Amplus Fund December 2021 Commentary

Equity markets notched all-time highs to end the year. The same cannot be said for fixed income, known as a safe haven, the FTSE Canadian Bond Universe closed down -2.5% as interest rates moved higher. Senior Portfolio Manager, Andrew James Labbad, discusses how Amplus Fund took a defensive view on the market for 2021. The fund continued to benefit from security selection and tactical interest rate trading to close out the year.

“The stock market is designed to transfer money from the active to the patient” – Warren Buffett

Looking back at 2021, equity markets turned in a solid year of performance with the S&P 500 closing +26.9%. Time and time again, investors brushed off news that could have derailed stocks: a contested U.S. election, an assault on the Capital, historically high inflation, supply chain disruptions, new Covid-19 variants, etc. Altogether equity markets notched all-time highs to end the year. The same cannot be said for fixed income, known as a safe haven, the FTSE Canadian Bond Universe closed down -2.5% as interest rates moved higher. When considering Canadian headline inflation rose 4.8% in December on a year-over-year basis, the average bond investor lost over 7% of their purchasing power.

THE FUND

Amplus Credit Income Fund finished up +0.72% in December after costs, closing 2021 returns at +10%. Canadian credit spreads closed largely unchanged in December. Debt issuance of $7.4bn was front-loaded for the month, with Rogers Communications taking the spotlight, issuing $2bn hybrid-callable debt to fund the Shaw acquisition that is set to close in the first half of 2022. The deal was very well received by the market. We participated in the deal and saw the 5% coupon as attractive for what will become Canada’s largest telecom company. Aside from that, two of our core investments closed approximately 10bps tighter on the month. Our fund continued to benefit from our tactical interest rate positions, as short rates rallied into year-end. We took profits from most of those positions to end the year.

Our investment thesis for 2021 can be summarized by our defensive view on the market. We were underweight credit risk, while taking calculated core positions in underpriced securities. Some of our top holdings materially outperformed the Canadian IG credit market; we owned CIXCN, HRUCN, FFHCN, SIACN to name a few. We combined these investments with short-dated maturities that were less sensitive to spread movements, naturally allowing us to remain light on credit risk.

As credit indices finished wider year-over-year, we continued to gradually add higher quality senior bank debt to our portfolio. We are comforted in knowing that senior bank paper is defensive in nature, liquid, and cheap domestically compared to other currencies. Credit spreads in financials were also one of the largest underperformers for 2021.

GO FORWARD OUTLOOK

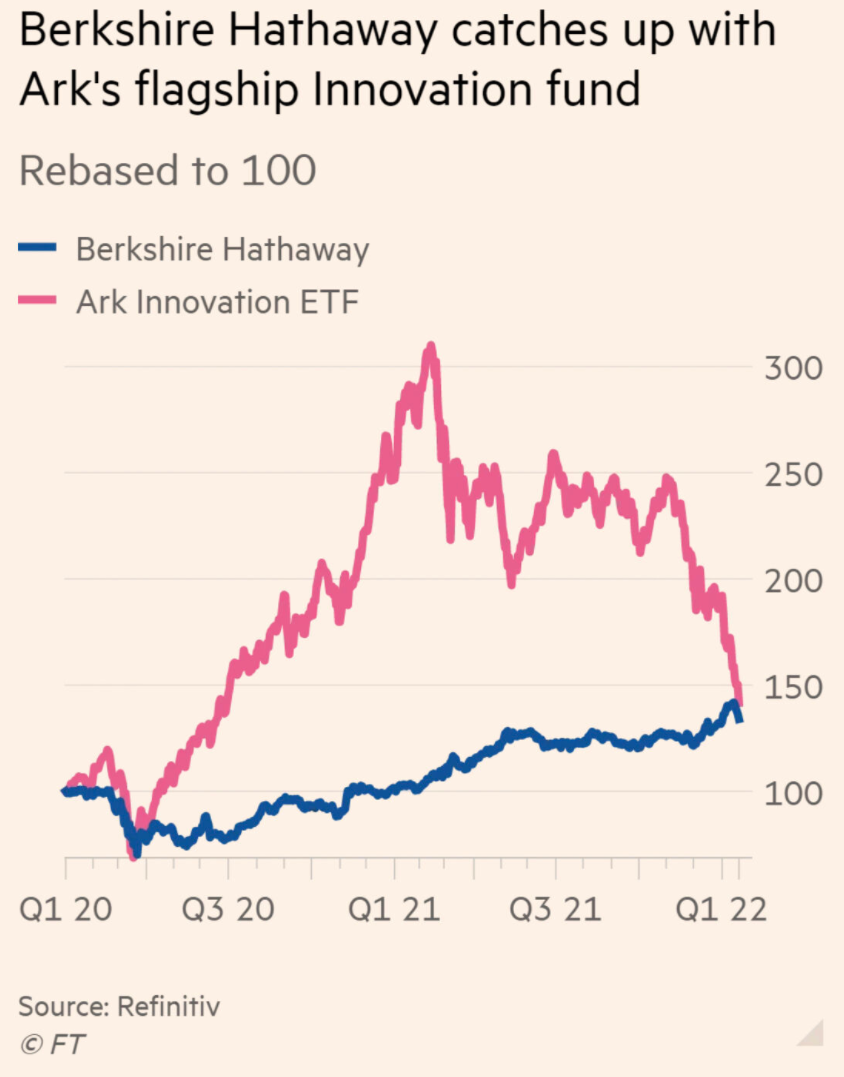

Omicron, inflation, interest-rates, and geopolitical tensions are dampening investor risk-appetite. So far 2022 seems to be off to a completely different start. As of January 21st, the S&P 500 is down -8.3%, on fears of uncontrollable inflation forcing central banks to take quicker and more restrictive monetary measures to cool off the highest inflation rates seen in decades. This has repriced interest rates significantly higher to start the year, forcing fixed income benchmarks to dip -2% to -3%. The market is currently pricing four hikes for 2022 in the U.S. compared to only two a few months ago. High-growth tech stocks, which are sensitive to higher interest rates, have been at the forefront of the stock market sell-off with the NASDAQ down -11.3% so far in 2022. Recent headlines from Peloton and Netflix have also affirmed the potential unsustainable push-forward affects of growth that the pandemic had on work-from-home stocks.

As we remain cautiously optimistic, our priority continues to be preservation of capital. With a diverse toolbox of investments at our disposal, we have successfully navigated the worst start to the year since the 2008 financial crisis.

We remain positive on credit overall. Developed nation GDP is growing, central banks remain supportive, and consumer savings at multi-year highs are all fundamentally positive for credit. Technical tailwinds include less debt supply in 2022, and record levels of dry powder to the tune of 1.7 trillion dollars parked in the Fed’s overnight reverse-repo facility yielding 0.05%. Higher overall yield should also lead to tighter spreads, as the correlation is historically negative between the two. Most debt issued in the last year is already trading below par. As yields continue to rise, this will attract new buyers who may invest entirely as recovery value thesis, targeting capital gains. JPM expects that by year-end, as interest rates continue to rise, 14% of all 30-year U.S. corporate debt outstanding will trade below 90 cents on the dollar. Higher interest rates also lead to higher margins of safety as investors will have more yield in the portfolio to weather price volatility.