Amplus Credit Income Fund September Commentary

The U.S. 60/40 portfolio is having one the most challenging years ever documented. Senior Portfolio Manager, Andrew James Labbad, shares how Amplus’ edge comes from its flexibility to hedge and actively pick credit exposures.

Short and Sweet: Brief but Pleasant

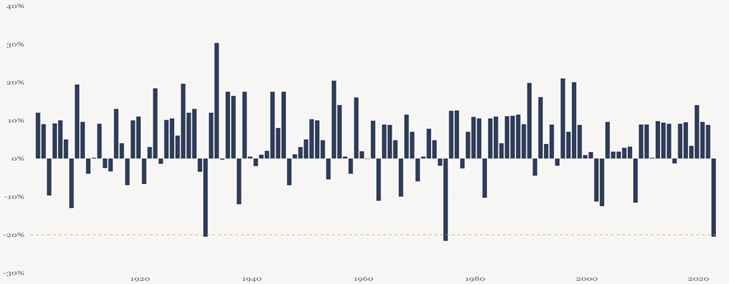

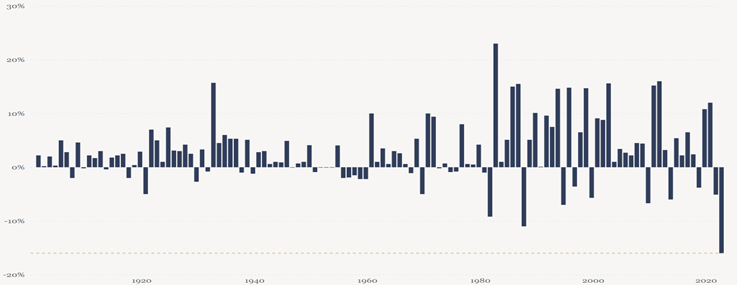

Since 1900, through Q3, a U.S. 60/40 portfolio is down -21%, for the 2nd worst year on record. Additionally, 10-year U.S. treasuries are down -17%, for the worst year on record outdoing 1987’s previous record of -10%. Many risk-averse investors did not sign up for these types of losses.

YTD PERFORMANCE OF 60/40 PORTFOLIO

YTD PERFORMANCE OF U.S. 10YR

The flexibility to hedge and actively pick our credit exposures has given Amplus Credit Income Fund (ACIF) the edge needed to outperform traditional long-only fixed income strategies and indices. Our investors have significantly benefited from our unconstrained strategy since the inception of the fund. September highlighted those abilities very well. Our hedging portfolio returned about +0.25% on our market shorts. On the security selection side, Suncor finally announced its long awaited and well telegraphed debt tender for their bonds at a sweet premium, returning about +1%. More on our Suncor trade can be found here.

THE FUND

Our September performance was up +0.83%, with 2022 year-to-date growth of +4.81%. Meanwhile both equities and fixed income indices continued their move lower. Credit spreads moved 13bps wider in September and closed at their widest levels in 2022. The U.S. markets didn’t fare any better closing 18bps wider on the month.

The fund continues to outperform and finished with positive returns for the following reasons:

- Amplus benefits from a portfolio yielding of close to 9%, creating a larger margin of safety for market swings, as we saw in September.

- Our overweight exposure to energy producers generated positive gains with Suncor wiping out over $3bn of their debt at a premium.

- Our insurance-like contracts produced outsized returns with risk trading considerably lower.

Our interest rate exposure, though minimal, did drag on performance as interest rates moved higher. We view this exposure as a natural hedge in the event of a large risk-off move.

GO FORWARD OUTLOOK

We continue to see tremendous value in high-quality credit versus other asset classes. Historically, wide credit spreads and elevated yields provide us with a large margin of safety. The inversion of the yield curve allows us to own shorter-dated debt at greater all-in yields, with lower duration and a higher break-even compared with longer-dated bonds. Our portfolio continues to hold investment in many companies that stand to benefit from elevated interest rates and strong commodity prices. We remain excited about credit and future return potential.

Thank you for your support and interest in Amplus.