Amplus Fund June Update

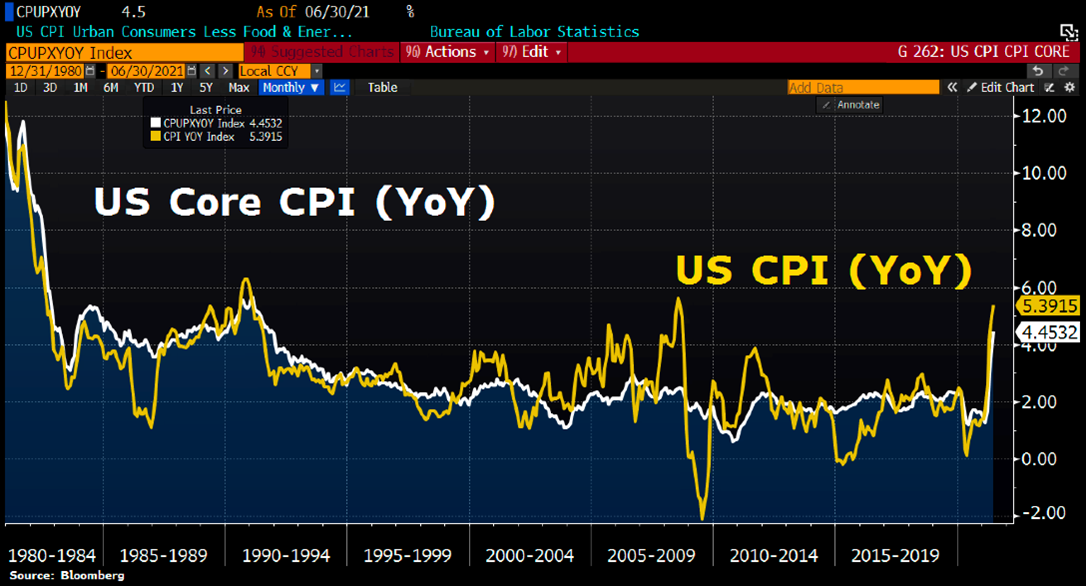

Inflation rose again in June, setting yet another CPI record to levels unseen since August 2008. PM Andrew James Labbad breaks down how he is positioning Amplus to take advantage of this foreseeable uncertainty.

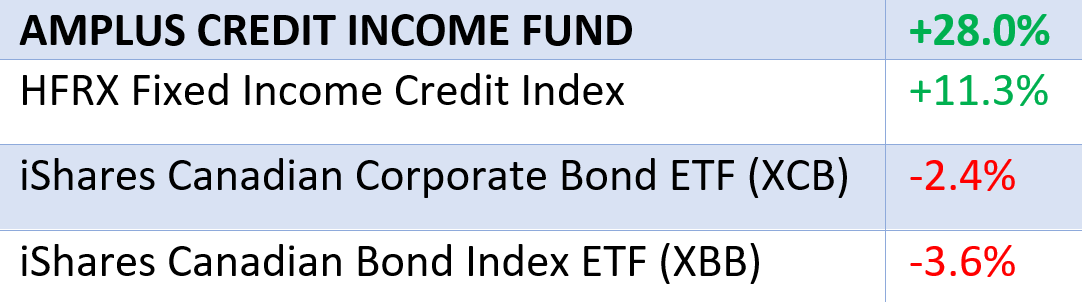

Amplus Credit Income Fund celebrated its 1-year anniversary returning +28% after costs to investors. Our June performance was up +1.51%. Since its launch, Amplus assets under management have more than doubled. We are pleased with these results and thankful to our investors and partners for their continued trust and confidence in Amplus. As we celebrate a truly exceptional year, where we have outperformed the respective benchmarks, we remain focused on the present-day investment climate and our goal to continue to grow your wealth while protecting it from market risk.

As we saw in May, Canadian credit spreads finished June almost unchanged. The stellar performance for Amplus continues to be driven by our core positions. Using Bloomberg dealer quotes, we tabulated the top seven investment-grade credit performers over the last three months. When comparing these securities to the Bloomberg Barclays CAD IG Credit index, their credit spreads beat the general market by over 30X. Amplus has owned five of the seven performers, hence driving the Fund’s performance higher.

Last month saw a monthly record for CAD corporate issuance – $19 billion of domestic supply came to market with little impact on existing debt. One of our core positions in NorthWest Redwater, an issuer with a joint-venture project between CNQ and the Province of Alberta, came to market with the largest ever corporate bond deal at $2.6 billion. With that came the positive news that they simplified their corporate structure which strengthened the backing between the issuer and the province. This long-awaited debt deal was well-received by the markets and repriced existing debt higher.

Investors are fearful of inflation and rising interest rates, and for good reason. Food suppliers General Mills, Conagra, and Campbell Soup Co. announced steep price increases to offset rising production costs. We highlight some of the comments made below. This is not transitory – when is the last time you saw a company lower prices on your favourite product?

“Facing highest costs in a decade…overall costs about 7% higher over the next year or so.” – General Mills executives

Campbell Soup sees inflation as ‘significant’, ‘pronounced’ and ‘sustained’ through the year

While Conagra has been raising prices to offset inflation, it said it would have to be ‘aggressive’ going forward

As we enter the second half of 2021, we see two key themes emerging:

1. It is painfully obvious that rising inflation continues to trump market expectations: U.S. core CPI increased +4.5% year-over-year, the highest it has been in 30 years.

2. The COVID-19 Delta-variant is a global concern: it has higher infection rates and vaccines are less effective in fighting it. The uncertainty surrounding it may be an excuse for Fed officials to keep rates lower for longer.

As a result, taking a short-term view on interest rates is challenging, but in our opinion, the long-term effects of fiscal and monetary support will lead to rising interest rates. As such, we have put on tactical trades to take advantage of the multi-month lows in rates. Being agile has allowed us to actively adapt throughout the volatility in rates and we see this entry point skewed in our favour for interest rates to rise and benefit our investors.

Overall, we continue to hedge out interest rate risk when investing in corporate debt securities. We continue to see strong tailwinds in credit driving positive returns for our investors. Central banks continue to pour trillions of dollars into the economy, robust inflows in U.S. fixed income ($105 billion year-to-date) and a rising rate environment are all positive for credit spreads. We continue to invest in companies that should see an increase in asset growth and earnings power from either rising interest rates or inflation including banks, commodities, and real estate.