Amplus Fund August Update

As we move into a new season, PM Andrew James Labbad explains why Amplus’ ability to stay nimble is key — so it can be quick to embrace the changes ahead.

“When the winds of change blow, some people build walls and others build windmills.” – Chinese Proverb

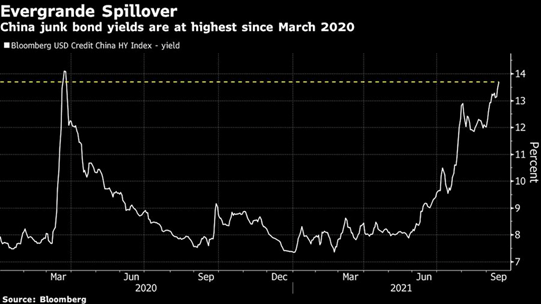

Momentum changed in August for commodities, as crude oil prices dropped close to 15% in one week, while BHP warned of slowing demand for steel in China. This further highlights how delicate commodities and overall markets are to dampening growth prospects. On the recent news surrounding indebted developer Evergrande, a company with US$300 billion worth of liabilities, we feel increasingly concerned for China’s real estate sector and its effect on broader Asian indices. In late 2020, Chinese regulators cracked down on shadow banking, the collection of non-bank financial intermediaries, while imposing credit limits on developers. Soon after, the largest and most indebted property developer Evergrande warned of a liquidity squeeze, without fresh capital they would fail. This has taken center stage, splashed throughout global headlines. We believe spillovers of Evergrande woes may dampen global growth and confidence, specifically in mining, energy, and real estate. Real estate accounts for 14% of the China economy, 25% including related sectors. China junk bond yields have now surpassed March 2020 levels, with JPM estimating up to US$30 billion bonds defaulting from weaker developers for China, in remaining 2021 alone.

As these new concerns emerge, we updated our views, made necessary changes to our portfolio, and put on tactical hedges. We have become increasingly defensive by lightening up on risk, increasing our credit quality and rotating into more liquid bonds, while reducing select exposure to commodities and real estate, which we feel will be most impacted by potential Chinese developer future default. Our portfolio continues to reward investors with the benefits of compounding interest, while being nimble and agile during this period of elevated volatility.

THE FUND

We are pleased to announce that Amplus Credit Income Fund has finished up +0.42% in August after costs. Our year-to-date returns in 2021 are +9.29%. For the month, fixed income indices and credit spreads were largely unchanged. As is common for summer months, both secondary trading volumes, and new debt offering were low. Our portfolio currently holds four years of credit duration – the least amount of risk since its inception of July 2020, and about 60% less than what we had at this time last year.

GO FORWARD OUTLOOK

Overall, we continue to hedge out interest rate risk when investing in corporate debt securities. Despite tactically positioning our portfolio for heightened volatility, we see any moderate pullback as a buying opportunity in quality credits. Our comfort in this view comes from the large sums of dry powder held in money-market funds and central bank programs. Longer-term, we continue to see tailwinds in specific credits driving positive returns for our investors. Central banks continue to pour trillions of dollars into the economy, robust inflows in U.S. fixed income and a rising rate environment are all positive for credit spreads.

Thank you for your support and interest in Amplus.

“The best time to plant a tree was 20 years ago. The second-best time is now.” – Chinese Proverb