Amplus Fund February Update

In February, the trending topic for investors shifted from “GameStop” to “10-year Treasury yield”. In his latest commentary, Amplus PM Andrew James Labbad explains how the rate affects both the stock market and his fund.

We start this newsletter with a meme from a famous animated sitcom – The Simpsons. Since debuting in 1989, The Simpsons has seen a remarkable run and with 32 seasons strong, it holds the record for longest running animated series. The 1980s were also known for a peak in interest rates. Throughout the decade, average 10-year U.S. treasury rates were 10.59%, by comparison last year’s average, which was 0.89%. Three decades later, interest rates again take center stage, this time signaling that 2020 was likely the bottom and that they are on the rise…

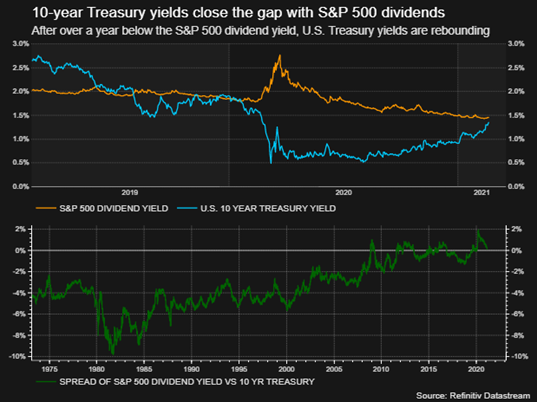

With record amounts of government stimulus, most major economies are set to grow at the fastest rate in over two decades. What does this mean for the market? In our most recent newsletter, we briefly spoke about the economic recovery trade, the significant increase of monetary supply and the impact it would have on rising inflation. Unfortunately, the move in interest rates caught many investors off-guard. With 10-year rates quickly moving higher, we saw ripple effects in other asset classes. February 25th saw 10-year U.S. rates of 1.49% breakthrough and surpass the average dividend yield of the S&P 500. Concerns were mounting that valuations in the equity markets were becoming stretched and a natural rotation into fixed income could eventually be underway.

Our strategy continues to be rewarding despite the volatility showcased in most asset classes. Amplus Credit Income Fund closed up +0.95% in February. After launching the fund on July 2nd, 2020, cumulative returns stand at +21.38% after costs. During that same time frame, major fixed income indices are hovering close to 0% returns, with many now negative. Investors must remind themselves that the return profile with interest rates at record lows is asymmetrical. In an extreme example, if we were to suddenly see bond yields rise to levels seen during the 80’s spoken about earlier, most investors would see more than half their investment vanish. To be clear, we do not think this will happen, but we use this example to demonstrate how skewed the risk return profile could be when your average U.S. 10-year treasury yield was 0.89% in 2020.

With the odds currently skewed against the natural fixed income investor, we think Amplus provides an alternative strategy of providing steady returns. Amplus hedges most interest rate risk, allowing us to preserve capital regardless of interest rate swings, while investing mainly in high quality corporate debt.

Recapping last month’s trades, with both inflation expectations increasing and a steeper yield curve, this benefitted our positions in banks and commodity names. Our exposure to the insurance sector included Fairfax debt, where we saw the issuer pay down debt early and refinance at more attractive levels. Seeing our bonds taken out at a premium, we took it as an opportunity to remain liquid and nimble. Our experience has shown that a rising yield environment would force corporate issuers to speed up their plans of issuing debt. This is in turn could saturate the secondary market and have an impact on performance. We saw it as prudent to redeploy this capital once issuers were forced to rush their issuance plans and possibly come at a greater concession. In the last couple of weeks, it has played out well for us as expected. YTD issuance in CAD and USD quickly eclipsed 2020 YTD levels, and some of the recent supply has come with larger than normal concessions. We seized it as an opportunity to buy quality names like Suncor and last week’s jumbo Verizon offering at discounted levels to secondaries.

Our long-term view remains intact for 2021. Tailwinds in credit remain strong. Monetary and fiscal policies continue to be extremely accommodating, robust inflows in U.S. fixed income ($44.2 billion YTD) and a rising rate environment are all positive for credit spreads. Amplus’ strategy is in an ideal situation to perform.