) utilizes a UCITSIII compliant methodology to construct the HFRX Hedge Fund Indices. The methodology is based on defined and predetermined rules and objective criteria to select and rebalance components to maximize representation of the Hedge Fund Universe. HFRX Indices utilize state-of-the-art quantitative techniques and analysis; multi-level screening, cluster analysis, Monte-Carlo simulations and optimization techniques ensure that each Index is a pure representation of its corresponding investment focus.

Cboe Volatility Index: The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants.

S&P TSX Composite: S&P/TSX Composite Index is an index that tracks the performance of an investment in the largest capitalized Canadian incorporated securities traded on the Toronto Stock Exchange (TSX). It is a market-float weighted index, meaning that the larger the capitalization of a company, the more weight it carries in the index. Since 1977, dividends have been reinvested at the index level on a daily basis.